Now Reading: Deira Islands: 7 Mixed-Use Developments Attracting Regional Retail Investors in 2025

-

01

Deira Islands: 7 Mixed-Use Developments Attracting Regional Retail Investors in 2025

Deira Islands: 7 Mixed-Use Developments Attracting Regional Retail Investors in 2025

Table of Contents

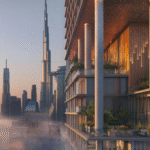

Deira Islands, rebranded as Dubai Islands by Nakheel in 2022, is a 17 sq.km. archipelago off Dubai’s northern coastline, comprising five islands: Marina Island, Central Island, Shore Island, Golf Island, and Elite Island. With AED 2.2 billion ($598 million) in transactions in 2024 and a 22% year-on-year sales increase in Q1 2025, it offers 6-8% rental yields and 8-12% capital gains, per gulfbusiness.com and dxbinteract.com.

Connected via the Deira Islands Bridge to Deira (5 minutes), Dubai International Airport (15 minutes), and Downtown Dubai (25 minutes), it features 20km of Blue Flag beaches, six marinas, and over 80 planned hotels, per nakheel.com.

The islands’ mixed-use developments, integrating retail, residential, and hospitality, attract regional retail investors from Saudi Arabia, Qatar, and Kuwait, driven by Dubai’s tax-free environment and 18.7 million tourists in 2024, per propertyfinder.ae and dxboffplan.com.

Below are seven mixed-use developments in Dubai Islands for 2025, detailing their features, investment potential, and compliance steps with the Dubai Land Department (DLD) and Federal Tax Authority (FTA). These align with the Dubai 2040 Urban Master Plan, per excelproperties.ae.

1. Deira Mall

Overview: A Nakheel project on Central Island, spanning 600,000 sq.m. with 1,100 retail spaces, set for completion in Q4 2026, per propsearch.ae.

Features: A mega-mall with a 1km retractable glass atrium, 100+ quayside cafes and restaurants, and entertainment zones. Includes office spaces and residential units above retail. Near The Night Market (5-minute walk), per nakheel.com. Design by Arif & Bintoak, per propsearch.ae.

Investment Potential: Retail units (500-2,000 sq.ft.) start at AED 3,000/sq.ft., yielding 6-8% (e.g., AED 180,000/year for a AED 3 million unit), per dxbproperties.ae. Capital gains of 8-10% by 2027, driven by high footfall (projected 20 million visitors annually), per kaizenams.com. Appeals to GCC retailers for anchor stores.

Compliance: Register retail leases via DLD’s Ejari system. Obtain commercial licenses from Dubai Tourism. Retain records for FTA audits, ensuring 5% VAT compliance, per taxvisor.ae.

2. Rixos Dubai Islands Hotel & Residences

Overview: A Nakheel and Excelsior Real Estate project on Shore Island, offering 1- to 3-bedroom apartments, 4-bedroom duplexes, beach houses, and 10 standalone villas, starting at AED 2.5 million ($680,800). Handover in Q4 2026, per drivenproperties.com.

Features: A mixed-use development with a luxury hotel, retail outlets, dining options, and a waterpark. Residential units feature sea views and access to beach clubs. Near Centara Mirage Beach Resort (5-minute walk), per keltandcorealty.com.

Investment Potential: Retail spaces yield 6-7.5% (e.g., AED 150,000/year for a AED 2.5 million unit), with residential yields at 7-8%, per aysdevelopers.ae. Capital gains of 8-12% by 2027, driven by Rixos branding and tourist demand, per dxbinteract.com. Attracts Qatari and Saudi investors for retail and hospitality synergy.

Compliance: Register SPAs and retail leases via Ejari. Verify escrow accounts. Retain records for FTA audits, per adres.ae.

3. The Night Market

Overview: A Nakheel project on Central Island, planned as the world’s largest night market, spanning 1.9km with 5,300 shops and 100+ dining options, set for completion in Q3 2026, per propertyfinder.ae.

Features: A modern Arabian souk with waterfront retail, outdoor dining, and cultural entertainment. Integrated with residential towers and office spaces.

Near Deira Mall (5-minute walk), per nakheel.com.

Investment Potential: Retail units (300-1,500 sq.ft.) start at AED 2,500/sq.ft., yielding 6-8% (e.g., AED 120,000/year for a AED 2 million unit), per dxbproperties.ae. Capital gains of 8-10% by 2027, fueled by cultural appeal and tourist footfall, per kaizenams.com. Popular among Kuwaiti investors for boutique retail.

Compliance: Register retail leases via Ejari. Obtain commercial licenses from Dubai Tourism. Retain records for FTA audits, per gtlaw.com.

4. Bay Grove Residences

Overview: A Nakheel project on Marina Island, offering apartments, townhouses, and retail spaces from AED 1.9 million ($517,300). Handover in Q2 2028, per bayut.com.

Features: Mixed-use development with waterfront retail (500-1,200 sq.ft.), 3- to 5-bedroom residences, and amenities like pools and cycling paths. Near Souk Al Marfa (7-minute drive), per famproperties.com.

Investment Potential: Retail units yield 6-7% (e.g., AED 114,000/year for a AED 1.9 million unit), with residential yields at 7-8.5%, per aysdevelopers.ae.

Capital gains of 8-12% by 2028, driven by marina proximity and flexible 70/30 payment plans, per dxbinteract.com. Appeals to Saudi retailers for high-traffic locations.

Compliance: Register SPAs and retail leases via Ejari. Verify escrow accounts. Obtain valuation certificate for Golden Visa (AED 2 million+). Retain records for FTA audits, per taxvisor.ae.

