Now Reading: 7 Surprising Real Estate Finance Hacks Dubai Buyers Love

-

01

7 Surprising Real Estate Finance Hacks Dubai Buyers Love

7 Surprising Real Estate Finance Hacks Dubai Buyers Love

Table of Contents

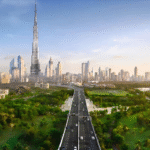

Dubai is home to one of the most dynamic and luxurious real estate markets in the world. Known for its opulent skyscrapers, man-made islands, and cutting-edge communities, this global city has become a top destination for high-net-worth individuals seeking prime real estate. However, what truly sets Dubai apart is not just the properties — it’s the unique luxury real estate financing options available to buyers.

In this article, we will uncover the most effective and innovative financing solutions tailored specifically for luxury buyers in Dubai. Whether you are a resident, expat, or foreign investor, these options offer flexibility, exclusivity, and strong financial leverage for securing your ideal luxury property.

1. Developer-Backed Payment Plans

One of the most popular luxury real estate financing options in Dubai is the developer-backed payment plan. Leading real estate developers such as Emaar, DAMAC, and Nakheel offer extended payment terms with low or no interest.

How it works:

- Buyers pay a small down payment (as low as 10-20%).

- Remaining amount is spread over 3–7 years.

- Some plans offer post-handover payments, allowing buyers to move in before paying the full amount.

Why it’s unique:

This model is rarely found in other global luxury markets. It helps reduce financial pressure and opens up opportunities for investment without needing a large upfront capital.

2. Islamic Financing (Sharia-Compliant Mortgages)

Dubai offers Islamic finance options that comply with Sharia law — especially appealing to Muslim investors and buyers from the Middle East.

Key Features:

- No interest; instead, banks charge a fixed profit margin.

- Use of Ijara (leasing) or Murabaha (cost-plus) structures.

- Transparent and ethically-driven finance practices.

Major Islamic Banks Offering This:

- Dubai Islamic Bank

- Abu Dhabi Islamic Bank

- Emirates Islamic

These banks provide Sharia-compliant solutions that blend religious integrity with modern financial needs.

3. Non-Resident Mortgages

Foreign investors often think getting a mortgage in Dubai is difficult. But in reality, many banks now offer non-resident mortgages as part of their luxury real estate financing options.

Details:

- Loan-to-value (LTV) ratio up to 50-60%

- Tenure up to 25 years

- Available in multiple currencies

Eligibility:

- Valid passport

- Proof of income (in some cases bank statements)

- Minimum property value (often AED 1 million or more)

Non-resident financing has helped boost global demand for Dubai’s luxury properties.

4. Lease-to-Own Schemes

Also known as rent-to-own, this is one of Dubai’s innovative luxury real estate financing options. It allows buyers to rent a property with the option to purchase it later.

How it works:

- A portion of rent paid goes toward the final purchase price.

- Agreements last 1–5 years.

- Minimal initial capital required.

Why it’s gaining popularity:

Ideal for expats who are unsure about long-term plans but want to lock in a luxury property without a full upfront commitment.

5. Off-Plan Purchase with Escrow Protection

Buying off-plan properties is a common investment strategy in Dubai. Developers offer financing flexibility, and Dubai law mandates the use of escrow accounts to protect buyers.

Benefits:

- Low entry costs (10–15% booking amount)

- Payment linked to construction milestones

- Legal protection through RERA-monitored escrow accounts

Best For:

Investors looking to enter the luxury market early with a strategic exit post-completion.

6. Private Banking & Wealth Management Loans

High-net-worth individuals (HNWIs) often prefer working with private banks for custom financing structures. Dubai’s leading private banks offer wealth-based mortgage solutions for luxury real estate.

Custom Features:

- Tailored interest rates

- Collateralized loan options

- Flexible repayment structures

Popular Providers:

- HSBC Premier

- Citi Private Bank

- Emirates NBD Private Banking

This solution is perfect for buyers who want discretion, speed, and high credit limits.

7. Bridge Financing & Short-Term Loans

For buyers who need fast funding for luxury properties, bridge financing has emerged as one of the most effective short-term luxury real estate financing options.

How it works:

- Short-term loan (3–12 months) to close the deal quickly

- Usually repaid by selling another asset or securing long-term finance

- Offered by boutique lenders and private equity firms

When it’s useful:

Bridge loans help in fast-paced deals, bidding wars, or when timing is crucial — a common scenario in Dubai’s luxury segment.

Why These Options Matter to Buyers

Dubai’s real estate market offers a rare combination of:

- Global investor appeal

- Tax-free ownership

- Long-term residency incentives

- Strong capital appreciation

But without proper financing solutions, even the best property can remain out of reach. The wide range of luxury real estate financing options in Dubai addresses diverse buyer needs — from first-time foreign investors to regional billionaires.

Moreover, the UAE’s proactive approach to regulation, digital transparency, and financial security makes these options not only attractive but also safe.

Final Thoughts

Whether you’re planning to buy a penthouse in Downtown Dubai, a mansion on Palm Jumeirah, or a waterfront villa in Dubai Marina, choosing the right luxury real estate financing option can make a significant difference in your investment journey.

With flexible payment plans, Islamic finance, lease-to-own models, and tailored private banking solutions, Dubai continues to stay ahead of global real estate trends — giving buyers more power, choice, and confidence.

Also Read – Top 7 Reasons Dubai Co-Living Is Gaining Huge Popularity