Now Reading: Dubai Harbour: 7 Marina-Focused Projects with High Capital Appreciation Potential in 2025

-

01

Dubai Harbour: 7 Marina-Focused Projects with High Capital Appreciation Potential in 2025

Dubai Harbour: 7 Marina-Focused Projects with High Capital Appreciation Potential in 2025

Table of Contents

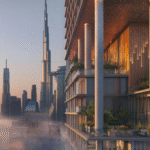

Dubai Harbour, a 20-million sq.ft. waterfront district by Meraas, located between Palm Jumeirah and Bluewaters Island, is Dubai’s premier maritime hub. Featuring the Middle East’s largest marina with 700+ berths, it recorded AED 4.2 billion ($1.14 billion) in transactions in 2024, with a 25% year-on-year sales increase in Q1 2025, per gulfbusiness.com.

Offering 6-8% rental yields and 10-15% capital gains, its prime location along King Salman Bin Abdulaziz Al Saud Street ensures connectivity to Dubai Marina (5 minutes), Downtown Dubai (20 minutes), and Dubai International Airport (25 minutes), per getstake.com.

With a 1.5km private beach, two cruise terminals, and proximity to Skydive Dubai, Dubai Harbour blends luxury and nautical lifestyles, per emaar.com. Below are seven marina-focused projects launching or completing in 2025, their features, investment potential, and compliance steps with the Dubai Land Department (DLD) and Federal Tax Authority (FTA).

1. Seapoint

Overview: A waterfront residential project by Emaar Properties at Emaar Beachfront, offering 1- to 3-bedroom apartments and 4-bedroom penthouses from AED 2.7 million ($735,100). Handover in Q2 2025, per properties.emaar.com.

Features: Direct marina access, floor-to-ceiling windows, and amenities like infinity pools, a gym, and a private beach. Near Dubai Marina Mall (5 minutes) and Emirates Hospital Clinic (7 minutes), per getstake.com.

Investment Potential: Yields of 6-8% (e.g., AED 216,000/year for a AED 2.7 million apartment) and 10-12% capital gains by 2026, driven by marina views and tourist demand, per dxbinteract.com.

Compliance: Register SPAs via DLD’s Ejari system. Verify escrow accounts. Retain records for FTA audits, per taxvisor.ae.

2. Beachgate by Address

Overview: A luxury residential tower by Emaar Properties, offering 1- to 4-bedroom apartments and penthouses from AED 3.2 million ($871,200). Handover in Q4 2025, per properties.emaar.com.

Features: Managed by Address Hotels, with marina-facing units, a rooftop pool, spa, and 24/7 concierge. Near Bluewaters Island (5 minutes) and Marina Medical Center (8 minutes), per getstake.com.

Investment Potential: Yields of 6-7.5% (e.g., AED 240,000/year for a AED 3.2 million apartment) and 12-15% capital gains by 2026, fueled by branded residences, per dxbproperties.ae.

Compliance: Register SPAs via Ejari. Verify freehold status. Obtain valuation certificate for Golden Visa (AED 2 million+). Retain records for FTA audits, per adres.ae.

3. Palace Beach Residence

Overview: A twin-tower development by Emaar Properties, offering 1- to 3-bedroom apartments and 4-bedroom penthouses from AED 2.5 million ($680,800). Handover in Q3 2025, per bayut.com.

Features: Marina and Burj Al Arab views, with amenities like a gym, infinity pool, and kids’ play area. Near Dubai Harbour Marina and JBR (5-10 minutes), per emaar.com.

Investment Potential: Yields of 6.5-8% (e.g., AED 200,000/year for a AED 2.5 million apartment) and 10-12% capital gains by 2026, driven by waterfront appeal, per dxbinteract.com.

Compliance: Register SPAs via Ejari. Verify escrow accounts. Retain records for FTA audits, per gtlaw.com.

4. Marina Shores

Overview: A 53-story tower by Emaar Properties, offering 1- to 5-bedroom apartments and penthouses from AED 2.8 million ($762,400). Handover in Q2 2025, per properties.emaar.com.

Features: Panoramic marina views, smart home systems, and amenities like a fitness center, pool, and yacht berthing access. Near Sheikh Zayed Road and JBR (5 minutes), per getstake.com.

Investment Potential: Yields of 6-8% (e.g., AED 224,000/year for a AED 2.8 million apartment) and 10-12% capital gains by 2026, supported by high rental demand, per dxbproperties.ae.

Compliance: Register SPAs via Ejari. Verify freehold status. Retain records for FTA audits, per dubailand.gov.ae.

5. Beach Mansion

Overview: A low-rise residential project by Emaar Properties, offering 1- to 4-bedroom apartments and townhouses from AED 2.3 million ($626,500). Handover in Q1 2025, per bayut.com.

