Now Reading: RAK Freehold Laws: What They Mean for Tax Planning in 2025

-

01

RAK Freehold Laws: What They Mean for Tax Planning in 2025

RAK Freehold Laws: What They Mean for Tax Planning in 2025

Table of Contents

Ras Al Khaimah (RAK), with its AED 20 billion real estate market and 5,200 Q1 2025 transactions (RAK Department of Economic Development), is a prime destination for expat and foreign investors due to its freehold property laws and tax-free environment. Introduced in 2005 through Decree No. 3 and expanded under the RAK Real Estate Regulatory Authority (RERA), freehold laws allow foreigners to own property outright in designated areas like Al Hamra Village, Al Marjan Island, and Mina Al Arab.

These laws, combined with RAK’s tax incentives, offer significant opportunities for tax planning in the AED 20 billion market, yielding 5–8% returns. Tailored to your interest in UAE property trends, blockchain, smart homes, off-plan investments, and prior queries on taxes, depreciation, residency, and VAT, this guide explains RAK’s freehold laws and their implications for tax planning in 2025, integrating insights from the Federal Tax Authority (FTA), RAK RERA, Property Finder, gulfnews.com, and X sentiment.

- Market Context: RAK’s AED 20B real estate market in 2024, 5,200 Q1 2025 transactions, per RAK Department of Economic Development. Freehold laws, introduced in 2005 via Decree No. 3, allow 100% foreign ownership in areas like Al Hamra, Al Marjan Island, and Mina Al Arab.

- Focus: Explains RAK’s freehold laws and their implications for tax planning, emphasizing zero CGT, no property or income taxes, VAT exemptions, and free zone benefits for expats and investors.

- Relevance: Aligns with your interest in UAE property trends, blockchain, smart homes, off-plan investments, and queries on taxes, depreciation, residency visas, VAT, and CGT minimization.

- Sources: FTA, RAK RERA, RAK DED, Property Finder, gulfnews.com, hlbhamt.com, blackswanbss.com, pantheondevelopment.ae, PwC, OECD, and X sentiment.

