Now Reading: Ras Al Khaimah Real Estate: Tax Incentives for Developers in 2025

-

01

Ras Al Khaimah Real Estate: Tax Incentives for Developers in 2025

Ras Al Khaimah Real Estate: Tax Incentives for Developers in 2025

Table of Contents

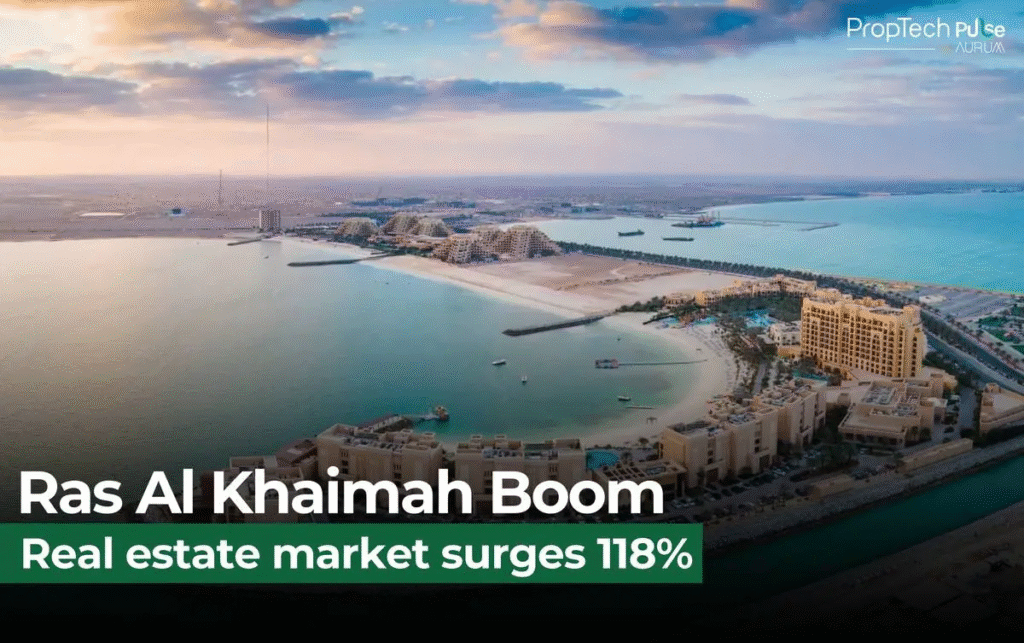

Ras Al Khaimah (RAK) has solidified its position as a burgeoning real estate hub in the UAE, with a 118% surge in transactions to AED 15.08 billion in 2024 and rental yields of 7–12% in prime areas like Al Marjan Island, per traveldailynews.com, topluxuryproperty.com. For developers, RAK offers a compelling tax environment characterized by exemptions and incentives, underpinned by Decree No. 12 of 2023, which regulates the real estate sector, per tamimi.com.

Unlike Abu Dhabi and Dubai, RAK’s lower transaction costs and free zone benefits make it particularly attractive for master and sub-developers. This response details the tax incentives available to developers in RAK in 2025, eligibility criteria, and actionable strategies, correcting misinformation from sources like regr.biz and addressing the regulatory framework.

1. Overview of RAK’s Real Estate Tax Environment for Developers

RAK operates under the UAE’s federal tax framework, which is notably developer-friendly, per tax.gov.ae. Key tax-related benefits for developers include:

- No Annual Property Tax: No recurring taxes on developed or unsold properties, reducing holding costs, per realiste.ai.

- No Capital Gains Tax (CGT): Profits from property sales are tax-free, regardless of project scale or nationality, per topluxuryproperty.com.

- Example: Selling 100 Al Marjan Island apartments for AED 100 million, purchased at AED 80 million, yields a tax-free AED 20 million profit.

- No Personal Income Tax: Individual developers or shareholders face no tax on dividends or personal income from projects, per realiste.ai.

- 9% Corporate Tax (CT): Applies to net taxable income above AED 375,000/year for entities, with deductions for development costs, per tax.gov.ae.

- No Municipality/Housing Fee: Unlike Dubai (3.5%) or Abu Dhabi (3%), RAK imposes no rental-based fees, saving 5% annually (e.g., AED 50,000 on AED 1 million rental income), per immigrantinvest.com.

- Misinformation Clarification: regr.biz erroneously claims a 10% rental income tax and 10% CGT. These do not exist in RAK or the UAE for real estate, per tax.gov.ae, realiste.ai. The 9% CT is the only applicable tax for high-income entities, and no CGT applies.

