Now Reading: Dubai Property Market 2025: Prices Soar Beyond Expectations

-

01

Dubai Property Market 2025: Prices Soar Beyond Expectations

Dubai Property Market 2025: Prices Soar Beyond Expectations

Table of Contents

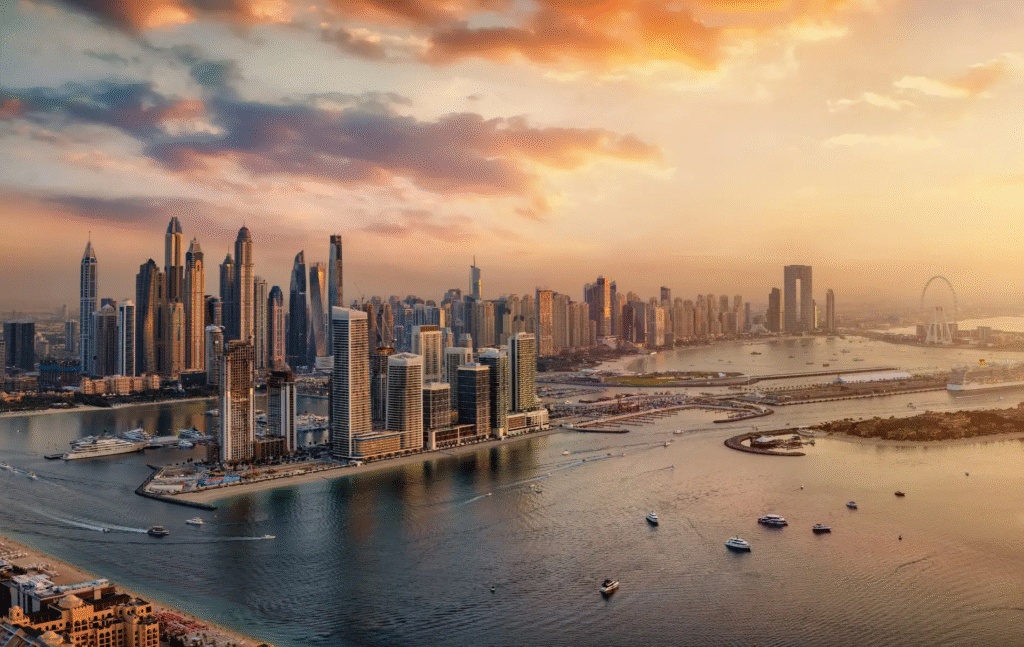

The Dubai property market is booming again in 2025. After a strong comeback post-pandemic, the city’s real estate sector is reaching new heights. With high rental yields, tax-free policies, and government reforms, Dubai is once again a global magnet for property buyers, investors, and developers.

Whether you’re looking to buy a luxury penthouse, an affordable apartment, or a commercial space, there is something for everyone in this dynamic market.

A Quick Glance at the 2025 Market

Dubai’s property prices have risen steadily in the first half of 2025. According to data from the Dubai Land Department, real estate transactions hit over AED 180 billion in the first quarter alone. This is a 25% jump from the same period in 2024.

Key areas like Downtown Dubai, Palm Jumeirah, Dubai Marina, and Business Bay continue to attract wealthy investors. Meanwhile, emerging communities such as Dubai South, Jumeirah Village Circle (JVC), and Arjan are gaining popularity for offering budget-friendly and off-plan projects.

What’s Driving the Surge?

Several factors are fueling the rise of Dubai’s real estate market:

- Strong Demand from Foreign Investors

Buyers from Europe, India, China, and the GCC are investing heavily in Dubai. The city’s tax-free income, residency visa options, and strong return on investment (ROI) are key reasons behind this trend. - Golden Visa and Residency Benefits

Dubai’s 10-year Golden Visa is now available to property buyers who invest AED 2 million or more. This move has made long-term residency easier for investors, encouraging them to choose Dubai as a second home. - Tourism and Expo 2020 Legacy

Dubai continues to attract millions of tourists every year. The success of Expo 2020 brought long-term benefits to infrastructure, business, and global attention. Investors see Dubai as a safe and growing destination. - Technology and Smart Homes

Developers are now offering smart homes with AI-powered systems, green building designs, and luxury amenities. Projects such as “The Oasis by Emaar” and “Sobha Hartland II” are examples of modern living at its finest.

Rising Rental Yields Attract Landlords

Dubai offers some of the highest rental yields in the world. On average, investors can expect:

- Apartments: 6–8% rental yield

- Villas: 4–6% rental yield

- Short-term rentals: 10%+ in tourist-heavy zones

This makes Dubai especially attractive to landlords and short-term rental operators on platforms like Airbnb and Booking.com.

Affordable Housing Sees a Surge Too

It’s not just the luxury market that’s booming. Affordable and mid-range housing projects are in high demand. Areas like Dubai Silicon Oasis, Al Furjan, and Jumeirah Village Triangle are popular among first-time buyers and young families.

In response, developers are launching more budget-friendly units, with flexible payment plans and post-handover schemes. For as little as AED 400,000, one can buy a studio apartment in key communities.

Government Reforms Support Real Estate Growth

Dubai’s government continues to roll out investor-friendly reforms:

- 100% foreign ownership in business sectors

- Faster property registration via blockchain systems

- Stricter regulations on brokers for better transparency

- Sustainability-focused building codes for greener developments

These measures build global trust and attract institutional investors and individual buyers alike.

Off-Plan Projects on the Rise

Off-plan sales (buying property before construction) have grown significantly. Buyers prefer off-plan due to:

- Lower upfront costs

- Flexible payment plans (as low as 1% monthly)

- Potential capital gains upon project completion

Popular off-plan developments in 2025 include:

- Emaar Beachfront

- Damac Lagoons

- Sobha SeaHaven

- Tilal Al Ghaf by Majid Al Futtaim

These projects promise not only luxury but also strong returns and lifestyle experiences.

Challenges Still Exist

While the market is strong, a few risks remain:

- Oversupply in some segments could lead to price corrections in future.

- High-interest rates globally may impact mortgage-driven buyers.

- Regulatory compliance must be followed strictly by foreign investors.

However, experts believe Dubai’s transparency, investor protection laws, and proactive government will continue to maintain growth and stability.

Outlook for the Second Half of 2025

Experts predict:

- A continued rise in property values in prime locations

- More foreign investment due to relaxed residency laws

- A steady shift towards eco-friendly and tech-based developments

- Better regulation in the brokerage and off-plan market

As global cities face economic uncertainty, Dubai remains a stable, profitable, and appealing market.

Should You Invest in Dubai Property Now?

If you are an investor looking for high ROI, long-term value, or even a luxury lifestyle, the answer is: Yes. Dubai offers one of the safest and fastest-growing real estate markets in the world.

Before investing, consider these tips:

- Choose the right location closer to business districts or tourist zones

- Understand developer reputation and past project delivery

- Opt for properties that offer long-term value, not just short-term hype

- Work with RERA-approved brokers for verified deals

Conclusion: Dubai Property Market Is in Full Swing

Dubai stands out as a global real estate powerhouse. From skyline views and luxury beachfront villas to affordable apartments and high-yield commercial properties, there’s no shortage of opportunities.

With visionary leadership, growing infrastructure, and supportive laws, the Dubai property market is not just surviving it’s thriving. Whether you’re a buyer, investor, or tenant, this is a market worth exploring right now.

Read More:- Deyaar’s Latest Announcement Shakes Up the UAE Property Market