Now Reading: 5 Strong Reasons South Korea May Ban Chinese Property Buying

-

01

5 Strong Reasons South Korea May Ban Chinese Property Buying

5 Strong Reasons South Korea May Ban Chinese Property Buying

Table of Contents

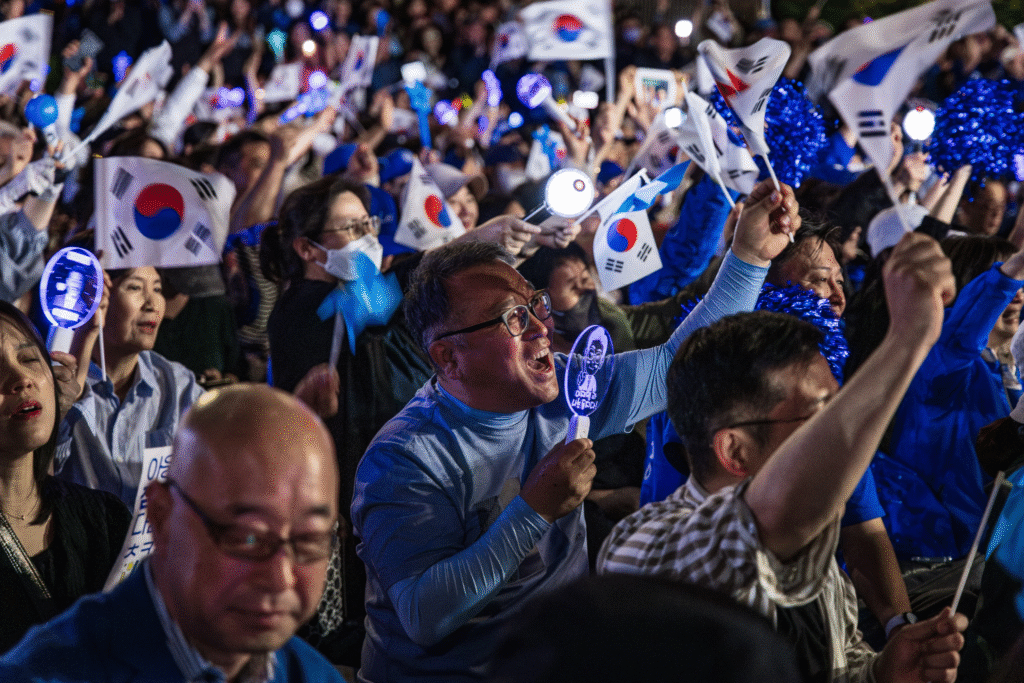

Chinese-led property shopping in South Korea is triggering a heated debate as public pressure mounts on the government to act. A growing number of lawmakers, civic groups, and residents are voicing concerns about rising property prices, local displacement, and national security issues tied to foreign ownership—particularly from China. With real estate turning into a hot-button political issue, the call to tighten foreign investment rules is louder than ever.

In recent months, petitions, news reports, and panel discussions have raised public awareness about how extensive Chinese-led property buying has become in South Korea. This draft explores five strong reasons why South Korea may soon implement stricter laws to regulate foreign real estate investments—especially from Chinese nationals.

1. Surge in Chinese Real Estate Investment Sparks Alarm

Over the past decade, Chinese investors have bought residential and commercial properties in South Korea at an increasing rate. Data from South Korea’s Ministry of Land, Infrastructure and Transport shows that Chinese nationals own over 60% of all foreign-owned residential properties in the country. The most popular locations include Jeju Island, Seoul, and Busan.

This wave of investment, often cash-based and aggressive, has led to accusations that Chinese buyers are inflating property prices and making it difficult for local citizens to afford homes. Critics argue that Chinese-led property shopping in South Korea is turning the housing market into a playground for wealthy foreigners.

2. Rising Property Prices Create Public Backlash

One of the most pressing concerns is the role foreign buyers play in skyrocketing real estate prices. While many factors affect property inflation, foreign ownership—particularly by Chinese investors—has become an emotional trigger for local residents.

In some areas, prices have doubled within five years, prompting accusations that overseas buyers are outbidding local citizens. The issue has become particularly sensitive in tourist-heavy regions like Jeju Island, where Chinese buyers were granted permanent residency in exchange for large property investments under the now-defunct “Investment Immigration System.”

Residents now say that policy was short-sighted and damaging. It’s no surprise that Chinese-led property shopping in South Korea is under heavy criticism by both citizens and opposition lawmakers.

3. National Security Concerns on the Rise

Beyond economic concerns, national security has become a major part of the discussion. Some politicians and military experts argue that allowing foreign ownership of land near sensitive areas—such as military bases or government institutions—poses a security risk.

Recently, lawmakers introduced bills to restrict foreigners from purchasing land in areas deemed strategic. Much of this focus has centered on Chinese buyers due to rising geopolitical tensions in East Asia and historical mistrust.

As tensions grow between South Korea and its neighbors, Chinese-led property shopping in South Korea may no longer be seen as a harmless investment trend but a potential threat to sovereignty.

4. Legal Loopholes and Regulatory Gaps

South Korea currently does not restrict foreigners from purchasing property outright, although they are subject to certain disclosure requirements and taxes. However, critics argue that these regulations are weak and easily bypassed.

For instance, some Chinese investors reportedly use local companies or Korean spouses as legal fronts for property purchases. Others acquire land through investment visas, taking advantage of outdated immigration rules.

Civic groups and legal scholars are urging the government to close these loopholes and impose clearer, stricter regulations. Proposals include foreign ownership caps, mandatory disclosure of the property’s intended use, and bans on purchases in rural or strategic areas.

Calls to crack down on Chinese-led property shopping in South Korea are growing louder by the day, especially as local buyers feel squeezed out of the market.

5. Political Pressure and Upcoming Elections

With national elections approaching, political parties are seizing on public anger over housing affordability. The issue of foreign ownership—especially by Chinese nationals—is becoming a key campaign topic.

Lawmakers from both the ruling and opposition parties have introduced various legislative proposals to limit foreign access to Korean real estate. Some proposals include:

- Banning foreigners from owning property in certain zones

- Increasing property tax rates for non-residents

- Reversing past policies that encouraged investment immigration

It is now politically advantageous for candidates to take a tough stance against Chinese-led property shopping in South Korea, and that pressure could result in swift policy changes after the election.

The Future of Foreign Property Ownership in South Korea

While foreign investment has helped fuel economic growth and tourism in the past, the mood has shifted. Many South Koreans now feel that the social costs outweigh the benefits. Property, once a stable dream for families, is becoming a symbol of inequality and foreign exploitation.

If new laws are passed, South Korea could follow countries like Canada and New Zealand, which have already banned or heavily restricted foreign real estate purchases to protect housing affordability for citizens.

Even if an outright ban doesn’t occur, it’s likely that Chinese-led property shopping in South Korea will face higher scrutiny, heavier taxes, and tighter regulations in the near future.

Conclusion

The movement to tighten rules on Chinese-led property shopping in South Korea is gaining serious momentum. With rising prices, security fears, and a frustrated public, government leaders are under pressure to act quickly and decisively.

As the debate continues, one thing is clear: the era of unchecked foreign property investment in South Korea may be coming to an end.

Also Read – Real Estate in Abu Dhabi: 10 Powerful Growth Drivers