Now Reading: Palm Jumeirah: 7 Luxury Residences Launching in 2025 You Should Know

-

01

Palm Jumeirah: 7 Luxury Residences Launching in 2025 You Should Know

Palm Jumeirah: 7 Luxury Residences Launching in 2025 You Should Know

Table of Contents

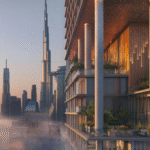

Palm Jumeirah, a 560-hectare man-made island by Nakheel, is a global symbol of luxury, stretching 6.5km into the Arabian Gulf. With AED 17.16 billion ($4.7 billion) in transactions in Q1 2025 and a 34% increase in high-end sales, it offers 6-10% rental yields and 12-15% capital gains, per jh-realestate.com.

Located near Dubai Marina (5 minutes), Downtown Dubai (20 minutes), and Dubai International Airport (30 minutes), it features 20km of Blue Flag beaches, a 5.4km monorail, and landmarks like Atlantis The Royal, per nakheel.com.

Below are seven luxury residences launching or completing in 2025, their features, investment potential, and compliance steps with the Dubai Land Department (DLD) and Federal Tax Authority (FTA).

1. The Palm Residences

Overview: A Nakheel development on West Crescent, offering 2- to 4-bedroom apartments and penthouses from AED 10 million ($2.72 million). Handover in Q4 2025, per bestluxury.properties.

Features: Spacious layouts with waterfront views, private beach access, and amenities like a clubhouse, infinity pool, and gym. Near W Dubai and Th8 Resort (5 minutes), per nakheel.com.

Investment Potential: Yields of 6-8% (e.g., AED 800,000/year for a AED 10 million apartment) and 12-15% capital gains by 2026, driven by exclusivity, per dxbproperties.ae.

Compliance: Register SPAs via DLD’s Ejari system. Verify escrow accounts. Retain records for FTA audits, per taxvisor.ae.

2. Ocean House

Overview: An Ellington Properties project on East Crescent, offering 2- to 6-bedroom apartments, duplexes, and penthouses from AED 9 million ($2.45 million). Handover in Q2 2025, per christiesrealestatedubai.com.

Features: Panoramic views of Burj Khalifa and Burj Al Arab, with an Olympic-size pool, wellness spa, and private beach. Near Nakheel Mall (5 minutes), per savemax.ae.

Investment Potential: Yields of 6.5-8% (e.g., AED 720,000/year for a AED 9 million apartment) and 12-14% capital gains by 2026, fueled by branded appeal, per dxbinteract.com.

Compliance: Register SPAs via Ejari. Verify freehold status. Retain records for FTA audits, per adres.ae.

3. W Residences

Overview: A dual-tower project by Al Mana Group and Al Sharq Investment on West Crescent, offering 2- to 5-bedroom apartments and penthouses from AED 12 million ($3.27 million). Handover in Q1 2025, per dxbproperties.ae.

Features: Resort-style amenities, including ‘The 104’ private club, gym, spa, and private pools. Near Atlantis The Royal (5 minutes), per savemax.ae.

Investment Potential: Yields of 6-7.5% (e.g., AED 900,000/year for a AED 12 million apartment) and 12-15% capital gains by 2026, driven by celebrity appeal, per dxbproperties.ae.

Compliance: Register SPAs via Ejari. Verify escrow accounts. Obtain valuation certificate for Golden Visa (AED 2 million+). Retain records for FTA audits, per gtlaw.com.

4. Serenia Living

Overview: A Palma Development project on East Crescent, offering 3- to 5-bedroom apartments and penthouses from AED 11 million ($2.99 million). Handover in Q3 2025, per luxhabitat.ae.

Features: Beachfront units with private elevators, infinity pools, and 24/7 concierge. Near The Pointe’s dining (5 minutes), per propertyfinder.ae.

Investment Potential: Yields of 6-8% (e.g., AED 880,000/year for a AED 11 million apartment) and 12-14% capital gains by 2026, supported by prime location, per dxbinteract.com.

Compliance: Register SPAs via Ejari. Verify freehold status. Retain records for FTA audits, per dubailand.gov.ae.

5. Palme Couture Residences

Overview: A 10-storey project by Innovate Living on West Crescent, offering 2- to 5-bedroom apartments, duplexes, and penthouses from AED 10 million ($2.72 million). Handover in Q2 2025, per bhomes.com.

Features: Townhouses with outdoor pools, royal penthouses, and amenities like a gym and private beach. Near Palm West Beach (5 minutes), per luxhabitat.ae.

Investment Potential: Yields of 6-7.5% (e.g., AED 750,000/year for a AED 10 million apartment) and 10-12% capital gains by 2026, driven by bespoke designs, per dxbproperties.ae.

