Now Reading: UAE Real Estate: 7 Tourism Zones Driving Coastal Development Investment in 2025

-

01

UAE Real Estate: 7 Tourism Zones Driving Coastal Development Investment in 2025

UAE Real Estate: 7 Tourism Zones Driving Coastal Development Investment in 2025

Table of Contents

Tourism Zones : The UAE’s AED 893B real estate market in 2024 (180,900 transactions, 33% year-on-year growth) offers apartments (AED 300K–20M), villas (AED 850K–100M), and townhouses (AED 600K–15M) with 6–10% ROI and 7–15% appreciation by 2028.

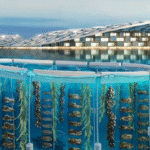

Tourism, with 18.7M visitors in 2024 (9% YoY growth) and a target of 40M hotel guests by 2031 under the UAE Tourism Strategy 2031, drives coastal development. Seven tourism zones Al Marjan Island (Ras Al Khaimah), Saadiyat Island and Yas Island (Abu Dhabi), Dubai Marina and Palm Jumeirah (Dubai), Al Zorah (Ajman), and Fujairah Beach (Fujairah) are key investment hotspots.

These zones, fueled by infrastructure (e.g., Etihad Rail, Al Maktoum Airport expansion), freehold laws (since 2002–2014 for expats in designated areas), and tax advantages (zero personal income, capital gains, and inheritance taxes, VAT exemptions, 0% corporate tax for qualifying free zone income), attracted AED 100B in coastal transactions in 2024.

This guide details each zone, its freehold benefits, tax incentives, and investment potential, supported by 2024–2025 data.

1. Al Marjan Island (Ras Al Khaimah)

- Project Details: A 2.7M sqm man-made archipelago by Marjan, offering apartments (AED 585K–3M, 600–2,000 sqft), villas (AED 2M–30M, 2,500–6,000 sqft), and branded residences (e.g., Wynn Resort, W Residences, set for 2027). Features 7.8km of beaches, retail, and the UAE’s first gaming resort (Wynn, $3.9B). Handover Q3 2025 for new phases with 40/60 payment plans. Average price: AED 1,200 psf.

- Freehold Benefits: 100% freehold ownership for all nationalities in designated areas, registered via RAK Land Department. Enables global resale and wealth transfer.

- Tax Incentives: Zero-rated first supply avoids 5% VAT (saving AED 29K–1.5M). Zero personal income tax on rentals (AED 30K–300K/year), zero capital gains tax on profits (e.g., AED 150K–4.5M by 2028), and zero inheritance tax. Gift transfers reduce 4% RETT to 0.125% (saving AED 9K–599K). Free zone ownership via RAK Free Zone ensures 0% corporate tax.

- Investment Potential: 8–9% ROI, with 85% occupancy driven by tourism (2M visitors in 2024, targeting 3M by 2030) and the Wynn Resort. AED 5B in 2024 sales, with 10–20% appreciation by 2028 (e.g., AED 2M villa to AED 2.2M–2.4M). Golden Visa eligible (AED 2M+).

- Impact: Coastal luxury, tax savings (AED 38K–2.1M), and connectivity to Dubai (45 min via E311) attract HNWIs from Europe, India, and GCC. RAK International Airport’s 30,000 sqm terminal expansion boosts accessibility.

2. Saadiyat Island (Abu Dhabi)

- Project Details: A 27M sqm cultural and leisure hub by Aldar Properties, offering villas (AED 4M–50M, 3,000–10,000 sqft) and apartments (AED 1.2M–10M, 600–3,000 sqft). Features Louvre Abu Dhabi, beachfront resorts, and NYU Abu Dhabi. Handover Q2 2025 for new phases with 50/50 payment plans. Average price: AED 2,000 psf.

- Freehold Benefits: 100% freehold ownership in designated areas, registered via Abu Dhabi Land Department. Supports global sales and legacy planning.

- Tax Incentives: Zero-rated first supply avoids VAT (saving AED 60K–2.5M). Zero personal income tax on rentals (AED 80K–500K/year), zero capital gains tax on profits (e.g., AED 300K–7.5M by 2028), and zero inheritance tax. Gift transfers reduce 4% RETT to 0.125% (saving AED 15K–999K). Free zone ownership ensures 0% corporate tax.

