Now Reading: Dubai Islands: 6 New Waterfront Communities Transforming the Coastline in 2025

-

01

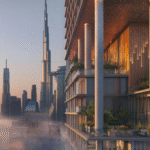

Dubai Islands: 6 New Waterfront Communities Transforming the Coastline in 2025

Dubai Islands: 6 New Waterfront Communities Transforming the Coastline in 2025

Table of Contents

Dubai Islands, formerly Deira Islands, is a 17-million sq.m. master-planned waterfront development by Nakheel, located off Deira’s coast. Comprising five islands—Marina Island, Central Island, Shore Island, Golf Island, and Elite Island—it recorded AED 2.2 billion ($598 million) in transactions in 2024, with a 22% year-on-year sales increase in Q1 2025, per gulfbusiness.com.

Offering 6-8.5% rental yields and 8-15% capital gains, it adds 20km of Blue Flag beaches and 2 sq.km. of parks, per nakheel.com. Connected via the Infinity Bridge to Deira (5 minutes), Dubai International Airport (20 minutes), and Downtown Dubai (25 minutes), it blends luxury, wellness, and connectivity, per propsearch.ae.

Below are six new waterfront communities launching or completing in 2025, their features, investment potential, and compliance steps with the Dubai Land Department (DLD) and Federal Tax Authority (FTA).

1. Nautis Residences

Overview: A boutique mid-rise by STAMN on Marina Island, offering 63 upscale 1- to 4-bedroom apartments and townhouses from AED 2 million ($544,600). Handover in Q4 2025, per @CBN_ME.

Features: 360° sea views, private terraces, and amenities like a rooftop pool, gym, and marina access.

Near Souk Al Marfa (7 minutes) and Centara Mirage Beach Resort, per propertyfinder.ae.

Investment Potential: Yields of 7-8.5% (e.g., AED 170,000/year for a AED 2 million apartment) and 10-12% capital gains by 2026, driven by exclusivity and marina lifestyle, per dxbinteract.com.

Compliance: Register SPAs via DLD’s Ejari system. Verify escrow accounts. Retain records for FTA audits, per taxvisor.ae.

2. Bay Grove Residences (Final Phase)

Overview: Nakheel’s final phase on Central Island, offering 1- to 4-bedroom apartments and penthouses from AED 2 million ($544,600). Handover in Q2 2029, per @CBN_ME.

Features: Beachfront units with resort-style amenities, including pools, cycling paths, and waterfront dining. Near planned cultural hubs and Deira Corniche (10 minutes), per nakheel.com.

Investment Potential: Yields of 6-7.5% (e.g., AED 150,000/year for a AED 2 million apartment) and 10-12% capital gains by 2029, supported by Nakheel’s reputation, per dxbproperties.ae.

Compliance: Register SPAs via Ejari. Verify freehold status. Retain records for FTA audits, per adres.ae.

3. Sia by Grovy

Overview: A luxury residential project by Grovy on Shore Island, offering 1- to 3-bedroom apartments from AED 1.2 million ($326,800). Handover in Q2 2027, per aboutinsider.com.

Features: Modern units with infinity pools, fitness centers, and sea views. Near Dubai Islands Beach and Nakheel Marinas (5 minutes), per grovy.ae.

Investment Potential: Yields of 7-8.5% (e.g., AED 102,000/year for a AED 1.2 million apartment) and 8-10% capital gains by 2028, appealing to budget-conscious investors, per dxbinteract.com.

Compliance: Register SPAs via Ejari. Verify escrow accounts. Retain records for FTA audits, per gtlaw.com.

4. Edgewater Residences 3

Overview: A waterfront tower by MGS Development on Marina Island, offering 1- to 3-bedroom apartments from AED 1.68 million ($457,600). Handover in Q3 2026, per aboutinsider.com.

Features: Sea-facing units with a 35/65 payment plan, communal gym, and marina promenade access. Near Souk Al Marfa and Dubai Hospital (12 minutes), per drivenproperties.com.

Investment Potential: Yields of 6.5-8% (e.g., AED 134,400/year for a AED 1.68 million apartment) and 8-10% capital gains by 2027, driven by early investment potential, per dxbproperties.ae.

Compliance: Register SPAs via Ejari. Verify freehold status. Retain records for FTA audits, per dubailand.gov.ae.