2. Specific Tax Incentives for Developers

RAK’s tax incentives are designed to attract developers through exemptions, VAT benefits, and free zone advantages, per marjan.ae, rakez.com. Below are the key incentives, eligibility criteria, and qualification steps.

a. Tax-Free Property Sales in Freehold Zones

- Incentive: 100% tax-free sales of residential and commercial properties in freehold zones, with no CGT or income tax, per pantheondevelopment.ae.

- Eligible Areas: Al Marjan Island, Mina Al Arab, Al Hamra Village, RAK Central, per topluxuryproperty.com.

- Qualification:

- Register as a developer with RAK’s Real Estate Regulatory Administration (RERA) under Decree No. 12 of 2023, per tamimi.com.

- Develop freehold projects with RERA-approved permits, ensuring compliance with the Real Estate Developer Register, per trowers.com.

- Pay a 4% transfer fee (split 2% buyer/2% seller) to the RAK Land Department, e.g., AED 4 million on a AED 100 million project, per realiste.ai.

- Example: A developer selling 50 Mina Al Arab villas for AED 50 million incurs only AED 1 million seller transfer fee (2%), with no CGT on profits.

- Investor Action:

- Partner with master developers like Marjan or RAK Properties for pre-approved freehold zones, per marjan.ae, rakproperties.ae.

- Budget 2% agent commission + 5% VAT (e.g., AED 2.1 million on AED 100 million), per realiste.ai.

- Verify project registration via RERA’s Real Estate Development Projects Register, per rera.rak.ae.

b. Zero-Rated VAT (0%) on First Sale of New Residential Properties

- Incentive: No 5% VAT on the first sale of new residential properties (within three years of completion), saving significant costs, per mof.gov.ae, realiste.ai.

- Qualification:

- Develop residential projects (apartments, villas) in freehold zones, registered with RERA, per tamimi.com.

- Ensure properties are sold within three years of completion certificate issuance, per dubaipropertyguides.com.

- Maintain VAT-compliant records for FTA audits, per mof.gov.ae.

- Example: Selling 200 new Al Hamra Village apartments for AED 200 million incurs no VAT, saving AED 10 million.

- Investor Action:

- Target off-plan projects (e.g., Mirasol by RAK Properties) for zero-rated VAT and 10–15% ROI, per thenationalnews.com.

- Engage VAT-registered contractors to reclaim 5% VAT on construction costs (e.g., AED 5 million on AED 100 million), per taxually.com.

- Submit completion certificates to RERA and FTA, per rera.rak.ae, tax.gov.ae.

c. 5% VAT on Commercial Property Sales and Rentals

- Incentive: While commercial sales and rentals incur 5% VAT, developers can reclaim input VAT on construction and operational costs if VAT-registered, per mof.gov.ae.

- Qualification:

- Develop commercial projects (offices, retail) in RAK Central or free zones, registered with RERA, per trowers.com.

- Register for VAT with FTA if annual taxable supplies exceed AED 375,000, per tax.gov.ae.

- Example: Selling a AED 50 million RAK Central office building incurs AED 2.5 million VAT (payable by buyer), but developers reclaim AED 1 million VAT on construction costs.

- Investor Action:

- Focus on mixed-use projects (e.g., One RAK Central by Pantheon) to balance residential (0% VAT) and commercial (5% VAT) revenue, per pantheondevelopment.ae.

- Maintain detailed invoices for VAT reclamation, per cleartax.com.

- Consult VAT advisors (AED 5,000–15,000) for compliance, per dubaipropertyguides.com.

d. Deductible Expenses Against 9% Corporate Tax

- Incentive: Developers with net taxable income above AED 375,000/year pay 9% CT but can deduct development and operational expenses, per tax.gov.ae.

- Eligible Deductions:

- Construction Costs: Materials, labor, contractor fees (e.g., AED 50 million for a 200-unit project), per realiste.ai.

- Marketing: Advertising, brochures (e.g., AED 500,000/year), per keltandcorealty.com.

- Management Fees: Project oversight (5–10% of costs, e.g., AED 5 million), per pantheondevelopment.ae.

- Interest: Mortgage or project financing (e.g., AED 2 million on AED 50 million loan at 4%), per realiste.ai.

- Maintenance: Pre-sale repairs (e.g., AED 1 million), per topluxuryproperty.com.

- Example: A developer with AED 20 million rental income from Al Marjan Island commercial units, less AED 8 million deductions, pays AED 1.08 million CT (9% of AED 12 million), saving AED 720,000.

- Qualification:

- Register with FTA via EmaraTax for CT compliance, per tax.gov.ae.

- Maintain audited financial records, per cleartax.com.

