Now Reading: Deira Islands: 5 Budget-Friendly Villas Offering High ROI Potential in 2025

-

01

Deira Islands: 5 Budget-Friendly Villas Offering High ROI Potential in 2025

Deira Islands: 5 Budget-Friendly Villas Offering High ROI Potential in 2025

Table of Contents

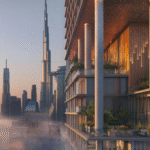

Dubai Islands, formerly Deira Islands, is a 17 sq.km. man-made archipelago by Nakheel, located off Deira’s coast in northern Dubai. Comprising five islands—Marina Island, Central Island, Shore Island, Golf Island, and Elite Island—it recorded AED 2.2 billion ($598 million) in transactions in 2024, with a 22% year-on-year sales increase in Q1 2025, per gulfbusiness.com.

Offering 7-9% rental yields and 8-12% capital gains, it appeals to investors seeking budget-friendly options with high returns, per dxbinteract.com. Connected via the Infinity Bridge to Deira (5 minutes), Dubai International Airport (15 minutes), and Downtown Dubai (25 minutes), it features 20km of Blue Flag beaches, 2 sq.km. of parks, and planned amenities like Deira Mall, per nakheel.com.

Below are five budget-friendly villa projects in Dubai Islands offering high ROI potential in 2025, their features, investment potential, and compliance steps with the Dubai Land Department (DLD) and Federal Tax Authority (FTA). All projects are selected for affordability (under AED 5 million) and proximity to key amenities like Souk Al Marfa and planned marinas, per propertyfinder.ae.

1. Bay Villas by Nakheel

Deira Islands Overview: A Nakheel residential project on Marina Island, offering 3- and 4-bedroom semi-detached villas starting at AED 3.5 million ($952,900). Handover in Q4 2026, per keltandcorealty.com.

Features: Waterfront villas (2,500-3,500 sq.ft.) with private gardens, direct beach access, and modern finishes. Amenities include community pools, fitness centers, and proximity to Souk Al Marfa (7 minutes) and planned marinas, per famproperties.com.

Investment Potential: Yields of 7-9% (e.g., AED 315,000/year for a AED 3.5 million villa) and 8-12% capital gains by 2027, driven by tourism and marina proximity, per dxbproperties.ae. Ideal for short-term rentals due to 17.2 million tourists in 2024, per dxboffplan.com.

Compliance: Register SPAs via DLD’s Ejari system. Verify escrow accounts. Retain records for FTA audits, per taxvisor.ae.

2. Rixos Dubai Islands Beach Houses

Overview: A Nakheel and Excelsior Real Estate project on Shore Island, offering 2- and 3-bedroom beach houses starting at AED 4.5 million ($1.22 million). Handover in Q4 2026, per drivenproperties.com.

Features: Beachfront homes (2,800-3,200 sq.ft.) with private terraces, open-plan layouts, and access to Rixos resort amenities like a spa, beach club, and waterpark. Near Centara Mirage Beach Resort (5 minutes), per luxhabitat.ae.

Investment Potential: Yields of 7-8.5% (e.g., AED 382,500/year for a AED 4.5 million beach house) and 8-10% capital gains by 2027, boosted by Rixos branding and tourist appeal, per aysdevelopers.ae. Strong short-term rental demand due to resort proximity, per dxbinteract.com.

Compliance: Register SPAs via Ejari. Verify freehold status. Obtain valuation certificate for Golden Visa (AED 2 million+). Retain records for FTA audits, per adres.ae.

3. Vestoria Bay Villas

Overview: A waterfront development by Ahmedyar Developments on Marina Island, offering 3-bedroom villas starting at AED 3.8 million ($1.03 million). Handover in Q3 2026, per excelproperties.ae.

Features: Modern villas (2,600-3,000 sq.ft.) with private pools, sea views, and smart home systems. Includes communal gyms and cycling paths, near Deira City Centre Metro Station (10 minutes), per famproperties.com.

Investment Potential: Yields of 7-8.5% (e.g., AED 323,000/year for a AED 3.8 million villa) and 8-12% capital gains by 2027, driven by affordability and connectivity, per dxbproperties.ae. Attractive for expat families, per kaizenams.com.

Compliance: Register SPAs via Ejari. Verify escrow accounts. Retain records for FTA audits, per dubailand.gov.ae.

4. Coral Isle Villas

Overview: A Grovy Developers project on Central Island, offering 3-bedroom villas starting at AED 3.2 million ($871,200). Handover in Q2 2027, per excelproperties.ae.

