Now Reading: Abu Dhabi City: 6 Real Estate Projects With Tax Compliance Incentives in 2025

-

01

Abu Dhabi City: 6 Real Estate Projects With Tax Compliance Incentives in 2025

Abu Dhabi City: 6 Real Estate Projects With Tax Compliance Incentives in 2025

Table of Contents

Abu Dhabi’s AED 79.3B real estate market in 2024 (34.5% YoY growth, 25,300 transactions in Q1 2025) offers apartments (AED 600K–15M) and villas (AED 1.2M–58M) with 6–9% ROI and 4–6% appreciation by 2026. Freehold laws since 2002 allow 100% ownership for all nationalities in designated zones, driving demand (50% from GCC, India, China, Europe).

Tax policies include zero personal income, capital gains, or property taxes, with Real Estate Transaction Tax (RETT) exemptions for first-time buyers and off-plan projects (saving AED 12K–300K). Recent 2024–2025 tax shifts, including VAT exemptions on residential sales and free zone corporate tax benefits (0% on qualifying income), enhance returns.

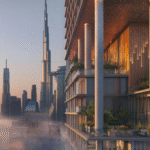

Six real estate projects Mandarin Oriental Residences (Saadiyat Island), Yas Riva (Yas Island), Rivage (Al Reem Island), Bloom Living (Zayed City), Al Fahid Island, and Al Raha Beach offer mixed-use developments with apartments, villas, retail, and offices (AED 600K–58M) featuring smart technology and sustainable designs.

These align with Abu Dhabi’s Vision 2030, targeting 24.49B USD in tourism revenue by 2030. This guide analyzes these projects, detailing rental yields, freehold benefits, tax incentives, sustainability features, and investment potential, supported by 2024–2025 data.

1. Mandarin Oriental Residences (Saadiyat Island)

- Project Details: Aldar Properties’ premium project offers 228 apartments, duplexes, and sky villas (AED 2.5M–15M, 800–4,000 sqft) with cultural district views, retail, and smart tech. Located near Louvre Abu Dhabi, 20 minutes from Zayed International Airport. Handover Q4 2026, with 40/60 payment plans and RETT exemptions for first-time buyers. Average price: AED 2,500–3,750 psf.

- Rental Yields: 6–8% (apartments: AED 100K–300K/year; sky villas: AED 400K–600K/year), with 10% rental growth in 2025 due to cultural tourism (5M visitors in 2024).

- Freehold Benefits: 100% freehold ownership via Abu Dhabi Department of Municipalities and Transport (DMT). Enables global resale, leasing, and inheritance.

- Tax Incentives: Zero personal income, capital gains, or property taxes. RETT exemption (2%, AED 50K–300K) for first-time buyers. 5% VAT exemption on residential sales; recoverable for off-plan purchases. 9% corporate tax on mainland profits above AED 375K; Abu Dhabi Global Market (ADGM) offers 0% corporate tax for Qualifying Free Zone Persons (QFZP).

- Sustainability Features: LEED-certified designs, energy-efficient systems, aligning with Abu Dhabi’s Vision 2030 and SDG 11.

- Investment Potential: 4–6% appreciation by 2026 (e.g., AED 2.5M apartment to AED 2.6M–2.65M). 85% occupancy due to cultural appeal. Golden Visa eligible (AED 2M+).

- Impact: Cultural hub with art galleries and museums. Tax savings (AED 50K–1.5M) and proximity to Guggenheim Abu Dhabi (5 min) attract HNWIs and European investors.

2. Yas Riva (Yas Island)

- Project Details: Aldar Properties’ waterfront project offers 3–5-bedroom villas and apartments (AED 1.2M–4.5M, 800–3,000 sqft) with canal views, retail, and smart tech. Located near Ferrari World, 20 minutes from Zayed International Airport. Handover Q2 2026, with 40/60 payment plans and RETT exemptions for off-plan purchases. Average price: AED 1,500–1,875 psf.

