Now Reading: Blockchain Real Estate Tokenization: Unlocking Key Investment Benefits

-

01

Blockchain Real Estate Tokenization: Unlocking Key Investment Benefits

Blockchain Real Estate Tokenization: Unlocking Key Investment Benefits

Table of Contents

The traditionally illiquid and exclusive world of real estate is experiencing a profound revolution, spearheaded by the innovative application of blockchain technology for asset tokenization. This burgeoning trend, rapidly gaining momentum in mid-2025, is democratizing property ownership, enhancing market liquidity, and streamlining transactions in ways previously unimaginable. By converting tangible real estate assets into digital tokens on a blockchain, this technology promises to unlock significant value for both investors and property owners, ushering in an era of unprecedented accessibility and transparency in global real estate markets.

What is Tokenization of Real Estate?

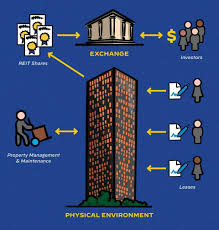

Real estate tokenization is the process of converting ownership rights or economic interests in a physical property into digital tokens that reside on a blockchain. Each token represents a fractional share of the underlying asset, akin to shares in a company. These digital tokens can then be bought, sold, and traded on blockchain-based platforms, effectively making real estate investments more divisible and transferable.

Unlike traditional securitization, which bundles properties into large funds, tokenization allows for direct, granular ownership of specific properties or even parts of a single property. This shift from illiquid, full-property ownership to digital, fractionalized assets is a game-changer for the industry.

What is Blockchain and How It Facilitates Tokenization?

Blockchain is a decentralized, distributed ledger technology that securely records transactions across a network of computers.1 Key characteristics of blockchain that make it ideal for real estate tokenization include:

- Immutability: Once a transaction is recorded on the blockchain, it cannot be altered or deleted, providing a secure and tamper-proof record of2 ownership.

- Transparency: All transactions are visible to network participants, fostering trust and reducing the need for intermediaries.

- Security: Cryptographic encryption protects transaction data, making it highly secure against fraud and cyberattacks.

- Decentralization: No single entity controls the network, reducing single points of failure and censorship.

- Smart Contracts: Self-executing contracts stored on the blockchain that automatically enforce the terms of an agreement when predefined conditions are met. These are crucial for automating dividends, managing governance rights, and facilitating transfers.

In the context of real estate tokenization, blockchain serves as the immutable registry of ownership, while smart contracts automate the distribution of rental income, manage voting rights for property decisions, and enable seamless transfer of tokens.

Why Tokenization is Gaining Traction in Real Estate

The traditional real estate market is notoriously illiquid, expensive to transact in, and often opaque. Tokenization directly addresses these pain points:

- Increased Liquidity: Selling an entire property can take months, if not years. Tokenization allows fractional shares to be traded instantly on secondary markets, akin to stocks, significantly enhancing liquidity for an otherwise illiquid asset class.

- Greater Accessibility: The high capital barrier to entry for real estate investment is drastically lowered. Investors can buy fractions of high-value properties (e.g., luxury hotels, commercial skyscrapers) for as little as a few hundred or thousand dollars, opening the market to a wider range of retail investors and democratizing access.

- Reduced Costs and Intermediaries: Blockchain’s automation capabilities, particularly through smart contracts, can eliminate or significantly reduce the need for traditional intermediaries like brokers, lawyers, and notaries, cutting down on transaction fees (which can be 5-6% of property value) and legal costs.

- Enhanced Transparency and Auditability: Every transaction and ownership change is immutably recorded on the public blockchain, providing a transparent and auditable history that reduces fraud risk and increases investor confidence.

- Global Reach: Tokenized real estate can be accessed by investors globally, regardless of geographical location, broadening the investor base for property owners and enabling cross-border investments with reduced complexities.

- Fractional Ownership and Diversification: Investors can diversify their portfolios by owning small fractions of multiple properties across different asset classes or geographies, spreading risk without committing large sums to a single asset.

The Process of Tokenizing Real Estate Assets

The tokenization of a real estate asset typically involves several key steps:

- Asset Selection and Due Diligence: The property to be tokenized is identified, and comprehensive legal, financial, and technical due diligence is conducted. This includes legal audits, valuation, and compliance reviews to ensure the asset’s legitimacy and market viability.

