Now Reading: Dubai Investment Park: 5 Integrated City Districts Offering Dual-Use Spaces in 2025

-

01

Dubai Investment Park: 5 Integrated City Districts Offering Dual-Use Spaces in 2025

Dubai Investment Park: 5 Integrated City Districts Offering Dual-Use Spaces in 2025

Table of Contents

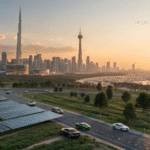

Dubai Investments Park (DIP), a 2,300-hectare mixed-use development by Dubai Investments PJSC in Jebel Ali, is a self-contained urban hub in 2025, blending industrial, commercial, and residential zones. Strategically located near Al Maktoum International Airport and Jebel Ali Port, with access via E311, E611, and the Dubai Metro Red Line (DIP Station), it offers property prices at AED 1,000–1,600/sq.ft., 6–8% rental yields, and 10–15% capital appreciation.

Five integrated city districts Green Community, Damac Riverside, Schon Business Park, Ritaj, and European Business Centre provide dual-use spaces combining living and working environments with smart technology (30% of units), sustainable features (LEED Silver, solar panels), and amenities like parks, retail, and clinics.

These districts align with Dubai’s 2040 Urban Master Plan, catering to mid-income professionals, families, and investors in a community of 120,000+ residents. Below is an analysis of these districts, their features, and investment potential.

Dubai Investments Park (DIP), a 2,300-hectare mixed-use development by Dubai Investments PJSC, established in 1997, is a thriving city-within-a-city in Jebel Ali, Dubai, in 2025. Located near Al Maktoum International Airport (10-minute drive) and Jebel Ali Port, with connectivity via E311 (Sheikh Mohammed Bin Zayed Road), E611 (Emirates Road), and the Dubai Metro Red Line (DIP Station, opened 2021), DIP integrates industrial, commercial, and residential zones.

Property prices range from AED 1,000–1,600/sq.ft., offering 6–8% rental yields and 10–15% capital appreciation. Five integrated city districts Green Community, Damac Riverside, Schon Business Park, Ritaj, and European Business Centre provide dual-use spaces for living and working, featuring smart technology (30% of units), sustainable designs (LEED Silver, 30% solar energy), and amenities like landscaped parks, retail, and clinics. Aligned with Dubai’s 2040 Urban Master Plan, these districts cater to mid-income professionals, families, and investors in a community of 120,000+ residents, driven by proximity to Expo City and JAFZA. This guide details their features, lifestyle benefits, and investment potential, supported by 2024–2025 data and trends.

1. Green Community

- Location: DIP 1, near E311, 15-minute drive to Expo City via D53.

- Developer: Properties Investment LLC.

- Green Certifications: LEED Silver.

- Features: A family-friendly district with villas, townhouses, and apartments (600–8,000 sq.ft.) set amidst lush greenery. Dual-use spaces include residential units with nearby retail and offices. Features smart home systems (AI-driven lighting, security), solar panels (10% energy savings), and water recycling. Amenities include lakes, pools, a community shopping center, and Spinneys supermarket. Close to Ibn Battuta Mall (10-minute drive).

- Sustainability Highlights: Recycled water irrigation and green buildings reduce environmental impact by 12%. Native landscaping cuts water use by 25%.

- Appeal: Ideal for mid-income families and professionals seeking a serene, green lifestyle with work proximity. Walkable retail and schools like Greenfield International (5-minute drive) enhance family appeal.

- Price Range: Apartments AED 0.3M–1.2M, villas AED 2M–6.5M (AED 1,000–1,500/sq.ft.).

- Investment Potential: 6–8% yields, 10–15% appreciation by 2026. Golden Visa eligible (AED 2M+). High rental demand (AED 40K–200K/year) from expat families due to schools and greenery. Offers 60/40 payment plan (40% over 2 years).

- Why Attractive: Green spaces and dual-use retail-office proximity drive family-oriented demand.

- Status: Ready to move, with ongoing expansions.

2. Damac Riverside

- Location: DIP 2, near Jebel Ali Industrial Area, 12-minute drive to Al Maktoum Airport via E611.

- Developer: Damac Properties.

- Green Certifications: Targeting LEED Silver.

- Features: A residential-focused district with 4–5-bedroom townhouses and villas (2,700–4,000 sq.ft.) alongside commercial spaces. Includes smart home automation (IoT-enabled controls), solar panels (15% energy savings), and district cooling. Offers clusters like Green Vein and Lush with parks, pools, and retail. Proximity to Paradise Plus Polyclinic and casual dining.

