Now Reading: Baashyaam’s Bold ₹1,100 Crore Move Shakes Property Market

-

01

Baashyaam’s Bold ₹1,100 Crore Move Shakes Property Market

Baashyaam’s Bold ₹1,100 Crore Move Shakes Property Market

Table of Contents

In a significant boost to Chennai’s booming real estate market, Baashyaam Group to acquire Standard Chartered property in Chennai for ₹1,100 crore, marking one of the largest commercial property acquisitions in the city in recent years. The deal represents a major show of confidence in Chennai’s commercial real estate sector, especially from homegrown players eyeing prime real estate.

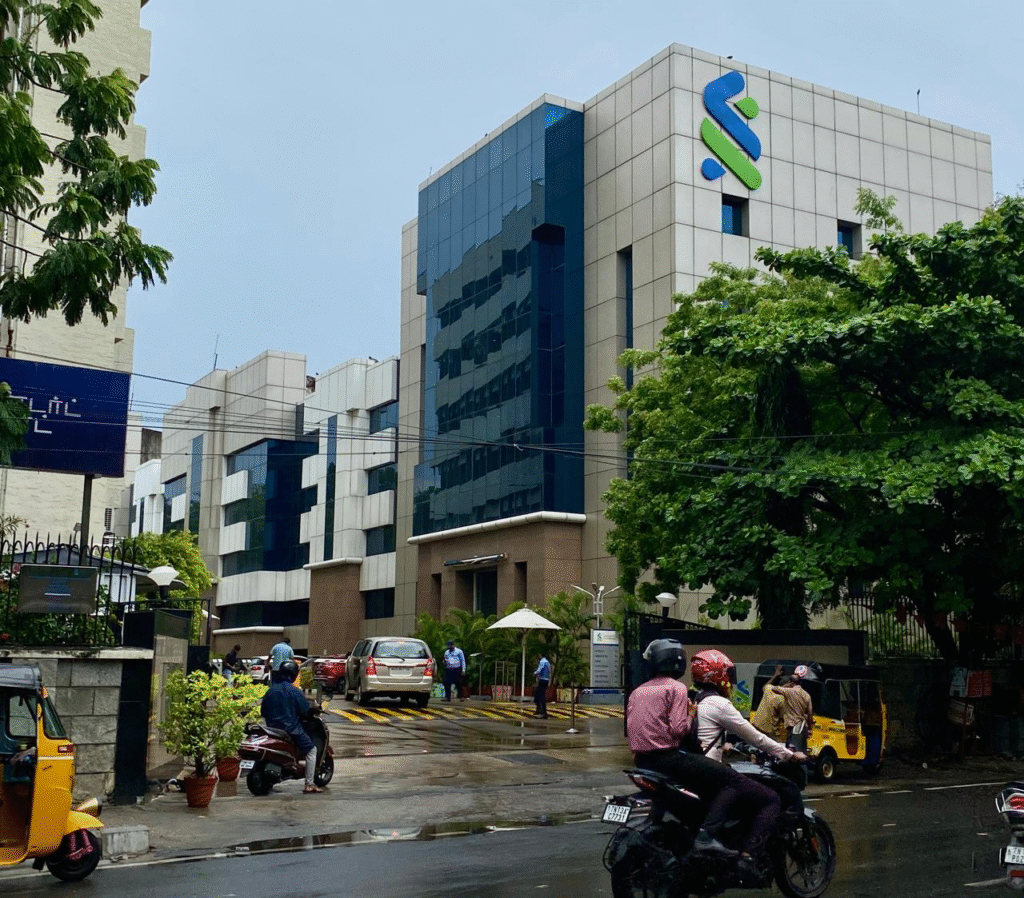

A Landmark Deal in the Heart of Chennai

The property, which spans approximately 2.4 acres in Chennai’s central business district, currently houses Standard Chartered Bank’s key offices. Situated in the prominent Anna Salai area, this property has long been considered a landmark due to its prime location, accessibility, and commercial viability.

Baashyaam Group to acquire Standard Chartered property is a headline-making move that showcases the group’s growing ambition in the Indian real estate landscape. The ₹1,100 crore price tag underscores the value of this asset and the potential it holds for redevelopment or long-term commercial leasing.

Baashyaam Group’s Growing Ambition

Known for its luxury residential and commercial developments across Tamil Nadu, Baashyaam Group has steadily been expanding its footprint over the last two decades. This acquisition aligns with their strategy to gain a stronger presence in premium locations.

Company insiders suggest that the property will either be redeveloped into a Grade-A commercial tower or a luxury mixed-use development. Either way, it will likely command premium rentals and boost the group’s profile among institutional investors and corporates.

“Baashyaam Group to acquire Standard Chartered property is more than just a transaction—it’s a strategic play,” said a real estate expert familiar with the deal. “The group is positioning itself among the top-tier players in India’s commercial real estate space.”

Real Estate Market Responds Positively

The Chennai real estate market has seen a steady rise in investor interest, especially in commercial and IT corridor zones. This ₹1,100 crore acquisition reinforces the belief that Chennai is set for a commercial boom similar to Bengaluru and Hyderabad.

According to analysts, the per square foot valuation of the property makes it one of the most expensive commercial land deals in the region. However, Baashyaam’s ability to unlock its full potential through design, marketing, and leasing strategy could yield exponential returns.

Baashyaam Group to acquire Standard Chartered property also comes at a time when private equity inflows and institutional interest in Indian real estate are peaking. With firms like Blackstone, Brookfield, and GIC making massive bets on Indian commercial spaces, Indian groups are now stepping up to compete.

What This Means for Standard Chartered

For Standard Chartered Bank, the sale is part of a larger global strategy to optimize real estate assets and shift toward more digital-first, asset-light operations. The bank is expected to lease alternative space in Chennai while reducing its physical footprint.

The bank’s spokesperson noted, “This move allows us to streamline operations and redeploy capital into priority areas. Our presence in Chennai will remain strong, but more agile.”

The proceeds from the sale may be redirected into expanding digital banking initiatives or strengthening operations in other key sectors.

Chennai’s Central Business District in Focus

Anna Salai, often called Mount Road, is one of Chennai’s oldest and most commercially vibrant roads. It is home to a mix of government offices, multinational companies, and financial institutions. The locality’s connectivity through metro, road, and railway makes it a highly sought-after address.

With Baashyaam Group to acquire Standard Chartered property, real estate watchers believe other developers will now begin to explore opportunities in similar core locations. Experts also predict a rise in property values and more aggressive land acquisition strategies from rival developers.

Market Experts React

Real estate analysts believe this deal is a sign of things to come. With rising demand for Grade-A commercial office space, Chennai’s central zones are expected to undergo a transformation.

“This deal will create ripple effects,” said a Chennai-based realty analyst. “Such large-ticket acquisitions not only validate the strength of the city’s commercial real estate market but also attract further institutional and private investment.”

The focus keyword Baashyaam Group to acquire Standard Chartered property is now being discussed in boardrooms and investment circles alike as a case study of strategic asset play in Indian real estate.

Conclusion: A Bold Bet on Chennai’s Future

The ₹1,100 crore deal by Baashyaam is not just a major financial transaction—it’s a statement. It signals rising confidence in Chennai’s growth as a real estate hub and reflects the ambition of Indian developers to take bold positions in premium markets.

As Baashyaam Group takes over this legacy asset from Standard Chartered, all eyes will be on how the developer reimagines this space and contributes to reshaping the skyline of Chennai. With this acquisition, Baashyaam is not just buying land—they are buying a piece of Chennai’s future.

Also Read – Real estate: Dwarka Expressway triggers 5X boom in prices