Now Reading: Dubai Property: 6 Tax Saving Moves for Luxury Apartment Buyers in 2025

-

01

Dubai Property: 6 Tax Saving Moves for Luxury Apartment Buyers in 2025

Dubai Property: 6 Tax Saving Moves for Luxury Apartment Buyers in 2025

Table of Contents

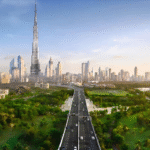

Tax Saving : Dubai’s luxury real estate market in 2025 is a global hotspot, with 99,000 transactions worth AED 326.7 billion in H1 and projected 5-9% price growth, per Dubai Land Department (DLD) data. Luxury apartments, priced above AED 2 million in areas like Palm Jumeirah and Downtown Dubai, offer 5.5-7% rental yields and 10-15% capital gains by 2028, fueled by 25 million tourists and 90-95% occupancy rates. Dubai’s tax advantages no annual property tax, personal income tax, capital gains tax, or VAT on first-time residential sales maximize returns.

Qualifying Free Zone Persons (QFZPs) in Jebel Ali Free Zone enjoy 0% corporate tax if non-qualifying mainland income is below 5% or AED 5 million, and SMEs are exempt from the 15% Domestic Minimum Top-up Tax (DMTT). The First-Time Home Buyer Program, launched July 2025, offers 5% discounts on properties up to AED 5 million, and Golden Visa eligibility for AED 2 million+ investments adds residency perks. Below are six tax-saving moves for luxury apartment buyers in 2025, ensuring optimal ROI in Dubai’s high-end market.

1. Leverage First-Time Home Buyer Discounts for Luxury Purchases

The First-Time Home Buyer Programme, launched July 2, 2025, offers UAE residents aged 18+ with a valid Emirates ID a 5% discount on properties up to AED 5 million, including luxury apartments in Dubai Creek Harbour or Business Bay. For a AED 3 million apartment, this saves AED 150,000, combinable with 0% VAT on first-time residential sales, avoiding a AED 150,000 VAT charge compared to commercial properties.

Register via the Dubai REST app with Emirates ID and proof of no prior Dubai freehold ownership. Budget for the 4% DLD fee (AED 120,000) and verify eligibility with DLD. Target off-plan projects with 70/30 payment plans to maximize savings and secure tax-free returns.

2. Prioritize Residential Classifications to Avoid 5% VAT

Luxury residential apartments, such as those in Palm Jumeirah or Downtown Dubai, are zero-rated (0% VAT) for first-time sales and exempt for subsequent sales or leases, saving 5% compared to commercial or hotel apartments. A AED 4 million Palm Jumeirah unit incurs no VAT, saving AED 200,000, and generates tax-free rental income (e.g., AED 280,000 annually at 7%).

Confirm residential status via DLD title deeds and developer contracts, as misclassified hotel apartments attract 5% VAT. Purchase directly from developers to avoid VAT on agency commissions (2% + 5% VAT, or AED 84,000 on AED 4 million), ensuring tax-free cash flow and capital gains.

3. Use QFZP Structures for Tax-Free Rental Income

For buyers planning to rent out luxury apartments, establishing a Qualifying Free Zone Person (QFZP) entity in Jebel Ali Free Zone secures 0% corporate tax on rental income, provided non-qualifying mainland income is below 5% or AED 5 million, per Federal Tax Authority (FTA) rules.

A AED 5 million Downtown Dubai apartment yielding AED 350,000 annually (7%) avoids AED 31,500 in 9% corporate tax. Setup costs AED 15,000-25,000, offset by tax savings for high-value units. Alternatively, use DIFC or RAK ICC entities to bypass 9% rental tax. Consult a UAE tax advisor to ensure compliance with FTA’s substance requirements, maximizing tax-free returns.

4. Negotiate DLD Fee Splits or Waivers in Off-Plan Deals

The 4% DLD transfer fee, typically split between buyer and seller, adds AED 160,000 to a AED 4 million Bluewaters Island apartment. In 2025, 30% of luxury off-plan projects in areas like Dubai Marina offer developer waivers or buyer-seller splits, per DLD data.

Negotiate these in competitive markets or early-phase sales, reducing costs by AED 80,000-160,000. Combine with 0% VAT and 5-15% pre-launch discounts for off-plan units, ensuring RERA-compliant Sale and Purchase Agreements (SPAs) and escrow accounts. This move preserves capital for tax-free rental yields of 5.5-7%.