- Legal Structuring: A Special Purpose Vehicle (SPV) – often a legal entity like an LLC or trust – is typically created to legally own the physical property. The digital tokens then represent shares or equity in this SPV, or directly represent ownership rights in the underlying asset, depending on the jurisdiction and legal framework. This step defines ownership rights, investor privileges (e.g., rental income distribution, voting rights), and regulatory compliance requirements.

- Token Creation and Smart Contract Development: Digital tokens (usually security tokens, which represent ownership or financial rights) are minted on a chosen blockchain platform (e.g., Ethereum, Polygon, Stellar, Polymesh). Smart contracts are programmed to govern the token’s lifecycle, including:

- Issuance: Defining the total number of tokens, their price, and distribution rules.

- Distribution of Income: Automating the payout of rental income or dividends to token holders.

- Governance: Encoding voting rights for major property decisions (e.g., selling the property, major renovations).

- Transfer Restrictions: Implementing compliance features like Know Your Customer (KYC) and Anti-Money Laundering (AML) checks, often by whitelisting approved investor wallets to comply with securities regulations.

- Token Distribution and Sale: The tokens are offered to investors through a primary offering (e.g., Security Token Offering – STO). This can be a public offering or a private placement, depending on regulatory requirements and target investors.

- Secondary Market Trading: Once issued, tokens can be traded on regulated secondary marketplaces specifically designed for tokenized securities. This is where the enhanced liquidity truly comes into play, allowing investors to buy and sell fractional shares 24/7.

- Asset Management and Governance: Ongoing property management (maintenance, tenant relations) continues, and the smart contracts automatically execute functions like dividend distribution and governance decisions voted on by token holders.

Benefits for Investors and Property Owners/Developers

For Investors:

- Fractional Ownership: Access to high-value properties that were previously out of reach for individual investors.

- Enhanced Liquidity: Ability to buy and sell small portions of real estate quickly on digital exchanges, reducing holding periods.

- Global Accessibility: Invest in properties worldwide without the complexities of cross-border real estate transactions.

- Transparency: Immutable records on the blockchain provide unparalleled transparency into ownership history and transactions.

- Diversification: Easily diversify portfolios across different property types, locations, and risk profiles with smaller capital commitments.

- Lower Entry Barriers: Significantly reduced minimum investment amounts, making real estate more inclusive.

- Automated Processes: Smart contracts automate income distribution and governance, reducing administrative overhead.

For Property Owners/Developers:

- Access to Broader Capital Pool: Tap into a global investor base, including retail investors, who might not have been able to participate in traditional real estate deals.

- Faster Fundraising: Efficient fundraising processes compared to traditional methods like bank loans or large private equity placements.

- Increased Liquidity for Their Assets: Ability to raise capital by tokenizing existing assets, providing an exit strategy or partial liquidity without selling the entire property.

- Reduced Transaction Costs: Lower reliance on intermediaries can translate to significant cost savings.

- Transparency for Stakeholders: All stakeholders have clear visibility into the asset’s performance and ownership.

Challenges and Risks

While promising, real estate tokenization faces several hurdles:

- Regulatory Uncertainty: This is the most significant challenge. Regulators globally are still developing clear frameworks for digital assets, particularly for security tokens. Classifying tokens as securities (e.g., under the Howey Test in the U.S.) subjects them to complex securities laws, requiring detailed disclosures and compliance with registration requirements unless exemptions apply. Different jurisdictions have varying rules, leading to a fragmented global landscape.

- Example: In the UAE (as of May 2025), Dubai’s Virtual Assets Regulatory Authority (VARA) and the Dubai Land Department (DLD) are actively collaborating on initiatives like the Real Estate Tokenization Sandbox, aiming to establish clearer frameworks and foster innovation within a regulated environment. A landmark US$3 billion real estate tokenization deal in Dubai, involving MAG Group, MultiBank Group, and Mavryk, underscores this proactive regulatory approach.

- Legal Frameworks and Ownership Rights: Ensuring that digital tokens legally represent ownership rights in a tangible asset and are recognized in traditional legal systems is crucial. This often requires complex legal structuring involving SPVs.

- Technical Complexity and Scalability: Developing and managing secure, robust blockchain platforms and smart contracts requires specialized technical expertise. Ensuring scalability as the market grows is also a consideration.

- Security Risks: While blockchain is inherently secure, vulnerabilities can arise from smart contract bugs, platform exploits, or poor cybersecurity practices in managing private keys.