Understanding RAK Freehold Laws

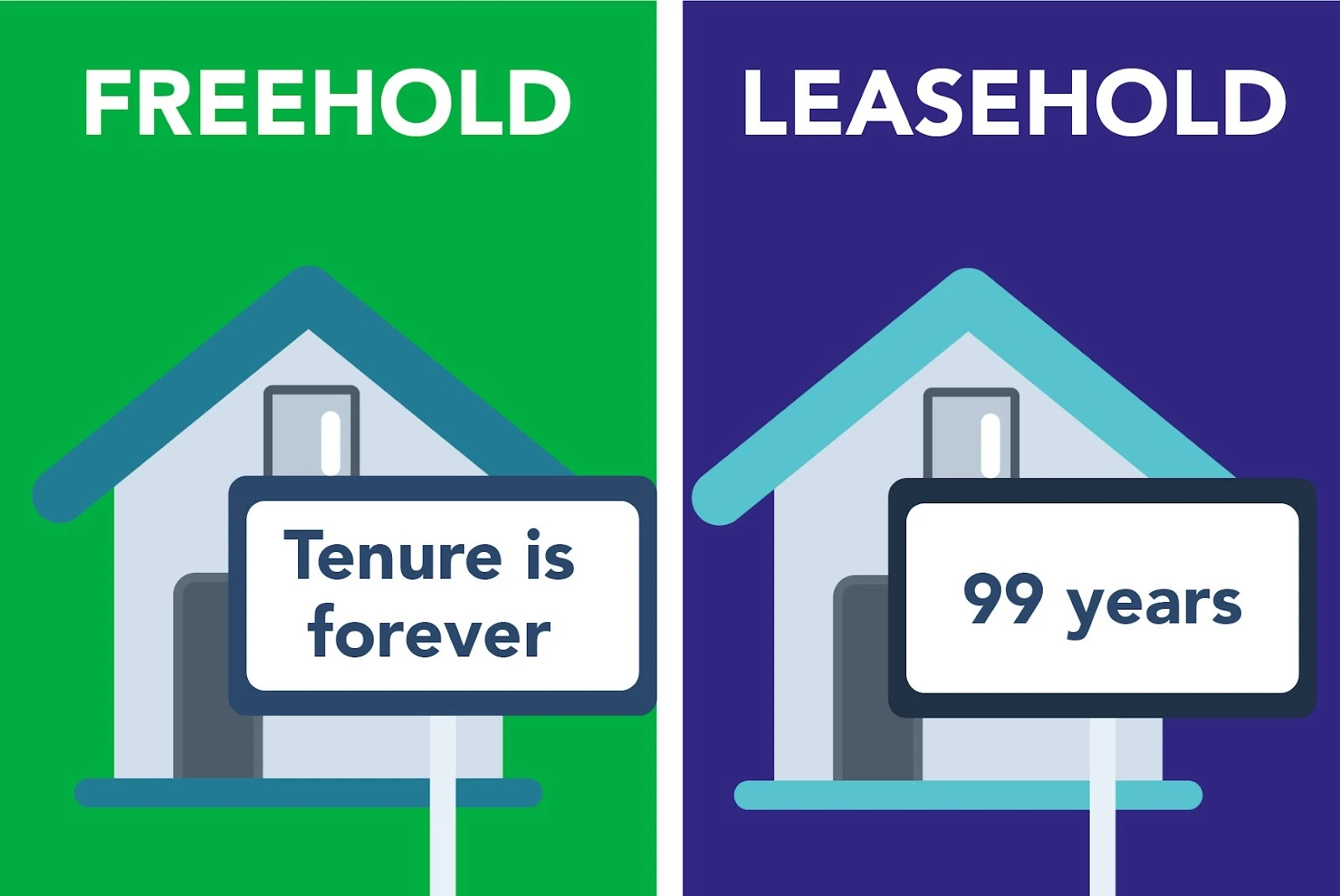

- Definition: Freehold ownership grants foreigners full property rights in perpetuity, including the right to sell, lease, or bequeath, in designated RAK areas, per Decree No. 3 of 2005 and RAK RERA regulations.

- Key Areas:

- Al Hamra Village: Luxury villas and apartments (AED 1M–5M), 5–7% yields, per Property Finder.

- Al Marjan Island: Waterfront properties (AED 1.5M–10M), 6–8% yields, home to Wynn Resort, per gulfnews.com.

- Mina Al Arab: Residential and mixed-use (AED 1M–4M), 5–7% yields.

- RAK Central: Off-plan projects like One RAK Central (AED 1.5M–3M), 5–7% yields, per pantheondevelopment.ae.

- RAKEZ Free Zone: Commercial properties (offices, warehouses, AED 1M–10M), 6–8% yields, per hlbhamt.com.

- Legal Framework:

- Governed by RAK RERA, established in 2008, ensuring transparency, escrow accounts, and dispute resolution, per blackswanbss.com.

- Foreigners enjoy 100% ownership without local sponsors, unlike leasehold areas requiring Emirati partners.

- Properties registered via RAK Land Department, with titles issued under Decree No. 3, per RAK DED.

- Investor Benefits:

- Long-term capital appreciation (3–6%, AED 30K–600K/year on AED 1M–10M).

- Rental yields: 5–7% residential, 6–8% commercial (AED 50K–800K/year).

- Residency visas: 12-year visa for AED 1M+ investments, per RAKEZ.

Tax Planning Implications of RAK Freehold Laws

RAK’s freehold laws, combined with the UAE’s tax regime, offer expats and investors significant tax planning opportunities. Below are the key tax benefits and strategies:

1. No Capital Gains Tax (CGT) or Personal Income Tax

- Rule: The UAE imposes zero CGT on freehold property sale profits and no personal income tax on rental income for individuals, per FTA (2025).

- Implication for Freehold Owners:

- Retain 100% of gains and rents, unlike 15–30% taxes in home countries (e.g., US, UK, India), saving AED 150K–600K on AED 1M–2M gains or AED 30K–240K on AED 200K–800K rents.

