Now Reading: Tourism-Driven Real Estate in Ajman: Capitalizing on the 2025 Surge

-

01

Tourism-Driven Real Estate in Ajman: Capitalizing on the 2025 Surge

Tourism-Driven Real Estate in Ajman: Capitalizing on the 2025 Surge

Table of Contents

Tourism-Driven Real Estate in Ajman: Capitalizing on the 2025 Surge

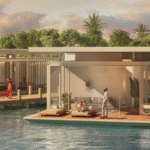

Ajman, the smallest emirate in the United Arab Emirates, is experiencing a remarkable transformation into a vibrant tourism and real estate hub in 2025. With its pristine beaches, rich cultural heritage, and strategic location, Ajman is attracting a growing number of tourists and investors, particularly from the United States. The emirate’s tourism-driven real estate market is booming, fueled by government initiatives, investor-friendly policies, and a surge in demand for vacation homes, boutique hotels, and short-term rental properties. This article explores how Ajman’s tourism sector is driving its real estate growth, the opportunities for U.S. investors, and the potential for high returns in 2025.

Ajman’s Tourism Boom: A Catalyst for Real Estate Growth

Ajman’s tourism sector is a key pillar of its economic diversification strategy, as outlined in the Ajman Vision 2030 plan. The emirate’s unique blend of coastal charm, cultural attractions, and proximity to major economic hubs like Dubai and Sharjah has positioned it as an emerging tourism destination. In 2024, Ajman’s accommodation and food service sector contributed AED 1.3 billion (approximately USD 362 million) to its GDP, reflecting a 43.5% growth from 2020 to 2023. This surge is driven by a 26% increase in non-UAE resident arrivals in 2022 alone, with key markets including Russia, India, the UK, Germany, and the U.S.

The emirate’s appeal lies in its diverse offerings. Ajman’s pristine beaches, such as those along the Al Zorah development, attract leisure travelers, while its cultural landmarks, like the Ajman Museum and Heritage District, draw visitors seeking authentic experiences. The emirate is also promoting eco-tourism and adventure tourism, with initiatives like the Al Zorah Nature Reserve and plans for mountain retreats in its Manama and Masfout enclaves. These developments are boosting demand for tourism-related real estate, including hotels, vacation rentals, and mixed-use properties that combine residential and commercial spaces.

Ajman’s strategic location enhances its tourism appeal. Just 10 km from Sharjah International Airport and 20 km from Dubai International Airport, the world’s busiest aviation hub in 2024, Ajman offers seamless connectivity for international visitors. The emirate’s port and the upcoming Al Zorah Seaport further strengthen its position as a trade and tourism gateway. For U.S. investors, this accessibility makes Ajman an attractive destination for developing properties that cater to the growing influx of tourists.

Why Tourism Is Driving Real Estate Demand

The rise in tourism has directly fueled demand for real estate in Ajman, particularly in the hospitality and short-term rental sectors. The Ajman Tourism Development Department (ATDD) has implemented a robust regulatory framework for holiday homes, ensuring high standards through regular inspections and licensing. This has streamlined the process for investors looking to enter the short-term rental market, which is seeing high occupancy rates due to Ajman’s growing popularity.

Key projects like the Ajman Marina, a AED 1 billion (USD 272 million) mixed-use development, are transforming the emirate’s tourism landscape. Featuring residential buildings, entertainment zones, commercial towers, and a hotel, the Marina is designed to attract visitors year-round with attractions like one of the region’s largest dancing fountains and spaces for seasonal festivals. Similarly, the Al Zorah Free Zone focuses on high-end tourism and leisure, offering luxury resorts and residential properties that appeal to both tourists and long-term investors. These developments are driving demand for properties that cater to tourists, such as boutique hotels and furnished apartments.

The emirate’s affordability compared to Dubai, where property prices are 30–50% higher, makes it a compelling choice for investors. For example, freehold apartments and villas in Ajman offer rental yields of up to 10% in 2025, significantly higher than Dubai’s projected 6.5%. This high ROI, combined with no property or capital gains taxes, allows U.S. investors to maximize returns on tourism-driven properties like vacation rentals and serviced apartments.

Opportunities for U.S. Investors in 2025

Ajman’s tourism-driven real estate market presents several opportunities for U.S. investors in 2025, supported by the emirate’s investor-friendly policies and economic stability. Here are some key areas to consider:

- Vacation Rentals and Holiday Homes: The surge in tourist arrivals has increased demand for short-term rentals, particularly in areas like Al Zorah and Ajman Marina. U.S. investors can capitalize on this by purchasing apartments or villas for use as holiday homes. For instance, a studio apartment in Ajman One Phase 2 can generate rental yields of 9–10%, with low entry costs compared to Dubai. The ATDD’s streamlined licensing process ensures compliance and quality, making it easier for investors to enter this market.

