Now Reading: Deyaar’s Soaring Revenue: What Investors Must Know Right Now 2025

-

01

Deyaar’s Soaring Revenue: What Investors Must Know Right Now 2025

Deyaar’s Soaring Revenue: What Investors Must Know Right Now 2025

Table of Contents

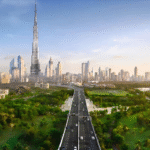

Deyaar Development PJSC, one of the leading real estate developers in the UAE, has recently reported strong revenue growth, bringing renewed attention to the company’s financial performance and its promising outlook for investors. The company’s latest earnings report highlights not only a sharp rise in revenue but also signals a strategic transformation that could benefit shareholders significantly.

This article explores what’s driving Deyaar’s growth, how it compares to previous years, and what current and potential investors should expect in the near future.

Strong Revenue Performance in 2024

Deyaar reported a notable increase in revenue for the first half of 2024, with figures showing a surge of over 55% compared to the same period last year. This marks one of the strongest growth phases for the company in recent years, fueled by robust property sales, successful handovers, and increasing demand in Dubai’s thriving real estate market.

The company’s net profit also jumped, reflecting efficient cost management, improved operational margins, and higher rental yields from their property portfolio. According to the official financial disclosures, the growth has been consistent across multiple segments, including residential, commercial, and hospitality properties.

What Is Driving This Growth?

There are several reasons behind Deyaar’s current upward trend:

- Booming Real Estate Market in Dubai

Dubai’s property market continues to attract investors from around the world, especially after the government introduced more flexible visa rules and foreign ownership laws. These regulatory shifts have boosted buyer confidence and increased demand for high-quality residential and commercial properties. - Strategic Project Deliveries

Deyaar has been able to deliver several key projects ahead of schedule, including the completion of Regalia by Deyaar, a luxury residential tower in Business Bay. The early handovers have translated into quicker revenue recognition and better cash flows. - Diversified Revenue Streams

Beyond property sales, Deyaar is now earning more from property and facility management, leasing, and hospitality ventures, providing stable income even during slower market cycles. - Digital Transformation and Operational Efficiency

Deyaar has adopted new digital platforms and smart technologies to streamline project development, marketing, and customer service. These improvements have lowered operational costs and enhanced customer experience, adding to overall profitability.

How Does It Affect Shareholders?

The strong financial performance is excellent news for shareholders for several reasons:

- Higher Dividends Expected

With growing profits and a strong balance sheet, Deyaar is likely to increase dividend payouts. This is particularly appealing to income-focused investors seeking stable returns. - Positive Share Price Outlook

The stock market typically rewards consistent financial performance. Deyaar’s positive earnings report has already resulted in a moderate uptick in its share price, and analysts believe this trend could continue if momentum is maintained. - Improved Investor Confidence

Transparent communication, timely project delivery, and consistent earnings can improve investor confidence, potentially drawing in more institutional investors and boosting the company’s market value.

What Are Analysts Saying?

Market analysts and financial experts have given mostly positive reviews of Deyaar’s recent performance. A report from one Dubai-based brokerage firm noted:

“Deyaar is becoming a more agile, profitable, and investor-focused entity. If current trends continue, it could be a standout performer in the UAE’s real estate sector over the next few years.”

Many experts believe that Deyaar’s approach of balancing property development with recurring income streams (such as rental and facility management) offers long-term stability, even in volatile markets.

Risks and Challenges to Watch

Despite the optimistic outlook, shareholders should remain aware of potential risks:

- Market Corrections: Dubai’s property market has seen boom-and-bust cycles before. A sharp correction in real estate prices could affect Deyaar’s sales and revenue.

- Interest Rates and Financing Costs: Rising interest rates globally could impact mortgage affordability and financing costs, which might slow down buyer demand.

- Geopolitical Tensions: As with all companies in the region, geopolitical instability could impact foreign investment inflows and market confidence.

However, Deyaar appears well-prepared to handle these challenges with a healthy cash position and a flexible business model.

Future Plans and Outlook

Deyaar has ambitious plans for the coming years, including launching new mid-income and luxury developments and expanding its hospitality portfolio. The company is also investing in sustainable building practices, aligning itself with Dubai’s green economy vision.

Their future strategy seems focused on long-term value creation for shareholders through:

- Continued project launches across prime locations

- Strengthening recurring income streams

- Expansion into new markets or real estate verticals

- Leveraging AI and PropTech for better operational decisions

Conclusion

Deyaar’s recent revenue growth is more than just a short-term financial win. It reflects a deeper, strategic shift in how the company operates and creates value. For shareholders, this means potentially higher returns, better dividend yields, and increased portfolio value over the long term.

As always, investors are advised to do their own due diligence, but for now, Deyaar’s growth story seems to be on a promising path.

Read More:- Shobha Realty Launches Its Most Luxurious Project Yet—Full Details Inside 2025