- Freehold status ensures full control over sales/leases, maximizing tax-free returns in high-demand areas like Al Marjan Island.

- Example:

- Selling a AED 3M Al Hamra villa for AED 4M nets AED 1M gain, tax-free in UAE, vs. AED 850K after 15% US CGT.

- Renting a AED 2M RAK Central apartment for AED 120K/year yields AED 120K, tax-free, vs. AED 84K after 30% Indian tax.

- Tax Planning Strategy:

- Hold Personally: Owning freehold properties as an individual avoids the 9% corporate tax applicable to businesses, per FTA.

- Mitigate Home Country Taxes: Use UAE’s 140+ Double Taxation Agreements (DTAs) to exempt or credit gains/rents, per OECD.

- Example: A UK investor uses the UK-UAE DTA to exempt AED 1M gain from 28% CGT (AED 280K saved).

- Establish UAE Residency: Spending 183+ days/year or securing a 12-year RAK visa (AED 1M+ property) shifts tax residency, potentially eliminating home country CGT, per FTA.

- Example: An Indian expat with a AED 2M Mina Al Arab villa becomes UAE tax resident, avoiding India’s 12.5% LTCG tax (AED 125K saved on AED 1M gain).

- Action:

- Register properties under personal name via RAK Land Department.

- Obtain UAE tax residency certificate (AED 2,000–5,000) from FTA.

- Consult cross-border tax advisors (e.g., PwC) for DTA claims.

2. No Annual Property Tax or Inheritance Tax

- Rule: RAK levies no annual property tax on freehold properties and no inheritance tax on transfers to heirs, per RAK DED and blackswanbss.com.

- Implication for Freehold Owners:

- Saves AED 10K–100K/year vs. 0.5–2% property taxes in US/UK (e.g., AED 50K/year on AED 5M villa), boosting net yields (5–8%).

- Freehold ownership ensures seamless, tax-free inheritance, saving 20–40% vs. UK/US (AED 600K–2M on AED 3M–5M properties).

- Enhances long-term wealth preservation in areas like Al Hamra or Mina Al Arab.

- Example:

- A AED 4M Al Marjan Island villa incurs no property tax, saving AED 80K/year vs. 2% in California.

- Passing a AED 5M RAK Central villa to heirs incurs no tax, vs. AED 2M at 40% in the UK.

- Tax Planning Strategy:

- Long-Term Holding: Freehold properties with no annual tax are ideal for multi-generational wealth planning, per Property Finder.

- Estate Planning: Structure ownership to simplify inheritance (e.g., joint ownership with heirs), avoiding home country taxes via DTAs.

- Example: A US expat names heirs on a AED 3M villa title, uses US-UAE DTA to minimize 40% estate tax (AED 1.2M saved).

- Smart Home Investments: Invest in IoT-enabled freehold villas (e.g., RAK Central) to save 10–15% utilities (AED 5K–15K/year), reducing costs without tax burdens, aligning with your smart home interest.

- Action:

- Budget for service fees (AED 10K–50K/year) and utilities (AED 20K–100K/year) instead of taxes.

- Use RAK RERA’s legal advisors for inheritance structuring.

- Retrofit villas with IoT systems (AED 50K–200K) for utility savings.

3. VAT Exemptions or Zero-Rated Supplies for Freehold Residential Properties

- Rule: Sales of new freehold residential properties (first supply within three years) are zero-rated (0% VAT), and subsequent sales/leases are VAT-exempt, per FTA. Commercial freehold properties incur 5% VAT, except in RAKEZ Designated Zones where transactions may be zero-rated.

- Implication for Freehold Owners:

- Saves 5% on residential purchases (AED 100K–500K on AED 2M–10M villas/apartments), enhancing affordability in Al Hamra or Al Marjan Island.

- VAT-exempt rentals boost tenant demand, supporting 5–7% yields (AED 100K–350K/year).

