Now Reading: Dubai Real Estate: 6 Golden Visa Zones Gaining Global Buyer Interest in 2025

-

01

Dubai Real Estate: 6 Golden Visa Zones Gaining Global Buyer Interest in 2025

Dubai Real Estate: 6 Golden Visa Zones Gaining Global Buyer Interest in 2025

Table of Contents

Dubai’s real estate market, contributing AED 761 billion ($207 billion) to the UAE’s AED 893 billion in 2024 transactions, continues to flourish in 2025, driven by a 6.2% GDP growth forecast and a population of 3.85 million, per deloitte.com.

The Golden Visa program, requiring a minimum AED 2 million ($545,000) property investment for a 10-year renewable residency, has significantly boosted global buyer interest, with 42,000 transactions in Q1 2025 (AED 114.4 billion), per timesofindia.indiatimes.com. Relaxed rules, including no minimum down payment and off-plan property eligibility (if 50% complete), have fueled demand.

Below are six Golden Visa-eligible freehold zones in Dubai attracting global buyers in 2025, their investment potential, key features, and compliance steps with the Dubai Land Department (DLD) and Federal Tax Authority (FTA).

1. Dubai Marina

Overview: A premier waterfront destination, Dubai Marina offers luxury apartments and penthouses with prices starting at AED 1.5 million ($408,200). It recorded a 7.8% price increase in 2024, per gulfnews.com.

Investment Potential: Yields of 6-7% (e.g., AED 105,000/year for a AED 1.5 million apartment) and 7-10% capital gains by 2026, per novviproperties.com. High demand from tourists and professionals, with 17% of foreign buyers from the UK, per dxbinteract.com. Golden Visa eligibility enhances appeal, per tencohomes.com.

Key Features: Yacht-lined marina, vibrant nightlife, and beach access. Prices average AED 1,558/sq.ft., per guestready.com. Projects like Oceanz by Danube (handovers Q1 2027) drive interest, per bayut.com.

Compliance: Verify freehold status and obtain a DLD valuation certificate for AED 2 million+ investment. Register Sales Purchase Agreements (SPAs) via Ejari. Retain records for FTA audits, per dubailand.gov.ae.

2. Palm Jumeirah

Overview: An iconic man-made island, Palm Jumeirah features luxury villas, townhouses, and apartments starting at AED 3.5 million ($952,800). It saw 19.5% price growth in 2024, per globalpropertyguide.com.

Investment Potential: Yields of 6-8% (e.g., AED 280,000/year for a AED 3.5 million villa) and 8-12% capital gains by 2026, per grovy.ae. Attracts HNWIs (43% of buyers with $15 million+ wealth), per forbes.com. Golden Visa demand drives 22% of Indian buyer interest, per dxbinteract.com.

Key Features: Beachfront properties, 5-star hotels, and retail. Prices average AED 2,500/sq.ft., per colife.ae. Ongoing Nakheel developments enhance value, per off-planproperties.ae.

Compliance: Obtain a DLD letter confirming AED 2 million+ investment. Register SPAs and leases via Ejari. Ensure AML/KYC compliance. Retain records for FTA audits, per gtlaw.com.

3. Dubai Hills Estate

Overview: A 2,700-acre master-planned community by Emaar and Meraas, offering villas and apartments from AED 1.8 million ($490,000). It recorded 7,397 transactions worth AED 23.4 billion in 2024, per topluxuryproperty.com.

Investment Potential: Yields of 6.5-8% (e.g., AED 144,000/year for a AED 1.8 million apartment) and 8-10% capital gains by 2026, per properties.emaar.com. Family-friendly appeal and Golden Visa eligibility attract Chinese (14%) and Saudi (11%) buyers, per dxbinteract.com.

Key Features: Golf course, parks, schools, and retail. Prices average AED 1,600/sq.ft., per gulfbusiness.com. Projects like The Oasis (handovers Q3 2025) boost demand, per properties.emaar.com.

Compliance: Verify DLD-approved escrow accounts for off-plan purchases. Register SPAs via Ejari. Retain records for FTA audits, per taxvisor.ae.

4. Downtown Dubai

Overview: Home to Burj Khalifa and Dubai Mall, Downtown Dubai offers luxury apartments and penthouses starting at AED 2 million ($545,000). Prices rose 16.9% in 2024, per forbes.com.

Investment Potential: Yields of 6-7% (e.g., AED 140,000/year for a AED 2 million apartment) and 7-10% capital gains by 2026, per tencohomes.com.

High rental demand from professionals and tourists, with 22% of buyers from India, per dxbinteract.com. Golden Visa drives HNWI interest, per forbes.com.

Key Features: Iconic skyline views, luxury retail, and dining. Prices average AED 2,200/sq.ft., per grovy.ae. New launches like Burj Al Arab Tower residences

Compliance: Obtain a DLD valuation certificate for AED 2 million+ investment. Register SPAs via Ejari. Retain records for FTA audits, per dubailand.gov.ae.

