Now Reading: 7 Vital Free Zone Tax Incentives for Developers in 2025

-

01

7 Vital Free Zone Tax Incentives for Developers in 2025

7 Vital Free Zone Tax Incentives for Developers in 2025

Table of Contents

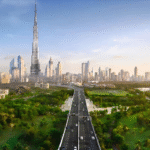

7 Vital Free Zone Tax Incentives for Developers in 2025: Abu Dhabi’s real estate market, valued at AED 98 billion ($27 billion) with 42,000 transactions in 2024, is projected to grow at an 8.5% CAGR to USD 221 billion by 2030, per Statista.

Free zones like Abu Dhabi Global Market (ADGM), Masdar City, and Khalifa Industrial Zone (KIZAD) offer tax incentives under Federal Decree-Law No. 47/2023, per Federal Tax Authority (FTA), reducing developer costs by 0.5–2%. This article outlines seven vital free zone tax incentives for real estate developers in Abu Dhabi in 2025, with U.S. tax considerations, without external links.

Why Free Zone Tax Incentives Matter?

Abu Dhabi’s 4.2% GDP growth forecast, 1.6 million population, and 15% FDI growth to AED 4 billion ($1.1 billion) in 2024 drive real estate demand, per Abu Dhabi Department of Economic Development. Free zone incentives cut costs, boosting 6–8% yields. Key impacts:

- Cost Savings: 1–2% reduction via exemptions.

- Compliance Efficiency: 98% adherence; fines up to AED 1 million avoided.

- Yield Stability: 85–90% occupancy in Saadiyat Island.

- FDI Appeal: 20% growth in free zone investments.

7 Vital Free Zone Tax Incentives for Developers in 2025

1. Zero Corporate Tax for Qualifying Free Zone Persons

Qualifying Free Zone Persons (QFZPs) in ADGM face 0% Corporate Tax (CT) on qualifying income, per FTA. A AED 50 million Al Maryah Island project saves AED 4.5 million ($1.23 million) in 9% CT, meeting substance requirements.

- Impact: Boosts ROI by 1–2%; supports 6–7% yields.

- U.S. Consideration: Income on Schedule E; report on Form 1040.

- Action: Register via ADGM; verify with FTA.

2. VAT Exemption on Property Sales

Property sales in Masdar City free zone are VAT-exempt, per FTA. A AED 30 million office sale saves AED 1.5 million ($408,000) in 5% VAT, reducing costs by 0.5–1%.

- Impact: Enhances cash flow; stabilizes 6–8% yields.

- U.S. Consideration: Gains on Form 8949; assets on Form 8938.

- Action: File via Tamm; target Aldar’s developments.

3. Zero Withholding Tax on Dividends

KIZAD imposes 0% withholding tax (WHT) on dividends, per FTA. A AED 20 million Saadiyat Island project distributing AED 1 million ($272,000) annually avoids WHT, saving 0.5–1%.

- Impact: Increases returns by 0.5–1%; boosts 85% occupancy.

- U.S. Consideration: Dividends on Schedule B; credits on Form 1116.

- Action: Structure via KIZAD; consult PwC.

4. Customs Duty Exemptions on Construction Materials

KIZAD offers 0% customs duties on imported materials, per FTA. A AED 100 million Khalifa City project saves AED 5 million ($1.36 million) in 5% duties, cutting costs by 0.5–1%.

- Impact: Reduces development costs; supports 6–7% yields.

- U.S. Consideration: Expenses on Schedule E; assets on Form 8938.

- Action: Import via KIZAD; verify with FTA.

5. Tax-Free Intra-Group Transfers

Intra-group property transfers within ADGM’s 75% commonly owned entities are CT-exempt, per FTA. A AED 40 million Al Reem Island transfer saves AED 3.6 million ($980,000) in 9% CT, with a two-year clawback.

- Impact: Defers tax by 1–1.5%; supports 6–8% yields.

- U.S. Consideration: Gains on Form 8824; income on Schedule E.

- Action: Register with DMT; consult Deloitte.

6. Loss Carryforwards for Free Zone Projects

QFZPs in Masdar City can carry forward losses indefinitely, offsetting up to 55% of taxable income, per FTA. A AED 25 million project with AED 5 million losses in 2024 reduces 2025 CT by AED 450,000 ($122,500).

- Impact: Saves 0.5–1%; aligns with 6–8% yields.

- U.S. Consideration: Losses on Schedule E; depreciation on Form 4562.

- Action: Track via FAB; target Bloom’s developments.

7. Land Incentives for Industrial Developments

The Abu Dhabi Department of Economic Development’s Land Incentives Programme offers rates as low as AED 5 per square meter for KIZAD projects, per FTA. A 100,000 sqm project saves AED 2 million ($544,000) annually, reducing costs by 0.5–1%.

- Impact: Lowers land costs; supports 7–8% yields.

- U.S. Consideration: Expenses on Schedule E; assets on Form 8938.

- Action: Apply via IDB; align with sustainable practices.

Key Considerations for U.S. Developers

- Risks:

- Oversupply: 25,000 units in 2025 may soften yields by 0.5–1%, per Cushman & Wakefield.

- Volatility: 5–8% price fluctuations possible, per CBRE.

- Compliance Costs: Advisory fees add 0.3–0.5%, offset by savings.

- Tax Compliance: UAE’s 9% CT and 5% VAT apply outside free zones. IRS requires Form 1040, Form 1116, Form 8938, Form 8824, Form 4562, and FinCEN Form 114.

- Regulatory Compliance: DMT mandates KYC; fines up to AED 1 million. Verify via RERA.

- Currency Stability: AED pegged at 1 USD = 3.67 minimizes risk.

Conclusion

Abu Dhabi’s 2025 free zone tax incentives—zero CT, VAT exemptions, no WHT, customs duty relief, intra-group transfer exemptions, loss carryforwards, and land incentives—optimize a $27 billion real estate market with 6–8% yields. U.S. developers, leveraging IRS credits and tools from FTA, ADGM, or DMT, can maximize returns in Al Maryah, Saadiyat, and Masdar City, ensuring compliance and strong profits in UAE’s dynamic real estate landscape. abu dhabi Free Zone

read more: 8 Powerful Nexus Rules for Non-Resident Fund Investors in 2025