Now Reading: Dubai Property: 5 Service Charge Hikes Impacting Investor Returns in 2025

-

01

Dubai Property: 5 Service Charge Hikes Impacting Investor Returns in 2025

Dubai Property: 5 Service Charge Hikes Impacting Investor Returns in 2025

Table of Contents

Dubai’s real estate market in 2025 is a global investment powerhouse, with 99,000 transactions worth AED 326.7 billion in H1 and projected 5-9% price growth, per Dubai Land Department (DLD) data. Offering 6-10% gross rental yields, Dubai’s tax-free environment no annual property tax, personal income tax, capital gains tax, or VAT on residential leases maximizes profitability. However, service charges, covering maintenance, security, and amenities, are rising 5-10% in 2025, consuming 10-25% of rental income and cutting net yields by 0.1-0.4%, per industry reports.

Regulated by RERA under Law No. 6 of 2019, these fees vary from AED 10-12/sq.ft. in affordable zones like Jumeirah Village Circle (JVC) to AED 20-53.7/sq.ft. in luxury areas like Palm Jumeirah. Qualifying Free Zone Persons (QFZPs) in Jebel Ali Free Zone secure 0% corporate tax, and the First-Time Home Buyer Program offers 5% discounts on properties up to AED 5 million. Below are five key service charge hikes impacting investor returns in 2025, with strategies to mitigate their effects.

1. Utility Cost Escalation: District Cooling and DEWA Tariffs

Rising utility costs, driven by 5-7% inflation in DEWA tariffs and district cooling fees, are increasing service charges by 5-8% in 2025, per Driven Properties. In Downtown Dubai, a 1000-sq.ft. apartment with AED 20/sq.ft. service charges (AED 20,000) faces a AED 1,600 increase, including AED 600-800 for cooling.

For a AED 2 million unit yielding 7% (AED 140,000), this cuts net yield from 6% to 5.9%. Investors can target energy-efficient properties in Dubai South or Al Furjan, with Al Sa’fat certifications reducing cooling costs by 10-15%, and verify charges via RERA’s Mollak system to ensure transparency.

2. Aging Infrastructure Upgrades: Maintenance in Older Buildings

Older properties (10+ years) in zones like Dubai Marina and Jumeirah Lakes Towers (JLT) face 7-10% service charge hikes for upgrades like elevator or HVAC replacements, per Elton Real Estate. A 1200-sq.ft. Marina apartment with AED 18/sq.ft. charges (AED 21,600) may rise by AED 2,160, reducing net yield on a AED 1.8 million unit with AED 126,000 rent (7%) from 6.3% to 6.2%.

Investors should prioritize newer off-plan projects in Business Bay (AED 12-15/sq.ft.) with 70/30 payment plans or budget 10-15% contingencies for older properties, leveraging RERA’s Mollak for fee transparency.

3. Sustainability Compliance: Green Retrofit Costs

Dubai’s Net Zero 2050 goals drive 4-6% service charge increases for eco-upgrades, like solar panels or LED lighting, in communities like Dubai Creek Harbour, per Prime Bullions Properties. A 1000-sq.ft. unit with AED 18/sq.ft. charges (AED 18,000) may rise by AED 1,080, cutting net yield on a AED 1.8 million unit with AED 126,000 rent (7%) from 6.5% to 6.4%. Developers like Emaar pass 5-10% R&D tax credit savings on off-plan units, reducing costs. Investors should verify LEED certifications via DLD and target eco-certified projects to balance fees with 8-12% capital gains by 2028.

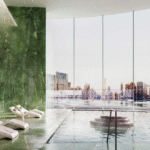

4. Premium Amenity Investments: Luxury Service Enhancements

Luxury zones like Palm Jumeirah and Bluewaters Island face 8-10% service charge hikes due to premium amenities, such as concierge services or upgraded gyms, per Driven Properties. A 1500-sq.ft. Palm Jumeirah unit with AED 30/sq.ft. charges (AED 45,000) may increase by AED 4,500, reducing net yield on a AED 3 million unit with AED 210,000 rent (7%) from 6.3% to 6.1%.

