Now Reading: 5 Tech Trends Like AI and Blockchain Transforming the Market in 2025

-

01

5 Tech Trends Like AI and Blockchain Transforming the Market in 2025

5 Tech Trends Like AI and Blockchain Transforming the Market in 2025

Table of Contents

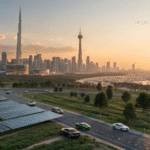

Tech Trends Like AI and Blockchain: The UAE’s real estate market, valued at AED 151 billion ($41 billion) in 2023 with a 34% transaction surge, per damacproperties.com, is a global leader in 2025, forecasting 5–8% price growth and 7% rental yields, per hermesre.ae. Dubai alone hit $18.2 billion in sales in May 2025, up 44% year-on-year, per cointelegraph.com.

Technologies like AI, blockchain, IoT, AR/VR, and big data are reshaping the sector, driven by Vision 2030, a $20 billion digital tech spend, and initiatives like Dubai’s REST platform, per socienta.com. This guide, crafted in clear, SEO-friendly language with an engaging tone, explores five transformative tech trends in UAE real estate for 2025, supported by data, legal insights, and risk analysis.

5 Tech Trends Transforming UAE Real Estate in 2025

1. AI-Powered Property Search and Valuation

AI-driven platforms like Realiste and Bayut’s TruEstimate™ analyze user preferences, market trends, and historical data to deliver personalized property recommendations and real-time valuations, per fullcircle-realestate.com and techtimes.com. In Dubai, AI forecasts 5–8% price growth for AED 2 million ($544,518) Downtown apartments, per tencohomes.com.

- Why It Transforms: AI reduces search time from weeks to minutes and improves valuation accuracy by 20%, per gulfbusiness.com. For a $272,259 Al Reem Island unit, AI predicts $21,781 annual rent at 8%, per thebusinessyear.com.

- Investor Action: Use AI tools on Bayut or Property Finder to target AED 800,000 ($217,807) Ajman studios with 9% yields, per improperties.ae.

- Example: A $544,518 Dubai Marina apartment, valued via AI, yields $43,561 at 8%, appreciating to $653,422 by 2028, a $108,904 gain.

- Source: fullcircle-realestate.com, techtimes.com, tencohomes.com

2. Blockchain for Real Estate Tokenization

Blockchain enables tokenization, allowing fractional ownership of properties on platforms like Prypco Mint, built on XRP Ledger, per coindesk.com. Dubai Land Department (DLD) aims to tokenize $16 billion in assets by 2033, per globalgovernmentfintech.com. A $3 billion deal by MAG and Mavryk tokenizes luxury projects, per cointelegraph.com.

- Why It Transforms: Tokenization lowers entry barriers to $540 for AED 2 million ($544,518) Palm Jumeirah units, boosting liquidity by 30%, per disruptafrica.com. Smart contracts reduce transaction times by 70%, per fintechview360.com.

- Investor Action: Invest in tokenized AED 1.5 million ($408,389) Saadiyat Island apartments via Prypco Mint, per coindesk.com.

- Example: A $544,518 tokenized property yields $38,116 at 7%, with fractional shares tradable 24/7, appreciating to $653,422 by 2028.

- Source: coindesk.com, globalgovernmentfintech.com, cointelegraph.com

3. IoT-Enabled Smart Homes

IoT devices, integrated by developers like DAMAC in projects like All Seasons Residences, optimize energy, security, and connectivity, per damacproperties.com. Smart sensors in AED 1 million ($272,259) Dubai Sports City homes reduce energy costs by 15%, per socienta.com.

- Why It Transforms: IoT enhances tenant appeal, boosting occupancy by 10% for AED 1.2 million ($326,711) Al Zorah units, per mybayut.com. AI-powered security adds 5% to property value, per proprli.com.

- Investor Action: Target IoT-equipped AED 900,000 ($245,033) Masdar City apartments for 7–8% yields, per topluxuryproperty.com.

- Example: A $272,259 smart home yields $21,781 at 8%, appreciating to $326,711 by 2028, with $2,723 in annual energy savings.

- Source: damacproperties.com, socienta.com, proprli.com

4. AR/VR for Virtual Property Tours

Augmented and virtual reality (AR/VR) enable immersive remote tours, saving 50% of buyer time, per techtimes.com. In Dubai, AR tools highlight features for AED 1.5 million ($408,389) Yas Island villas, per hermesre.ae, increasing buyer confidence by 25%, per noumouproperties.com.

- Why It Transforms: AR/VR bridges geographical gaps, driving 18% more international sales for AED 2 million ($544,518) Al Maryah Island units, per arabianbusiness.com. Virtual tours cut marketing costs by 30%, per fintechview360.com.

- Investor Action: List AED 600,000 ($163,355) Ajman Creek Tower units with AR tours on Bayut, per improperties.ae.

- Example: A $408,389 villa yields $32,671 at 8%, sold remotely via VR, appreciating to $490,067 by 2028, a $81,678 gain.

- Source: techtimes.com, hermesre.ae, noumouproperties.com

5. Big Data Analytics for Market Insights

Big data tools analyze trends, consumer behavior, and economic indicators, improving investment decisions by 15%, per proprli.com. In Abu Dhabi, analytics predict 7–9% ROI for AED 1 million ($272,259) Al Ghadeer apartments, per cushwake.ae.

