Now Reading: Can You Own Freehold Property in Dubai?

-

01

Can You Own Freehold Property in Dubai?

Can You Own Freehold Property in Dubai?

Table of Contents

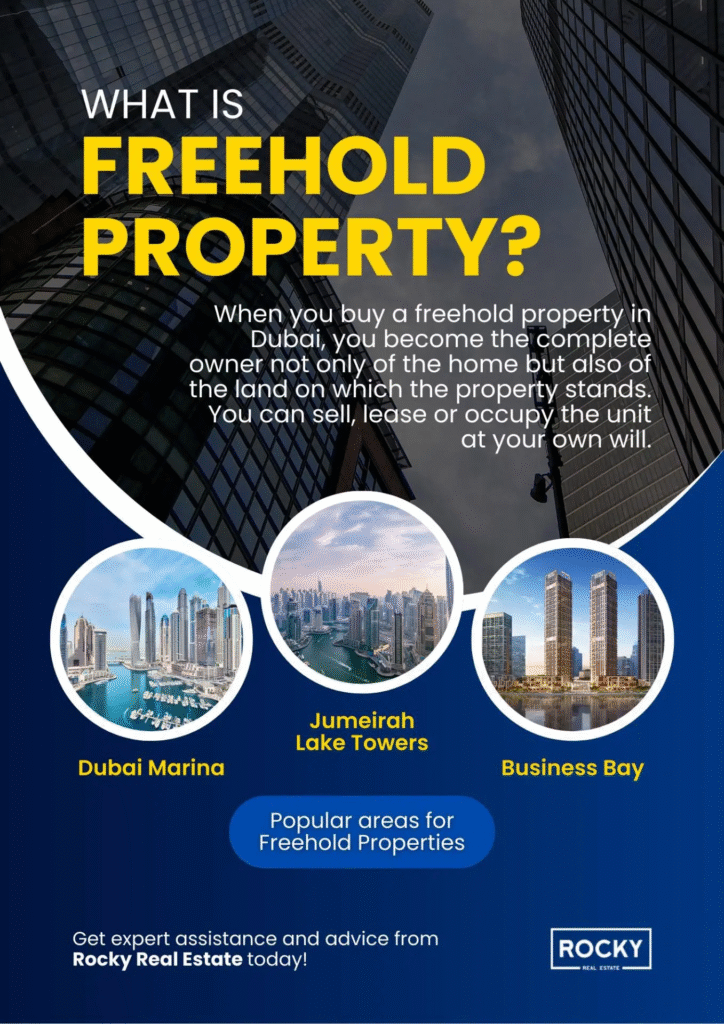

Yes, you can own freehold property in Dubai as a foreigner or resident in designated freehold areas, a policy established in 2002 under Decree No. 3 of 2006. Freehold ownership grants full property rights, including the ability to sell, lease, or bequeath, without a local sponsor, per dubailand.gov.ae. Below is a concise guide to freehold property ownership in Dubai in 2025, leveraging UAE real estate trends and prior discussions on luxury living and Golden Visas.

Key Points on Freehold Ownership in Dubai

- Eligibility:

- Open to UAE residents, non-residents, and expats of any nationality, per Decree No. 3 of 2006.

- No minimum income or residency visa required for cash purchases; mortgage buyers need a UAE residency visa and AED 15,000/month salary, per Emirates NBD.

- Freehold Areas: Designated zones where foreigners can own property outright, including:

- Palm Jumeirah: Luxury villas/apartments (AED 3–100 million), 5–7% yields, per nakheel.com.

- Dubai Marina: Waterfront apartments (AED 1–10 million), 6–8% yields, per drivenproperties.com.

- Dubai Hills Estate: Family-friendly villas/apartments (AED 1.5–5 million), 5–7% yields, per properties.emaar.com.

- Dubai South: Affordable apartments (AED 600,000+), 7–9% yields, per dubaisouth.ae.

- Emaar Beachfront, Bluewaters Island, Jumeirah Village Circle (JVC), and more, per Bayut.

- Property Types:

- Residential: Apartments, villas, townhouses, per propertyfinder.ae.

- Commercial: Offices, retail, warehouses, per keltandcorealty.com.

- Off-plan or ready properties, with off-plan offering 10–20% lower prices, per dubaisouth.ae.

- Restrictions:

- Non-freehold areas (e.g., older parts of Deira, Bur Dubai) allow only leasehold (99-year leases) or usufruct rights, per drivenproperties.com.

- Freehold ownership is limited to designated zones approved by the Dubai Land Department (DLD), per dubailand.gov.ae.

Process to Own Freehold Property

- Select a Property:

- Use platforms like bayut.com, propertyfinder.ae, or developer sites (emaar.com, nakheel.com) to find freehold properties.

- Verify freehold status via DLD’s Dubai REST app or website, per dubailand.gov.ae.

- Example: A 1-bedroom in Dubai Marina (AED 1.5–2 million) or a villa in Palm Jumeirah (AED 10 million+).

- Engage Professionals:

- Hire a RERA-licensed agent (2% fee + 5% VAT), verifiable via DLD portal, per bhomes.com.

- Optional: Lawyer for due diligence (AED 5,000–15,000), especially for off-plan, per emiratesadvocates.com.

- Financing:

- Cash: Full payment or developer payment plans (e.g., 50–70% over 2–3 years), per damacproperties.com.

- Mortgage: 50–75% loan-to-value for residents, 3–5% interest rates, 25-year tenure, per HSBC Middle East.

