Now Reading: Bluewaters Island: 5 Premium Projects Blending Retail and Residential Lifestyle in 2025

-

01

Bluewaters Island: 5 Premium Projects Blending Retail and Residential Lifestyle in 2025

Bluewaters Island: 5 Premium Projects Blending Retail and Residential Lifestyle in 2025

Table of Contents

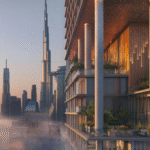

Bluewaters Island, a 32-hectare man-made island by Meraas, located 400 meters off Jumeirah Beach Residence (JBR), is a vibrant lifestyle destination in Dubai. With AED 3.5 billion ($952 million) in transactions in 2024 and a 24% year-on-year sales increase in Q1 2025, it offers 7-9% rental yields and 15-20% capital gains, per aysdevelopers.ae.

Home to Ain Dubai, the world’s tallest observation wheel, and Banyan Tree Dubai, it features 698 apartments, 4 penthouses, 17 townhouses, and 132 retail outlets at The Wharf, per inhabitgroup.com. Connected by a 265m pedestrian bridge and a direct road to Sheikh Zayed Road, it’s near Dubai Marina (5 minutes), Downtown Dubai (15 minutes), and Dubai International Airport (25 minutes), per bluewatersdubai.ae.

Below are five premium projects launching or completing in 2025, blending retail and residential lifestyles, with their features, investment potential, and compliance steps with the Dubai Land Department (DLD) and Federal Tax Authority (FTA).

1. Bluewaters Bay

Overview: A Meraas residential project in the bay between Bluewaters and JBR, offering 1- to 4-bedroom apartments and penthouses from AED 2.56 million ($697,000). Handover in Q2 2027, per meraas.com.

Features: Seafront apartments with open-plan layouts, floor-to-ceiling windows, and smart home systems. Amenities include an infinity pool, gym, and direct access to The Wharf’s retail and dining (132 outlets). Near Ain Dubai (5-minute walk) and JBR Beach, per elysian.com.

Investment Potential: Yields of 7-9% (e.g., AED 230,400/year for a AED 2.56 million apartment) and 15-20% capital gains by 2028, driven by tourism and retail proximity, per aysdevelopers.ae.

Compliance: Register SPAs via DLD’s Ejari system. Verify escrow accounts. Retain records for FTA audits, per taxvisor.ae.

2. Bluewaters Residences (Building 5 Expansion)

Overview: A Meraas expansion on Bluewaters Island, offering 1- to 4-bedroom apartments from AED 3.99 million ($1.09 million). Handover in Q4 2025, per dubaioffplanprojects.com.

Features: Waterfront units with views of Ain Dubai and Dubai Marina, featuring a state-of-the-art gym, pools, and children’s play areas. Direct access to The Wharf’s retail and dining, near Caesars Palace (2 minutes), per drivenproperties.com.

Investment Potential: Yields of 7-8.5% (e.g., AED 339,150/year for a AED 3.99 million apartment) and 15-18% capital gains by 2026, fueled by Ain Dubai’s tourist draw, per dxbinteract.com.

Compliance: Register SPAs via Ejari. Verify freehold status. Retain records for FTA audits, per adres.ae.

3. La Voile Residences

Overview: A luxury residential project by Meraas, offering 1- to 4-bedroom apartments and penthouses from AED 3.5 million ($952,900). Handover in Q3 2025, per meraas.com.

Features: Contemporary units with private terraces, smart automation, and eco-friendly systems like solar panels. Includes a spa, infinity pool, and access to The Wharf’s retail and dining. Near Dubai Marina Mall (5 minutes), per providentestate.com.

Investment Potential: Yields of 6.5-8% (e.g., AED 280,000/year for a AED 3.5 million apartment) and 15-18% capital gains by 2026, driven by sustainable design and retail integration, per aysdevelopers.ae.

Compliance: Register SPAs via Ejari. Verify escrow accounts. Obtain valuation certificate for Golden Visa (AED 2 million+). Retain records for FTA audits, per gtlaw.com.

4. Bluewaters Wharf Residences

Overview: A mixed-use project by Meraas and Woods Bagot, offering 1- to 3-bedroom apartments above The Wharf retail precinct from AED 3 million ($816,900). Handover in Q2 2025, per woodsbagot.com.

