Now Reading: Want to Own Property in Dubai? Here’s How Easily Now 2025

-

01

Want to Own Property in Dubai? Here’s How Easily Now 2025

Want to Own Property in Dubai? Here’s How Easily Now 2025

Dubai, the shining jewel of the United Arab Emirates (UAE), is famous for its stunning skyscrapers, luxury lifestyle, and world-class infrastructure. It’s also one of the most attractive cities in the world for property investors. Thanks to high rental yields, zero property tax, and a booming tourism sector, many people from around the world are looking to buy property in Dubai.

But how do you actually buy property in Dubai, especially as a foreigner? Is it safe, legal, and easy? The answer is yes—but you need to follow the right steps.

This simple, step-by-step guide will help you understand how to buy property in Dubai, whether you are an investor, a first-time buyer, or someone planning to relocate.

1. Can Foreigners Buy Property in Dubai?

Yes, foreigners can buy property in Dubai. Since 2002, the government has allowed non-UAE nationals to buy, sell, and rent property in designated freehold areas.

These areas include popular spots like:

- Dubai Marina

- Downtown Dubai

- Palm Jumeirah

- Business Bay

- Jumeirah Village Circle (JVC)

- Dubai Hills Estate

In these zones, foreigners can own property 100% outright, without the need for a local sponsor.

2. Choose the Right Type of Property

There are several types of property available:

- Apartments – perfect for first-time buyers or investors

- Villas – ideal for families or luxury buyers

- Townhouses – good for mid-range budgets

- Off-plan properties – bought directly from developers before construction ends

- Ready-to-move-in properties – fully completed and often furnished

Each has pros and cons. Off-plan properties are usually cheaper, but you may wait years before moving in. Ready homes are more expensive but are instantly usable.

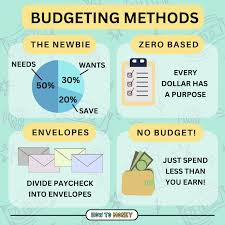

3. Set Your Budget and Check Costs

Buying a home in Dubai involves more than just the property price. Be sure to plan for additional costs such as:

- Dubai Land Department (DLD) fee – 4% of the property value

- Registration fee – varies depending on property type

- Brokerage fee – around 2% if using an agent

- Service charges – ongoing yearly costs for maintenance and community services

You may also need to pay a mortgage registration fee (0.25%) if taking a loan.

Budget smartly and make sure to include all these in your final calculations.

4. Decide on Financing: Mortgage or Cash?

You can either:

- Pay in cash – fastest method

- Apply for a mortgage – available for both residents and non-residents

Banks in Dubai typically offer up to 80% financing for UAE residents and 50-60% for non-residents. To qualify, you must:

- Be between 21 and 65 years old

- Show proof of stable income

- Have a good credit history

Mortgage interest rates range from 2.5% to 5% depending on the lender and your financial profile.

5. Find a Reputable Real Estate Agent or Developer

Always work with a licensed real estate agent or an RERA-certified (Real Estate Regulatory Agency) developer. Check the agent’s license on the Dubai REST App or DLD website.

Good agents can help you:

- Find properties that suit your needs

- Negotiate prices

- Prepare and process documents

- Coordinate with the DLD

Avoid agents or developers who promise “too good to be true” deals without proper paperwork.

6. Make an Offer and Sign the Agreement

Once you find the perfect property, here’s what to expect:

- Make an offer – negotiate the price with the seller

- Sign a Memorandum of Understanding (MOU) – includes terms and payment details

- Pay a deposit – usually 10% of the property value

- Apply for No Objection Certificate (NOC) – needed to transfer property ownership

7. Register the Property with Dubai Land Department

This is the final and official step. You will need to:

- Pay the DLD transfer fee (4%)

- Submit documents including passport, visa (if available), Emirates ID (if resident), and signed MOU

- Complete the ownership transfer process

After successful registration, you will receive the title deed, officially confirming you as the property owner.

8. What About Buying Off-Plan Property?

Off-plan properties are popular for their lower prices and flexible payment plans. To buy off-plan:

- Choose a project from a DLD-approved developer like Emaar, DAMAC, or Nakheel

- Pay the booking fee (usually 10-20%)

- Follow the payment schedule agreed in the sales agreement

Always check that the project is registered with Oqood, the off-plan registration system.

9. Can You Get a Visa by Buying Property?

Yes, Dubai offers property-linked residence visas. To qualify, you must:

- Own property worth at least AED 750,000 (USD 204,000)

- The property must be fully paid (not mortgaged over 50%)

- You can apply for a 3-year or 10-year renewable visa

This visa allows you to live in Dubai and sponsor your family. However, it does not allow you to work unless you get a separate work permit.

10. Final Tips for Safe Buying

- Always check legal documents and contracts

- Verify the project or building with the Dubai Land Department

- Never pay in cash without official receipts

- Work with a trusted lawyer if needed

- Don’t rush—do your research and visit the property

Conclusion

Buying property in Dubai is a straightforward process if you follow the correct steps. Whether you’re looking to invest, live, or earn rental income, Dubai offers a wide range of options for foreigners.

With no property tax, high rental yields, and a fast-growing economy, it’s no wonder Dubai remains one of the top real estate markets in the world.

If you’re ready to take the leap, start by setting a clear budget, choosing the right location, and partnering with trusted agents or developers. Soon, you could be calling Dubai your new home—or your next smart investment!

Read More:- Shobha Realty Launches Its Most Luxurious Project Yet—Full Details Inside 2025