- Rental Yields: 6.5–8% (apartments: AED 80K–150K/year; villas: AED 200K–300K/year), with 12% rental growth in 2025 due to Disneyland Abu Dhabi and tourism.

- Freehold Benefits: 100% freehold ownership via DMT. Supports global resale and legacy planning.

- Tax Incentives: Zero personal income, capital gains, or property taxes. RETT exemption (2%, AED 24K–90K) for off-plan purchases. 5% VAT exemption on residential sales; recoverable for off-plan purchases. 9% corporate tax on mainland profits above AED 375K; ADGM offers 0% corporate tax for QFZP.

- Sustainability Features: Green spaces, smart water systems, aligning with Abu Dhabi’s Vision 2030 and SDG 11.

- Investment Potential: 4–6% appreciation by 2026 (e.g., AED 1.2M apartment to AED 1.25M–1.27M). 80% occupancy due to leisure appeal. Golden Visa eligible (AED 2M+).

- Impact: Entertainment hub with theme parks and marinas. Tax savings (AED 24K–450K) and connectivity to Saadiyat Island (15 min) attract GCC and Asian investors.

3. Rivage (Al Reem Island)

- Project Details: Deyaar’s luxury project offers 1–3-bedroom apartments, duplexes, and sky palaces (AED 1M–10M, 600–3,500 sqft) with waterfront views, retail, and smart tech. Located 10 minutes from Abu Dhabi CBD. Handover Q1 2026, with 50/50 payment plans and RETT exemptions for first-time buyers. Average price: AED 1,400–2,000 psf.

- Rental Yields: 6–9% (apartments: AED 70K–200K/year; sky palaces: AED 300K–500K/year), with 15% rental growth in 2025 due to ADGM free zone status and expat demand.

- Freehold Benefits: 100% freehold ownership via DMT, enhanced by ADGM’s free zone status. Enables global resale and inheritance.

- Tax Incentives: Zero personal income, capital gains, or property taxes. RETT exemption (2%, AED 20K–200K) for first-time buyers. 5% VAT exemption on residential sales; recoverable for off-plan purchases. 9% corporate tax on mainland profits above AED 375K; ADGM offers 0% corporate tax for QFZP.

- Sustainability Features: Eco-friendly designs, smart energy systems, aligning with Abu Dhabi’s Vision 2030 and SDG 11.

- Investment Potential: 4–6% appreciation by 2026 (e.g., AED 1M apartment to AED 1.04M–1.06M). 85% occupancy due to urban appeal. Golden Visa eligible (AED 2M+).

- Impact: Waterfront business hub with retail and schools. Tax savings (AED 20K–1M) and proximity to CBD (10 min) attract European and Indian investors.

4. Bloom Living (Zayed City)

- Project Details: Bloom Properties’ Mediterranean-inspired community offers 1–3-bedroom apartments and 3–5-bedroom villas (AED 600K–3M, 500–3,000 sqft) with retail, parks, and smart tech. Located in Western Region, 25 minutes from Zayed International Airport. Handover Q3 2025, with 50/50 payment plans and RETT exemptions for off-plan purchases. Average price: AED 1,200–1,500 psf.

- Rental Yields: 6–8% (apartments: AED 40K–100K/year; villas: AED 80K–150K/year), with 10% rental growth in 2025 due to affordability and family appeal.

- Freehold Benefits: 100% freehold ownership via DMT. Supports global resale and legacy planning.

- Tax Incentives: Zero personal income, capital gains, or property taxes. RETT exemption (2%, AED 12K–60K) for off-plan purchases. 5% VAT exemption on residential sales; recoverable for off-plan purchases. 9% corporate tax on mainland profits above AED 375K; ADGM offers 0% corporate tax for QFZP.

- Sustainability Features: Green landscaping, energy-efficient systems, aligning with Abu Dhabi’s Vision 2030 and SDG 11.

- Investment Potential: 4–6% appreciation by 2026 (e.g., AED 600K apartment to AED 624K–636K). 80% occupancy due to community focus. Golden Visa eligible (AED 2M+).