- Commercial freehold properties in RAKEZ benefit from zero-rated deals, saving 5% (AED 50K–500K on AED 1M–10M).

- Example:

- Buying a new AED 2.5M Al Hamra freehold villa is zero-rated, saving AED 125K VAT.

- Renting a AED 3M Mina Al Arab villa for AED 150K/year is VAT-exempt, vs. AED 7.5K VAT on a ≤6-month lease.

- Selling a AED 5M RAKEZ freehold warehouse to a free zone entity is zero-rated, saving AED 250K VAT.

- Tax Planning Strategy:

- Off-Plan Investments: Buy off-plan freehold properties (e.g., One RAK Central, AED 1.5M–3M) for zero-rated VAT savings, aligning with your off-plan interest, per pantheondevelopment.ae.

- Example: A AED 2M off-plan RAK Central apartment saves AED 100K VAT, gains 5–10% by handover (AED 100K–200K).

- Long-Term Leases: Structure residential leases >6 months to avoid 5% VAT, enhancing rental competitiveness.

- Example: A AED 2M Al Hamra apartment’s AED 120K/year lease is VAT-exempt.

- RAKEZ Commercial Investments: Lease or sell commercial freehold properties to free zone entities for zero-rated VAT, per PwC.

- Example: A AED 3M RAKEZ office leased for AED 200K/year to a free zone tenant incurs no VAT.

- VAT Registration: Register for VAT if commercial supplies exceed AED 375,000/year to recover input VAT (e.g., AED 5K–25K on maintenance), per hlbhamt.com.

- Action:

- Verify zero-rated status with developers via RAK RERA.

- Structure leases via RERA-registered brokers.

- Register for VAT if eligible (AED 500–5,000/year via HLB HAMT).

4. Free Zone Tax Benefits for Freehold Commercial Properties

- Rule: Qualifying Free Zone Persons (QFZPs) in RAKEZ face 0% corporate tax on qualifying income (e.g., commercial freehold leases to free zone entities), per UAE Corporate Tax Law (2023). Non-qualifying income (e.g., residential sales to individuals) is taxed at 9%, per FTA.

- Implication for Freehold Owners:

- Freehold commercial properties in RAKEZ (e.g., warehouses, offices) owned by QFZPs avoid 9% tax, saving AED 90K–900K on AED 1M–10M profits.

- Enhances 6–8% yields (AED 60K–800K/year on AED 1M–10M), per Property Finder.

- Example:

- A QFZP owning a AED 5M RAKEZ freehold warehouse leases it for AED 400K/year to a free zone entity, earning AED 300K profit, tax-free, vs. AED 273K after 9% tax.

- Selling a AED 3M RAKEZ office to a free zone entity nets AED 1M gain, tax-free for individuals or QFZPs.

- Tax Planning Strategy:

- QFZP Setup: Register a company in RAKEZ (AED 3,650–15,000/year license) to hold commercial freehold properties, ensuring qualifying income, per hlbhamt.com.

- Example: A AED 5M warehouse owned by a QFZP saves AED 180K tax on AED 2M profit.

- Substance Compliance: Maintain physical presence (e.g., flexi desk, AED 3,650/year) and adequate employees/assets to avoid 9% tax, per PwC.

- Blockchain Integration: Use blockchain for transparent lease/sale records in RAKEZ, reducing compliance costs (AED 5K–20K/year), aligning with your blockchain interest.

- Example: Smart contracts for a AED 3M office lease save AED 5K/year in legal fees.

- Action:

- Setup QFZP via RAKEZ, verify qualifying income with FTA.

- Engage blockchain platforms (e.g., RAK DAO) for transactions.

- Consult tax advisors (e.g., HLB HAMT) for compliance.

5. Residency Visa and Home Country Tax Mitigation

- Rule: Freehold properties worth AED 1M+ grant a 12-year RAK investor visa, enhancing UAE tax residency, per RAKEZ. Properties ≥AED 2M may qualify for a 10-year UAE Golden Visa, per Federal Decree-Law No. 29 of 2021.

