Now Reading: Dubai Real Estate: 7 Landmark Projects Redefining Urban Living in 2025

-

01

Dubai Real Estate: 7 Landmark Projects Redefining Urban Living in 2025

Dubai Real Estate: 7 Landmark Projects Redefining Urban Living in 2025

Table of Contents

Landmark Projects : Dubai’s real estate market in 2025 is thriving, with 169,000 transactions (AED 488B) in 2024 and a projected population of 4M by 2026, driving demand for innovative urban developments. Seven landmark projects—spanning Dubai Creek Harbour, Palm Jumeirah, Downtown Dubai, and emerging areas like Dubai South and Jumeirah Village Circle (JVC)—are redefining urban living through luxury, sustainability, and smart technology.

These projects, led by developers like Emaar, Nakheel, and DAMAC, offer 6–15% rental yields, 5–30% price appreciation, and Golden Visa eligibility (AED 2M+), appealing to HNWIs (7,200 in 2024) and families. This guide details each project’s features, investment potential, and contribution to Dubai’s 2040 Urban Master Plan, addressing sustainability and market risks.

1. Dubai Creek Harbour (Emaar Properties)

- Location: Dubai Creek, near Ras Al Khor Wildlife Sanctuary.

- Features: A 6 sq km waterfront community with the Dubai Creek Tower (set to surpass Burj Khalifa as the world’s tallest), luxury residential towers, villas, and penthouses. Includes waterfront promenades, yacht marina, retail spaces, and eco-friendly designs (LEED Gold aspirant, solar panels, smart irrigation).

- Price Range: AED 1.5M–50M (apartments, villas, penthouses).

- Investment Potential: 6–8% rental yields, 8–12% annual appreciation. Golden Visa eligible. High demand from HNWIs and long-term investors due to proximity to Dubai Creek Tower and Festival City Mall (15 minutes).

- Why It Redefines Urban Living: Combines sustainable design (20% energy savings via solar and smart systems) with high walkability and cultural landmarks, creating a vibrant, eco-conscious community.

- Status: Ongoing, with new towers and Creek Tower completion expected by 2026.

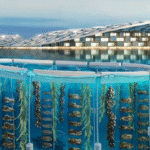

2. Palm Jebel Ali (Nakheel)

- Location: South of Palm Jumeirah, 80% larger than its predecessor.

- Features: Luxury villas, waterfront residences, and entertainment zones across a palm-shaped island. Incorporates solar power, water recycling (15% water savings), and sustainable transport (bike lanes, EV charging). Amenities include private beaches, marinas, and retail hubs.

- Price Range: AED 10M–100M (villas, waterfront homes).

- Investment Potential: 6–9% yields, 10–15% appreciation, driven by exclusivity and tourism (20M visitors projected for 2025). Golden Visa eligible.

- Why It Redefines Urban Living: Offers resort-style, eco-friendly living with unmatched waterfront access, doubling Palm Jumeirah’s scale and integrating smart infrastructure for net-zero goals.

- Status: Off-plan, gaining momentum in 2025, with completion phases through 2027.

3. The Oasis (Emaar Properties)

- Location: Dubailand, near Al Qudra Road.

- Features: A master-planned community with townhouses and high-end villas, featuring expansive parks, fitness centers, dining establishments, and LEED Silver designs (solar water heaters, low-VOC materials, 11% water reduction). Emphasizes wellness and greenery.

- Price Range: AED 2M–40M (townhouses, villas).

- Investment Potential: 6–8% yields, 5–7% appreciation. Golden Visa eligible. Appeals to families seeking sustainable suburban living.

- Why It Redefines Urban Living: Blends urban luxury with nature, offering a serene, wellness-focused lifestyle with smart home systems and community amenities, aligning with Dubai’s green vision.

- Status: Off-plan, handover starting 2026.

4. Burj Binghatti (Binghatti Developers, Jacob & Co.)

- Location: Business Bay, Dubai Canal.

- Features: A 100+ story “hypertower” aiming to be the world’s tallest residential building. Offers 181 luxury apartments (2–3-bedroom, studios), with diamond-inspired design, infinity pools, spa, and 24/7 concierge (chauffeur, chef, bodyguard). Features sustainable materials and energy-efficient systems.

- Price Range: AED 5M–50M (apartments).

- Investment Potential: 6–8% yields, 10–15% appreciation, driven by its landmark status and central location. Golden Visa eligible.

- Why It Redefines Urban Living: Redefines ultra-luxury with bespoke services and iconic architecture, integrating eco-friendly systems for urban professionals and HNWIs.

- Status: Off-plan, completion expected in 2026.

5. Ciel Tower (The First Group, NORR)

- Location: Dubai Marina.