5. Sea Legend One

Overview: A residential project by an undisclosed developer on Central Island, offering 1- to 5-bedroom apartments from AED 1.78 million ($484,900). Handover in Q3 2026, per aboutinsider.com.

Features: Beachfront apartments with 60/40 or 80/20 payment plans, rooftop yoga decks, and spa facilities. Near planned golf courses and Al Mamzar Beach Park (12 minutes), per propertyfinder.ae.

Investment Potential: Yields of 7-8.5% (e.g., AED 151,300/year for a AED 1.78 million apartment) and 8-10% capital gains by 2027, ideal for short-term rentals, per dxbinteract.com.

Compliance: Register SPAs via Ejari. Verify escrow accounts. Retain records for FTA audits, per taxvisor.ae.

6. Azizi Wasel

Overview: A luxury community by Azizi Developments on Shore Island, offering 1-bedroom apartments to 3-bedroom townhouses from AED 1.5 million ($408,500). Handover in Q4 2026, per excelproperties.ae.

Features: Marina views, green surroundings, kids’ playgrounds, and nearby retail. Near Nakheel Marinas and Deira district (10 minutes), per bayut.com.

Investment Potential: Yields of 6.5-8% (e.g., AED 120,000/year for a AED 1.5 million apartment) and 8-10% capital gains by 2027, driven by affordability and lifestyle, per dxbproperties.ae.

Compliance: Register SPAs via Ejari. Verify freehold status. Retain records for FTA audits, per adres.ae.

Why These Projects Matter

Nautis Residences, Bay Grove Residences, Sia by Grovy, Edgewater Residences 3, Sea Legend One, and Azizi Wasel are transforming Dubai Islands’ 40km coastline, offering 6-8.5% yields, surpassing global averages (e.g., London’s 3-4%), per qbd.ae.

With 80+ hotels, marinas, and 2 sq.km. of parks, these communities integrate wellness (yoga decks, fitness trails), retail (Souk Al Marfa), and recreation (golf courses, watersports), per nakheel.com. The Infinity Bridge and planned Shindagha Corridor ensure connectivity to Bur Dubai and Downtown, per fakhruddinproperties.com.

Posts on X highlight their luxury and investment potential, per @CBN_ME and @Al_Tamimi_RE. Challenges include construction delays and limited current healthcare (nearest: Dubai Hospital, 12 minutes), mitigated by Nakheel’s track record (e.g., Palm Jumeirah) and 85% occupancy in early phases, per propsearch.ae.

Golden Visa eligibility (AED 2 million+) applies to multiple units or higher-end apartments, per pangeadubai.com.

Tax Tools for American Investors

U.S.-UAE DTA: Credit UAE taxes via IRS Form 1118, preserving 8-15% returns, per immigrantinvest.com.

Zakat for Muslim Investors: Pay 2.5% Zakat on rental income (e.g., AED 2,500 on AED 100,000). Consult Islamic scholars, per taxvisor.ae.

VAT Recovery: Recover 5% input VAT on commercial expenses (e.g., AED 25,000 on AED 500,000) for VAT-registered investors, per fintedu.com.

Market Outlook and Challenges

Dubai Islands’ 22% transaction growth in Q1 2025 and up to 15% ROI for select properties reflect strong demand, with off-plan projects driving 60% of Dubai’s market, per gulfbusiness.com. The Dubai Reef Project, with 20,000 eco-friendly reef modules, boosts sustainability and tourism, enhancing property values, per rootsofhomes.com.

Risks include oversupply (97,000 new units by 2026) and reliance on private transport, offset by limited waterfront supply and high rental demand, per excelproperties.ae. Aligned with the Dubai 2040 Urban Master Plan, these communities redefine coastal living with wellness and luxury, per u.ae.

Conclusion

Nautis Residences, Bay Grove Residences, Sia by Grovy, Edgewater Residences 3, Sea Legend One, and Azizi Wasel are Dubai Islands’ top waterfront communities for 2025, offering 6-8.5% yields and 8-15% capital gains. With beaches, marinas, and wellness amenities, they attract investors and residents seeking coastal luxury. Compliance with DLD’s Ejari and FTA ensures secure investments in this transformative waterfront destination.

read more: Palm Jumeirah: 7 Luxury Residences Launching in 2025 You Should Know