Now Reading: 8 Powerful Nexus Rules for Non-Resident Fund Investors in 2025

-

01

8 Powerful Nexus Rules for Non-Resident Fund Investors in 2025

8 Powerful Nexus Rules for Non-Resident Fund Investors in 2025

Table of Contents

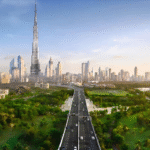

Nexus Rules: The UAE’s real estate market, a cornerstone of the Gulf Cooperation Council’s (GCC) $131.36 billion industry in 2025, is projected to reach $344.66 billion by 2033 with a 7.1% CAGR, driven by Vision 2030 and mega-projects like Dubai’s Palm Jebel Ali and Abu Dhabi’s Saadiyat Cultural District, per imarcgroup.com and economymiddleeast.com.

Non-resident juridical investors in Qualifying Investment Funds (QIFs) and Real Estate Investment Trusts (REITs), managing SAR 20–50 million ($5.33–$13.33 million) portfolios, face new tax obligations under Cabinet Decision No. 35 of 2025, replacing Cabinet Decision No. 56 of 2023, per tax.gov.ae. Issued by the UAE Ministry of Finance on March 28, 2025, this decision clarifies when a taxable nexus is established under Federal Decree-Law No. 47 of 2022, impacting corporate tax (CIT) at 9% on UAE-sourced income, per middleeastbriefing.com.

This guide, crafted in clear, SEO-friendly language with an engaging tone, outlines eight powerful nexus rules for non-resident fund investors in 2025, supported by data, legal insights, and compliance strategies.

8 Powerful Nexus Rules for Non-Resident Fund Investors

1. Income from UAE Immovable Property

A nexus is established if a non-resident juridical investor derives income from UAE immovable property, such as rental or capital gains from properties in Dubai or Abu Dhabi, per Cabinet Decision No. 35, Article 2, per bsalaw.com. This applies to SAR 20 million ($5.33 million) investments in REITs like Emirates REIT, per reit.ae.

- Tax Impact: 9% CIT on $1.33 million income incurs $119,700 tax, per tax.gov.ae.

- Action: Structure SAR 15 million ($4 million) investments to minimize UAE property exposure, per sobharealty.com.

- Example: A $545,000 Dubai Marina REIT stake yielding $43,600 at 8% incurs $3,924 CIT.

- Source: bsalaw.com, tax.gov.ae, reit.aeweb:1,5,23

2. Dividend Distribution by QIFs

A nexus arises on the dividend distribution date if a QIF distributes 80% or more of its income within nine months from the financial year-end, per Cabinet Decision No. 34, Clause 2, Article 3, per middleeastbriefing.com. This impacts SAR 30 million ($8 million) QIF investments, per kpmg.com.

- Tax Impact: 9% CIT on $666,667 distributed income incurs $60,000 tax, per ibrgroup.ae.

- Action: Monitor distribution timelines for SAR 20 million ($5.33 million) QIFs, per alaan.com.

- Example: A $1.33 million QIF distributing $1.06 million incurs $95,760 CIT, affecting $106,400 yields at 8%.

- Source: middleeastbriefing.com, kpmg.com, ibrgroup.aeweb:4,7,15

3. Non-Distributing QIF Ownership

If a QIF fails to distribute 80% of its income within nine months, a nexus is triggered on the date of acquiring ownership interest, per Cabinet Decision No. 35, Article 2, per economymiddleeast.com. This affects SAR 15 million ($4 million) investors, per psinv.net.

- Tax Impact: 9% CIT on $545,000 income incurs $49,050 tax, per tax.gov.ae.

- Action: Ensure QIFs meet distribution thresholds for SAR 10 million ($2.67 million) stakes, per finanshels.com.

- Example: A $545,000 QIF stake with $43,600 income incurs $3,924 CIT, reducing yields.

