Now Reading: Dubai Property for Expats: Legal, Location, and Lifestyle Tips

-

01

Dubai Property for Expats: Legal, Location, and Lifestyle Tips

Dubai Property for Expats: Legal, Location, and Lifestyle Tips

Table of Contents

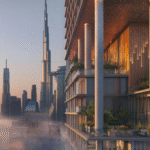

Property for Expats: Imagine settling into a sleek apartment with views of Dubai’s glittering skyline or a cozy villa in a family-friendly suburb, knowing your investment is secure and your new home fits your expat lifestyle perfectly. Dubai’s real estate market is a haven for expatriates, offering freehold properties, high rental yields, and a vibrant, multicultural environment. With no personal income tax, capital gains tax, or annual property taxes, you keep far more than in cities like London or New York, where taxes can erode 15-40% of profits.

The UAE’s dirham, pegged to the U.S. dollar, eliminates currency risk, and residential sales are VAT-exempt, saving thousands. With a 5% population surge, 25 million tourists, and 5-8% price appreciation expected in 2025, Dubai’s 6-10% rental yields outshine global hubs like London (2-4%) or New York (3-4%).

Properties over $545,000 qualify for a 10-year Golden Visa, offering residency perks. This guide provides expats with essential legal, location, and lifestyle tips for buying property in Dubai, focusing on top areas like Dubai Marina, Jumeirah Village Circle (JVC), Dubai Hills Estate, Business Bay, and Palm Jumeirah.

Understanding Dubai’s Legal Framework for Expats

Navigating Dubai’s property laws is straightforward for expats, thanks to freehold zones that allow 100% foreign ownership. Unlike leasehold markets, freehold properties in designated areas let you own the title deed outright, enabling resale, rental, or personal use without restrictions.

With 58% of buyers being non-residents, Dubai’s market is expat-friendly. The Dubai Land Department (DLD) oversees transactions, requiring a 4% transfer fee ($5,445-$200,000 based on property value), a 2% broker fee ($2,723-$100,000), and a 10% deposit ($13,613-$500,000) for purchases. Off-plan properties may incur a 5% VAT ($6,806-$250,000), recoverable through Federal Tax Authority (FTA) registration for $500-$1,000.

For properties over $545,000, expats can apply for a 10-year Golden Visa, granting residency without a sponsor and family sponsorship perks. The process requires a DLD valuation and $1,000-$2,000 in fees. Ensure the developer uses an escrow account under the 2025 Oqood system to protect your investment from delays or fraud. A free zone company as a Qualified Free Zone Person (QFZP) eliminates corporate tax on rental income up to $174,400, saving $15,696 annually.

Small business relief waives corporate tax for revenues under $816,000 until December 31, 2026. U.S. expats report rental income on Schedule E, deducting depreciation ($5,940-$148,364) and management fees ($914-$26,109), saving up to $43,273. Non-U.S. expats benefit from double taxation treaties with 130+ countries, avoiding taxes like the UK’s 20-28% capital gains tax. Always consult a tax professional and verify developer credentials to ensure compliance.

Dubai Marina: Vibrant Waterfront Living

Dubai Marina, a freehold free zone, is a top choice for expats seeking a lively urban lifestyle. Offering 1-3 bedroom apartments ($272,250-$816,750) with 6-8% rental yields, projects like Marina Gate feature yacht views, DMCC Metro access, and proximity to Marina Walk. A $400,000 apartment yields $24,000-$32,000 tax-free annually, versus $16,800-$22,400 elsewhere. With 6.2% price growth, selling it for $600,000 yields a $200,000 tax-free profit, saving $40,000-$56,000. Golden Visa eligibility applies for properties over $545,000.

