Now Reading: Bluewaters Island: 6 Rental Trends Reshaping the Short-Term Market in 2025

-

01

Bluewaters Island: 6 Rental Trends Reshaping the Short-Term Market in 2025

Bluewaters Island: 6 Rental Trends Reshaping the Short-Term Market in 2025

Table of Contents

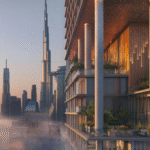

Bluewaters Island, a man-made luxury destination by Meraas, is located off Jumeirah Beach Residence (JBR) and hosts Ain Dubai, the world’s tallest observation wheel, and Caesars Palace Dubai. With 1.5km of beachfront, 200 retail and dining outlets, and 132 residential units, it recorded AED 1.2 billion ($326 million) in property transactions in 2024, per propertyfinder.ae.

Short-term rental demand surged 18% in 2024, driven by 18.7 million tourists, with yields averaging 9-11% in prime areas, per arthurmackenzy.com. Connected via a pedestrian bridge to JBR (5 minutes), Dubai Marina (5 minutes), DMCC Metro Station (5 minutes), and Dubai International Airport (25 minutes), Bluewaters is a hotspot for short-term rentals, per famliving.com.

Below are six rental trends reshaping Bluewaters Island’s short-term market in 2025, their impacts, and compliance steps with the Dubai Land Department (DLD) and Federal Tax Authority (FTA). These trends align with Dubai’s D33 Economic Agenda, per damacproperties.com.

1. Surge in Luxury Short-Term Rental Demand

Overview: An 18% increase in short-term rental demand is projected for 2025, driven by Dubai’s tourism boom and Bluewaters’ luxury appeal, per kaizenams.com. High-net-worth tourists seek furnished 1- to 3-bedroom apartments near Ain Dubai and Caesars Palace.

Features: Fully furnished apartments (800-1,600 sq.ft.) with sea views, smart home systems, and access to pools, gyms, and dining. Monthly rates range from AED 9,999 to AED 49,500, per dubizzle.com. Properties like Bluewaters Residences and Banyan Tree Dubai cater to this demand, per bayut.com.

Impact: Yields of 9-11% (e.g., AED 594,000/year for a AED 6 million 2-bedroom apartment) due to high occupancy (85-90%), per arthurmackenzy.com. Capital gains of 8-10% expected by 2026, per dxbinteract.com.

Compliance: Register short-term rental agreements via DLD’s Ejari system. Obtain a Dubai Tourism holiday home license. Retain records for FTA audits, ensuring 5% VAT compliance, per taxvisor.ae.

2. Rise of Tech-Driven Guest Experiences

Overview: Tech innovations like automated check-ins, AI concierge apps, and smart home integrations are enhancing guest experiences in 2025, per hausandhaus.com. Platforms like Airbnb and Booking.com prioritize tech-enabled listings.

Features: Apartments feature keyless entry, IoT climate control, and virtual tours. Integration with platforms like famliving.com offers real-time booking and guest support, per famliving.com. Located near Cove Beach (3-minute walk), per propertyfinder.ae.

Impact: Tech-enabled properties command 10-15% higher rates (e.g., AED 30,000/month vs. AED 26,000 for a 1-bedroom), boosting yields to 9-10%, per kaizenams.com. Increases booking conversions by 20%, per airdna.co.

Compliance: Ensure smart systems comply with DLD’s Ejari registration. Declare rental income and retain tech expense records for FTA audits, per adres.ae.

3. Flexible Booking Options Gain Traction

Overview: Tourists and digital nomads prefer flexible lease terms (weekly to 3-month stays) in 2025, driven by remote work visas and seasonal travel, per miradevelopments.ae. Bluewaters’ 185 rental listings reflect this shift, per bayut.com.

Features: Furnished 1- to 4-bedroom apartments offer rolling contracts, with monthly rates from AED 13,499 (2-bedroom) to AED 45,000 (3-bedroom), per dubizzle.com. Near Dubai Marina Mall (8-minute drive), per famliving.com.

Impact: Flexible terms increase occupancy by 15%, yielding 8-10% (e.g., AED 480,000/year for a AED 5 million apartment), per dxbinteract.com. Capital gains of 7-9% by 2026, per aysdevelopers.ae.

Compliance: Register flexible leases via Ejari. Obtain holiday home permits from Dubai Tourism. Retain booking records for FTA audits, per taxvisor.ae.

4. Eco-Friendly Properties Attract Premiums

Overview: Sustainability-focused rentals with energy-efficient designs and green certifications (e.g., LEED) are in demand, per miradevelopments.ae. Bluewaters emphasizes sustainable materials in new units, per damacproperties.com.

Features: Apartments with solar panels, smart thermostats, and recycled materials. Access to eco-friendly amenities like e-scooter docks near Ain Dubai. Average rental: AED 523,208/year, per bayut.com.

