Dubai has quickly become one of the world’s most attractive cities for property investors. Known for its luxury lifestyle, world-class infrastructure, and zero income tax, it’s no surprise that foreign investors are flocking to the UAE’s real estate market. If you’re thinking about buying property in Dubai for the first time, this guide will help you make smart, informed decisions.

Whether you’re investing for rental income, capital growth, or a second home, here’s everything you need to know.

There are several reasons why Dubai is a favorite destination for property investment:

Dubai’s real estate market is regulated and transparent, offering security and trust to international investors. According to the Dubai Land Department (DLD), property transactions have increased steadily, showing strong confidence in the market.

There are many kinds of properties you can invest in:

Each type has its pros and cons. Apartments are easier to rent out, while villas offer more space and privacy.

Foreigners can buy property in freehold areas. These include popular locations like:

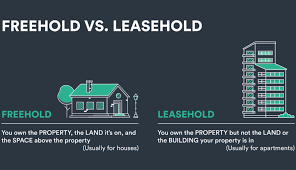

In freehold areas, buyers own the property and the land outright. In leasehold areas, ownership is limited to a 10–99 year lease, after which ownership reverts to the landowner.

Always confirm with the Dubai Land Department or your real estate agent whether a property is in a freehold zone.

Here’s how the buying process typically works in Dubai:

Decide how much you want to invest. Don’t forget to account for extra costs like:

Your location depends on your goals. For rental income, choose high-demand areas like Downtown, Marina, or JVC. For long-term growth, look at emerging areas like Dubai South or Meydan.

Work only with agents registered with the Real Estate Regulatory Agency (RERA). A good agent can help you find the best properties and guide you through paperwork.

Once you’ve chosen a property, sign a Memorandum of Understanding (MoU) and pay a 10% deposit.

Complete payments, clear all checks, and register the property with the Dubai Land Department. This is when the title deed is issued in your name.

Yes, non-residents and residents can get mortgages in Dubai. However:

To apply, you’ll need documents such as:

It’s best to get a pre-approval before property hunting. Many local and international banks offer mortgage services in the UAE.

Off-plan properties are popular among first-time investors because:

However, they come with some risks:

Always check if the project is registered with RERA and if the developer has a strong track record.

Dubai’s property laws are investor-friendly, but it’s crucial to stay informed and cautious.

Aside from the property price, you should budget for:

| Expense | Cost |

|---|---|

| DLD Registration Fee | 4% of property value |

| Agency Commission | 2%–5% |

| NOC Fees (if applicable) | AED 500–5,000 |

| Mortgage Fees | 1% of loan + valuation fee |

| Trustee Fee | AED 4,000 (approx.) |

Investors who buy property worth AED 2 million or more may qualify for the UAE Golden Visa, allowing long-term residency.

This is a huge benefit for those looking to live, work, or retire in the UAE.

Dubai offers a dynamic property market with great opportunities for first-time investors. Whether you’re looking for high rental yields, long-term capital growth, or a dream holiday home, Dubai has it all.

Just remember to do your homework, work with professionals, and think long-term.

Read More:- Shobha Realty Launches Its Most Luxurious Project Yet—Full Details Inside 2025