Now Reading: Top 7 Cities Where Property Prices Are About to Explode Now 2025

-

01

Top 7 Cities Where Property Prices Are About to Explode Now 2025

Top 7 Cities Where Property Prices Are About to Explode Now 2025

The real estate market is constantly changing. As cities grow and people move, some places become more popular and valuable for buying homes and investing. In 2025, several real estate markets across the U.S. and globally have shown fast growth and strong potential. These emerging real estate markets are gaining attention from investors, homebuyers, and developers.

In this article, we explore the top emerging real estate markets of the year, why they are growing fast, and what makes them attractive in today’s economic climate.

What Is an Emerging Real Estate Market?

An emerging real estate market is a city or region where housing prices are rising, new developments are happening, and demand is growing—but it’s not yet over-saturated or too expensive. These markets often offer:

- Affordable property prices

- Job growth and economic development

- Population growth

- Quality infrastructure and transportation

- A high return on investment (ROI) for property buyers

Top U.S. Emerging Markets in 2025

1. Raleigh-Durham, North Carolina

Raleigh-Durham, also called the “Research Triangle,” is booming thanks to its tech and education sectors. Major companies like Apple, Google, and Amazon have expanded operations here. The area also has top universities like Duke, UNC, and NC State, which attract young professionals.

- Median home price: $450,000

- Population growth (past year): +3.2%

- Why it’s hot: Tech jobs, quality of life, and a lower cost of living than cities like San Francisco or New York.

2. Boise, Idaho

Boise continues to shine as one of the fastest-growing cities in the U.S. Many Californians have relocated to Boise due to its natural beauty, lower taxes, and more affordable housing.

- Median home price: $420,000

- Population growth: +2.7%

- Why it’s hot: Low crime, clean environment, outdoor activities, and strong community feel.

3. Tampa, Florida

Florida remains attractive due to its tax benefits and warm weather, but Tampa stands out this year. The city is seeing an increase in startups and remote workers moving in.

- Median home price: $390,000

- Job growth: +4.1%

- Why it’s hot: No state income tax, business-friendly climate, and booming downtown development.

4. Indianapolis, Indiana

Often overlooked, Indianapolis is gaining attention from investors. With a low cost of living and a high rental yield, it’s becoming a top pick for those looking to build passive income through rental properties.

- Median home price: $280,000

- Rental yield: 8% average

- Why it’s hot: Affordable homes, solid job market, and landlord-friendly laws.

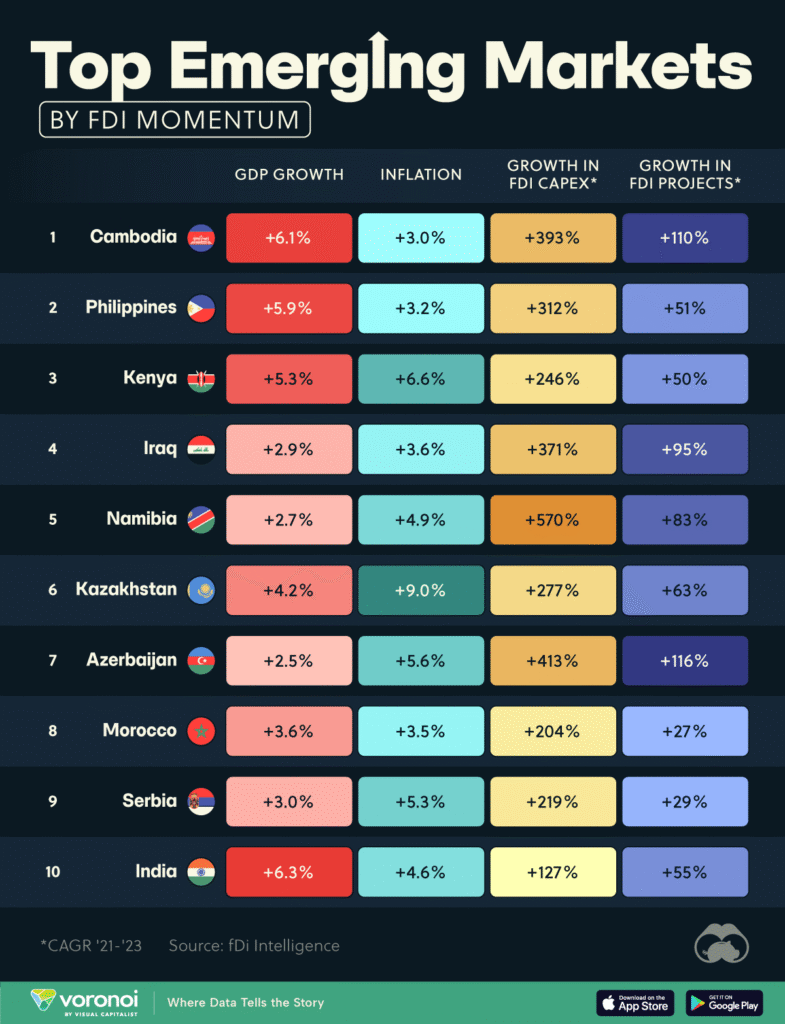

Top Global Emerging Markets in 2025

1. Lisbon, Portugal

Lisbon is a rising star in European real estate. Foreign investors are buying up property thanks to Portugal’s Golden Visa program and digital nomad visa.

- Average property price: €3,800 per square meter

- Why it’s hot: Coastal lifestyle, growing expat community, and favorable tax benefits.

2. Medellín, Colombia

Once known for its past troubles, Medellín is now a vibrant, safe, and innovative city. It’s become popular with remote workers and retirees.

- Cost of living: 60% lower than most U.S. cities

- Why it’s hot: Modern infrastructure, year-round spring weather, and affordable luxury.

3. Ho Chi Minh City, Vietnam

Vietnam’s economy is on the rise, and its largest city is leading the charge. With strong foreign investment and a young population, it’s a smart long-term bet.

- Real estate price growth (YoY): +9%

- Why it’s hot: Manufacturing boom, expanding middle class, and major infrastructure projects.

Why These Markets Matter

These emerging markets are important for several reasons:

- Investment Potential – Properties in early-growth markets often offer better returns over time.

- Diversification – Investors can spread risk by looking beyond major, expensive cities.

- Lifestyle Changes – Many people now prefer smaller cities with better quality of life, especially since remote work has become more common.

Tips for Investing in Emerging Real Estate Markets

If you’re thinking about investing in any of these cities or regions, here are a few smart tips:

- Do your homework: Study local trends, future development plans, and economic indicators.

- Visit the area: Spend time in the neighborhood before buying.

- Work with local experts: Real estate agents and property managers in the area can offer valuable insights.

- Think long-term: Emerging markets may take time to fully grow, so patience is key.

Conclusion

Whether you’re an investor, a first-time homebuyer, or someone planning to relocate, the top emerging real estate markets of 2025 offer exciting opportunities. From the tech hubs of the U.S. to the vibrant streets of Southeast Asia and Europe, these places combine affordability, growth, and quality of life.

Keep an eye on these rising stars—they may just be the best property bets of the decade.

Read More:- What Is an Emerging Real Estate Market?