Investing in commercial real estate (CRE) has always been a powerful way to grow wealth. However, in recent years, new technology and data tools have completely changed how investors make decisions. Today, having the right data is no longer just helpful—it’s essential to stay ahead in the competitive CRE market.

This article explores the game-changing data transforming commercial real estate investing. We’ll explain what this data is, why it matters, and how investors can use it to make smarter, safer, and more profitable decisions.

Commercial real estate means properties used for business purposes. Examples include office buildings, shopping centers, warehouses, and hotels. Unlike residential real estate, which involves homes or apartments, CRE focuses on properties meant to generate income through rent or leases from businesses.

Investors in CRE buy these properties hoping their value will increase over time. They also earn steady rental income. But CRE markets are complex, with many factors influencing property value and demand. This is why data plays a key role in making wise investments.

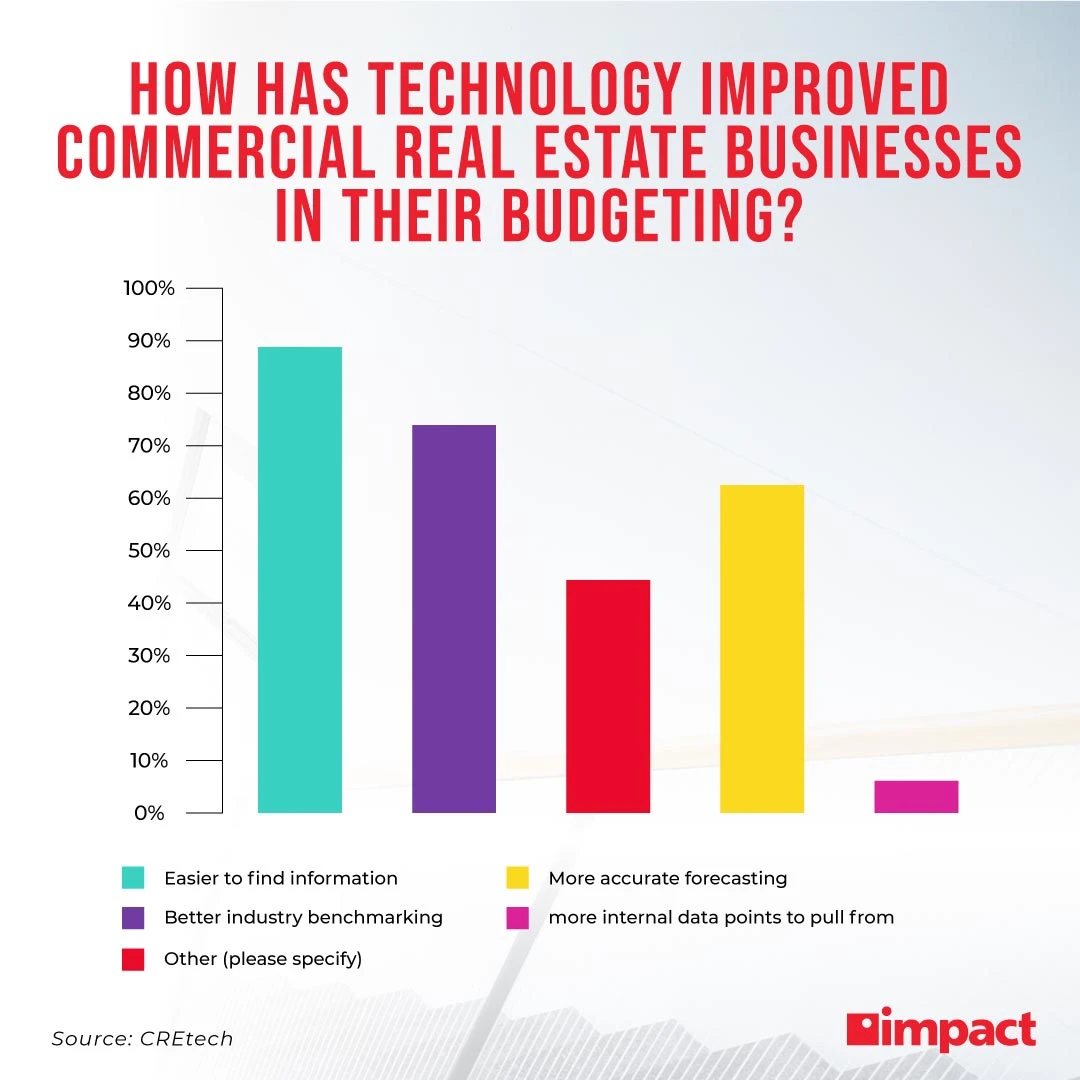

Traditionally, CRE investors relied on experience, local knowledge, and financial reports to decide which properties to buy. While these are still important, data now gives investors a much deeper and clearer view.