Features: Urban island-style apartments with direct access to 132 retail and dining outlets, including waterfront cafes and fine dining. Amenities include a fitness center and private beach. Near JBR’s promenade (5-minute walk), per therealestatereports.com.

Investment Potential: Yields of 7-8.5% (e.g., AED 255,000/year for a AED 3 million apartment) and 15-20% capital gains by 2026, driven by retail footfall and tourist appeal, per dxbproperties.ae.

Compliance: Register SPAs via Ejari. Verify freehold status. Retain records for FTA audits, per dubailand.gov.ae.

5. Banyan Tree Residences

Overview: A branded residential project by Banyan Tree Dubai (formerly Caesars Palace), offering 2- to 4-bedroom apartments and penthouses from AED 5 million ($1.36 million). Handover in Q1 2025, per therealestatereports.com.

Features: Resort-style living with private beach access, award-winning spa, and fine dining. Integrated with The Wharf’s retail and entertainment, near Madame Tussauds Dubai (5 minutes), per bluewatersdubai.ae.

Investment Potential: Yields of 6-7.5% (e.g., AED 375,000/year for a AED 5 million apartment) and 12-15% capital gains by 2026, boosted by Banyan Tree’s luxury branding, per dxbinteract.com.

Compliance: Register SPAs via Ejari. Verify escrow accounts. Obtain valuation certificate for Golden Visa (AED 2 million+). Retain records for FTA audits, per taxvisor.ae.

Why These Projects Matter

Bluewaters Bay, Bluewaters Residences (Building 5 Expansion), La Voile Residences, Bluewaters Wharf Residences, and Banyan Tree Residences elevate Bluewaters Island as a premium lifestyle hub, offering 6-9% yields, surpassing global benchmarks (e.g., New York’s 2-3%), per aysdevelopers.ae.

With 10 mid-rise towers, 132 retail outlets, and attractions like Ain Dubai and Madame Tussauds, the island blends residential luxury with retail vibrancy, per mirageglobal.com. Connectivity via a pedestrian bridge, road to Sheikh Zayed Road, and planned water taxis ensures accessibility, per drivenproperties.com. Proximity to JBR Beach, Dubai Marina Mall (5 minutes), and GEMS Wellington International (15 minutes) enhances livability, per providentestate.com.

Posts on X praise the island’s views and entertainment, per @luxury_playbook. Challenges include high entry prices and occasional Ain Dubai closures, mitigated by flexible payment plans (e.g., 60/40 for Bluewaters Bay) and 90% occupancy, per hausandhaus.com. Golden Visa eligibility (AED 2 million+) applies to all projects, per pangeadubai.com.

Tax Tools for American Investors

U.S.-UAE DTA: Credit UAE taxes via IRS Form 1118, preserving 15-20% returns, per immigrantinvest.com.

Zakat for Muslim Investors: Pay 2.5% Zakat on rental income (e.g., AED 2,500 on AED 100,000). Consult Islamic scholars, per taxvisor.ae.

VAT Recovery: Recover 5% input VAT on commercial expenses (e.g., AED 25,000 on AED 500,000) for VAT-registered investors, per fintedu.com.

Market Outlook and Challenges

Bluewaters Island’s 24% transaction growth in Q1 2025 and 7.5% average ROI reflect strong demand, with off-plan properties driving 65% of transactions, per aysdevelopers.ae. Ongoing enhancements, like new dining terraces and landscaping, align with Dubai’s Clean Energy Strategy 2050, per therealestatereports.com.

Risks include oversupply (97,000 new units by 2026) and reliance on private transport, offset by limited waterfront inventory and 17.2 million tourists in 2024, per dxboffplan.com. These projects, integrating retail, dining, and luxury living, align with Dubai’s 2040 Urban Master Plan for vibrant coastal communities, per u.ae.

Conclusion

Bluewaters Bay, Bluewaters Residences (Building 5 Expansion), La Voile Residences, Bluewaters Wharf Residences, and Banyan Tree Residences are Bluewaters Island’s top premium projects for 2025, offering 6-9% yields and 12-20% capital gains. With waterfront views, retail integration at The Wharf, and proximity to Ain Dubai, they attract affluent buyers and tourists. Compliance with DLD’s Ejari and FTA ensures secure investments in this iconic lifestyle destination. Bluewaters Island

read more: Dubai Islands: 6 New Waterfront Communities Transforming the Coastline in 2025