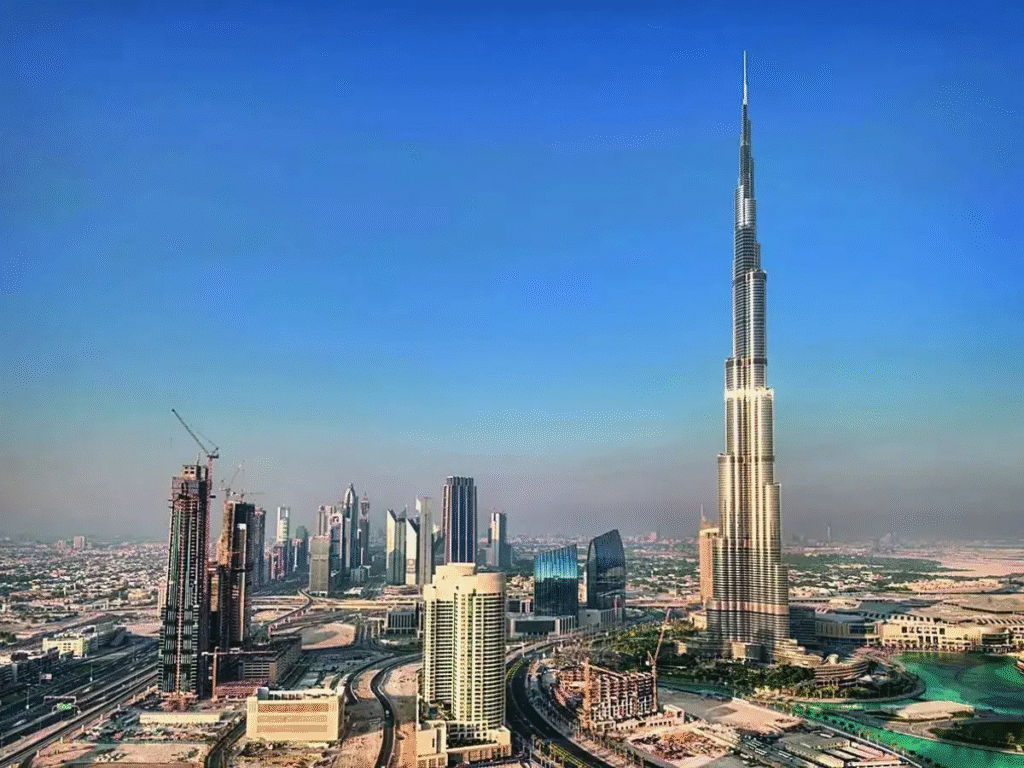

Legal Tax Benefits: The UAE’s real estate market is booming, with transactions reaching AED 893 billion ($243 billion) in 2024 and rental yields ranging from 7% to 11%. For American investors, particularly those eyeing freehold properties in areas like Dubai Marina, Saadiyat Island, and Al Marjan Island, the UAE offers a compelling opportunity.

What makes it even more attractive are the tax benefits available to new buyers, shaped by the UAE’s 9% corporate tax (effective June 2023 under Federal Decree-Law No. 47 of 2022), 5% VAT (Federal Decree-Law No. 8 of 2017), and the absence of personal income tax. With the introduction of the 15% Domestic Minimum Top-up Tax (DMTT) for multinationals in 2025, strategic tax planning is essential.

This article explores six legal tax benefits for new buyers, especially Americans, ensuring compliance with Federal Tax Authority (FTA) regulations while maximizing returns.

The UAE’s real estate sector is a global standout, offering higher yields than markets like New York, where returns hover around 4.2%. Freehold ownership, visa programs like the Golden Visa (requiring a AED 2 million investment), and proximity to Dubai International Airport (20-45 minutes from key areas) make it a top choice. In 2025, 45% of Dubai’s buyers are foreign, with Americans drawn to the tax-free personal income environment and a market projecting 5-8% price growth. For new buyers, understanding the tax landscape is key to unlocking the full potential of investments in this dynamic market.

One of the biggest advantages for new buyers is the exemption from the 9% corporate tax when purchasing properties as individuals. If you buy up to four residential properties without a UAE business license, rental income and capital gains are tax-free. For instance, an American investor purchasing a AED 1.5 million ($408,000) apartment in Jumeirah Village Circle (JVC) that generates AED 120,000 ($32,700) in annual rent avoids AED 10,800 in tax, preserving 7-9% yields. This makes personal ownership a smart choice for small-scale investors.

How to Benefit: Register your property with the Real Estate Regulatory Agency (RERA) and avoid setting up a business entity unless necessary. Keep ownership documents clear to maintain this exemption, ensuring no FTA filings are required.

New buyers can save significantly on VAT when purchasing residential properties in the secondary market. While the first sale of a residential property by a developer incurs 5% VAT, subsequent sales are exempt under Federal Decree-Law No. 8 of 2017. For example, buying a AED 2 million ($545,000) villa in Saadiyat Island from a previous owner saves AED 100,000 in VAT, boosting your investment’s 10-15% appreciation potential.