- Investment Potential: 6–8% ROI, with 85% occupancy driven by cultural tourism and HNWIs. AED 10B in 2024 sales, with 7–12% appreciation by 2028 (e.g., AED 4M villa to AED 4.28M–4.48M). Golden Visa eligible (AED 2M+).

- Impact: Cultural luxury, tax savings (AED 75K–3.5M), and proximity to Abu Dhabi city (15 min) attract global elites and investors from Europe and GCC.

3. Yas Island (Abu Dhabi)

- Project Details: A 25M sqm entertainment hub by Aldar Properties, offering villas (AED 4.5M–20M, 2,500–6,000 sqft) and apartments (AED 1.2M–3.8M, 600–2,000 sqft). Features Ferrari World, Yas Marina Circuit, and Warner Bros. World. Handover Q3 2025 with 40/60 payment plans. Average price: AED 1,800 psf.

- Freehold Benefits: 100% freehold ownership in designated areas, registered via Abu Dhabi Land Department. Enables global resale and wealth transfer.

- Tax Incentives: Zero-rated first supply avoids VAT (saving AED 60K–1M). Zero personal income tax on rentals (AED 70K–300K/year), zero capital gains tax on profits (e.g., AED 225K–3M by 2028), and zero inheritance tax. Gift transfers reduce 4% RETT to 0.125% (saving AED 15K–399K). Free zone ownership ensures 0% corporate tax.

- Investment Potential: 6.5–7% ROI, with 85% occupancy driven by 3M visitors in 2024. AED 8B in 2024 sales, with 7–12% appreciation by 2028 (e.g., AED 4.5M villa to AED 4.82M–5.04M). Golden Visa eligible (AED 2M+).

- Impact: Entertainment-driven lifestyle, tax savings (AED 75K–1.4M), and connectivity to Abu Dhabi (20 min) and Dubai (45 min) attract families and investors from GCC and Asia.

4. Dubai Marina (Dubai)

- Project Details: A 4M sqm waterfront community by Emaar Properties, offering apartments (AED 1M–10M, 600–3,000 sqft) and penthouses (AED 5M–20M, 2,000–5,000 sqft). Features Dubai Marina Mall, yacht facilities, and short-term rental demand (18% growth projected for 2025). Handover Q1 2025 for new towers with 50/50 payment plans. Average price: AED 2,200 psf.

- Freehold Benefits: 100% freehold ownership in designated areas, registered via Dubai Land Department (DLD). Supports global sales and legacy planning.

- Tax Incentives: Zero-rated first supply avoids VAT (saving AED 50K–1M). Zero personal income tax on rentals (AED 60K–400K/year), zero capital gains tax on profits (e.g., AED 150K–3M by 2028), and zero inheritance tax. Gift transfers reduce 4% RETT to 0.125% (saving AED 12K–399K). Free zone ownership ensures 0% corporate tax.

- Investment Potential: 7–10% ROI, with 85% occupancy driven by tourism (17M visitors to Dubai in 2024). AED 20B in 2024 sales, with 7–12% appreciation by 2028 (e.g., AED 1M apartment to AED 1.07M–1.12M). Golden Visa eligible (AED 2M+).

- Impact: Urban coastal luxury, tax savings (AED 62K–1.4M), and proximity to Downtown Dubai (15 min) attract expats and investors from Europe, Asia, and Americas.

5. Palm Jumeirah (Dubai)

- Project Details: A 5.6M sqm man-made island by Nakheel, offering villas (AED 10M–100M, 3,000–10,000 sqft) and apartments (AED 2M–20M, 800–4,000 sqft). Features Atlantis resorts, beach clubs, and premium dining. Handover Q2 2025 for new residences with 50/50 payment plans. Average price: AED 3,000 psf.

- Freehold Benefits: 100% freehold ownership in designated areas, registered via DLD. Enables global resale and wealth transfer.