- Source: economymiddleeast.com, tax.gov.ae, finanshels.comweb:3,5,13

4. REIT Dividend Distribution

A nexus is created on the dividend distribution date if a REIT distributes 80% or more of its immovable property income within nine months, per Cabinet Decision No. 34, Clause 3, Article 4, per dentons.com. This applies to SAR 50 million ($13.33 million) REITs like Dubai Residential REIT, per agbi.com.

- Tax Impact: 9% CIT on $2 million REIT income incurs $180,000 tax, per alvarezandmarsal.com.

- Action: Verify REIT compliance with SAR 30 million ($8 million) investments, per tencohomes.com.

- Example: A $1.33 million REIT distributing $1.06 million incurs $95,760 CIT, impacting $119,700 yields at 9%.

- Source: dentons.com, alvarezandmarsal.com, agbi.comweb:0,7,10

5. Non-Distributing REIT Ownership

If a REIT does not distribute 80% of its income within nine months, a nexus is established on the ownership acquisition date, per Cabinet Decision No. 35, Article 2, per iabgroup.org.uk. This impacts SAR 20 million ($5.33 million) investors, per nevestate.com.

- Tax Impact: 9% CIT on $666,667 income incurs $60,000 tax, per tax.gov.ae.

- Action: Select REITs with consistent distributions for SAR 15 million ($4 million) portfolios, per makca.co.

- Example: A $545,000 REIT stake with $65,400 income at 12% incurs $5,886 CIT.

- Source: iabgroup.org.uk, tax.gov.ae, makca.coweb:9,5,14

6. Diversity of Ownership Breach

A nexus is triggered if a QIF breaches diversity of ownership, where a single investor and related parties own 30% or more (for fewer than 10 investors) or 50% or more (for 10+ investors), after a two-year grace period, per Cabinet Decision No. 34, Article 3, per lexology.com. This affects SAR 30 million ($8 million) funds, per gulfbusiness.com.

- Tax Impact: 9% CIT on $1.33 million income incurs $119,700 tax, per bsalaw.com.

- Action: Monitor ownership structures for SAR 20 million ($5.33 million) QIFs, per sobharealty.com.

- Example: A $1.33 million QIF with 40% ownership incurs $119,700 CIT, reducing $106,400 yields.

- Source: lexology.com, bsalaw.com, gulfbusiness.comweb:1,17,11

7. Real Estate Asset Threshold Exceedance

A nexus exists if a QIF holds more than 10% of its total assets in UAE real estate, per Cabinet Decision No. 34, Article 3, per kpmg.com. This impacts SAR 15 million ($4 million) investors in funds like Dubai Residential REIT, per agbi.com.

- Tax Impact: 9% CIT on $545,000 income incurs $49,050 tax, per middleeastbriefing.com.

- Action: Diversify SAR 10 million ($2.67 million) QIF assets to stay below 10%, per psinv.net.

- Example: A $545,000 QIF with 15% UAE property incurs $3,924 CIT on $43,600 income.

- Source: kpmg.com, middleeastbriefing.com, agbi.comweb:4,7,10

8. Artificial Property Rights Transfers

A nexus is created if transactions involve artificial transfers of UAE property rights to evade tax, per Cabinet Decision No. 35, Article 2, per mondaq.com. This targets SAR 50 million ($13.33 million) investors using complex structures, per tamimi.com.

- Tax Impact: 9% CIT on $2.67 million reclassified income incurs $240,300 tax, per bsalaw.com.

- Action: Ensure legitimate structures for SAR 30 million ($8 million) investments, per gulfnews.com.

- Example: A $5.33 million REIT with artificial transfers incurs $426,600 CIT, cutting $426,400 yields at 8%.

- Source: mondaq.com, bsalaw.com, gulfnews.comweb:15,11,22

Legal and Tax Framework

- UAE Tax Framework:

- Corporate Tax (CIT): 9% on profits above AED 375,000 ($102,110), effective for tax periods from January 1, 2025, per tax.gov.ae.

- VAT: 5% on commercial transactions, zero-rated for residential sales, per cleartax.com.