- Boutique Hotels and Serviced Apartments: Ajman’s focus on boutique tourism experiences creates opportunities for developing small-scale hotels or serviced apartments. Projects like the Grand Mall Complex and Ajman Pearl Tower are attracting investors with their modern amenities and proximity to tourist hotspots. U.S. investors can leverage their expertise in hospitality to develop properties that cater to international visitors seeking affordable luxury.

- Mixed-Use Developments: Developments like Ajman Marina and Al Zorah integrate residential, commercial, and entertainment spaces, offering diverse investment options. U.S. investors can acquire commercial units for retail or dining establishments that cater to tourists, benefiting from high foot traffic and visibility.

- Cultural and Eco-Tourism Ventures: Ajman’s investment in cultural attractions, such as the Heritage District, and eco-tourism initiatives, like the Al Zorah Nature Reserve, creates opportunities for unique real estate projects. Investors can develop properties that offer cultural tours, water sports facilities, or eco-friendly accommodations, aligning with global trends toward sustainable tourism.

Ajman’s 2025 budget of AED 3.7 billion (USD 964 million) supports these opportunities by prioritizing infrastructure, digital transformation, and sustainability. Investments in road networks, smart city projects, and green spaces enhance the emirate’s appeal for tourists and residents alike, driving property demand. Additionally, policies allowing 100% foreign ownership and residency visas for property investments of AED 750,000 or more make Ajman accessible and attractive for U.S. investors.

Tax Benefits and Financial Incentives

Ajman’s tax-free environment is a major draw for U.S. investors. The emirate imposes no property taxes, capital gains taxes, or income taxes on rental earnings, allowing investors to retain a larger share of their profits. For example, a vacation rental property generating AED 50,000 annually in rental income incurs no tax liability, unlike in the U.S., where such income would be subject to federal and state taxes. The UAE’s currency, pegged to the U.S. dollar, further reduces financial risk, providing stability for American investors.

The Ajman Free Zone and Al Zorah Free Zone offer additional incentives, including 100% foreign ownership, exemption from customs duties, and streamlined business setup processes. These benefits lower operational costs and enhance profitability, making tourism-driven real estate projects highly lucrative. For U.S. investors, this creates a low-risk entry point into a high-growth market.

Challenges to Consider

Despite its potential, Ajman’s tourism-driven real estate market faces challenges. Competition from Dubai and Sharjah, which have more established tourism and real estate sectors, could impact growth. Additionally, global economic uncertainties, such as trade tensions or slowdowns, may affect tourist arrivals and investment flows. However, Ajman’s affordability, supportive policies, and ongoing infrastructure improvements mitigate these risks, ensuring sustained growth in 2025.

How U.S. Investors Can Get Started

To capitalize on Ajman’s tourism-driven real estate surge, U.S. investors should consider the following steps:

- Research High-Potential Areas: Focus on neighborhoods like Al Helio 2, Al Zahia, and Al Yasmeen, which are among the most traded for real estate transactions. Projects like Ajman One Phase 2 and Al Ameera Village offer high rental yields and capital appreciation potential.

- Partner with Local Experts: Collaborate with reputable firms like or to identify prime investment opportunities and navigate local regulations. These firms provide insights into projects like Biltmore Residences and Ajman Creek Tower, which are gaining traction in 2025.

- Leverage Financing Options: Ajman offers competitive financing with low-interest rates and flexible payment plans, such as post-handover options. U.S. investors can also explore U.S.-based financing or real estate investment trusts (REITs) to diversify their investments.

- Focus on Sustainability: Align investments with Ajman’s sustainability goals by targeting eco-friendly developments or properties with green certifications, which appeal to environmentally conscious tourists and investors.

Conclusion

Ajman’s tourism-driven real estate market in 2025 offers U.S. investors a unique opportunity to capitalize on a high-growth sector with significant financial incentives. The emirate’s booming tourism industry, supported by strategic initiatives like Ajman Vision 2030, is driving demand for vacation rentals, boutique hotels, and mixed-use developments. With its tax-free environment, 100% foreign ownership, and affordable property prices, Ajman stands out as a compelling alternative to more expensive markets like Dubai. By leveraging local expertise and focusing on high-potential areas, U.S. investors can achieve high returns and establish a foothold in one of the UAE’s most promising real estate markets. As Ajman continues to grow as a tourism and investment hub, 2025 is the perfect time to invest in its vibrant real estate landscape.

WATCH MORE: https://www.youtube.com/watch?v=qpl6ftds42o

READ MORE: Ajman’s Industrial Real Estate Boom: Tax Benefits and Investment Potential in 2025