Compliance: Register SPAs via Ejari. Verify escrow accounts. Retain records for FTA audits, per taxvisor.ae.

6. Six Senses Residences

Overview: A Select Group and ESIC project on West Crescent, offering 2- to 5-bedroom apartments, penthouses, and villas from AED 12.39 million ($3.37 million). Handover in Q1 2025, per bhomes.com.

Features: Wellness-focused design with private pools, spa, and beach access. Near Aquaventure Waterpark (5 minutes), per aysdevelopers.ae.

Investment Potential: Yields of 6-8% (e.g., AED 991,200/year for a AED 12.39 million apartment) and 12-15% capital gains by 2026, boosted by branded wellness, per dxbinteract.com.

Compliance: Register SPAs via Ejari. Verify freehold status. Obtain valuation certificate for Golden Visa (AED 2 million+). Retain records for FTA audits, per adres.ae.

7. AVA Palm Jumeirah

Overview: An Omniyat project on East Crescent, offering 3- to 5-bedroom apartments and penthouses from AED 15 million ($4.08 million). Handover in Q4 2025, per bhomes.com.

Features: Managed by Dorchester Collection, with private elevators, terraces with pools, and 270-degree views of Burj Al Arab. Near The Pointe (5 minutes), per jh-realestate.com.

Investment Potential: Yields of 6-7.5% (e.g., AED 1.125 million/year for a AED 15 million apartment) and 12-15% capital gains by 2026, driven by ultra-luxury branding, per dxbproperties.ae.

Compliance: Register SPAs via Ejari. Verify escrow accounts. Obtain valuation certificate for Golden Visa (AED 2 million+). Retain records for FTA audits, per gtlaw.com.

Why These Projects Matter

The Palm Residences, Ocean House, W Residences, Serenia Living, Palme Couture Residences, Six Senses Residences, and AVA Palm Jumeirah reinforce Palm Jumeirah’s status as Dubai’s ultra-luxury hub, with 6-8% yields outperforming global benchmarks (e.g., Monaco’s 2-3%), per qbd.ae. The island’s 34 transactions over AED 36.7 million ($10 million) in Q1 2025, totaling AED 2.07 billion ($562.8 million), highlight demand from high-net-worth individuals (HNWIs), per luxuryproperty.com.

Amenities like private beaches, Nakheel Mall, and Michelin-starred dining (e.g., Nobu) cater to affluent buyers, per luxhabitat.ae. Connectivity via the Palm Monorail and Sheikh Zayed Road, plus proximity to JBR (5 minutes) and Dubai Marina Mall, enhances appeal, per nakheel.com.

Posts on X emphasize the island’s prestige and views, per @luxury_playbook. Challenges include limited villa supply and high entry prices, mitigated by flexible payment plans (e.g., 60/40 for Ocean House) and 90% occupancy, per hausandhaus.com. Golden Visa eligibility (AED 2 million+) applies to all projects, per pangeadubai.com.

Tax Tools for American Investors

U.S.-UAE DTA: Credit UAE taxes via IRS Form 1118, preserving 12-15% returns, per immigrantinvest.com.

Zakat for Muslim Investors: Pay 2.5% Zakat on rental income (e.g., AED 2,500 on AED 100,000). Consult Islamic scholars, per taxvisor.ae.

VAT Recovery: Recover 5% input VAT on commercial expenses (e.g., AED 25,000 on AED 500,000) for VAT-registered investors, per fintedu.com.

Market Outlook and Challenges

Palm Jumeirah’s 34% transaction growth in 2024 and 6.5% average ROI reflect robust demand, with off-plan properties driving 69% of luxury sales above AED 10 million, per topluxuryproperty.com. Infrastructure like Al Ittihad Park and beach enhancements (1.5 million cubic meters of sand added by 2023) supports livability, per propsearch.ae.

Risks include oversupply (97,000 new units by 2026) and seasonal jellyfish, offset by limited high-end inventory and strong tourist demand, per dxboffplan.com. These projects align with Dubai’s 2040 Urban Master Plan for sustainable luxury, per u.ae.

Conclusion

The Palm Residences, Ocean House, W Residences, Serenia Living, Palme Couture Residences, Six Senses Residences, and AVA Palm Jumeirah are Palm Jumeirah’s top luxury residences for 2025, offering 6-8% yields and 12-15% capital gains.

With private beaches, branded services, and proximity to landmarks like Atlantis The Royal, they attract HNWIs and investors. Compliance with DLD’s Ejari and FTA ensures secure investments in this iconic waterfront destination. Palm Jumeirah

read more: Wasl Gate: 5 Community Projects Offering Lifestyle, Retail, and Business Integration in 2025