- File CT returns by February 28, 2025, for 2024–25 financial year, per tax.gov.ae.

- Investor Action:

- Use accounting software (e.g., Xero) for expense tracking, per dubaipropertyguides.com.

- Hire tax consultants (AED 10,000–30,000) for deduction optimization, per rak-ibc.com.

- Maximize deductions by bundling pre-sale maintenance and marketing, per realiste.ai.

e. 100% Tax Exemption in Free Zones

- Incentive: Developers operating in RAK Economic Zone (RAKEZ) or RAK Free Trade Zone (RAKFTZ) enjoy 100% exemption from corporate tax on income from commercial or residential projects for up to 50 years, per rakez.com, nomoretax.eu.

- Qualification:

- Incorporate a free zone entity (e.g., LLC) with RAKEZ, costing AED 15,000–50,000, per rakez.com.

- Develop projects within free zone jurisdictions, such as RAK Central commercial plots, per economymiddleeast.com.

- Maintain a physical presence (e.g., office lease, AED 20,000–50,000/year), per nomoretax.eu.

- Ensure no income is derived from mainland UAE to maintain exemption, per rak-ibc.com.

- Example: A RAKEZ-registered developer earning AED 30 million from Al Marjan Island hotel rentals pays no CT, saving AED 2.7 million.

- Investor Action:

- Contact RAKEZ for setup guidance (www.rakez.com).

- Develop hospitality projects (e.g., Wynn Al Marjan Island partners) for 9%+ yields, per traveldailynews.com.

- Verify free zone boundaries with RERA, per rera.rak.ae.

f. Government Incentives for Sustainable Development

- Incentive: Subsidies and priority permitting for green building projects, aligning with UAE Economic Vision 2030, per majordevelopers.com, forbes.com.

- Qualification:

- Incorporate sustainable features (e.g., solar panels, water recycling) in projects, certified by RAK Municipality, per economymiddleeast.com.

- Submit environmental impact assessments to RERA, per tamimi.com.

- Example: A developer building 100 eco-friendly villas in Mina Al Arab receives expedited permits, saving 3–6 months and AED 500,000 in delays.

- Investor Action:

- Partner with green consultants (AED 20,000–50,000) for certification, per majordevelopers.com.

- Target branded residences (40% of 14,000 units by 2029) for high-net-worth investors, per topluxuryproperty.com.

- Monitor RAK Municipality for subsidy updates, per rak.ae.

3. Regulatory Requirements for Developers

To access these incentives, developers must comply with Decree No. 12 of 2023, which enhances investor confidence through robust regulations, per trowers.com, tamimi.com:

- RERA Registration:

- Mandatory registration in RERA’s Real Estate Developer Register, costing AED 10,000–50,000, per tamimi.com.

- Submit financial statements, project plans, and proof of capital, per rera.rak.ae.

- Project Registration:

- Register projects in RERA’s Real Estate Development Projects Register, including escrow account details, per trowers.com.

- Obtain Off-Plan Sale Permits for pre-construction sales, requiring 20% project completion or escrow funding, per tamimi.com.

- Escrow Accounts:

- Open project-specific escrow accounts with RERA-registered trustees, ensuring buyer funds are protected, per trowers.com.

- Example: A AED 100 million project requires a main escrow account and sub-accounts per unit, with withdrawals approved by RERA.

- Transfer Fees:

- Pay 2% seller transfer fee per unit sold (e.g., AED 20,000 on AED 1 million), per realiste.ai.

- Register sales with RAK Land Department, per rakland.gov.ae.

- Compliance Costs:

- Legal fees: AED 20,000–100,000 for RERA/escrow setup, per dubaipropertyguides.com.

- Audits: AED 10,000–30,000/year for CT/VAT compliance, per cleartax.com.

- Investor Action:

- Hire RERA-registered lawyers (e.g., Al Tamimi & Co.) for compliance, per tamimi.com.

- Verify escrow trustees via RERA, per rera.rak.ae.

- Budget 1–2% of project value for regulatory fees, per realiste.ai.

4. Additional Considerations

- Risks:

- Non-compliance with RERA or FTA risks fines (AED 50,000–1 million), per tamimi.com.

- Oversupply of 14,000 units by 2029 could depress prices by 10–15%, per topluxuryproperty.com.

- Foreign developers may face home country taxes (e.g., U.S. at 15–20% CGT), offset by 140+ double taxation agreements (DTAs), per rak-ibc.com.

- Market Context:

- 70% transaction growth since 2020, 35% price increase in 2024, per topluxuryproperty.com.

- Wynn Al Marjan Island (2027) to drive 20%+ demand, per economymiddleeast.com.