- Implication for Freehold Owners:

- UAE tax residency (183+ days/year or visa) allows expats to leverage DTAs, exempting RAK gains/rents from home country taxes (15–30%), per OECD.

- Freehold ownership in Al Hamra or RAK Central simplifies visa eligibility, boosting tax planning.

- Example:

- A AED 2M Al Marjan Island freehold villa secures a 12-year visa, enabling a Canadian expat to avoid 25% CGT on AED 1M gain (AED 250K saved) via DTA.

- A AED 3M Mina Al Arab villa qualifies for a Golden Visa, exempting AED 200K/year rent from 30% Indian tax (AED 60K saved).

- Tax Planning Strategy:

- Visa Investment: Purchase freehold properties ≥AED 1M (e.g., AED 1.5M RAK Central apartment) for visa and residency benefits.

- Example: AED 1.5M Al Hamra apartment yields AED 75K–105K/year, secures 12-year visa.

- Tax Residency Certificate: Obtain certificate (AED 2,000–5,000) to claim DTA relief, per FTA.

- Example: US expat with AED 2M villa uses certificate to defer 20% CGT on AED 1M gain (AED 200K saved).

- Home Country Reporting: Declare RAK assets to comply with home country rules (e.g., US FBAR, UK HMRC), avoiding penalties, per OECD.

- Action:

- Apply for visa via RAK DED or RAKEZ.

- File DTA claims with home country tax authorities (e.g., IRS, HMRC).

- Use advisors (e.g., PwC) for compliance.

Financial Snapshot

- Property Prices:

- Residential: AED 1M–10M (Al Hamra, Al Marjan, RAK Central).

- Commercial: AED 1M–10M (RAKEZ offices, warehouses).

- Initial Costs:

- Transfer Fee: 2% (AED 20K–200K, split.

- Agent Fee: 4% + 5% VAT (AED 42K–210K).

- AML/KYC: AED 5,250K–25K.

- RAKEZ License: AED 3,650K–15K/year.

- Ongoing Costs:

- Service Fees: AED 10K–50K/year.

- Utilities: AED 20K–100K/year.

- VAT on Services: 5% (AED 1K–5K/year).

- Tax Savings:

- No CGT/Income Tax: AED 150K–600K on AED 1M–2M gain, AED 30K–240K/year on AED 200K–800K/year rent.

- No Property Tax: AED 10K–200K/year.

- No Inheritance Tax: AED 200K–400K.

- VAT Exemption: AED 100K–500K on AED 2M–10M residential.

- Corporate Tax: 0% for QFZPs (AED 90K–900K on AED 1M–10M profit).

- Returns (Tax-Free in UAE):

- Yields: 5–7% residential, 6–8% commercial (AED 50K–800K/year).

- Appreciation: 3–6% (AED 30K0K–600K/year).

- Home Country Taxes: 15–30% (AED 15K–450K–240K on AED 100K–1.5M), mitigable via DTAs).

Strategic Considerations

- Residential Freehold Investments:

- Why: Zero-rated VAT, VAT-exempt rents, no property tax, 5–7% yields, visa eligibility.

- Example: AED 2M Al Hamra villa saves AED 100K VAT, yields AED 100K00–140K/year.

- Action: Buy off-plan in RAK Central for VAT savings, secure 12-year visa.

- Commercial Freehold in RAKEZ:

- Why: 0% corporate tax, zero-rated VAT, 6–8% yields.

- Example: AED 5M warehouse saves AED 250K VAT, yields AED 300K–400K/year.

- Action: Setup QFZP, lease to free zone entities.

- ** Visa and Residency:

- Why: 12-year visa or Golden Visa mitigates home country taxes.

- Savings: Example: AED 2M villa saves AED 250K CGT via DTA.

- Action: Invest ≥AED 1M+, apply via RAK DED.

- ** Blockchain for Efficiency:

- Why: Saves 10–20% compliance/legal costs (AED 5K–20K/year), per RAK DAO.

- Example: Smart contracts for AED 3M lease save AED 5K/year.