- Costs: 4% DLD fee, 2% agent commission, AED 2,000–4,000 registration, totaling 7–10% of property value, per Bayut.

- Sign Agreements:

- Ready properties: Sign Memorandum of Understanding (Form F) with a 5–10% deposit, per dubailand.gov.ae.

- Off-plan: Sign Sale and Purchase Agreement (SPA), payments to DLD-approved escrow, per RERA Off-Plan Rules.

- Complete Purchase:

- Finalize payment at DLD (Oud Metha or Dubai Marina branch), pay fees, and receive blockchain-registered title deed, per dubailand.gov.ae.

- Timeline: 1–2 weeks for ready, 1–3 months for off-plan initial transfer, per Tenco Homes.

Benefits of Freehold Ownership

- Full Control: Sell, rent, or modify without restrictions, per Bayut.

- Investment Returns:

- Rental yields: 5–9% (e.g., 6–8% in Dubai Marina, 7–9% in Dubai South), per Colife.

- Capital appreciation: 8–12% by 2026 in premium areas, per DAMAC Properties.

- Golden Visa: Properties worth AED 2 million+ qualify for a 5/10-year renewable residency visa, including family, per icp.gov.ae.

- Tax Advantages: No personal income or capital gains tax, though U.S./EU owners face home-country taxes, per Bayut.

- Lifestyle: Access to luxury amenities (e.g., private beaches on Palm Jumeirah, Marina Walk), per visitdubai.com.

Challenges and Considerations

- Market Risks: 15% price correction risk in mid-market areas (e.g., Dubai South, JVC), though premium areas like Palm Jumeirah are resilient, per Fitch Ratings.

- Costs:

- Maintenance: AED 15–30/sq ft annually, higher for waterfront, per Tenco Homes.

- Compliance: KYC, AML, and 9% corporate tax (if renting) via EmaraTax by March 31, 2025, AED 10,000–50,000, per Understanding UAE’s 15% Corporate Tax.

- Off-Plan Risks: Delays (1–3 years), mitigated by DLD escrow, per RERA Off-Plan Rules.

- Learning Curve: 20–30% of buyers need guidance on blockchain deeds and smart home systems, per PropTech Trends 2025.

Recommended Freehold Properties for 2025

- Budget AED 600,000–2 Million:

- Dubai South: Off-plan studios (AED 600,000+), 7–9% yields, per dubaisouth.ae.

- JVC: 1-bedroom apartments (AED 700,000–1.5 million), 6–8% yields, per propertyfinder.ae.

- Budget AED 2–5 Million (Golden Visa Eligible):

- Dubai Marina: 2-bedroom apartments (AED 2–3 million), 6–8% yields, per drivenproperties.com.

- Emaar Beachfront: 2-bedroom apartments (AED 2–5 million), 6–8% yields, per Premier Estates Dubai.

- Budget AED 5 Million+:

- Palm Jumeirah: Apartments (AED 5–20 million), villas (AED 10–100 million), 5–7% yields, per nakheel.com.

- Action: Use bayut.com for listings, focus on off-plan for affordability or premium areas for prestige.

Recommendations

- Verify Freehold Status: Check via DLD’s Dubai REST (www.dubailand.gov.ae) or RERA agents, per bhomes.com.

- Engage Professionals: Hire RERA agents on propertyfinder.ae, lawyers via emiratesadvocates.com for contracts, per Bayut.

- Financing: Explore 50–70% payment plans for off-plan via emaar.com or mortgages from Emirates NBD, per mortgagefinder.ae.

- Golden Visa: Target AED 2 million+ properties (e.g., Dubai Marina, Palm Jumeirah) for residency, apply via icp.gov.ae, per GDRFA Dubai.

- Compliance: Register via EmaraTax (www.tax.gov.ae) by March 31, 2025, consult PwC for U.S./EU taxes, per Understanding UAE’s 15% Corporate Tax.

- Stay Informed: Monitor DLD reports, Emirates 24/7, and ACRES 2025, per cbnme.com.

- Eligibility: Residents, non-residents, expats, no sponsor needed.

- Areas: Palm Jumeirah, Dubai Marina, Dubai Hills, Dubai South, etc.

- Types: Apartments, villas, commercial, off-plan/ready.

Process

- Select Property: Browse bayut.com, verify freehold via Dubai REST.

- Professionals: RERA agents (2% fee), lawyers (AED 5,000–15,000).

- Financing: Cash, 50–70% plans, or 50–75% LTV mortgages.

- Agreements: Sign MoU (ready) or SPA (off-plan), 5–10% deposit.

- Complete: Pay 4% DLD, get blockchain title deed, 1–2 weeks.

Benefits

- Control: Full ownership rights.

- Returns: 5–9% yields, 8–12% growth.

- Golden Visa: AED 2M+ properties.

- Tax: No UAE income/capital gains tax.

Challenges

- Risks: 15% correction, off-plan delays.

- Costs: Maintenance AED 15–30/sq ft, compliance AED 10,000–50,000.

- Taxes: U.S./EU rental income tax.

Conclusion

In 2025, foreigners can own freehold property in Dubai’s designated areas like Palm Jumeirah, Dubai Marina, and Dubai South, enjoying 5–9% yields, 8–12% appreciation, and Golden Visa eligibility for AED 2 million+ investments. Use bayut.com for listings, verify freehold status via DLD, engage RERA agents, and comply with EmaraTax by March 31, 2025, to secure ownership in this dynamic market. watch more here

read more: New UAE Property Laws You Should Know