New sources of data help investors understand market trends, tenant behavior, property performance, and economic changes faster and more accurately. This “game-changing” data reduces risk, uncovers hidden opportunities, and helps predict future returns.

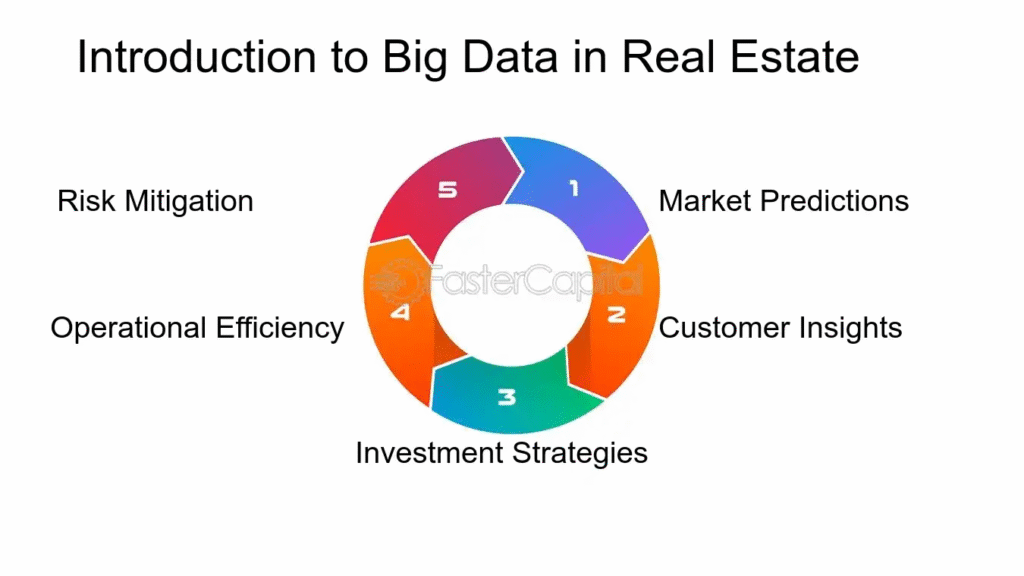

Here are some key types of data transforming CRE investing today:

Detailed data about regional and city-level markets shows where demand for commercial spaces is growing or shrinking. For example, vacancy rates, rental prices, and new construction activity help investors spot hot markets or avoid risky areas.

Knowing who rents space in a building, their lease length, payment history, and creditworthiness is critical. New data platforms gather and analyze tenant profiles, helping investors assess the stability and income potential of a property.

Advanced data tools track how well a property is doing financially. This includes cash flow, operating costs, maintenance expenses, and occupancy rates. Real-time monitoring helps investors react quickly to any issues or opportunities.

Economic indicators like employment rates, population growth, and business openings affect CRE markets. Data that connects these trends to specific locations helps investors predict future demand for commercial properties.

Sustainability is becoming a big focus. Data on energy use, carbon footprint, and environmental risks (like flood zones) can impact property value and appeal to tenants. Investors use this data to choose green buildings that perform better over time.

With this rich data, CRE investors can:

Several technologies power this game-changing data for CRE:

While data offers huge advantages, investors must be careful:

The commercial real estate world is rapidly evolving. Investors who embrace these new data tools and insights gain a competitive edge. They make better, faster decisions, reduce risks, and find more opportunities to grow their portfolios.

For anyone interested in CRE investing, understanding and using game-changing data is no longer optional—it’s a must. The future belongs to investors who can combine data with experience to navigate the market smartly.

Whether you’re a seasoned CRE investor or just starting, investing in data and technology will pay off. Start by exploring data platforms, learning about AI tools, and tracking market and tenant information closely.

The power of data can transform your commercial real estate investments from guesswork into a science. Stay informed, stay strategic, and watch your investments thrive.

Also read –Best Homebuyer Picks Amid India’s Slowing Real Estate Market