- Action: Use blockchain platforms for leases/sales.

- ** Compliance:

- Why: Avoids AED 1,000–50,000 fines for VAT, up to AED 5M for AML, per blackswanbss.com.

- Action: Use HLB HAMT for compliance, verify escrow via RERA.

Challenges and Mitigations

- ** Home Country Taxeses:

- Challenge: 15–30% taxes erode returns, per OECD.

- Mitigation: Use DTAs, establish residency, hold via RAK ICC IBCs.

- Savings: AED 150K–450K.

- ** VAT on Serviceses:

- Challenge: 5% VAT on maintenance/agency fees (AED 1K–10K/year), per hlbhamt.com.

- Mitigation: Register for VAT, recover input VAT, negotiate fees.

- Savings: AED 2K–5K.

- ** Compliance Costs:

- Challenge: AED 3,650–50K/year for licenses, AML, fines.

- Mitigation: Use HLB HAMT (AED 500–5,000/year), automate records.

- ** Oversupply Risk:

- Challenge: 5,200 new units may dip yields by 1–2%, per RAK DED.

- Mitigation: Target Al Marjan Island, RAKEZ commercial properties.

Recommendations for 2025

- Budget Investors (AED 1M–AED 2M):

- Action: Buy off-plan freehold apartments in RAK Central (AED 1.5M–2M, 5–7% yields), secure 12-year visa.

- Savings: AED 1.5M apartment saves AED 75K VAT, yields AED 75K75–105K/year.

- Mid-Tier Investors (AED 2M–AED 5M):

- Action: Invest in Al Hamra or Al Marjan Island freehold villas (AED 2M–5M, 5–7%), target Golden Visa.

- Savings: AED 3M villa yields AED 150K–210K/year, saves AED 150K on CGT on AED 1M gain.

- **Luxury Investors (AED 5M+):

- Action: Buy commercial freehold in RAKEZ (AED 5M–10M, 6–8% yields) or Al Marjan luxury villas, setup QFZP.

- Savings: AED 5M warehouse saves AED 250K VAT, AED 300K tax, yields AED 300K.

- Smart Home/Blockchain Focus:

- Action: Buy IoT-enabled freehold properties or use blockchain for transactions, save 10–15% utilities (AED 5K–15K/year).

- Savings: AED 3M smart villa saves AED 100K/year utilities, AED 5K in legal fees via blockchain.

- Due Diligence:

- Action: Verify freehold titles via RERA, ensure AML compliance, use escrow accounts.

- Example: AED AED 2M Al Hamra purchase confirmed, no delays.

X Sentiment

- X posts celebrate RAK’s “100% freehold freedom” and “zero tax” appeal, with @InvestRAK noting Al Marjan’s tax-free yields and 5–8% 12-year visas as “game-changers” for expats.

- Some expats flag home country taxes and AML scrutiny (AED 5K–25K, but optimism persists for Al Hamra and RAKEZ’s 5–8% returns, per X discussions.

Conclusion

In 2025, RAK’s freehold laws, enabled since 2005, empower expats to own properties in Al Hamra, Al Hamra, Al Marjan, and RAKEZ, with zero CGT, no property/inheritance taxes (saving AED 50K–2M/year on AED 1M–5M), VAT exemptions (AED 100K–500K on residential), and 0% corporate tax for RAKEZPs in RAKEZ (AED 90K–900K). These benefits boost 5–8% yields and 3–6% appreciation in the AED 20B market.

Tax planning strategies include holding properties personally, using DTAs, securing 12-year/Golden Visas, and leveraging blockchain for efficiency. Challenges include home country taxes (15–30%), compliance (AED 3,650–50K/year, fines up to AED 5M), and oversupply (5,200 units). By targeting off-plan freeholds, commercial RAKEZ properties, or smart homes and ensuring RERA compliance, expat investors can achieve tax-free returns, aligning with your goals in RAK’s dynamic real estate landscape. watch more here

read more here: Ras Al Khaimah Real Estate: Tax Incentives for Developers