- Tax Incentives: Zero-rated first supply avoids VAT (saving AED 100K–5M). Zero personal income tax on rentals (AED 100K–1M/year), zero capital gains tax on profits (e.g., AED 300K–15M by 2028), and zero inheritance tax. Gift transfers reduce 4% RETT to 0.125% (saving AED 24K–1.999M). Free zone ownership ensures 0% corporate tax.

- Investment Potential: 6–8% ROI, with 85% occupancy driven by luxury tourism and HNWIs. AED 25B in 2024 sales, with 7–12% appreciation by 2028 (e.g., AED 10M villa to AED 10.7M–11.2M). Golden Visa eligible (AED 2M+).

- Impact: Iconic luxury, tax savings (AED 124K–6.999M), and global appeal attract ultra-wealthy investors from Europe, Asia, and GCC.

6. Al Zorah (Ajman)

- Project Details: A 5.4M sqm coastal community by Solidere International, offering villas (AED 9.25M–29.5M, 5,651 sqft) and apartments (AED 685K–2M, 685–2,000 sqft). Features Al Zorah Golf Club, Oberoi Beach Resort, and creek views. Handover Q4 2025 with 10/50/40 payment plans. Average price: AED 1,000–5,220 psf.

- Freehold Benefits: 100% freehold ownership in Al Zorah free zone, registered via Ajman Land Department. Supports global sales and legacy planning.

- Tax Incentives: Zero-rated first supply avoids VAT (saving AED 34K–1.475M). Zero personal income tax on rentals (AED 40K–500K/year), zero capital gains tax on profits (e.g., AED 69K–4.425M by 2028), and zero inheritance tax. Gift transfers reduce 4% RETT to 0.125% (saving AED 8K–589K). Free zone ownership ensures 0% corporate tax.

- Investment Potential: 7–9% ROI, with 90% occupancy driven by tourism (1.5M visitors in 2024) and resort amenities. AED 2B in 2024 sales, with 10–15% appreciation by 2028 (e.g., AED 9.25M villa to AED 10.18M–10.64M). Golden Visa eligible (AED 2M+).

- Impact: Affordable coastal luxury, tax savings (AED 42K–2.064M), and connectivity to Dubai (25 min via E311) attract families and investors from GCC and Europe.

7. Fujairah Beach (Fujairah)

- Project Details: A coastal development by Fujairah Investment near Fujairah Port, offering apartments (AED 500K–2M, 600–1,500 sqft) and villas (AED 1.5M–4M, 2,000–4,500 sqft). Features beach access, retail, and eco-tourism amenities. Handover Q2 2025 with 40/60 payment plans. Average price: AED 1,100 psf.

- Freehold Benefits: 100% freehold ownership in designated areas, registered via Fujairah Land Department. Supports global sales and legacy planning.

- Tax Incentives: Zero-rated first supply avoids VAT (saving AED 25K–200K). Zero personal income tax on rentals (AED 30K–200K/year), zero capital gains tax on profits (e.g., AED 75K–600K by 2028), and zero inheritance tax. Gift transfers reduce 4% RETT to 0.125% (saving AED 9K–79K). Free zone ownership ensures 0% corporate tax.

- Investment Potential: 7–9% ROI, with 85% occupancy driven by eco-tourism and port expansion. AED 600M in 2024 sales, with 10–15% appreciation by 2028 (e.g., AED 1.5M villa to AED 1.65M–1.73M). Residency visa eligible (AED 750K+).

- Impact: Eco-friendly coastal living, tax savings (AED 34K–279K), and connectivity to Dubai (90 min via E99) attract families and investors from GCC and Europe.

Market Trends and Outlook for 2025

- Yields and Appreciation: Coastal zones offer 6–10% ROI (apartments 7–10%, villas 6–9%) and 7–15% appreciation, driven by AED 100B in 2024 coastal sales and 7–11% rental growth. Off-plan sales (60% of transactions) dominate, with 15,000 units expected by 2028. Prices rose 10–20% in 2024 (AED 1,000–5,220 psf).