- Impact: Affordable family hub with retail and schools. Tax savings (AED 12K–300K) and connectivity to Al Ain Road (10 min) attract GCC and Indian investors.

5. Al Fahid Island

- Project Details: Modon Properties’ emerging coastal project offers 2–5-bedroom villas and townhouses (AED 2M–10M, 1,500–4,000 sqft) with beach access, retail, and smart tech. Located 30 minutes from Zayed International Airport. Handover Q2 2027, with 40/60 payment plans and RETT exemptions for off-plan purchases. Average price: AED 1,500–2,500 psf.

- Rental Yields: 6–8% (townhouses: AED 100K–200K/year; villas: AED 150K–300K/year), with 12% rental growth in 2025 due to tourism and exclusivity.

- Freehold Benefits: 100% freehold ownership via DMT. Enables global resale and inheritance.

- Tax Incentives: Zero personal income, capital gains, or property taxes. RETT exemption (2%, AED 40K–200K) for off-plan purchases. 5% VAT exemption on residential sales; recoverable for off-plan purchases. 9% corporate tax on mainland profits above AED 375K; ADGM offers 0% corporate tax for QFZP.

- Sustainability Features: Eco-conscious designs, smart water systems, aligning with Abu Dhabi’s Vision 2030 and SDG 11.

- Investment Potential: 4–6% appreciation by 2026 (e.g., AED 2M villa to AED 2.08M–2.12M). 80% occupancy due to coastal appeal. Golden Visa eligible (AED 2M+).

- Impact: Exclusive island hub with retail and leisure. Tax savings (AED 40K–1M) and proximity to Yas Island (20 min) attract HNWIs and GCC investors.

6. Al Raha Beach

- Project Details: Aldar Properties’ waterfront community offers 1–3-bedroom apartments and 3–5-bedroom villas (AED 1M–7M, 600–3,500 sqft) with beachfront access, retail, and smart tech. Located 15 minutes from Zayed International Airport. Handover ongoing through 2026, with 50/50 payment plans and RETT exemptions for off-plan purchases. Average price: AED 1,667–2,000 psf.

- Rental Yields: 6–8% (apartments: AED 70K–150K/year; villas: AED 150K–300K/year), with 15% rental growth in 2025 due to waterfront appeal and expat demand.

- Freehold Benefits: 100% freehold ownership via DMT. Enables global resale and inheritance.

- Tax Incentives: Zero personal income, capital gains, or property taxes. RETT exemption (2%, AED 20K–140K) for off-plan purchases. 5% VAT exemption on residential sales; recoverable for off-plan purchases. 9% corporate tax on mainland profits above AED 375K; ADGM offers 0% corporate tax for QFZP.

- Sustainability Features: Green designs, energy-efficient systems, aligning with Abu Dhabi’s Vision 2030 and SDG 11.

- Investment Potential: 4–6% appreciation by 2026 (e.g., AED 1M apartment to AED 1.04M–1.06M). 85% occupancy due to coastal lifestyle. Golden Visa eligible (AED 2M+).

- Impact: Luxury waterfront hub with retail and schools. Tax savings (AED 20K–700K) and connectivity to CBD (15 min) attract European and GCC investors.

Market Trends and Outlook for 2025

- Yields and Appreciation: Abu Dhabi’s projects offer 6–9% ROI and 4–6% appreciation, driven by AED 79.3B in 2024 transactions and a 34.5% surge in Q1 2025 (AED 1,200–3,750 psf). Short-term rentals grew 15%, long-term rentals 10%, with 80–85% occupancy due to tourism (5M visitors in 2024) and infrastructure.

- Freehold and Tax Environment: Freehold laws since 2002 allow 100% ownership in zones like Saadiyat and Yas Islands, boosting demand (50% from GCC, India, China, Europe). Zero personal income, capital gains, and property taxes, with RETT exemptions (2%, AED 12K–300K) for first-time buyers and off-plan projects, save AED 12K–1.5M. 5% VAT exemption on residential sales; recoverable for off-plan purchases. 9% corporate tax on mainland profits above AED 375K; ADGM offers 0% corporate tax for QFZP. Domestic Minimum Top-up Tax (DMTT) applies a 15% rate to MNEs with revenues over €750M, aligning with OECD standards.