5. Claim R&D Tax Credit Benefits Through Eco-Friendly Projects

Luxury off-plan projects with sustainable features, like smart HVAC or solar panels, qualify developers for 30-50% R&D tax credits, per UAE’s green incentives. Developers like Emaar and Nakheel pass 5-10% savings to buyers in areas like Dubai Hills Estate, saving AED 100,000-200,000 on a AED 2 million unit.

These projects align with Dubai’s Net Zero 2050 goals, offering 6-8% yields and 10-15% capital gains by 2028. Verify LEED or Al Sa’fat certifications via DLD to ensure discounts, reducing purchase costs while maintaining tax-free income and appreciation.

6. Optimize Home-Country Tax Compliance with DTAs

Luxury buyers face home-country tax risks despite Dubai’s 0% income and capital gains taxes. The UAE’s 193 Double Taxation Agreements (DTAs) with countries like the U.S., UK, and India mitigate this. A U.S. buyer with a AED 3 million apartment earning AED 210,000 in rent reports income on IRS Form 1040, using Form 1118 to claim credits under the U.S.-UAE DTA, offsetting 0-20% CGT.

Indian buyers comply with the Liberalised Remittance Scheme ($250,000 limit) and report assets on ITR-2/3. Muslim investors account for 2.5% Zakat (e.g., AED 5,250 on AED 210,000). Obtain a UAE Tax Residency Certificate (TRC, AED 1,000) for 183+ days in the UAE to leverage DTAs, consulting cross-border tax advisors for compliance.

Why These Tax-Saving Moves Matter

These six moves First-Time Home Buyer discounts, residential VAT exemptions, QFZP structures, DLD fee negotiations, R&D credits, and DTA optimization reduce costs by 5-10% and preserve 5.5-7% net yields in Dubai’s luxury market. Hidden fees, including 4% DLD (AED 80,000-200,000), 2% agency commission (+5% VAT), conveyancing (AED 6,000-10,000), and service charges (AED 20-53.7/sq.ft.), add 6-8% upfront and 10-25% of annual rent. With 90-95% occupancy, 10-12% rent growth, and AED 761 billion in 2024 transactions, strategic planning maximizes tax-free returns. RERA escrow accounts and Golden Visa perks enhance security and appeal.

Tax Optimization Strategies

- Register via Dubai REST: Secure First-Time Home Buyer discounts and track DLD compliance.

- Verify Residential Status: Confirm via DLD to avoid 5% VAT on misclassified units.

- Use QFZP or DIFC Entities: Achieve 0% corporate tax or bypass 9% rental tax for rental income.

- Negotiate Off-Plan Incentives: Secure DLD waivers and 5-15% discounts in early-phase sales.

- Leverage Eco-Projects: Target LEED-certified units for R&D-driven savings and lower service charges.

- Comply with Home-Country Taxes: U.S. buyers use Form 1118; Indian buyers adhere to LRS; Muslim buyers calculate Zakat. Obtain a TRC for DTA benefits.

- Budget for Fees: Plan for 4% DLD, 2% commission (+5% VAT), and service charges, using RERA’s Mollak for transparency.

Outlook for Dubai’s 2025 Luxury Market

Dubai’s 6.2% GDP growth, Economic Agenda D33, and infrastructure like Metro Blue Line and Al Maktoum Airport drive luxury demand, per DLD. Despite 76,000 new units, 90-95% absorption rates and RERA protections mitigate oversupply risks. Luxury off-plan sales (25% of Q1 2025) and developer incentives like 5-20% discounts or DLD waivers enhance affordability. These tax-saving moves ensure buyers capitalize on Dubai’s tax-free, high-ROI luxury market.

Conclusion

First-Time Home Buyer discounts, residential VAT exemptions, QFZP structures, DLD fee negotiations, R&D credits, and DTA optimization are six tax-saving moves for luxury apartment buyers in 2025. With 5.5-7% yields, 10-15% capital gains, and no property, income, or gains taxes, these strategies minimize costs and maximize returns. Strategic planning and compliance position buyers to thrive in Dubai’s elite real estate market. Tax Saving Moves for Luxury Apartment

read more: Dubai Real Estate: 7 Post-Tax Planning Tools for Property Developers in 2025