In today’s competitive real estate market, bidding wars have become the norm—especially in popular neighborhoods and during peak buying seasons. Homes are selling fast, and buyers often find themselves competing with multiple offers, sometimes within hours of a property hitting the market.

If you’re planning to buy a home, you might feel the pressure to go above your budget just to win. But here’s the good news: it’s possible to navigate a bidding war without overpaying—if you plan ahead, stay calm, and follow smart strategies.

Bidding wars happen when more than one buyer is interested in a property at the same time. With low housing inventory in many cities, there are often more buyers than available homes. Sellers use this to their advantage, hoping for higher offers.

Interest rates also play a role. When rates are low, more people want to buy homes, adding to the competition. Add emotional attachment to a “dream home,” and buyers can quickly get caught up in a frenzy.

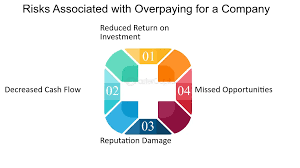

In a bidding war, it’s easy to get carried away and offer more than a property is worth. But overpaying comes with serious risks:

That’s why it’s crucial to stay focused on what the home is truly worth to you—and not just what others are willing to pay.

Here are proven strategies to help you stay competitive without making a costly mistake:

Before you even start house-hunting, talk to a mortgage lender and get pre-approved. This gives you a clear idea of how much you can borrow and what you can comfortably afford.

Set a firm budget, and don’t let the pressure of a bidding war push you past it. Remember, your monthly mortgage payment isn’t the only expense—you’ll also need to budget for insurance, taxes, repairs, and more.

A skilled agent can help you spot red flags, understand market trends, and craft strong offers. They’ll also guide you on the right offer price by comparing similar properties in the area (called “comps”).

Most importantly, a good agent knows how to communicate effectively with listing agents to learn what the seller really wants—sometimes it’s not just about the money.

Sellers love simple, clean offers. Consider removing unnecessary contingencies, such as minor repair requests. While you should never waive important protections like the home inspection or financing clause without careful thought, reducing complexity can make your offer more attractive.

Also, be flexible with the closing date if it helps the seller. Offering convenience can make your bid stand out even if it’s not the highest.

Believe it or not, real estate is still personal. Adding a short, heartfelt letter to your offer can help the seller see you as more than just numbers on paper.

Share why you love the home and how you envision your future there. Emotional connections can make a real difference, especially if the seller has lived in the home for years.

Some buyers try to strengthen their offer by waiving the appraisal contingency. This means if the home appraises for less than the offer, you agree to pay the difference.

While this can win deals, it’s risky—especially if you don’t have a financial cushion. A smarter move is to offer a partial appraisal gap coverage. For example, you agree to cover up to $10,000 if the home appraises low. It shows confidence while still setting a limit.

This might be the hardest part: learning to walk away. If the bidding war pushes the price too high or the terms become too risky, it’s okay to say no.

There will be other homes. Making a smart, informed decision is always better than overpaying for a house you might regret.

Bidding wars can feel overwhelming, but they don’t have to lead to financial mistakes. With the right strategy, a clear budget, and expert help, you can stay competitive and stay smart.

Remember, the goal isn’t just to win the house—it’s to buy a home that fits your life and your finances. Don’t rush the process. The right home at the right price is worth the wait.

Read More:- Shobha Realty Launches Its Most Luxurious Project Yet—Full Details Inside 2025