Now Reading: Dubai Real Estate: 7 Post-Tax Planning Tools for Property Developers in 2025

-

01

Dubai Real Estate: 7 Post-Tax Planning Tools for Property Developers in 2025

Dubai Real Estate: 7 Post-Tax Planning Tools for Property Developers in 2025

Table of Contents

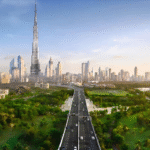

Dubai’s real estate market in 2025 is thriving, with 99,000 transactions worth AED 326.7 billion in H1 and projected 5-9% price growth, per Dubai Land Department (DLD) data. Off-plan sales dominate, comprising 70% of Q1 transactions, driven by flexible payment plans and high rental yields of 6-10%. While Dubai offers no personal income tax, capital gains tax, or VAT on first-time residential sales, the introduction of a 9% corporate tax in June 2023 for profits exceeding AED 375,000 and a 15% Domestic Minimum Top-up Tax (DMTT) for multinationals impacts developers.

Qualifying Free Zone Persons (QFZPs) in Jebel Ali Free Zone enjoy 0% corporate tax if non-qualifying mainland income is below 5% or AED 5 million, and SMEs are exempt from DMTT. Below are seven post-tax planning tools for property developers to optimize financial outcomes in 2025, leveraging Dubai’s tax-friendly environment and regulatory framework.

1. Free Zone Corporate Structures: 0% Corporate Tax via QFZPs

Establishing a company in Jebel Ali Free Zone as a QFZP allows developers to benefit from 0% corporate tax on profits from off-plan sales or rentals, provided non-qualifying mainland income (e.g., commercial property sales) is below 5% or AED 5 million, per UAE Ministry of Finance guidelines.

For example, a developer selling AED 50 million in off-plan residential units in Dubai Creek Harbour avoids AED 4.5 million in corporate tax (9%). Setup costs range from AED 15,000-25,000, with annual fees of AED 10,000. Developers must ensure compliance with substance requirements (e.g., local office, employees) and consult tax advisors to maintain QFZP status, maximizing tax-free profits.

2. R&D Tax Credits: 30-50% Savings on Sustainable Projects

Developers incorporating eco-friendly features, such as solar panels or energy-efficient HVAC, in projects like Dubai Hills Estate qualify for 30-50% VAT refunds and R&D tax credits on construction costs, per UAE’s green incentives aligned with Net Zero 2050.

For a AED 100 million project, credits could save AED 15-25 million. Emaar and Sobha Realty pass 5-10% savings to buyers, boosting off-plan sales by 20% in 2024, per DLD. Developers must document R&D expenses via certified audits and submit claims through the Federal Tax Authority (FTA) within six months, ensuring compliance with Al Sa’fat or LEED standards to optimize savings.

3. VAT Recovery on Off-Plan Residential Sales: Zero-Rated Advantage

First-time sales of off-plan residential properties are zero-rated for VAT (0%), saving developers 5% compared to commercial sales, per FTA rules. For a AED 500 million residential project in Business Bay, this avoids AED 25 million in VAT. Developers must register projects with DLD, classify units as residential, and file VAT returns quarterly. Non-compliance risks penalties of AED 10,000-50,000.

By structuring sales through escrow accounts and offering DLD fee waivers (4%), developers like Damac enhance buyer appeal, driving 35% of Q1 2025 off-plan sales. Consulting tax advisors ensures accurate VAT classification.

4. Double Taxation Agreements (DTAs): Mitigating Foreign Tax Liabilities

The UAE’s 100+ DTAs with countries like India, China, and the U.S. allow developers to offset foreign taxes on profits repatriated from Dubai projects, per OECD guidelines. For example, an Indian developer with AED 10 million in Dubai rental income can claim a foreign tax credit under Section 90 of India’s Income Tax Act, reducing Indian tax liability by AED 2.5 million (25% tax rate). Developers must file DTA claims via the FTA, providing project financials and foreign tax receipts. This tool is critical for multinational developers, as 38% of 2024 transactions involved foreign investors, per DLD.

5. Post-Handover Payment Plans: Deferring Taxable Income

Offering post-handover payment plans (50-60% over 3-5 years) defers developer revenue recognition, delaying corporate tax liability, per IFRS 15 standards. For a AED 200 million project in JVC, deferring AED 100 million over three years spreads tax liability, saving AED 2.7 million annually at 9% corporate tax. Developers like Danube use 1% monthly plans, increasing sales by 15% in 2024, per DLD. RERA-compliant SPAs and escrow accounts are mandatory to avoid penalties. Developers must consult accountants to align revenue recognition with tax filings, optimizing cash flow.

