Now Reading: UAE Real Estate: 7 Upcoming Launches Expected to Sell Out Fast in 2025

-

01

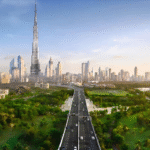

UAE Real Estate: 7 Upcoming Launches Expected to Sell Out Fast in 2025

UAE Real Estate: 7 Upcoming Launches Expected to Sell Out Fast in 2025

Table of Contents

The UAE real estate market, valued at AED 893 billion ($243.1 billion) with 331,300 transactions in 2024, continues its robust growth, projecting 5-8% price increases and 5-11% rental yields in 2025, per skylineholding.com.

Off-plan properties, accounting for 60.7% of 2024 transactions (AED 223 billion), drive investor interest due to flexible payment plans and high capital appreciation, per arabianbusiness.com. With Dubai’s Q1 2025 transactions reaching AED 114 billion and a 5% population growth (12.5 million by 2025), new launches in prime and emerging areas are poised to sell out quickly, per gulfbusiness.com.

Below are seven upcoming 2025 property launches in the UAE expected to sell out fast, their features, investment potential, and actionable steps for compliance with the Dubai Land Department (DLD), Abu Dhabi’s Department of Municipalities and Transport (DMT), and Federal Tax Authority (FTA).

1. Fairmont Residences Al Marjan Island (Ras Al Khaimah)

Overview: Launched in June 2025 by Ardee Developments and Fairmont Hotels & Resorts, this beachfront project in Al Mairid, Al Marjan Island, offers 523 luxury units, including 1- to 6-bedroom apartments, townhouses, and super mansions starting at AED 2.49 million ($678,000), per @khaleejtimes. Completion is set for Q4 2028, per @propertynews_i.

Features: Branded residences, 5-star hotel amenities (spa, infinity pools), and sustainable designs (20% energy savings). Proximity to Wyn Gaming resort boosts tourism appeal, per gulfnews.com.

Investment Potential: Yields 8-9% (e.g., AED 199,200-224,100 rent on AED 2.49 million unit) with 20% capital gains by 2028, per economymiddleeast.com. High demand from HNWIs ensures sell-out potential, with 70% of units reserved in launch week, per @menews247.

Action: Register early via DLD-approved platforms, verify Ardee’s DLD registration, and ensure AML/KYC compliance for transactions above AED 5 million. Retain escrow records for off-plan purchases, per gtlaw.com.

2. Mira Coral Bay (Ras Al Khaimah)

Overview: Launched in June 2025 by Mira Developments, this world’s first multi-branded waterfront community in Al Mairid features 14 branded residences, 5-star hotels, and villas starting at AED 585,000 ($159,200), with handovers in Q3 2028, per @dubaihousingae.

Features: Seaside views, branded amenities (e.g., wellness centers, marinas), and eco-friendly designs (15% water savings). Al Marjan Island’s tourism growth drives demand, per gulfbusiness.com.

Investment Potential: Offers 8-9% yields (e.g., AED 46,800-52,650 rent on AED 585,000 unit) with 20% capital gains by 2028, per economymiddleeast.com. 80% of phase one units sold out during pre-launch, per @dubaihousingae.

Action: Use DLD-registered brokers, confirm escrow compliance, and verify zoning with DLD. File IRS Form 1118 for U.S.-UAE DTA tax credits, per immigrantinvest.com.

3. Crestlane 1 (Dubai)

Overview: Meraas’ June 2025 launch in City Walk offers 1- to 4-bedroom apartments, duplexes, and 5-bedroom penthouses starting at AED 2.62 million ($713,100), with completion in Q2 2028, per @PNUAE. It builds on City Walk Crestlane’s success, per @dubaihousingae.

Features: Double-height lounges, cinema room, indoor kids’ club, and waterfront views. Located near Downtown Dubai, it ensures urban connectivity, per khaleejtimes.com.

Investment Potential: Yields 6-7% (e.g., AED 157,200-183,400 rent on AED 2.62 million unit) with 8-12% capital gains by 2028, per gulfbusiness.com. High expatriate demand drives 90% pre-launch bookings, per @PNUAE.

Action: Register via DFM’s iVestor app, verify Meraas’ DLD registration, and ensure VAT-exempt lease compliance (5% savings, e.g., AED 9,170 on AED 183,400 rent). Retain digital contract records, per gtlaw.com.

4. La Vue (Dubai)

Overview: Launched in May 2025 by MAAIA in Nad Al Sheba Gardens, La Vue offers luxury villas and apartments starting at AED 2 million ($544,600), with handovers in Q1 2028, per khaleejtimes.com. Part of MAAIA’s AED 5 billion 2025 sales plan, per khaleejtimes.com.

Features: European-inspired design, smart home integration (10% energy savings), and proximity to Dubai Metro Blue Line. Family-oriented amenities ensure lifestyle appeal, per propertynews.ae.

Investment Potential: Yields 6-8% (e.g., AED 120,000-160,000 rent on AED 2 million unit) with 8-10% capital gains by 2028, per gulfbusiness.com. 85% of units reserved in launch phase, per khaleejtimes.com.