- Infrastructure Impact: Etihad Rail, eVTOL aircraft (20-min Dubai commute by 2026), and airport expansions boost values by 10–15%. Amenities like Louvre Abu Dhabi, Disneyland Abu Dhabi, and Yas Marina drive rentals (AED 150–10,000/night).

- Investor Drivers: Limited supply (5,000 units in 2025–26), Golden Visa eligibility (AED 2M+ for 10-year residency, AED 750K for 2-year), and flexible payment plans (5–10% down, 40/60 or 50/50 plans) fuel 60% of demand from GCC (30%), India (15%), and Europe (15%). Smart tech and sustainability (LEED certification) enhance appeal.

- Risks: Oversupply (5,000 units in 2025–26) and AML compliance costs (AED 5K–15K) pose a 5–8% correction risk in H2 2025. Mitigated by 80% absorption, escrow accounts, and DMT oversight. Corporate tax (9% for profits over AED 375K) may impact large investors, though free zone structures minimize this.

- Regulatory Framework: DMT ensures transparency with digital title deeds and escrow laws for off-plan sales (handover 2025–2027). Freehold zones allow inheritance with no estate tax; DIFC Wills Service Centre recommended for non-Muslims. AML compliance requires KYC and source-of-funds verification.

Investment Strategy

- Diversification: Invest in Bloom Living (AED 600K–3M, 6–8% ROI) for affordability, Al Raha Beach (AED 1M–7M, 6–8% ROI) or Yas Riva (AED 1.2M–4.5M, 6.5–8% ROI) for waterfront appeal, Rivage (AED 1M–10M, 6–9% ROI) or Al Fahid Island (AED 2M–10M, 6–8% ROI) for urban luxury, and Mandarin Oriental Residences (AED 2.5M–15M, 6–8% ROI) for cultural prestige.

- Entry Points: Off-plan units (5–10% down, 40/60 or 50/50 plans) offer flexibility. Early investment maximizes appreciation as tourism and infrastructure mature.

- Tax Optimization: Hold properties personally to avoid 9% corporate tax or use ADGM entities for 0% corporate tax on qualifying income. Leverage RETT exemptions (2%, AED 12K–300K) and recover 5% VAT (AED 3K–100K/year) via UAE FTA registration. Consult advisors like Savills for compliance.

- Process: Verify freehold status via DMT portals. Pay 2% RETT (unless exempt) and registration fees (AED 2K–4K). Use platforms like PropertyFinder.ae, Bayut.com, or SquareYards.ae. Required documents: passport copy, proof of funds, no UAE visa needed. Documents must be translated into Arabic and legalized.

Conclusion

In 2025, Abu Dhabi’s six real estate projects Mandarin Oriental Residences, Yas Riva, Rivage, Bloom Living, Al Fahid Island, and Al Raha Beach offer 6–9% ROI and 4–6% appreciation, backed by AED 79.3B in 2024 transactions and a 34.5% surge in Q1 2025. Freehold laws since 2002 enable global ownership, while tax policies zero personal income, capital gains, and property taxes, with RETT exemptions (AED 12K–300K) and 5% VAT exemptions on residential sales maximize returns.

Recent tax shifts, including ADGM’s 0% corporate tax for QFZP and OECD-aligned DMTT (15% for MNEs), enhance investor appeal. Sustainability features (LEED, smart tech) align with Abu Dhabi’s Vision 2030 and SDG 11.

Despite a 5–8% correction risk from oversupply, 80% absorption, escrow protections, and infrastructure (Etihad Rail, eVTOL) ensure stability. With prices from AED 600K–58M, tourism-driven rentals (15% growth), and diverse appeal, these projects attract GCC, Indian, and European investors. Abu Dhabi City

read more: Sharjah Property: 5 Urban Clusters Supporting Tax-Efficient Property Portfolios in 2025