- Sustainability Highlights: Water recycling and solar energy reduce resource use by 15%. Green construction guidelines promote sustainability.

- Appeal: Attracts mid-income professionals and families working in JAFZA or logistics, blending residential comfort with nearby industrial-commercial zones. South Asian and Filipino expats favor the area for affordability and community vibe.

- Price Range: Townhouses AED 2M–3.5M, villas AED 3.5M–5M (AED 1,200–1,600/sq.ft.).

- Investment Potential: 6–7% yields, 10–12% appreciation by 2028. Golden Visa eligible. High rental demand (AED 100K–200K/year) from industrial workers and families. Offers 70/30 payment plan (30% over 3 years).

- Why Attractive: Affordable dual-use spaces near industrial hubs appeal to workforce renters.

- Status: Under construction, completion expected Q4 2027–Q4 2028.

3. Schon Business Park

- Location: DIP 1, near E311, 10-minute drive to Jebel Ali Port via E11.

- Developer: Schon Properties.

- Green Certifications: Targeting Estidama Pearl.

- Features: A commercial-residential hub with offices, retail shops (100–2,496 sq.ft.), and nearby apartments. Features smart building systems (AI-driven energy management), solar panels (10% energy savings), and high-quality insulation. Offers dining, fitness centers, and proximity to Green Community residences. Ideal for businesses and live-work setups.

- Sustainability Highlights: Energy-efficient LED lighting and low-carbon materials reduce environmental impact by 10%. Waste management systems enhance sustainability.

- Appeal: Suits mid-income professionals and small business owners seeking integrated work-live environments. Proximity to JAFZA and metro station (5-minute drive) attracts logistics and manufacturing firms.

- Price Range: Retail/offices AED 0.1M–1M, nearby apartments AED 0.4M–1.2M (AED 1,200–1,500/sq.ft.).

- Investment Potential: 7–8% yields, 10–12% appreciation by 2026. High rental demand (AED 30K–80K/year for retail, AED 40K–100K/year for apartments) from businesses and employees. Offers 50/50 payment plan (50% over 2 years).

- Why Attractive: Business-friendly location and dual-use flexibility drive commercial-residential demand.

- Status: Ready to move, with ongoing retail expansions.

4. Ritaj

- Location: DIP 1, near Green Community, 15-minute drive to Expo City via D53.

- Developer: Dubai Investments Real Estate.

- Green Certifications: LEED Silver.

- Features: A residential-commercial district with apartments (600–3,000 sq.ft.) and retail spaces. Includes smart home systems (app-based controls), a 1.2MW solar power plant (30% energy needs), and double-glazed windows. Offers community pools, retail, and proximity to NMC Royal Hospital (5-minute drive). Walkable to Carrefour Hypermarket.

- Sustainability Highlights: Solar power and recycled water irrigation reduce carbon emissions by 756,000 kg annually. Green spaces enhance eco-living.

- Appeal: Attracts mid-income families and professionals seeking affordable dual-use spaces with retail and healthcare access. Proximity to schools and metro enhances expat appeal.

- Price Range: Apartments AED 0.3M–1.2M (AED 1,000–1,400/sq.ft.).

- Investment Potential: 7–8% yields, 10–15% appreciation by 2026. High rental demand (AED 40K–120K/year) from families and healthcare workers. Offers 60/40 payment plan (40% over 2 years).

- Why Attractive: Affordable pricing and solar-powered sustainability boost mid-income demand.

- Status: Ready to move, with solar plant operational.

5. European Business Centre

- Location: DIP 1, near E311, 10-minute drive to Jebel Ali Port via E11.

- Developer: Dubai Investments.

- Green Certifications: Targeting Estidama Pearl.

- Features: A commercial-residential hub with offices (821–2,527 sq.ft.), retail, and nearby residential units. Features smart building technology (AI-driven security, cooling), solar-powered communal areas (10% energy savings), and EV charging stations. Offers dining, parking, and proximity to Green Community residences. Ideal for startups and SMEs alongside live-work setups.

- Sustainability Highlights: Energy-efficient systems and green roofs reduce resource use by 10%. Smart infrastructure supports eco-friendly operations.

- Appeal: Attracts mid-income professionals and entrepreneurs seeking cost-effective, tech-integrated work-live spaces. Proximity to JAFZA and metro station suits logistics and trade professionals.