- RAK Properties plans 12 projects worth AED 5 billion in 2025, per thenationalnews.com.

- Costs:

- Transaction: 4% transfer (2% developer), 2% agent + 5% VAT, per realiste.ai.

- Development: AED 10–20/sq m service charges, 6% tourism fee on hotel rentals, per keltandcorealty.com.

- Compliance: AED 50,000–200,000 for legal/tax advisors, per dubaipropertyguides.com.

5. Strategic Recommendations for Developers

- Small-Scale Developers (AED 10–50 Million Projects):

- Target: Off-plan apartments in Al Hamra Village (7–9% yields).

- Strategy: Leverage zero-rated VAT, keep income below AED 375,000 to avoid CT, per topluxuryproperty.com.

- Action: Register with RERA, budget 4–7% fees, verify via rera.rak.ae.

- Mid-Scale Developers (AED 50–200 Million Projects):

- Target: Mixed-use projects in Al Marjan Island (9%+ yields).

- Strategy: Deduct construction costs (AED 20–50 million), reclaim VAT on commercial, list hotels on Airbnb, per traveldailynews.com.

- Action: Register for EmaraTax by March 31, 2025, consult for DTAs, per tax.gov.ae.

- Large-Scale Developers (AED 200 Million+ Projects):

- Target: Branded residences in Mina Al Arab or RAK Central (5–7% yields).

- Strategy: Set up RAKEZ entity for 100% tax exemption, pursue green subsidies, per rakez.com, majordevelopers.com.

- Action: Hire legal/tax advisors, verify via rakland.gov.ae, monitor Wynn impact, per economymiddleeast.com.

- Compliance:

- Use RERA-registered developers (e.g., RAK Properties, Marjan), per rakproperties.ae, marjan.ae.

- Register projects/escrows with RERA, file CT/VAT returns by February 28, 2025, per dxbinteract.com.

- Monitor:

- Track The National, Zawya, RAK Property Reports, per thenationalnews.com, zawya.com.

- Follow RERA/RAKEZ updates for new incentives, per rera.rak.ae, rakez.com.

1. Tax Environment

- No Property Tax/CGT: Tax-free sales, e.g., AED 20M profit on AED 100M project.

- No Income Tax: Except 9% CT on income > AED 375K.

- No Municipality Fee: Saves AED 50K on AED 1M rentals vs. Dubai (3.5%).

- Action: Verify via www.tax.gov.ae, ignore 10% tax claims.

2. Tax Incentives

- Freehold Sales:

- Tax-free in Al Marjan, Mina Al Arab; 4% transfer (2% developer).

- Action: Register with RERA, budget AED 2.1M agent fee on AED 100M.

- Zero-Rated VAT:

- 0% on new residential sales, saves AED 10M on AED 200M.

- Action: Sell within 3 years, reclaim construction VAT, verify www.mof.gov.ae.

- Commercial VAT:

- 5% on sales/rentals, reclaim input VAT, e.g., AED 1M on AED 50M.

- Action: Register for VAT, focus mixed-use, retain invoices.

- CT Deductions:

- Deduct construction, interest; saves AED 720K on AED 20M income.

- Action: Register EmaraTax by March 31, 2025, file by February 28, 2025.

- Free Zone Exemption:

- 100% tax-free in RAKEZ, saves AED 2.7M on AED 30M.

- Action: Set up RAKEZ entity, develop in RAK Central.

- Green Subsidies:

- Priority permits for eco-projects, saves AED 500K delays.

- Action: Certify with RAK Municipality, target branded residences.

3. Regulatory Requirements

- RERA registration: AED 10K–50K, submit financials.

- Project registration: Escrow accounts, Off-Plan Sale Permits.

- Transfer fees: 2% developer, e.g., AED 20K/unit.

- Action: Hire lawyers, verify www.rera.rak.ae, budget 1–2% fees.

Conclusion

RAK’s 2025 tax incentives for developers—no property tax, no CGT, zero-rated VAT, CT deductions, and free zone exemptions—offer 7–12% ROI, surpassing Abu Dhabi (6–10%) and Dubai (5–9%), per topluxuryproperty.com. Developers qualify by registering with RERA, opening escrow accounts, and targeting freehold or free zone projects like Al Marjan Island, where Wynn’s 2027 opening will boost demand by 20%, per economymiddleeast.com. Compliance with Decree No. 12, EmaraTax registration by March 31, 2025, and verification via RERA/RAKEZ are critical to maximizing benefits in a market with 118% transaction growth, per traveldailynews.com. watch more here

read more here: VAT and Property Taxes in RAK: What Expats Should Know