5. Flow Residences

Overview: A Main Realty Real Estate project on Dubai Islands, offering 1- to 4-bedroom apartments and retail spaces from AED 1.8 million ($489,900). Handover in Q1 2027, per keltandcorealty.com.

Features: A mid-rise development with retail shops (400-1,000 sq.ft.), sea-view apartments, and amenities like a rooftop pool and gym. Near planned marinas (5-minute drive), per dubaiislandsproperty.com.

Investment Potential: Retail units yield 6-7.5% (e.g., AED 108,000/year for a AED 1.8 million unit), with residential yields at 7-8%, per dxbproperties.ae. Capital gains of 8-10% by 2027, driven by modern design and investor-friendly payment plans, per kaizenams.com. Attracts GCC investors for retail-residential integration.

Compliance: Register SPAs and retail leases via Ejari. Verify freehold status. Retain records for FTA audits, per adres.ae.

6. Wellington Ocean Walk

Overview: A Wellington Developments project on Dubai Islands, offering luxury apartments and retail spaces from AED 2 million ($544,600). Handover in Q4 2026, per keltandcorealty.com.

Features: A mixed-use development with retail units (500-1,500 sq.ft.), 1- to 4-bedroom apartments, and resort-style amenities like a spa and fitness center. Near Dubai Islands Mall (5-minute drive), per dubaiislandsproperty.com.

Investment Potential: Retail units yield 6-7% (e.g., AED 140,000/year for a AED 2 million unit), with residential yields at 7-8.5%, per aysdevelopers.ae. Capital gains of 8-12% by 2027, driven by strategic location and high-end amenities, per dxbinteract.com. Appeals to Qatari investors for retail opportunities.

Compliance: Register SPAs and retail leases via Ejari. Verify escrow accounts. Retain records for FTA audits, per gtlaw.com.

7. Isolana Residences

Overview: A Hayaat Developments project on Dubai Islands, offering 1- to 4-bedroom apartments and retail spaces from AED 1.7 million ($462,800). Handover in Q3 2026, per keltandcorealty.com.

Features: A seafront development with retail shops (400-1,200 sq.ft.), modern apartments, and amenities like a gym and communal gardens. Near The Night Market (7-minute drive), per dubaiislandsproperty.com.

Investment Potential: Retail units yield 6-7.5% (e.g., AED 102,000/year for a AED 1.7 million unit), with residential yields at 7-8%, per dxbproperties.ae. Capital gains of 8-10% by 2027, driven by affordability and cultural proximity, per kaizenams.com.

Popular among Kuwaiti and Saudi investors for boutique retail.

Compliance: Register SPAs and retail leases via Ejari. Verify freehold status. Obtain valuation certificate for Golden Visa (AED 2 million+). Retain records for FTA audits, per taxvisor.ae.

Why These Developments Matter

Deira Mall, Rixos Dubai Islands, The Night Market, Bay Grove Residences, Flow Residences, Wellington Ocean Walk, and Isolana Residences are pivotal mixed-use projects driving Dubai Islands’ appeal for regional retail investors, offering 6-8% retail yields and 8-12% capital gains, per dxbinteract.com.

With 3,206 active listings and an average price of AED 4.3 million in Q1 2025 (+3% from 2024), these developments blend retail, residential, and hospitality, attracting GCC investors, per bayut.com. The islands’ 20km of beaches, six marinas, and planned Dubai Islands Mall (2026) ensure high footfall, with 85-90% occupancy in early phases, per drivenproperties.com.

Connectivity via the Deira Islands Bridge and a planned 1,425m bridge to Bur Dubai enhances access, per propsearch.ae.

Posts on X highlight retail investor interest, per @MEP_Middle_East. Challenges include construction delays and limited healthcare (nearest: Dubai Hospital, 12 minutes), mitigated by Nakheel’s AED 7.5 billion investment and 80% infrastructure completion, per excelproperties.ae. Golden Visa eligibility (AED 2 million+) applies to properties, per pangeadubai.com.

Tax Tools for American Investors

U.S.-UAE DTA: Credit UAE taxes via IRS Form 1118, preserving 8-12% returns, per immigrantinvest.com.

Zakat for Muslim Investors: Pay 2.5% Zakat on rental income (e.g., AED 2,500 on AED 100,000). Consult Islamic scholars, per taxvisor.ae.

VAT Recovery: Recover 5% input VAT on commercial expenses (e.g., AED 25,000 on AED 500,000) for VAT-registered investors, per fintedu.com.

Market Outlook and Challenges

Dubai Islands’ 22% transaction growth in Q1 2025 and 6-8% ROI reflect strong retail investment potential, with 60% of 2024 sales being off-plan, per prelaunch.ae. Retail spaces benefit from Dubai’s 9,800 millionaire influx and 18.7 million tourists, per gulfnews.com.

Risks include oversupply (97,000 new units by 2026) and reliance on private transport, offset by limited waterfront retail supply and flexible payment plans (e.g., 60/40, 10% down), per propertyfinder.ae. These developments, backed by Nakheel and others, align with Dubai’s vision for a vibrant coastal hub, per u.ae.

Conclusion

Deira Mall, Rixos Dubai Islands, The Night Market, Bay Grove Residences, Flow Residences, Wellington Ocean Walk, and Isolana Residences are Dubai Islands’ top mixed-use developments for 2025, attracting regional retail investors with 6-8% yields and 8-12% capital gains.

Integrating retail, residential, and hospitality near marinas and cultural hubs, they offer high footfall and investor-friendly terms. Compliance with DLD’s Ejari, Dubai Tourism licenses, and FTA ensures secure investments in this dynamic waterfront destination. Deira Islands

read more: Bluewaters Island: 6 Rental Trends Reshaping the Short-Term Market in 2025