Investors can leverage short-term rentals (10-12% yields) via Airbnb, capitalizing on 18% tourist rental growth in 2025, or negotiate tenant cost-sharing within RERA’s 20% rent cap.

5. Inflation-Driven Operational Costs: Labor and Maintenance

Inflation and rising operational costs, including labor and maintenance contracts, add 5-7% to service charges across Dubai, per What’s On. In JVC, a 1000-sq.ft. unit with AED 12/sq.ft. charges (AED 12,000) may rise by AED 840, cutting net yield on a AED 1 million unit with AED 80,000 rent (8%) from 7.5% to 7.4%.

Investors can lock in long-term leases under RERA’s rental index, capping increases at 20% if below market rates, or target emerging zones like Dubai South (AED 10-12/sq.ft.) to minimize fees, using DLD’s Service Charge Index for verification.

Why These Hikes Impact Investor Returns

Service charge increases of 5-10% consume 10-25% of gross rental income, reducing net yields by 0.1-0.4%, per Prime Bullions Properties. For a AED 2 million property with 7% gross yield (AED 140,000), a AED 2,000 fee hike cuts net yield from 6% to 5.9%. Dubai’s 6-10% yields surpass global averages (e.g., London’s 2.4%), but luxury zones (AED 20-53.7/sq.ft.) face higher impacts than affordable areas (AED 10-12/sq.ft.).

RERA’s Mollak system and DLD’s Service Charge Index ensure transparency, while 90-95% occupancy and 10-12% rent growth in 2025 sustain demand. The First-Time Home Buyer Programme and Golden Visa (AED 2 million+ investments) offset costs, per DLD’s AED 761 billion 2024 transactions.

Strategies to Mitigate Service Charge Impacts

- Verify Fees via Mollak and DLD SCI: Check RERA’s Mollak or DLD’s Service Charge Index for accurate rates and dispute unjustified hikes via RDC.

- Invest in Energy-Efficient Properties: Choose LEED-certified buildings in Dubai South or JVC to cut cooling costs by 10-15%.

- Leverage Short-Term Rentals: Use platforms like Airbnb in Palm Jumeirah for 10-12% yields to offset fees, per 2025 tourist demand.

- Secure Long-Term Leases: Lock in tenants with RERA-compliant rent hikes (up to 20%) to pass on costs.

- Use QFZP Structures: Hold properties via Jebel Ali Free Zone for 0% corporate tax or DIFC/RAK ICC to avoid 9% rental tax.

- Budget Contingencies: Plan for 10-15% fee buffers and void periods, per industry advice.

- Foreign Tax Planning: U.S. investors use IRS Form 1118 for U.S.-UAE DTA credits; Indian investors comply with Liberalised Remittance Scheme ($250,000 limit). Muslim investors account for 2.5% Zakat (e.g., AED 2,000 on AED 80,000 rent).

Outlook for Dubai’s 2025 Rental Market

Dubai’s 6.2% GDP growth, 25 million tourists, and infrastructure like Metro Blue Line and Al Maktoum Airport drive demand, per DLD. Despite 76,000 new units, 90-95% absorption rates and RERA protections mitigate oversupply risks. Off-plan sales (70% of Q1 2025) and developer incentives like 5-20% discounts enhance affordability. Service charge hikes challenge net yields, but tax-free returns and strategic planning maintain Dubai’s appeal as a high-ROI market.

Conclusion

Utility cost escalation, aging infrastructure upgrades, sustainability compliance, premium amenity investments, and inflation-driven operational costs are five service charge hikes impacting Dubai’s 2025 investor returns. With 5-10% increases cutting net yields by 0.1-0.4%, investors can preserve 6-10% gross yields by targeting eco-efficient properties, leveraging short-term rentals, and using QFZP structures. Strategic budgeting and RERA compliance ensure Dubai remains a tax-advantaged investment hub.

read more: Dubai Property: 5 Developer Tax Incentives Shaping Off-Plan Sales 2025