How to Benefit: Focus on secondary market properties, such as those listed on platforms like Property Finder, and verify the property’s VAT-exempt status with RERA-registered agents to avoid unexpected costs.

For buyers planning to rent out their properties, long-term residential leases (over six months) are exempt from 5% VAT. A AED 150,000 ($40,800) annual lease for an apartment in Al Marjan Island saves AED 7,500 in VAT, increasing 7-9% rental yields and making your property more attractive to tenants. This exemption applies to residential properties, unlike commercial leases, which are taxable.

How to Benefit: Structure lease agreements to exceed six months and maintain seven-year records for FTA audits. Work with RERA-registered property managers to ensure compliance and maximize tenant appeal.

Muslim American buyers can optimize Zakat obligations, which require paying 2.5% on wealth above Nisab (approximately AED 25,000 or $6,800) after one lunar year. For properties held as long-term investments, Zakat applies only to rental income, not the property’s value. A AED 1.8 million ($490,000) Ajman Corniche apartment generating AED 100,000 in rent incurs AED 2,500 in Zakat, not AED 45,000 on the property value, aligning with 7-10% yields.

How to Benefit: Document your investment intent as long-term and consult Islamic scholars to calculate Zakat accurately. This ensures spiritual compliance while maintaining financial efficiency.

American buyers using corporate entities to purchase UAE properties face U.S. taxes (21% corporate, up to 37% individual), but the U.S.-UAE double taxation agreement (DTA) allows credits for UAE taxes paid. For example, a corporate buyer paying AED 90,000 in 9% tax on AED 1 million ($272,000) rental income from a Dubai South property can offset this against U.S. tax liability, minimizing double taxation and supporting 10-15% appreciation.

How to Benefit: File IRS Form 1118 (corporations) or Form 1040 (individuals) and work with tax advisors familiar with the DTA, such as those at PwC Middle East, to maximize credits and streamline reporting.

Buyers setting up corporate entities as Qualifying Free Zone Persons (QFZPs) in free zones like Dubai Multi Commodities Centre (DMCC) or Ras Al Khaimah Economic Zone (RAKEZ) enjoy 0% corporate tax on free zone property income, per Decision 265 of 2023. A QFZP leasing a AED 3 million ($816,000) Al Reem Island property for AED 200,000 annually avoids AED 18,000 in tax, boosting 8-10% yields. Mainland income, however, is taxed at 9%.

How to Benefit: Establish a QFZP, meet substance requirements (e.g., local office, staff costing AED 50,000 annually), and segregate free zone and mainland income. Consult FCA (formerly FTA) advisors to ensure compliance, as outlined by KPMG UAE.

While these tax benefits are significant, new buyers must navigate challenges. The DMTT’s 15% rate for multinationals, stricter AML compliance, and a potential 10-15% market correction in 2026 due to oversupply (41,000 Dubai units) require vigilance. Non-compliance with corporate tax or VAT filings (nine-month or 28-day deadlines) can incur penalties up to AED 10,000. Additionally, buyers must consider U.S. tax reporting obligations, including Foreign Account Tax Compliance Act (FATCA) requirements, to avoid IRS penalties.

How to Stay Compliant: Engage RERA-registered agents and FCA-accredited tax consultants to manage filings and audits. Maintain seven-year records for all transactions, including leases, sales, and expenses, to support tax claims and avoid fines.

The UAE’s tax advantages make it a standout for American investors seeking high returns in a stable market. With no personal income tax, VAT exemptions, and free zone perks, new buyers can achieve 7-11% yields, far exceeding U.S. markets. The Golden Visa program, requiring a AED 2 million ($545,000) investment, offers long-term residency, adding lifestyle benefits. The UAE’s strategic location, world-class infrastructure, and projected 5-8% price growth in 2025, with freehold zones like Al Marjan Island at 10-15%, ensure sustained demand.

The UAE real estate market is poised for growth, but buyers must act strategically. Freehold zones like Dubai South and Saadiyat Island are seeing robust demand, with 95% occupancy in prime areas. However, oversupply risks and rising compliance costs necessitate careful planning. By leveraging tax benefits, American investors can mitigate costs and capitalize on the UAE’s growth trajectory, supported by government initiatives like Dubai 2040 and Abu Dhabi Vision 2030.

For new buyers, the UAE property market in 2025 offers six compelling tax benefits: no corporate tax for individuals, VAT exemptions on secondary sales and long-term leases, Zakat optimization, DTA credits, and free zone advantages. These perks maximize 7-11% ROI while ensuring compliance with FTA and IRS regulations. By working with RERA-registered agents and FCA consultants, American investors can navigate challenges and secure long-term wealth in Dubai, Abu Dhabi, and Ras Al Khaimah’s vibrant real estate landscape. Start your investment journey today to unlock the UAE’s tax-efficient opportunities. Legal Tax Benefits

read more: UAE Real Estate: 7 Corporate Tax Strategies for Property Investors in 2025