5. Dubai South

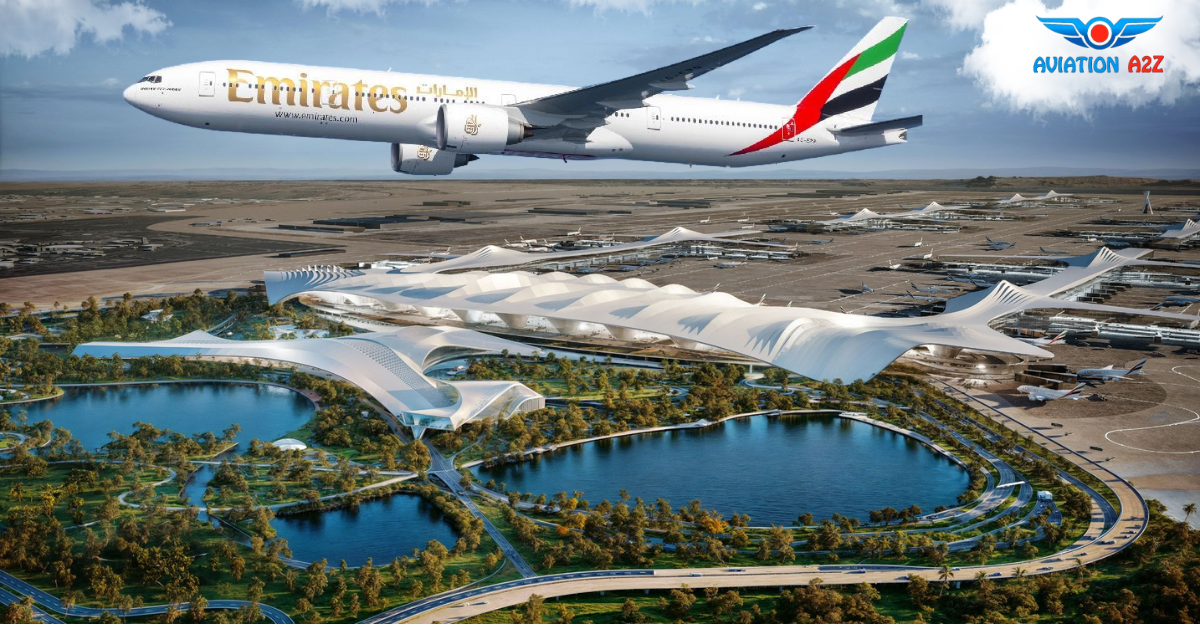

Overview: Near Al Maktoum International Airport and Expo City, Dubai South offers affordable apartments and villas from AED 954/sq.ft. It’s a growing hub with projects like Hayat (launched June 2025, handovers Q3 2027), per @propertynews_i.

Investment Potential: Yields of 6-8% (e.g., AED 80,000/year for a AED 1 million apartment) and 6-10% capital gains by 2026, per tencohomes.com. Golden Visa eligibility and affordability attract first-time buyers and Russian investors (9%), per dxbinteract.com.

Key Features: Metro connectivity, wellness-focused communities, and commercial hubs. Prices average AED 1,000/sq.ft., per colife.ae.

Compliance: Verify freehold status and escrow accounts with DLD. Register SPAs via Ejari. Retain records for FTA audits, per taxvisor.ae.

6. Dubai Islands

Overview: A new waterfront destination with five islands, offering villas, townhouses, and apartments from AED 1.63 million ($444,000). Projects like Bonds Avenue Residences (handovers Q3 2028) drive interest.

Investment Potential: Yields of 6-7.5% (e.g., AED 122,250/year for a AED 1.63 million apartment) and 6-10% capital gains by 2029, per tencohomes.com. Emerging status and Golden Visa eligibility attract global buyers, including Britons (17%), per dxbinteract.com.

Key Features: Resort-style amenities, lagoons, and beachfront living. Prices average AED 1,500/sq.ft., per grovy.ae.

Compliance: Ensure DLD-approved escrow accounts for off-plan purchases. Register SPAs via Ejari. Retain records for FTA audits, per dubailand.gov.ae.

Why These Zones Matter

These Golden Visa zones align with Dubai’s 2025 market strength, with a 19.4% price surge and 19% rental growth in 2024, per deloitte.com. The Golden Visa’s relaxed rules—no minimum down payment and off-plan eligibility—have driven a 60.6% surge in off-plan deals (109,527 in 2024), per globalpropertyguide.com.

Posts on X highlight Palm Jumeirah’s luxury appeal and Dubai South’s affordability for Golden Visa investors, per @luxury_playbook and @DXBMediaOffice.

Challenges include a potential 15% price correction in H2 2025 due to 182,000 new units by 2026 and rising interest rates (4.4-6.25%), mitigated by high occupancy (95-97%) and tax-free returns, per timesofindia.indiatimes.com. The program’s benefits, including family sponsorship and no residency requirement, attract HNWIs and expats, per knsproperty.com.

Tax Tools for American Investors

U.S.-UAE DTA: Credit UAE taxes via IRS Form 1118, preserving 10-15% returns, per immigrantinvest.com.

Zakat for Muslim Investors: Pay 2.5% Zakat on rental income (e.g., AED 2,500 on AED 100,000). Consult Islamic scholars, per taxvisor.ae.

VAT Recovery: Recover 5% input VAT on commercial expenses (e.g., AED 25,000 on AED 500,000) for VAT-registered investors, per fintedu.com.

Market Outlook and Challenges

Dubai’s 5-6% GDP growth, 19 million tourist arrivals in 2024, and infrastructure projects like Al Maktoum Airport expansion fuel demand, per pangeadubai.com. The Golden Visa program supports Dubai’s D33 Agenda, doubling the economy by 2030, per forbes.com.

Risks include oversupply and global economic uncertainties, offset by high yields and DLD’s transparency measures, per tencohomes.com. These zones offer diverse options for global investors seeking residency and returns.

Conclusion

Dubai Marina, Palm Jumeirah, Dubai Hills Estate, Downtown Dubai, Dubai South, and Dubai Islands are top Golden Visa zones in 2025, offering 6-8% yields and 6-12% capital gains.

Driven by relaxed visa rules, luxury appeal, and infrastructure growth, these areas attract global buyers. Compliance with DLD and FTA ensures secure, high-return investments in Dubai’s dynamic market.

read more: Dubai Property: 7 Waterfront Projects Offering Premium Living in 2025