6. Corporate Restructuring: Transferring Assets to Individuals

Transferring property ownership from corporate entities to individual shareholders avoids the 9% corporate tax on rental income or capital gains, as individuals face no income or gains tax in Dubai, per Taylor Wessing. For a AED 20 million villa portfolio generating AED 1.5 million in rent, restructuring saves AED 135,000 annually.

Legal fees (AED 10,000-20,000) and DLD transfer fees (4%, AED 800,000) apply, but long-term savings outweigh costs. Developers must ensure compliance with DLD registration and Sharia inheritance laws for non-Muslims, consulting legal experts to minimize risks.

7. Escrow Account Optimization: Managing Taxable Cash Flow

Using RERA-approved escrow accounts for off-plan sales ensures funds are released in stages, aligning taxable income with construction milestones, per Law No. 8 of 2007. For a AED 300 million project in Dubai Marina, developers like Nakheel release 10-20% per phase, deferring AED 27 million in corporate tax (9%) over 2-3 years. Escrow audits cost AED 5,000-15,000 but ensure compliance and buyer trust, driving 60% of 2024 off-plan sales, per DLD. Developers must integrate digital compliance tools and consult tax advisors to optimize cash flow and minimize tax exposure.

Why These Tools Are Critical in 2025

These seven tools free zone structures, R&D credits, VAT recovery, DTAs, post-handover plans, corporate restructuring, and escrow optimization reduce tax liabilities by 5-20%, enhancing profitability in a market with AED 761 billion in 2024 transactions. Dubai’s 6.2% GDP growth, 25 million tourists, and infrastructure like Metro Blue Line drive demand, but oversupply (76,000 units) and rising service charges (AED 10-53.7/sq.ft.) pressure margins. RERA’s Mollak system and DLD’s Service Charge Index ensure transparency, while 90-95% absorption rates mitigate risks. Developers must consult tax and legal experts to navigate the 9% corporate tax and DMTT, leveraging QFZP exemptions and DTAs.

Implementation Strategies

- Engage Tax Advisors: Work with FTA-accredited consultants to structure QFZP entities and file DTA claims, avoiding penalties (AED 10,000-50,000).

- Leverage Dubai REST: Use DLD’s Dubai REST app for real-time project data, escrow tracking, and compliance with RERA regulations.

- Incorporate Sustainability: Integrate Al Sa’fat or LEED standards to secure 30-50% R&D credits, boosting sales with 5-10% buyer discounts.

- Monitor DLD Updates: Check DLD’s website for tax and fee changes, ensuring compliance with 2025 regulations.

- Budget for Fees: Account for 4% DLD fees (unless waived), 2% agency commission (+5% VAT), and conveyancing costs (AED 6,000-10,000).

- Foreign Tax Compliance: U.S. developers file IRS Form 1118 for DTA credits; Indian developers report assets under Liberalised Remittance Scheme ($250,000 limit). Muslim developers account for 2.5% Zakat (e.g., AED 37,500 on AED 1.5 million rent).

Outlook for Dubai’s 2025 Real Estate Market

Dubai’s 2040 Urban Master Plan, Golden Visa scheme, and Al Maktoum Airport expansion fuel off-plan demand, with 10-12% rent growth forecast. Developers like Emaar, Damac, and Nakheel dominate, offering DLD waivers and 70/30 payment plans. Despite corporate tax challenges, the absence of personal income and capital gains taxes, combined with these tools, ensures 6-10% yields and 15-20% capital gains. Strategic tax planning and RERA compliance position developers to capitalize on Dubai’s tax-advantaged market.

Conclusion

Free zone structures, R&D credits, VAT recovery, DTAs, post-handover plans, corporate restructuring, and escrow optimization are seven post-tax planning tools empowering Dubai property developers in 2025. By reducing tax liabilities and enhancing cash flow, these strategies drive profitability in a competitive market. With expert consultation and regulatory compliance, developers can maximize returns in Dubai’s dynamic, tax-friendly real estate landscape. Real Estate

read more: Dubai Property: 5 Service Charge Hikes Impacting Investor Returns in 2025