Initial costs include a 4% DLD fee ($10,890-$32,670), 2% broker fee ($5,445-$16,335), and a 10% deposit ($27,225-$81,675). Annual maintenance fees are $2,000-$5,000, and landlords pay a 5% municipality fee ($1,200-$1,600). Short-term rentals, leveraging 25 million tourists, boost yields by 10-20%, ideal for expats who travel frequently. The area’s low 4% vacancy rate ensures steady income.

Expats love the waterfront dining, beach access, and vibrant nightlife, making Dubai Marina perfect for young professionals or couples seeking an energetic lifestyle.

Jumeirah Village Circle (JVC): Affordable Community Charm

Jumeirah Village Circle (JVC), a freehold free zone, offers budget-friendly options with studios to 2-bedroom apartments ($136,125-$408,375) and villas ($544,500-$816,750), delivering 7-10% rental yields. Projects like Belgravia feature parks, schools, and Circle Mall access, attracting expat families and young professionals. A $200,000 apartment yields $14,000-$20,000 tax-free annually, versus $9,800-$14,000 elsewhere. With 7% price growth, selling it for $300,000 yields a $100,000 tax-free profit, saving $20,000-$28,000.

Initial costs include a 4% DLD fee ($5,445-$32,670), 2% broker fee ($2,723-$16,335), and a 10% deposit ($13,613-$81,675). Annual maintenance fees are $1,500-$5,000, and landlords pay a 5% municipality fee ($700-$1,600). A free zone company saves $6,534 on $65,340 in rental income. U.S. expats can deduct depreciation ($5,940-$29,673) and management fees ($914-$5,227), saving up to $11,006. JVC’s 5% vacancy rate ensures consistent tenancy.

Its relaxed, green spaces and proximity to Al Khail Road (10 minutes to Downtown) make JVC ideal for expats seeking affordability and community.

Dubai Hills Estate: Upscale Family Haven

Dubai Hills Estate, a freehold gated community, offers 2-3 bedroom apartments ($408,375-$816,750) and 3-6 bedroom villas ($680,625-$2.18 million) with 5-8% yields, perfect for expat families. Projects like Sidra Villas feature golf-course views, Dubai Hills Mall, and top schools like GEMS Wellington. A $600,000 villa yields $30,000-$48,000 tax-free annually, versus $21,000-$33,600 elsewhere. With 6-8% price growth, selling it for $900,000 yields a $300,000 tax-free profit, saving $60,000-$84,000. Golden Visa eligibility applies.

Initial costs include a 4% DLD fee ($16,335-$87,200), 2% broker fee ($8,168-$43,600), and a 10% deposit ($40,838-$217,800). Annual maintenance fees are $3,000-$10,000, and landlords pay a 5% municipality fee ($1,500-$2,400). A free zone company saves $8,720 on $87,200 in rental income. U.S. expats can deduct depreciation ($14,836-$79,273) and management fees ($2,283-$8,727), saving up to $17,341. Vacancy rates below 4% reflect strong family demand.

Expats enjoy the secure gates, parks, and 15-minute drive to Downtown, making it a serene family retreat.

Business Bay: Corporate Expat Hub

Business Bay, a freehold free zone, offers studios to 3-bedroom apartments ($272,250-$1.09 million) with 6-8% yields, ideal for expat professionals. Projects like Peninsula Four feature canal views and DIFC proximity, with a 17% office rent increase signaling corporate demand. A $400,000 apartment yields $24,000-$32,000 tax-free annually, versus $16,800-$22,400 elsewhere. With 5-8% price growth, selling it for $600,000 yields a $200,000 tax-free profit, saving $40,000-$56,000. Golden Visa eligibility applies.

Initial costs include a 4% DLD fee ($10,890-$43,560), 2% broker fee ($5,445-$21,780), and a 10% deposit ($27,225-$109,000). Annual maintenance fees are $2,000-$6,000, and landlords pay a 5% municipality fee ($1,200-$1,600). A free zone company saves $8,720 on $87,200 in rental income. U.S. expats can deduct depreciation ($9,891-$39,636) and management fees ($1,523-$6,976), saving up to $14,678. Vacancy rates below 4% ensure steady tenancy.

