Now Reading: Dubai Property Prices Surge Again in July 2025 Update

-

01

Dubai Property Prices Surge Again in July 2025 Update

Dubai Property Prices Surge Again in July 2025 Update

Table of Contents

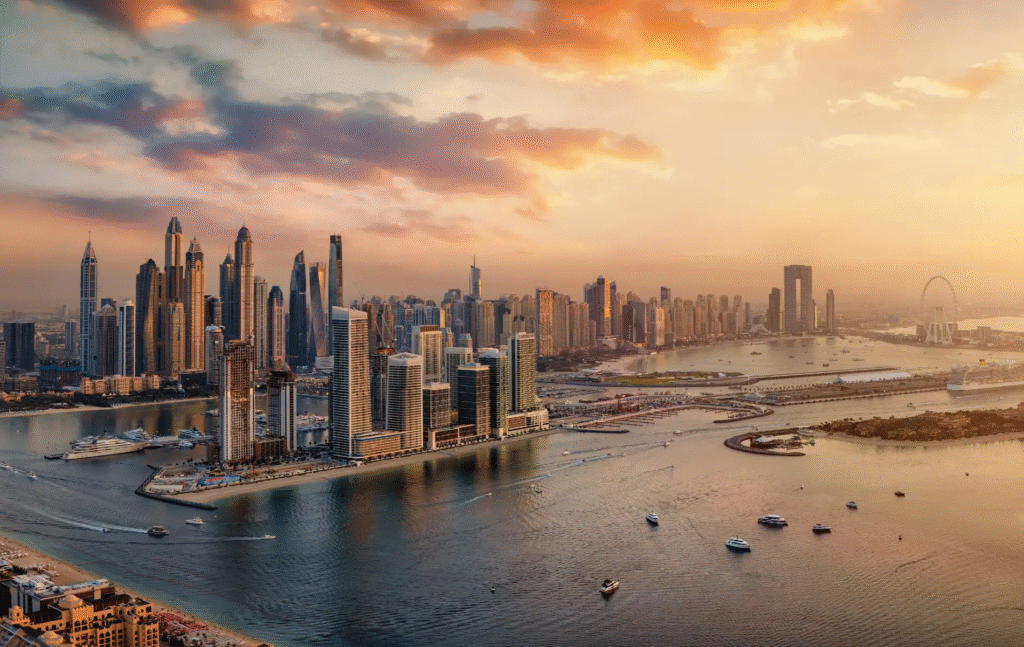

The Dubai property market continues to show strong performance in July 2025, with new data indicating rising sales, growing investor confidence, and record interest in off-plan properties. Despite global economic uncertainties, Dubai’s real estate sector is proving resilient, attracting both local and international buyers.

The monthly update by Dubai Land Department (DLD) and various property platforms highlights a major increase in transactions compared to July last year. Analysts credit this growth to a mix of investor-friendly policies, growing demand for luxury units, and continued population growth driven by expat arrivals.

Over 12,000 Transactions in July

According to the latest data, Dubai recorded more than 12,300 property transactions in July alone. This represents a 17% year-on-year increase from July 2024 and maintains the strong momentum seen throughout the first half of the year.

Of these transactions, around 55% were off-plan sales, showing strong trust in upcoming developments. Developers like Emaar, Sobha, DAMAC, and Nakheel continue to dominate the market with high-end launches and attractive payment plans.

Popular areas for sales in July included:

- Dubai Marina

- Business Bay

- Jumeirah Village Circle (JVC)

- Dubai Creek Harbour

- Downtown Dubai

These communities attracted both investors and end-users due to high rental returns, lifestyle offerings, and increasing connectivity.

Prices Continue to Climb, Especially for Villas

The average property price per square foot rose to AED 1,650, marking an 8% increase compared to July last year. Villas and townhouses showed the most significant appreciation due to limited supply and rising demand from families seeking larger living spaces.

Key price insights:

- Villa prices in Arabian Ranches and Dubai Hills Estate saw a rise of 12–15% year-on-year.

- Apartments in Business Bay and JLT increased by around 6–9%, depending on the tower and view.

- Luxury beachfront units in areas like Palm Jumeirah and Emaar Beachfront continue to break records, with some units selling above AED 6,000 per square foot.

Rental prices have also risen, providing a strong case for buy-to-let investors. Yields remain attractive, with average gross rental returns ranging between 6% and 9% across most communities.

Foreign Investors Flock to Dubai

Dubai remains a top choice for international property investors. The government’s ongoing visa reforms and residency programs tied to property investment (like the Golden Visa for AED 2 million+ investments) continue to attract high-net-worth individuals.

Top buying nationalities in July 2025 included:

- India

- Russia

- United Kingdom

- China

- Pakistan

- Saudi Arabia

Investors see Dubai as a tax-free, stable, and high-return market. The city’s safe environment, strong legal system, and rapid infrastructure development make it an ideal place to buy property in 2025.

Off-Plan Segment Leads the Market

The off-plan segment continues to thrive, with developers launching new projects across the city. Flexible post-handover payment plans and high resale potential are key factors driving this demand.

Hot off-plan projects launched in July 2025 include:

- Emaar’s Creek Waters 3 at Dubai Creek Harbour

- Sobha Hartland Phase 3

- DAMAC Lagoons – Morocco cluster

- Nakheel’s Palm Jebel Ali villas

Buyers are attracted to the lower entry prices, customization options, and potential for capital appreciation before completion. Experts advise due diligence when choosing a developer and understanding project timelines before investing.

Real Estate Experts Remain Bullish

Industry experts believe the Dubai property market will continue to grow in the second half of 2025, albeit at a more moderate pace. Rising interest rates globally and inflation concerns may slow down some speculative buyers, but end-user demand remains strong.

Haider Taufiq, Senior Analyst at DRE Insights, said:

“Dubai’s market fundamentals remain solid. With Expo City expansion, improved visa regulations, and high population growth, the real estate sector is set for continued upward movement.”

Other real estate analysts also point to increased government spending on infrastructure and upcoming mega projects as long-term growth drivers. New zones like Dubai South and Meydan are expected to become future hubs of residential and commercial activity.

Buyer Tips for July–August 2025

If you’re considering entering the Dubai real estate market now, here are some expert tips:

- Compare locations carefully Areas like Dubai Hills, JVC, and Arjan offer good value.

- Look for developer reputation when choosing off-plan stick to names with proven delivery.

- Check rental yield potential before purchasing not all units offer high returns.

- Read the fine print watch out for service charges, payment plans, and handover dates.

- Use RERA-approved brokers avoid unlicensed agents to stay protected legally.

Final Thoughts

Dubai’s property market is going through one of its most exciting phases in recent years. July 2025 confirms that investor confidence is strong, prices are climbing steadily, and demand for quality properties remains robust.

Whether you’re an investor looking for capital growth, a family seeking a dream home, or a global buyer interested in a second home, Dubai is proving to be one of the best real estate destinations in the world.

With a growing economy, international appeal, and world-class infrastructure, Dubai real estate is not just a trend it’s a long-term opportunity.

Read More:- Deyaar’s Latest Announcement Shakes Up the UAE Property Market