Features: Contemporary villas (2,400-3,000 sq.ft.) with private gardens, rooftop terraces, and access to planned Deira Mall (opening 2026, 5-minute drive). Near The Night Market’s 5,300 shops, per propsearch.ae.

Investment Potential: Yields of 7.5-9% (e.g., AED 288,000/year for a AED 3.2 million villa) and 8-10% capital gains by 2028, fueled by retail proximity and family appeal, per dxbinteract.com. High demand from young professionals, per luxliving.ae.

Compliance: Register SPAs via Ejari. Verify freehold status. Retain records for FTA audits, per taxvisor.ae.

5. Villa del GAVI

Overview: A boutique project by Mr. Eight Development on Elite Island, offering 3- and 4-bedroom villas starting at AED 4 million ($1.09 million). Handover in Q3 2026, per propsearch.ae.

Features: Luxury villas (3,000-4,000 sq.ft.) with private beaches, wellness enclaves, and eco-friendly designs like solar panels. Near planned golf courses on Golf Island (10 minutes), per keltandcorealty.com.

Investment Potential: Yields of 6.5-8% (e.g., AED 320,000/year for a AED 4 million villa) and 8-12% capital gains by 2027, driven by exclusivity and sustainability, per aysdevelopers.ae. Appeals to eco-conscious investors, per inzoneproperties.ae.

Compliance: Register SPAs via Ejari. Verify escrow accounts. Obtain valuation certificate for Golden Visa (AED 2 million+). Retain records for FTA audits, per gtlaw.com.

Why These Projects Matter

Bay Villas, Rixos Dubai Islands Beach Houses, Vestoria Bay Villas, Coral Isle Villas, and Villa del GAVI offer budget-friendly villas (AED 3.2-4.5 million) with 7-9% yields, outperforming global averages (e.g., London’s 3-4%), per qbd.ae. Priced significantly below Dubai Islands’ average 4-bedroom villa cost of AED 11.7 million, they provide affordable entry points for investors, per keltandcorealty.com.

The archipelago’s 20km of beaches, six marinas, and planned Deira Mall (1,000+ shops) enhance lifestyle and rental demand, per propsearch.ae. Connectivity via the Infinity Bridge and a planned second 1,425m bridge to Bur Dubai ensures accessibility, per propsearch.ae.

Proximity to Deira City Centre Mall (10 minutes) and cultural hubs like Dubai Creek adds appeal, per propertyfinder.ae. Posts on X highlight the islands’ investment buzz, per @Al_Tamimi_RE. Challenges include construction delays and limited current healthcare (nearest: Dubai Hospital, 12 minutes), mitigated by Nakheel’s AED 7.5 billion infrastructure investment and 85% occupancy in early phases, per propsearch.ae. Golden Visa eligibility (AED 2 million+) applies to all projects, per pangeadubai.com.

Tax Tools for American Investors

U.S.-UAE DTA: Credit UAE taxes via IRS Form 1118, preserving 8-12% returns, per immigrantinvest.com.

Zakat for Muslim Investors: Pay 2.5% Zakat on rental income (e.g., AED 2,500 on AED 100,000). Consult Islamic scholars, per taxvisor.ae.

VAT Recovery: Recover 5% input VAT on commercial expenses (e.g., AED 25,000 on AED 500,000) for VAT-registered investors, per fintedu.com.

Market Outlook and Challenges

Dubai Islands’ 22% transaction growth in Q1 2025 and 7.5% average ROI reflect strong demand, with off-plan properties driving 60% of sales, per gulfbusiness.com. Infrastructure like 2 sq.km. of parks, six marinas, and planned golf courses supports livability, per nakheel.com.

Risks include oversupply (97,000 new units by 2026) and reliance on private transport, offset by limited waterfront supply and high tourist demand, per dxboffplan.com. Aligned with Dubai’s 2040 Urban Master Plan, these villas offer affordability, luxury, and high ROI in a vibrant coastal hub, per u.ae.

Conclusion

Bay Villas, Rixos Dubai Islands Beach Houses, Vestoria Bay Villas, Coral Isle Villas, and Villa del GAVI are Dubai Islands’ top budget-friendly villa projects for 2025, offering 7-9% yields and 8-12% capital gains.

With waterfront access, modern amenities, and proximity to retail and leisure hubs, they attract investors and expat families. Compliance with DLD’s Ejari and FTA ensures secure investments in this emerging waterfront destination. Deira Islands

read more: The World Islands: 6 Boutique Projects Gaining Ultra-High-Net-Worth Interest in 2025