Impact: Green properties command 5-10% rental premiums (e.g., AED 550,000/year vs. AED 500,000 for a 3-bedroom), yielding 9-11%, per arthurmackenzy.com. Capital gains of 8-10% by 2026, per dxbproperties.ae.

Compliance: Verify green certifications in SPAs via Ejari. Claim 5% VAT input recovery on eco-friendly upgrades, per fintedu.com. Retain records for FTA audits.

5. Branded Residences Drive High Occupancy

Overview: Branded residences like Caesars Palace and Banyan Tree Dubai are top choices for short-term rentals, with 17 Caesars units listed, per bayut.com. Demand rises with Dubai’s 437 global business events in 2024, per miradevelopments.ae.

Features: Serviced apartments with hotel-style amenities (concierge, dining, spa). Located near Madame Tussauds Dubai (3-minute walk). Monthly rates: AED 27,500 (1-bedroom) to AED 49,500 (2-bedroom), per dubizzle.com.

Impact: Yields of 9-11% (e.g., AED 660,000/year for a AED 6 million unit) due to 90% occupancy from MICE tourists, per kaizenams.com. Capital gains of 8-12% by 2026, per drivenproperties.com.

Compliance: Register SPAs and leases via Ejari. Obtain Dubai Tourism holiday home license. Retain records for FTA audits, per gtlaw.com.

6. Data-Driven Pricing Models Optimize Returns

Overview: Landlords use platforms like Bayut and Property Finder for real-time pricing data, adjusting rates dynamically, per kaizenams.com. Peak season (November-March) sees 20% higher rates, per airdna.co.

Features: 1- to 4-bedroom apartments with dynamic pricing (e.g., AED 35,000/month in peak season vs. AED 28,000 off-peak for a 2-bedroom). Near Caesars Palace dining (5-minute walk), per propertyfinder.ae.

Impact: Dynamic pricing boosts yields by 10-15% (e.g., AED 600,000/year for a AED 6 million apartment), per dxbinteract.com. Capital gains of 7-10% by 2026, per aysdevelopers.ae.

Compliance: Register adjusted leases via Ejari. Declare rental income and retain pricing records for FTA audits, per taxvisor.ae.

Why These Trends Matter

These six trends—luxury demand, tech-driven experiences, flexible bookings, eco-friendly properties, branded residences, and data-driven pricing—reshape Bluewaters Island’s short-term rental market, delivering 9-11% yields, surpassing Dubai’s 7% average, per damacproperties.com.

With 168 new rental contracts in 2024 (average AED 520,384/year), Bluewaters outperforms JBR (7-8% yields), per bayut.com. Proximity to Ain Dubai, Caesars Palace, and Dubai Marina Mall drives 85-90% occupancy, fueled by 10.5 million visitors in Q1-Q2 2025, per arthurmackenzy.com.

Challenges include a -3% price fluctuation due to new supply (182,000 units by 2026) and regulatory tightening, mitigated by limited inventory (185 listings) and Dubai’s 6,500 UHNWI influx, per miradevelopments.ae. Posts on X highlight Bluewaters’ appeal for luxury rentals, per @luxury_playbook. Golden Visa eligibility (AED 2 million+) applies to investment properties, per pangeadubai.com.

Tax Tools for American Investors

U.S.-UAE DTA: Credit UAE taxes via IRS Form 1118, preserving 8-12% returns, per immigrantinvest.com.

Zakat for Muslim Investors: Pay 2.5% Zakat on rental income (e.g., AED 2,500 on AED 100,000). Consult Islamic scholars, per taxvisor.ae.

VAT Recovery: Recover 5% input VAT on commercial expenses (e.g., AED 25,000 on AED 500,000) for VAT-registered investors, per fintedu.com.

Market Outlook and Challenges

Bluewaters’ 18% short-term rental growth in 2025 aligns with Dubai’s 6.2% GDP growth, per kaizenams.com. The island’s mixed-use design (residential, retail, hospitality) and connectivity via JBR’s pedestrian bridge support demand, per propertyfinder.ae.

Risks include rising competition and stricter holiday home regulations, offset by Bluewaters’ exclusivity and tourism-driven fundamentals, per airdna.co. These trends position Bluewaters as a premier short-term rental hub, per drivenproperties.com.

Conclusion

The surge in luxury demand, tech-driven experiences, flexible bookings, eco-friendly properties, branded residences, and data-driven pricing are reshaping Bluewaters Island’s short-term rental market in 2025, offering 9-11% yields and 7-12% capital gains.

With world-class amenities and proximity to JBR and Dubai Marina, these trends attract investors and tourists. Compliance with DLD’s Ejari, Dubai Tourism licenses, and FTA ensures secure, high-return investments in this vibrant coastal destination. Bluewaters Island

read more: The World Islands: 5 Hospitality-Focused Villas Targeting Luxury Investors in 2025