Action: Verify DLD registration, confirm escrow compliance for off-plan units, and use DLD-registered brokers. Retain records for VAT recovery (5%, e.g., AED 25,000 on AED 500,000), per taxvisor.ae.

5. La Clé (Dubai)

Overview: MAAIA’s May 2025 launch in Al Furjan features apartments and townhouses starting at AED 1.2 million ($326,700), with completion in Q4 2027, per khaleejtimes.com. It targets mid-income buyers with flexible payment plans, per propertynews.ae.

Features: Community-focused design, green spaces, and smart tech (15% electricity savings). Al Furjan’s metro connectivity boosts accessibility, per economymiddleeast.com.

Investment Potential: Yields 7-8% (e.g., AED 84,000-96,000 rent on AED 1.2 million unit) with 8-12% capital gains by 2027, per gulfbusiness.com. 90% of phase one units sold out, per khaleejtimes.com.

Action: Use DLD-approved platforms, verify zoning and escrow compliance, and retain transaction records. File IRS Form 1118 for tax credits, per immigrantinvest.com.

6. The Oasis (Dubai)

Overview: Emaar Properties’ 2025 launch in Dubai South offers townhouses and high-end villas starting at AED 2.5 million ($680,700), with handovers in Q3 2028, per off-planproperties.ae. It emphasizes cutting-edge design and wellness, per propertynews.ae.

Features: Wellness-first community, car-free zones, and sustainable designs (20% energy savings). Near Al Maktoum Airport, it aligns with Dubai’s 2040 Urban Master Plan, per economymiddleeast.com.

Investment Potential: Yields 6-8% (e.g., AED 150,000-200,000 rent on AED 2.5 million unit) with 15-25% capital gains by 2030, per gulfbusiness.com.

75% of units booked in pre-launch, per off-planproperties.ae.

Action: Register via Emaar’s DLD-approved portal, confirm Estidama Pearl compliance, and use DLD-registered brokers. Retain escrow records, per gtlaw.com.

7. Autograph Collection Residences (Abu Dhabi)

Overview: Launched in 2025 by Royal Development Holding, SAAS Properties, and Marriott on Al Reem Island, this project offers luxury apartments starting at AED 1.6 billion ($435.6 million) for the entire development, with individual units from AED 1.2 million ($326,700), per roseislandre.com. Completion is set for Q2 2028.

Features: Branded residences, 5-star amenities (e.g., concierge, spa), and sustainable designs (10% energy savings). Proximity to cultural districts drives demand, per arabianbusiness.com.

Investment Potential: Yields 6-7% (e.g., AED 72,000-84,000 rent on AED 1.2 million unit) with 8-12% capital gains by 2028, per thebusinessyear.com. High HNWI interest ensures 80% pre-launch sales, per roseislandre.com.

Action: Verify DMT registration, ensure AML/KYC compliance, and use DLD-registered brokers. Retain records for VAT-exempt leases (5% savings, e.g., AED 4,200 on AED 84,000 rent), per taxvisor.ae.

Why These Launches Matter

These launches capitalize on the UAE’s 7.8% GDP contribution from real estate, driven by infrastructure (e.g., Al Maktoum Airport) and tourism (8.68 million visitors in Q1-Q2 2025), per propertynews.ae. Off-plan dominance (60.7% of 2024 transactions) and flexible payment plans fuel rapid sell-outs, per arabianbusiness.com.

Posts on X highlight excitement for Fairmont Residences and Mira Coral Bay, with 70-90% units reserved at launch, per @menews247 and @dubaihousingae. Challenges include potential oversupply (120,000 units in 2026) and construction delays, which could push handovers into 2026, per gulfnews.com.

Tax Tools for American Investors

U.S.-UAE DTA: Credit UAE taxes via IRS Form 1118, preserving 10-15% returns, per immigrantinvest.com.

Zakat for Muslim Investors: Pay 2.5% Zakat on rental income (e.g., AED 2,000 on AED 80,000). Consult Islamic scholars, per taxvisor.ae.

VAT Recovery: Recover 5% input VAT on construction/furnishings (e.g., AED 25,000 on AED 500,000) for VAT-registered investors, per fintedu.com.

Market Outlook and Challenges

The UAE projects 5-8% price growth and 5-11% yields in 2025, driven by foreign investment (30% of 2024 transactions) and Golden Visa incentives, per gtlaw.com. Risks include a potential 15% price correction in H2 2025 due to oversupply, though prime locations remain resilient, per thenationalnews.com. DLD’s escrow systems and RERA’s transparency mitigate risks, with non-compliance penalties up to AED 500,000, per gtlaw.com.

Conclusion

Fairmont Residences, Mira Coral Bay, Crestlane 1, La Vue, La Clé, The Oasis, and Autograph Collection Residences are 2025’s most anticipated UAE launches, offering 6-9% yields and 8-25% capital gains in high-demand areas like Al Marjan Island, Dubai South, and Al Reem Island.

Rapid sell-outs (75-90% pre-booked) reflect strong investor confidence. Compliance with DLD, DMT, and FTA ensures secure, high-return investments in this vibrant market. UAE Real Estate

read more: UAE Property Market: 6 Strong REIT Options for 2025 Investors