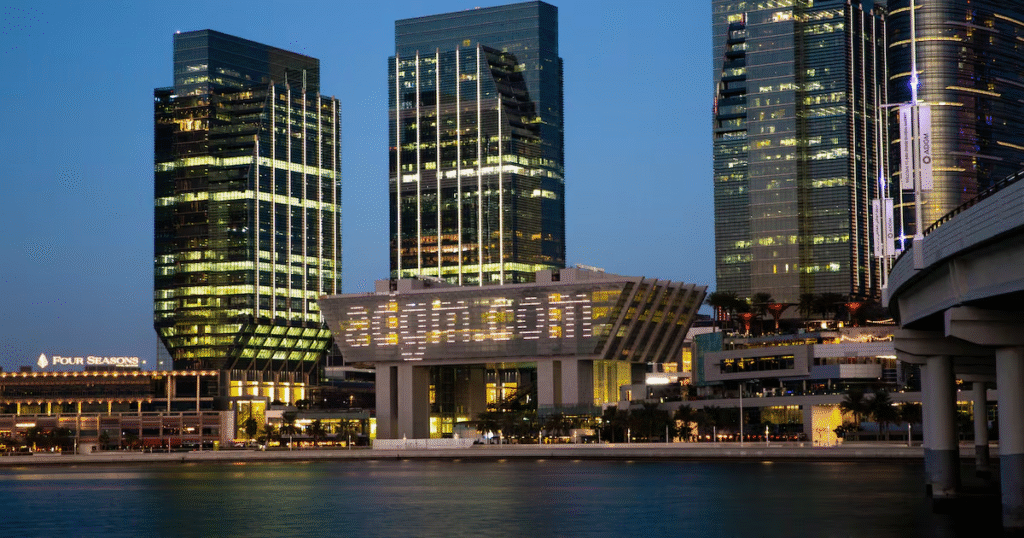

Bain Capital, one of the world’s most influential global investment firms, has entered a strategic partnership with the Abu Dhabi Investment Office (ADIO) to establish new alternative investment platforms in the region, marking a pivotal moment for Abu Dhabi’s financial ecosystem and global investors alike. This collaboration is not just another expansion it represents a bold step toward making the Emirate a hub for cutting‑edge finance and long‑term economic transformation.

Bain Capital’s decision to expand its footprint into Abu Dhabi is significant on multiple fronts. By teaming up with ADIO, the firm is aligning its substantial global expertise with Abu Dhabi’s ambitious vision for economic diversification and financial innovation. This collaboration goes beyond traditional investment deals to forge a future‑ready financial ecosystem that attracts capital, creates jobs, and advances regional competitiveness.

At its core, the partnership focuses on building a locally anchored asset management ecosystem that deepens regional capital deployment and enhances financial capabilities. With Abu Dhabi striving to attract high‑growth companies and visionary investors, Bain Capital’s presence underscores confidence in the region’s strategic positioning and growth potential.

A cornerstone of this strategic alliance is its integration with ADIO’s newly launched Fintech, Insurance, Digital, and Alternative Investments (FIDA) cluster, an ambitious initiative designed to transform Abu Dhabi into a leading global asset management and financial technology hub. The FIDA cluster aims to develop next‑generation financial infrastructure across alternative investments, digital assets, portable savings, transition finance, and capital solutions for small‑to‑medium enterprises (SMEs).

Under this framework, the partnership is expected to contribute significantly to Abu Dhabi’s economic goals driving GDP growth, attracting substantial investment inflows, and creating thousands of skilled jobs over the coming decades. This synergy between strategic vision and practical implementation illustrates the depth of Abu Dhabi’s commitment to building a competitive global financial landscape.

One of the key goals of this collaboration is to establish alternative investment platforms that are rooted in the region but connected to global capital flows. By doing so, Bain Capital and ADIO aim to ensure that more investment activity is spearheaded directly from Abu Dhabi, reinforcing local expertise and enabling more tailored capital deployment strategies that address regional priorities.

Through structured investments and co‑investment opportunities, the partnership will work with local partners, sovereign entities, institutional investors, and academic institutions. This networked approach not only fosters investment innovation but also encourages the exchange of knowledge and resources critical for sustainable ecosystem development.

The partnership won’t focus solely on capital; it aims to drive growth in sectors where innovation and demand converge. Key areas include digital infrastructure, healthcare, financial technology, aviation, transition finance, and more. By channeling investment and expertise into these sectors, Abu Dhabi positions itself to capture future economic opportunities and diversify beyond traditional energy‑led growth models.

This sector‑focused strategy reflects both global trends and local needs, supporting companies that have high growth trajectories and significant potential to contribute to economic transformation. It also aligns with global investor appetite for dynamic, future‑focused sectors.

A critical, yet often overlooked, component of financial ecosystem growth is talent. This partnership places emphasis on developing pathways for research, skill enhancement, and educational programs in fields like alternative investments, risk management, and asset advisory. By building local human capital, the initiative ensures that the region’s financial ecosystem is supported by both global expertise and homegrown talent.

Investing in talent isn’t just good policy it’s a strategic move that prepares Abu Dhabi for future challenges, ensures that innovation stays rooted locally, and gives professionals the tools they need to compete on the global stage. This focus sets the stage for deeper economic resilience and long‑term sustainability.

While the collaboration has clear regional significance, it also reflects a broader economic relationship between the United States and the United Arab Emirates. As a U.S.–headquartered firm with an expansive global network, Bain Capital’s decision to establish a major presence in Abu Dhabi signals confidence in the emirate’s investment environment and strategic direction.

This partnership underscores the value of international cooperation in finance and signals to global investors that the Middle East is not only open for business, but also ready to lead in alternative asset innovation. It strengthens Abu Dhabi’s role as a financial gateway between East and West.

Abu Dhabi’s ambition to become a regional hub for alternative investments is mirrored by other global firms that have been expanding their presence in the region. More private markets firms are identifying opportunities and establishing bases, further cementing the emirate’s status as a transformative financial center. This momentum cultivates an ecosystem where capital, talent, and innovative ideas converge.

For institutional investors, entrepreneurs, and financial professionals, this partnership represents a unique gateway to regional and global opportunity. By blending local insights with global investment capabilities, Bain Capital and ADIO are creating avenues for diversified capital deployment and strategic growth.

As Abu Dhabi continues to roll out initiatives like the FIDA cluster and builds supportive regulatory and educational frameworks, the region’s investment landscape will likely become increasingly attractive to investors seeking long‑term, sustainable returns.

Bain Capital’s strategic alliance with the Abu Dhabi Investment Office showcases an ambitious vision—one that embraces innovation, fosters growth, and positions Abu Dhabi at the forefront of global alternative investments. This collaboration is more than just an expansion; it’s a transformative moment that signals a future where the emirate becomes a powerful, globally connected financial hub.

As investment flows, talent development, and sector innovation flourish, the ripple effects of this partnership will influence regional economic growth, investor confidence, and global financial dynamics for years to come.

Do Follow Estate Magazine on Instagram

Read More:- Global Capital Flows Rise with Arch Sale and UAE Growth 2025