- Market Adoption and Liquidity of Tokens: While liquidity is a promise, the actual liquidity of newly issued real estate tokens depends on robust secondary markets and sufficient buyer/seller interest. Widespread market adoption and education are still in early stages.

- Valuation and Pricing: Determining the fair market value of fractionalized tokenized assets, especially in nascent markets, can be challenging and requires evolving valuation methodologies.

- Custody Solutions: Securely storing and managing digital tokens (especially private keys) for investors requires specialized custodial solutions.

- AML/KYC Compliance: Implementing rigorous Anti-Money Laundering (AML) and Know Your Customer (KYC) checks for all investors is essential for regulatory compliance, but can add friction to the investment process.

Use Cases and Examples (as of May 2025)

Real estate tokenization is being applied across various property types and investment models:

- Fractional Ownership of Luxury Properties: High-value residential or commercial properties are tokenized to allow multiple smaller investors to own a piece. Examples include luxury penthouses, office buildings, or hotels.

- Commercial Real Estate (CRE) Investments: Tokenizing shares in commercial properties like shopping centers, logistics warehouses, or office complexes to provide institutional and accredited investors with more flexible investment options.

- Rental Income Distribution: Smart contracts automatically distribute rental income generated by properties to token holders, providing passive income streams.

- Debt Tokenization: Creating tokens that represent a debt secured by real estate, allowing for more flexible and liquid real estate-backed lending.

- Crowdfunding Real Estate Projects: Enabling a broader base of investors to fund new real estate developments or acquisitions through token sales.

- Metaverse Real Estate (NFTs): While not traditional physical real estate, the concept of tokenized ownership extends to virtual land in metaverse platforms, represented by Non-Fungible Tokens (NFTs), which can be bought, sold, and leased.

- Specific Examples:

- RealT (U.S.): A prominent platform enabling fractional ownership of U.S. residential properties.

- Propy: A blockchain-based real estate transaction platform facilitating property transfers and tokenization.

- Magnam Properties (UAE): In March 2025, it was announced that MAG Group would tokenize US$3 billion worth of luxury real estate on MultiBank.io’s regulated RWA marketplace, marking a significant step in the UAE.

- BlockEstate: A fund that offers tokenized shares in real estate portfolios.

Future Outlook and Trends for 2025/2026

The trajectory for real estate tokenization is one of exponential growth and increasing sophistication:

- Regulatory Clarity: Expect continued efforts from regulators, particularly in progressive jurisdictions like the UAE, Singapore, and parts of Europe (e.g., MiCA in EU), to develop clearer, more harmonized frameworks for digital assets, which will significantly de-risk tokenization.

- Institutional Adoption: As regulatory clarity increases, more institutional investors, traditional real estate funds, and major developers will actively engage in tokenization, moving it from niche to mainstream.

- Interoperability: Greater development of cross-chain interoperability solutions will allow real estate tokens to be traded seamlessly across different blockchain networks, enhancing liquidity and market reach.

- Hybrid Models: Blending traditional real estate finance with tokenization will become common, offering flexible capital structures that appeal to a wider range of investors.

- Advanced Smart Contracts: Smart contracts will become more sophisticated, automating complex legal clauses, property management functions, and even incorporating AI for predictive analytics in asset management.

- Focus on Secondary Markets: Development of robust, regulated secondary trading platforms will be crucial for fulfilling the promise of liquidity.

- Real-World Asset (RWA) Tokenization Boom: Real estate will lead the broader trend of tokenizing various real-world assets, driving innovation in decentralized finance (DeFi) and traditional finance integration.

- ESG Integration: Tokenized real estate will increasingly incorporate ESG metrics directly into the tokens, allowing investors to select properties based on their sustainability performance, health, and social impact.

In conclusion, the tokenization of real estate assets using blockchain is not merely a technological novelty; it is a fundamental shift that is reshaping the investment landscape. While challenges, particularly regulatory ones, persist, the immense benefits of enhanced liquidity, accessibility, transparency, and cost efficiency are driving its rapid adoption. As legal frameworks mature and market understanding deepens, blockchain-powered real estate tokenization is poised to become a cornerstone of global property investment in the years to come.

WATCH MORE: https://www.youtube.com/watch?v=zPQ0yRSxGrw

READ MORE: Sustainable Real Estate Investments: Achieving Best Financial & Impact Returns