Features: Direct beach and marina access, with lush greenery, a gym, and children’s play areas. Near Dubai Harbour Promenade and Nakheel Mall (10 minutes), per emaar.com.

Investment Potential: Yields of 6.5-8% (e.g., AED 184,000/year for a AED 2.3 million apartment) and 10-12% capital gains by 2026, driven by family-friendly design, per dxbinteract.com.

Compliance: Register SPAs via Ejari. Verify escrow accounts. Retain records for FTA audits, per taxvisor.ae.

6. Grand Bleu Tower

Overview: A branded residential project by Emaar Properties and Elie Saab, offering 1- to 4-bedroom apartments and penthouses from AED 3.5 million ($952,900). Handover in Q3 2025, per properties.emaar.com.

Features: Couture-inspired interiors, marina views, and amenities like a spa, pool, and private beach. Near Bluewaters Island and Ain Dubai (5 minutes), per getstake.com.

Investment Potential: Yields of 6-7.5% (e.g., AED 262,500/year for a AED 3.5 million apartment) and 12-15% capital gains by 2026, boosted by branded appeal, per dxbproperties.ae.

Compliance: Register SPAs via Ejari. Verify freehold status. Obtain valuation certificate for Golden Visa (AED 2 million+). Retain records for FTA audits, per adres.ae.

7. Sobha Seahaven

Overview: A luxury waterfront tower by Sobha Realty, offering 1- to 4-bedroom apartments from AED 3 million ($816,900). Handover in Q4 2025, per sobharealty.com.

Features: Marina-facing units with premium finishes, infinity pool, yacht docking, and wellness facilities. Near Dubai Harbour Cruise Terminal and JBR (5-10 minutes), per bayut.com.

Investment Potential: Yields of 6-8% (e.g., AED 240,000/year for a AED 3 million apartment) and 10-12% capital gains by 2026, driven by Sobha’s quality reputation, per dxbinteract.com.

Compliance: Register SPAs via Ejari. Verify escrow accounts. Retain records for FTA audits, per gtlaw.com.

Why These Projects Matter

Seapoint, Beachgate by Address, Palace Beach Residence, Marina Shores, Beach Mansion, Grand Bleu Tower, and Sobha Seahaven position Dubai Harbour as a top-tier investment hub, offering 6-8% yields, surpassing global benchmarks (e.g., New York’s 2-3%), per qbd.ae. With 700+ marina berths, a private beach, and proximity to Bluewaters Island and Dubai Marina, these projects cater to luxury buyers and tourists, per getstake.com.

Amenities like infinity pools, branded interiors, and yacht access drive short-term rental demand via platforms like Airbnb, per signaturehabitat.com. Connectivity via Sheikh Zayed Road and proximity to JBR’s dining and retail enhance livability, per emaar.com. Posts on X highlight Dubai Harbour’s exclusivity and marina lifestyle, per @luxury_playbook.

Challenges include construction delays and high entry prices, mitigated by reputable developers (Emaar, Sobha) and 90% occupancy in completed projects, per hausandhaus.com. Golden Visa eligibility (AED 2 million+) applies to most projects, per pangeadubai.com.

Tax Tools for American Investors

U.S.-UAE DTA: Credit UAE taxes via IRS Form 1118, preserving 10-15% returns, per immigrantinvest.com.

Zakat for Muslim Investors: Pay 2.5% Zakat on rental income (e.g., AED 2,500 on AED 100,000). Consult Islamic scholars, per taxvisor.ae.

VAT Recovery: Recover 5% input VAT on commercial expenses (e.g., AED 25,000 on AED 500,000) for VAT-registered investors, per fintedu.com.

Market Outlook and Challenges

Dubai Harbour’s 25% transaction growth in Q1 2025 and 6.5% average ROI reflect strong demand, with off-plan properties driving 60% of Dubai’s market, per gulfbusiness.com. Infrastructure like the Dubai Harbour Marina and planned metro extensions (Blue Line by 2029) boost connectivity, per u.ae.

Risks include oversupply (97,000 new units by 2026) and premium pricing, offset by limited marina-front supply and high tourist demand, per valorisimo.com. These projects align with Dubai’s 2040 Urban Master Plan for sustainable, luxury waterfront living, per u.ae.

Conclusion

Seapoint, Beachgate by Address, Palace Beach Residence, Marina Shores, Beach Mansion, Grand Bleu Tower, and Sobha Seahaven are Dubai Harbour’s top marina-focused projects for 2025, offering 6-8% yields and 10-15% capital gains. With direct marina access, luxury amenities, and proximity to JBR and Bluewaters Island, they attract high-net-worth investors and tourists. Compliance with DLD’s Ejari and FTA ensures secure investments in this exclusive waterfront destination. Dubai Harbour

read more: City Walk Dubai: 6 Boutique Developments Offering Premium Urban Lifestyles