Its urban energy and metro access make Business Bay a top pick for career-driven expats.

Palm Jumeirah: Luxurious Coastal Retreat

Palm Jumeirah, a freehold free zone, offers 1-3 bedroom apartments ($544,500-$1.36 million) and 3-7 bedroom villas ($1 million-$5 million) with 5-7% yields, perfect for expats seeking luxury. Projects like The Royal Atlantis feature private beaches and resort-style dining. A $1 million apartment yields $50,000-$70,000 tax-free annually, versus $35,000-$49,000 elsewhere. With 5-8% price growth, selling it for $1.5 million yields a $500,000 tax-free profit, saving $100,000-$140,000. Golden Visa eligibility applies.

Initial costs include a 4% DLD fee ($21,780-$200,000), 2% broker fee ($10,890-$100,000″?>

Initial costs include a 4% DLD fee ($21,780-$200,000), 2% broker fee ($10,890-$100,000), and a 10% deposit ($54,450-$500,000). Annual maintenance fees are $8,000-$15,000, and landlords pay a 5% municipality fee ($2,500-$3,500). A free zone company saves $15,696 on $174,400 in rental income. U.S. expats can deduct depreciation ($29,673-$148,364) and management fees ($4,564-$26,109), saving up to $34,682. Short-term rentals boost yields by 10-20%.

Expats love the resort-like lifestyle, with beachfront views and exclusivity, ensuring high demand.

Lifestyle Tips for Expat Property Owners

Choose your lifestyle wisely when picking a location. Dubai Marina suits expats who crave vibrant nightlife and waterfront dining, with short-term rentals boosting income. JVC is ideal for budget-conscious families seeking green spaces and affordability. Dubai Hills Estate offers upscale, family-friendly living with schools and parks. Business Bay caters to professionals needing urban connectivity, while Palm Jumeirah delivers luxury for vacation-focused expats.

Consider proximity to workplaces, schools, and amenities like Dubai Hills Mall or Marina Walk. Short-term rentals in tourist-heavy areas like Dubai Marina or Palm Jumeirah maximize yields, while long-term leases in JVC or Dubai Hills ensure stability. Regular maintenance ($1,500-$15,000 annually) keeps tenants happy and properties competitive.

Strategies to Maximize Your Investment

To optimize your investment, use these strategies. First, target high-demand areas like Dubai Marina for short-term rentals or JVC for affordability. Second, set up a free zone company as a QFZP, saving $2,000-$15,000 annually on corporate tax.

Third, recover 5% VAT ($6,806-$250,000) on off-plan purchases via FTA registration. Fourth, leverage small business relief for revenues under $816,000 until December 31, 2026. Fifth, consult a tax professional to maximize deductions or treaty benefits. Sixth, choose trusted developers like Emaar or Nakheel to avoid delays. Seventh, monitor market trends to stay ahead of oversupply risks (41,000 new units).

Navigating Risks for Expats

Risks include off-plan delays and economic shifts. Mitigate by verifying escrow compliance under the 2025 and choosing established developers. Ensure QFZP eligibility to avoid fines up to $136,125. Long-term leases in Dubai Hills or JVC ensure stable income, while short-term rentals in Dubai Marina offset risks. Regular market analysis keeps you informed.

Why Expats Choose Dubai’s Properties

Dubai’s freehold zones offer expats legal simplicity, high 6-10% yields, and vibrant lifestyles. Dubai Marina provides waterfront excitement, JVC offers affordability, Dubai Hills delivers family-friendly luxury, Business Bay suits professionals, and Palm Jumeirah ensures coastal prestige.

With Golden Visa perks, tax-free profits, and low vacancies, these areas are perfect for expats seeking a home and investment in 2025.

read more: Top Areas in Dubai With High Tenant Demand and Low Vacancies