- Features: The world’s tallest hotel (360m, 82 floors, 1,042 luxury suites), with a rooftop observatory, glass-encased design, and Wabi-Sabi-inspired aesthetics. Includes solar panels, smart HVAC, and views of Burj Khalifa, Palm Jumeirah, and the Arabian Gulf.

- Price Range: AED 3M–20M (suites for investment).

- Investment Potential: 8–12% yields (short-term rentals), 8–10% appreciation. Golden Visa eligible. High tourist demand (20M visitors) ensures occupancy.

- Why It Redefines Urban Living: Combines vertical luxury with sustainable design, offering a hospitality-driven lifestyle in a prime urban hub.

- Status: Completed in H1 2024, fully operational in 2025.

6. Dubai Urban Tech District

- Location: Al Quoz, near Downtown Dubai.

- Features: A technology and innovation hub hosting startups, AI firms, and green tech companies. Includes eco-friendly residential apartments and commercial spaces with LEED Gold certification, solar energy (20% savings), and smart infrastructure (AI traffic optimization, digital services).

- Price Range: AED 1M–5M (apartments).

- Investment Potential: 6–8% yields, 5–8% appreciation. Appeals to professionals and tech entrepreneurs. Golden Visa eligible for AED 2M+ units.

- Why It Redefines Urban Living: Creates a collaborative, sustainable ecosystem for tech-driven urbanites, supporting Dubai’s goal to lead in AI and green technology.

- Status: Under construction, completion expected by 2030, with phases launching in 2025.

7. Marsa Al Arab (Jumeirah Group, Killa Designs)

- Location: Jumeirah, east of Burj Al Arab.

- Features: A reclaimed peninsula with a deluxe hotel, four super penthouses (up to AED 420M), nine high-end villas, a yacht club, and a 128-berth marina. Incorporates LEED Silver designs, solar power, and nautical-inspired architecture with infinity pools and private beaches.

- Price Range: AED 30M–420M (villas, penthouses).

- Investment Potential: 6–9% yields (short-term rentals), 10–15% appreciation, driven by luxury tourism and exclusivity. Golden Visa eligible.

- Why It Redefines Urban Living: Offers an ultra-luxury, resort-style experience with sustainable features, catering to HNWIs seeking privacy and opulence.

- Status: Completed in H2 2024, fully operational in 2025.

Investment Potential

- Rental Yields: 6–8% (long-term, Dubai Creek Harbour, The Oasis), 8–15% (short-term, Ciel Tower, Marsa Al Arab, Palm Jebel Ali). Short-term rentals thrive in tourist-heavy areas (20M visitors).

- Price Appreciation: 5–7% (suburban, e.g., The Oasis), 8–15% (prime, e.g., Burj Binghatti, Marsa Al Arab), 15–30% (Palm Jebel Ali, Dubai Creek Harbour).

- Golden Visa: Properties above AED 2M qualify for 10-year residency, attracting HNWIs and investors (150,000+ visas issued).

- Financing: Developer plans (1% monthly, 50% post-handover) and mortgages (2.99–4.99%) ease entry. A AED 5M property requires ~AED 1M down payment and AED 24,000/month (20 years, 4%).

- Demand Drivers: Population growth (3.92M, +89,695 in Q1 2025), tourism, and 60% cash transactions ensure market stability.

Sustainability and Market Resilience

- Green Features: All projects align with Dubai’s 2040 Urban Master Plan, integrating LEED certifications (Silver to Gold), solar power (10–30% energy savings), water recycling (11–15% savings), and smart systems (25% efficiency gains).

- Market Stability: Demand-driven market (20M tourists, 7,200 HNWIs), RERA regulations, and escrow accounts mitigate risks compared to 2008’s 40–60% crash.

- Risks: A 15% price correction is possible in H2 2025 (Fitch Ratings) due to 61,580 planned units. High absorption (80% since 2022) and cash deals (60%) reduce crash risks.

Conclusion

Dubai’s seven landmark projects in 2025—Dubai Creek Harbour, Palm Jebel Ali, The Oasis, Burj Binghatti, Ciel Tower, Dubai Urban Tech District, and Marsa Al Arab—redefine urban living through luxury, sustainability, and innovation. Offering 6–15% yields, 5–30% appreciation, and Golden Visa eligibility, they cater to diverse buyers, from families in The Oasis to HNWIs in Marsa Al Arab.

Sustainable features like LEED certification, solar power, and smart systems align with Dubai’s net-zero goals, while strong demand (3.92M population, 20M tourists) and regulatory safeguards ensure resilience. Landmark Projects

read more: Bluewaters Island: 5 Lifestyle Projects Attracting Global Property Buyers