Now Reading: 5 Brutal Reasons ₹3 Crore Home Is A Bad Deal

-

01

5 Brutal Reasons ₹3 Crore Home Is A Bad Deal

5 Brutal Reasons ₹3 Crore Home Is A Bad Deal

Table of Contents

Buying a ₹3 crore home in India sounds like the ultimate sign of success. After all, for many Indians, owning a luxury property in cities like Mumbai, Delhi, or Bangalore is more than just an asset—it’s a status symbol. But what if the dream home is actually a financial trap?

A top financial planner recently shared a bold take: buying a ₹3 crore home in India might be a poor investment decision. Despite the emotional and cultural importance of home ownership in India, the cold numbers don’t always support the decision—especially when the price tag is so high.

Here’s a breakdown of why spending ₹3 crore on a home might not be the smart investment it appears to be.

1. Low Rental Yield: Your Returns Are Tiny

The average rental yield in Indian cities ranges from 2% to 3% per year. That means if you buy a ₹3 crore home, your annual rental income may only be around ₹6–9 lakh.

Now compare this with what you’d earn if you invested the same amount in mutual funds, stocks, or even fixed deposits. You’d likely make 8–10% returns annually—translating into ₹24–30 lakh, without the stress of property maintenance or legal obligations.

So, from a pure investment perspective, buying a ₹3 crore home in India gives poor returns.

2. Heavy EMIs Can Destroy Cash Flow

Most people don’t pay ₹3 crore upfront—they take a home loan. Let’s say you take a loan of ₹2 crore at 8.5% interest for 20 years. Your EMI will be around ₹1.7 lakh per month. That’s ₹20.4 lakh a year.

Even if you rent out the home and earn ₹8 lakh annually, you’re still burning ₹12 lakh every year from your own pocket.

This destroys your cash flow and limits your ability to invest elsewhere, take career risks, or even plan a peaceful retirement.

3. High Taxes and Maintenance Costs

Owning a ₹3 crore home also means property tax, society charges, insurance, and general maintenance. These can easily amount to ₹1–2 lakh per year.

Add in occasional repairs, interior upgrades, and legal fees, and your costs keep rising. None of these expenses contribute to capital appreciation. They’re just money lost every year—reducing your overall return on investment.

4. Real Estate Appreciation Is Not What It Used to Be

Gone are the days when real estate prices doubled every 5 years. In the past decade, property appreciation has slowed significantly, especially in metro cities.

From 2014 to 2024, real estate prices in many parts of Mumbai and Delhi barely moved—while equity markets delivered massive returns. And the new tax rules have made it tougher to save on capital gains if you sell the house later.

So, buying a ₹3 crore home in India is not a guaranteed wealth creator anymore.

5. Lock-in Period and Illiquidity Trap

When you invest in stocks or mutual funds, you can redeem them quickly. But a home is different. If your job shifts, or you need urgent funds, selling a ₹3 crore home is not easy.

You may have to wait months to find the right buyer. Plus, large properties often face price negotiation, legal issues, or even regulatory hurdles. This makes it a highly illiquid investment.

Being stuck with such an asset can be risky—especially if you’re dealing with life emergencies, job loss, or business failure.

Why Do People Still Buy Expensive Homes?

Despite all the above, people continue to buy ₹3 crore homes. Here are the reasons:

- Emotional Satisfaction: Owning a home feels safe and secure.

- Social Prestige: A luxury home boosts status in society and family.

- Tax Benefits: Home loan repayments give deductions under sections 80C and 24(b).

But financial planners argue that these benefits don’t compensate for the weak returns, high costs, and liquidity issues.

What Should You Do Instead?

If you have ₹3 crore to invest, you might be better off renting a home and investing the rest in diversified financial assets. Renting gives you flexibility, and your investments work harder for you.

Example strategy:

- Rent a home for ₹60,000/month (₹7.2 lakh/year)

- Invest ₹3 crore in mutual funds or index funds with 10% annual return

- Earn ₹30 lakh per year—while still living comfortably

This approach helps you stay financially agile, especially in your 30s and 40s.