- Why It Transforms: Predictive analytics forecasts 5–7% price growth for AED 1.8 million ($490,066) Dubai Hills Estate units, per damacproperties.com, reducing risk by 20%, per fullcircle-realestate.com.

- Investor Action: Use analytics platforms like Property Finder to target AED 500,000 ($136,130) Seaside Hills Residences in Ajman, per bayut.com.

- Example: A $272,259 apartment yields $21,781 at 8%, appreciating to $326,711 by 2028, guided by data-driven insights.

- Source: proprli.com, cushwake.ae, damacproperties.com

Legal and Tax Framework

- UAE Legal Framework:

- Property Ownership: 100% foreign ownership in freehold zones (e.g., Dubai Marina, Saadiyat Island), per Dubai Law No. 7 of 2006 and Abu Dhabi Law No. 19 of 2005.

- Corporate Tax: 9% on taxable income above AED 375,000 ($102,103), 0% for QFZPs in free zones like ADGM. File by September 30, 2025, per Federal Decree-Law No. 47 of 2022.

- VAT: 5% on commercial transactions, exempt for residential. Register if supplies exceed AED 375,000 by March 31, 2025, per Federal Decree-Law No. 8 of 2017.

- AML: KYC mandatory for transactions above AED 100,000, per Federal Law No. 20 of 2018. Penalties: AED 5 million ($1.36 million).

- Blockchain Regulations: VARA oversees tokenization, requiring compliance for platforms like Prypco Mint, per coindesk.com.

- Fees: Dubai: 4% DLD transfer fee (split 2% each), 2% broker fee, per arabianbusiness.com. Abu Dhabi: 2% transfer fee, per mediaoffice.abudhabi. Ajman: 2% transfer fee, per ajmanproperties.ae.

- Off-Plan Laws: Escrow accounts mandatory, per Dubai Law No. 8 of 2007 and Abu Dhabi Law No. 3 of 2015.

- U.S. Tax Framework:

- Reporting: Declare rental income via Forms 1040, 1116, Schedule E under FATCA. Income taxed at 10–37%, capital gains at 0–20%, per IRS.

- Foreign Tax Credit (FTC): Offset UAE corporate tax against U.S. liability.

- FEIE: $130,800 exclusion for earned income, not rentals, per brighttax.com.

- Residency: AED 2 million ($544,518) investments qualify for 10-year Golden Visa in Dubai/Abu Dhabi; AED 250,000 ($68,065) in Ajman, per topluxuryproperty.com and eplogoffplan.com.

Risks and Mitigation

- Regulatory Uncertainty: Tokenization platforms face evolving VARA rules, risking delays, per practiceguides.chambers.com. Engage compliant platforms like Prypco Mint, per coindesk.com.

- Data Privacy: AI and IoT collect sensitive data, raising privacy concerns, per techtimes.com. Choose GDPR-compliant PropTech solutions, per fintechview360.com.

- Market Volatility: 5–8% price growth may slow if global rates rise, per hermesre.ae. Target stable areas like Al Reem Island, per thebusinessyear.com.

- Tech Adoption Costs: IoT and AR/VR integration adds 5–10% to development costs, per socienta.com. Invest in completed projects like Ajman One Phase 2, per improperties.ae.

- U.S. Tax Burden: IRS reporting reduces returns. Maximize FTC with tax advisors, per brighttax.com.

Step-by-Step Guide for U.S. Investors

- Leverage Tech Trends: Use AI tools on Bayut to target AED 800,000–1.5 million ($217,807–$408,389) properties in Al Zorah or Yas Island, per mybayut.com.

- Set Budget: Allocate $544,518 for Golden Visa eligibility, including fees (4% Dubai, 2% Abu Dhabi/Ajman), per arabianbusiness.com and ajmanproperties.ae.

- Explore Tokenization: Invest in fractional AED 1 million ($272,259) Dubai Marina units via Prypco Mint, per coindesk.com.

- Verify Developers: Confirm DAMAC or Aldar’s escrow compliance for off-plan units, per mediaoffice.abudhabi and damacproperties.com.

- Secure Financing: Obtain 80% LTV mortgages at 4–6% or developer plans, per sandsofwealth.com.

- Execute Purchase: Sign DLD/ADREC-registered SPAs, complete AML/KYC, and apply for Golden Visa via dubailand.gov.ae or mediaoffice.abudhabi, per topluxuryproperty.com.

- Ensure Compliance: Register for UAE VAT/corporate tax by March 31, 2025, if income exceeds $102,103, and U.S. taxes by April 18, 2025, with FTC, per FTA and IRS.

- Optimize Rentals: List IoT-equipped units with AR tours on Property Finder for 80–90% occupancy, per bayut.com.

- Monitor Returns: Track 7–9% yields and 5–8% appreciation via analytics on properties.market, per hermesre.ae.

Conclusion

The UAE’s 2025 real estate market, with $18.2 billion in May sales and AED 151 billion in 2023 transactions, is transformed by AI, blockchain, IoT, AR/VR, and big data, per cointelegraph.com and damacproperties.com. Initiatives like Prypco Mint and DAMAC’s smart homes drive 5–8% price growth and 7% yields, per hermesre.ae. U.S. investors, leveraging FTC and VARA-compliant platforms, can mitigate risks like regulatory uncertainty and privacy concerns, per practiceguides.chambers.com, to capitalize on high-ROI opportunities in Dubai, Abu Dhabi, and Ajman. AI and Blockchain

read more: 6 Strategic Affordable Housing Projects Yielding Returns in 2025