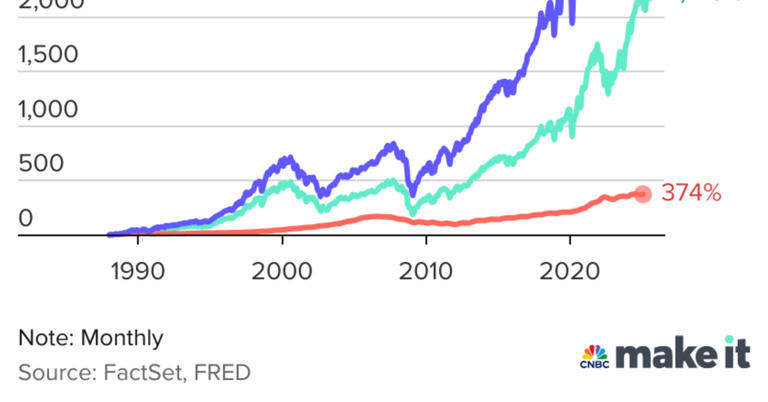

Warren Buffett, one of the world’s most successful investors, has once again shared his thoughts on where investors should focus their money. In a recent interview, Buffett emphasized that the stock market offers much more opportunity than real estate. This statement is grabbing attention from investors, both new and experienced, who want to understand where to put their money for the best returns.

Warren Buffett, often called the “Oracle of Omaha,” has built his fortune through smart and patient investing in stocks. His advice has always been clear: invest in companies with strong fundamentals, good management, and solid long-term growth potential. Over decades, Buffett’s approach has shown that the stock market can create wealth faster and more reliably than many other investment options, including real estate.

Recently, Buffett highlighted that while real estate can be a valuable investment, the stock market provides far greater opportunities for growth and income. He pointed out that owning shares in companies allows investors to benefit from innovation, global business growth, and dividends — factors not always present in real estate.

Buffett says there are “just so much more opportunities” in the stock market. Unlike real estate, where growth depends on local markets, property values, and rent prices, the stock market includes thousands of companies worldwide. This diversity means investors can choose from many industries, regions, and business types — increasing their chances of finding winners.

Stocks are much easier to buy and sell than real estate. Real estate transactions often take weeks or months, involve many fees, and require physical upkeep. Stocks can be traded instantly online, allowing investors to react quickly to market changes or new information. This liquidity is a major advantage, especially for beginners or those who want flexible access to their money.

Owning real estate involves costs such as maintenance, taxes, insurance, and sometimes property management fees. Buffett reminds investors that stocks don’t require this kind of hands-on effort. You don’t need to fix a leaking roof or find tenants when you own shares. Instead, investors can focus on choosing the right companies and letting their money grow.

Many stocks pay dividends — regular payments to shareholders — which can be reinvested to buy more shares. This compounding effect can boost wealth over time. Real estate income often depends on rent, which can vary or be interrupted if tenants leave. Buffett appreciates how dividends provide a steady income stream without the hassles of property management.

Buffett’s views come at a time when real estate prices have surged in many places, making it harder for average investors to enter the market. High prices and rising interest rates have cooled some property markets, while stocks continue to offer attractive entry points in various sectors.

For new investors wondering whether to buy a home, invest in rental properties, or put money into stocks, Buffett’s message is clear: don’t overlook the power of the stock market. While real estate can be part of a balanced portfolio, stocks provide more options, easier management, and potentially higher returns.

If you want to follow Buffett’s advice, here are a few simple tips:

Buffett doesn’t dismiss real estate entirely. Many people enjoy the benefits of owning a home, such as stability and personal use. Rental properties can also generate steady income, especially in the right markets. However, Buffett’s point is that when comparing pure investment potential, the stock market often outshines real estate.

Warren Buffett’s latest comments remind investors that the stock market is a vast world filled with opportunities. From small startups to giant corporations, investors can find companies with potential to grow and create wealth. Stocks also offer more flexibility, fewer hassles, and income through dividends, making them attractive for many people.

Whether you are a beginner or experienced investor, Buffett’s advice is valuable: look beyond just real estate and explore the many chances to grow your money in the stock market. With the right approach, patience, and knowledge, you could tap into the same opportunities that helped build Buffett’s legendary fortune.

Also read – Gurugram’s Real Estate Game-Changer: Oberoi Realty’s New Luxury Project