- Freehold and Tax Environment: Freehold laws (since 2002–2014) allow 100% expat ownership in designated areas, with inheritance rights, boosting demand (20,000 foreign transactions in 2024, AED 100B). Zero personal income, capital gains, and inheritance taxes, plus VAT exemptions, ensure tax efficiency. The 4% RETT (2% buyer in some emirates) drops to 0.125% via gift transfers, saving AED 8K–1.999M. Free zone entities (e.g., RAK Free Zone, Ajman Free Zone) offer 0% corporate tax. No RETT changes confirmed for 2025.

- Infrastructure Impact: Etihad Rail, Al Maktoum Airport expansion (AED 128B), and RAK/Fujairah airport upgrades boost values by 5–10%. Tourism (18.7M visitors in 2024, targeting 40M by 2031) and 85–90% occupancy drive rental demand (AED 500–2,000/night short-term). Emirate-specific plans (e.g., RAK Vision 2030, Fujairah 2040) enhance appeal.

- Investor Drivers: Freehold status, 100% foreign ownership, and flexible payment plans (5–10% down) fuel 60% of demand. Golden Visa eligibility (AED 750K–2M) and coastal lifestyle attract buyers from India, Europe, and GCC. Branded residences (e.g., Wynn, Atlantis) and eco-friendly designs drive HNWIs and end-user demand.

- Risks: Oversupply (15,000 units by 2028), AML compliance costs (AED 2K–7K), and off-plan delays pose a 10–12% correction risk in H2 2025. Mitigated by 85–90% absorption, escrow accounts, and RERA regulations.

- Regulatory Framework: Land Departments (e.g., DLD, Ajman, Fujairah) ensure transparency with digital portals. Escrow laws protect off-plan investments. Freehold zones allow inheritance rights for expats.

Investment Strategy

- Diversification: Invest in Al Marjan Island (AED 585K–30M, 8–9% ROI) for branded luxury, Saadiyat Island (AED 1.2M–50M, 6–8% ROI) for cultural appeal, Yas Island (AED 1.2M–20M, 6.5–7% ROI) for entertainment, Dubai Marina (AED 1M–20M, 7–10% ROI) for urban luxury, Palm Jumeirah (AED 2M–100M, 6–8% ROI) for iconic status, Al Zorah (AED 685K–29.5M, 7–9% ROI) for affordability, or Fujairah Beach (AED 500K–4M, 7–9% ROI) for eco-tourism.

- Entry Points: Off-plan units (5–10% down) like Al Marjan Island or Al Zorah provide flexibility. Ready-to-move units in Dubai Marina suit immediate rentals (AED 30K–1M/year).

- Tax Optimization: Hold properties personally to avoid 9% corporate tax or use free zone entities for 0% corporate tax. Use gift transfers (0.125% RETT) or payment plans to reduce costs. Recover input VAT (AED 2K–50K/year) via FTA registration. Consult advisors like Shuraa Tax for compliance.

- Process: Verify freehold status (expats limited to designated areas) and tax benefits via Land Department portals (e.g., DLD, Ajman One). Pay 2–4% RETT and secure NOC. Use platforms like Property Finder, Bayut, or squareyards.ae. Required documents: passport copy, proof of funds, no UAE visa needed. Documents must be translated into Arabic and legalized.

Conclusion

In 2025, the UAE’s seven tourism zones Al Marjan Island, Saadiyat Island, Yas Island, Dubai Marina, Palm Jumeirah, Al Zorah, and Fujairah Beach drive coastal development with 6–10% ROI and 7–15% appreciation, backed by AED 100B in 2024 sales. Freehold laws (since 2002–2014) enable global ownership and inheritance, while tax advantages—zero personal income, capital gains, and inheritance taxes, VAT exemptions, and gift transfers (saving AED 8K–6.999M) maximize returns.

Despite a 10–12% correction risk from oversupply, 85–90% absorption, escrow protections, and infrastructure (e.g., Etihad Rail, airport expansions) ensure stability. With tourism (18.7M visitors in 2024, targeting 40M by 2031), coastal appeal, and connectivity (15–90 min to major hubs), these zones attract families and investors. Explore opportunities via Property Finder, Bayut, or developers like Marjan, Aldar, and Emaar for high-return, tax-efficient investments in the UAE’s coastal market. Tourism Zones

read more: Ajman Property: 5 Projects With Flexible Payment Plans and High Demand in 2025