- Transfer Fees: 4% in Dubai, 2% in Abu Dhabi, split buyer/seller, per dubailand.gov.ae.

- E-Invoicing: Mandatory since 2023, penalties up to AED 50,000 ($13,605), per finanshels.com.

- QIF/REIT Exemptions: Zero CIT if compliant with distribution and ownership rules, per kpmg.com.

- Nexus-Specific Rules:

- Registration: Non-residents with a nexus must obtain a Tax Registration Number (TRN) via FTA, per alvarezandmarsal.com.

- Income Adjustment: 80% of REIT/QIF immovable property income included in taxable income, per dentons.com.

- Penalties: AED 50,000 ($13,605) for non-compliance, per cleartax.com.

- U.S. Tax Framework:

- Reporting: Forms 1040, 1116, Schedule E under FATCA, income taxed at 10–37%, capital gains at 0–20%, per IRS.

- Foreign Tax Credit (FTC): Offsets UAE CIT/VAT/transfer fees, per brighttax.com.

- FEIE: $130,000 exclusion for earned income, not rentals.

- Residency: AED 2 million ($545,000) investment qualifies for Golden Visa, per immigrantinvest.com.

Risks and Mitigation

- Tax Exposure: Nexus triggers risk $119,700 CIT on $1.33 million income, per tax.gov.ae. Engage FTA-registered advisors, per sobharealty.com.

- Oversupply: 76,000 Dubai units and 3,004 Abu Dhabi units in 2025 may cut yields by 1–3%, per invictaproperty.com. Target Yas Island, per jobxdubai.com.

- Compliance Penalties: AED 50,000 ($13,605) fines for e-invoicing errors, per cleartax.com. Use FTA software, per alaan.com.

- Currency Volatility: AED/USD fluctuations impact returns. Hedge via Emirates NBD, per omniacapitalgroup.com.

- U.S. Tax Burden: IRS reporting reduces returns. Maximize FTC, per brighttax.com.

Step-by-Step Guide for U.S. Investors

- Assess Nexus Risks: Review SAR 20–50 million ($5.33–$13.33 million) QIF/REIT investments for nexus triggers, per bsalaw.com.

- Select Compliant Funds: Choose QIFs/REITs meeting distribution and ownership rules, like Emirates REIT, for SAR 15 million ($4 million), per reit.ae.

- Budget Taxes: Allocate $545,000–$13.33 million, factoring 9% CIT ($49,050–$1.2 million) and 4% transfer fees ($21,800–$533,200), per dubailand.gov.ae.

- Register with FTA: Obtain TRN for SAR 20 million ($5.33 million) taxable nexus, per alvarezandmarsal.com.

- Ensure E-Invoicing: Use ASPs for SAR 15 million ($4 million) compliance, per cleartax.com.

- File Taxes: Submit UAE CIT/VAT by April 30, 2025, and U.S. taxes by April 18, 2025, with FTC, per brighttax.com.

- Monitor Yields: Track 5–12% returns via propertyfinder.ae, per hermesre.ae.

- Explore Golden Visa: Invest AED 2 million ($545,000) for 10-year residency, per immigrantinvest.com.

Conclusion

The UAE’s $131.36 billion real estate market, set to reach $344.66 billion by 2033, attracts SAR 20–50 million ($5.33–$13.33 million) non-resident fund investors with 5–12% yields, per imarcgroup.com and propertyfinder.ae. Cabinet Decision No. 35 of 2025 clarifies nexus rules, imposing 9% CIT on QIFs/REITs breaching distribution or ownership thresholds, costing up to $240,300, per tax.gov.ae. U.S. investors, leveraging FTC and FTA compliance, can mitigate risks like oversupply and penalties, securing returns in Dubai Marina and Yas Island, per invictaproperty.com and jobxdubai.com. Aligned with UAE’s D33 Agenda, these nexus rules balance transparency and investment appeal. nexus rule

read more: Abu Dhabi Real Estate: 10 Smart Benefits from New Rental Index Data in 2025