Conclusion: A Costly Dream May Cost Your Future

Buying a ₹3 crore home in India is an emotional dream, but financially it could be a trap. With low rental yields, high EMIs, rising maintenance costs, slow appreciation, and poor liquidity, such an investment might limit your wealth-building journey.

For smart investors and young professionals, it’s time to shift mindset. Assets should grow your money, not just give shelter. A home can be part of your plan—but not the whole plan.

So before locking ₹3 crore into a property, ask yourself: Is this move about wealth, or just pride?

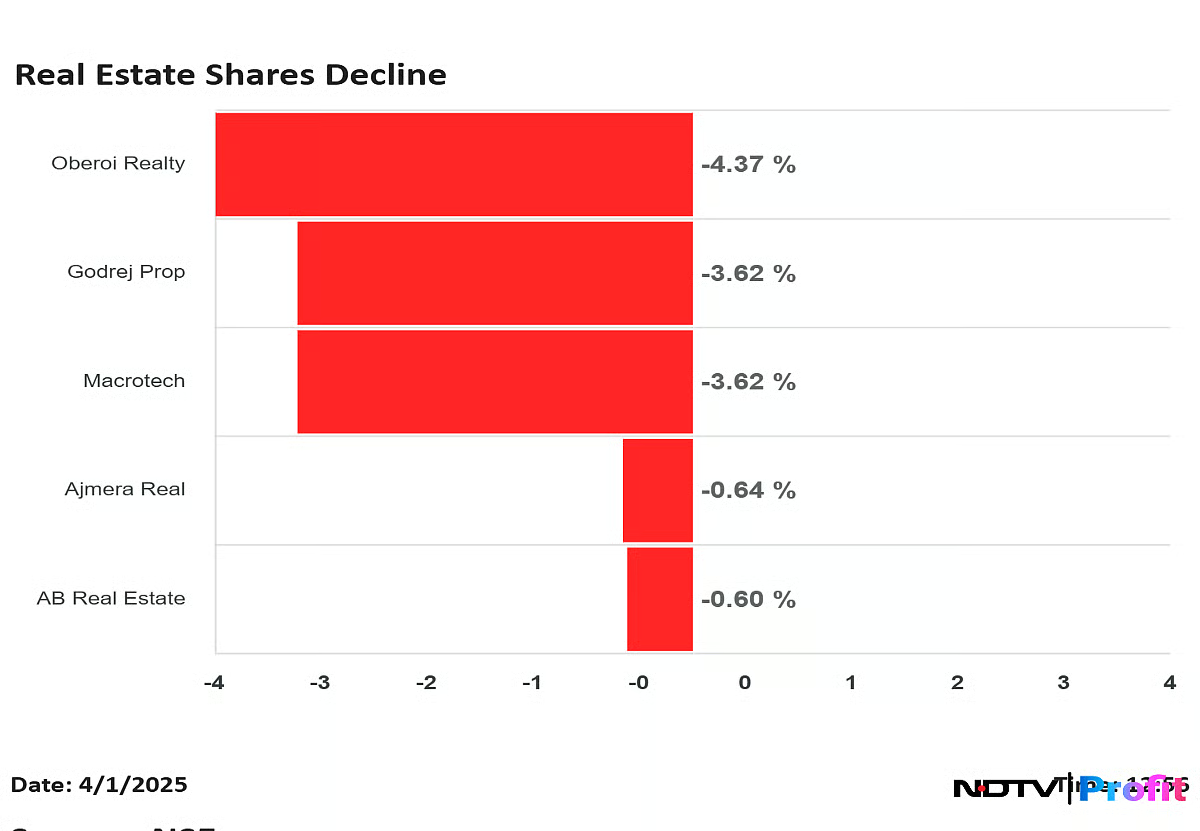

Also Read – Shares Crash: 7 Shocking Reasons Why Real Estate Is Falling