- Price Range: Offices AED 0.2M–0.8M, nearby apartments AED 0.4M–1M (AED 1,100–1,500/sq.ft.).

- Investment Potential: 7–8% yields, 10–12% appreciation by 2026. High rental demand (AED 30K–70K/year for offices, AED 40K–80K/year for apartments) from SMEs and expats. Offers 50/50 payment plan (50% over 2 years).

- Why Attractive: Tech-driven dual-use spaces and strategic location draw business-minded renters.

- Status: Ready to move, with ongoing commercial fit-outs.

Investment Trends for 2025

- Rental Yields: 6–8% across districts, exceeding Dubai’s average (4.87%) due to demand from mid-income expats (70% of residents, Filipino and South Asian professionals) and proximity to JAFZA and Expo City. Ritaj and Green Community lead with 7–8% yields for apartments; Damac Riverside offers stable 6–7% for villas. Short-term rentals yield 8–10% with 25% growth, driven by tourism (20M visitors) and business travelers.

- Price Appreciation: 10–15% annually, fueled by 12% growth in 2024 and AED 16.6B transactions across DIP. Off-plan projects like Damac Riverside gain 15–20% by completion (2027–2028), supported by metro connectivity and Expo City proximity.

- Golden Visa: Properties above AED 2M qualify for 10-year residency, attracting 150K+ investors (25% more in Q1 2025). Green Community and Damac Riverside offer eligible units.

- Financing and Incentives: Flexible 50/50 to 70/30 payment plans (30–50% over 2–3 years) ease costs. A AED 1M property requires ~AED 200K down payment and AED 4,800/month (20 years, 4%). Incentives include waived registration fees (Ritaj) and free maintenance for 2 years (Schon Business Park). Green mortgages at 3.9–4.25%.

- Demand Drivers: DIP’s 120,000+ population, growing at 5% annually, drives demand. Smart homes (30% of units), green certifications (20% of projects), and amenities like Circle Mall, schools, and clinics enhance mid-income appeal. Connectivity to JAFZA, Expo City, and Al Maktoum Airport via E311 and metro boosts business and residential demand.

Sustainability and Market Resilience

- Green Features: Districts integrate solar panels, water recycling, and green roofs (10–15% savings), aligning with Dubai’s net-zero goals. Ritaj’s 1.2MW solar plant and Damac Riverside’s district cooling lead sustainability efforts.

- Market Stability: RERA regulations, escrow accounts, and 65% cash transactions ensure stability. A 5–10% price correction risk in H2 2025 is mitigated by DIP’s 10% transaction share and developer reliability (Damac, Dubai Investments).

- Risks: Construction noise in DIP 2 (Damac Riverside) and limited on-site hospitals may deter some buyers. Mitigated by NMC Royal Hospital (5-minute drive), metro access, and planned retail expansions.

Renting vs. Buying

- Renting:

- Costs: Apartments (AED 40K–120K/year), villas/townhouses (AED 100K–200K/year).

- Benefits: Flexibility for short-term residents (1–2 years), no maintenance, stable rents.

- Drawbacks: Misses 10–15% appreciation and Golden Visa benefits.

- Buying:

- Benefits: 6–8% yields, 10–15% growth, utility savings (10–15%), Golden Visa eligibility. Smart tech and dual-use spaces boost resale value.

- Drawbacks: Initial costs, off-plan delay risks (6–12 months). Mitigated by payment plans and demand.

- Strategy: Rent for flexibility; buy for long-term gains (3+ years).

Conclusion

Dubai Investment Park’s five integrated city districts—Green Community, Damac Riverside, Schon Business Park, Ritaj, and European Business Centre—offer dual-use spaces in 2025, blending residential and commercial environments with properties priced from AED 0.3M–6.5M. Delivering 6–8% yields, 10–15% appreciation, and sustainable features like solar power and smart systems, these districts cater to mid-income professionals, families, and investors.

Supported by DIP’s 120,000+ population, connectivity (E311, E611, metro), and proximity to JAFZA and Expo City, they align with Dubai’s 2040 Urban Master Plan. Despite risks like construction noise or a potential 5–10% price correction, DIP’s infrastructure, amenities, and developer reliability ensure strong ROI. Dubai Investment Park

read more: Palm Jebel Ali: 7 Ultra-Exclusive Projects Powering Island Investment Boom in 2025