Now Reading: Dubai Real Estate Strategies: Top Expert Tips for 2025 Success

-

01

Dubai Real Estate Strategies: Top Expert Tips for 2025 Success

Dubai Real Estate Strategies: Top Expert Tips for 2025 Success

Table of Contents

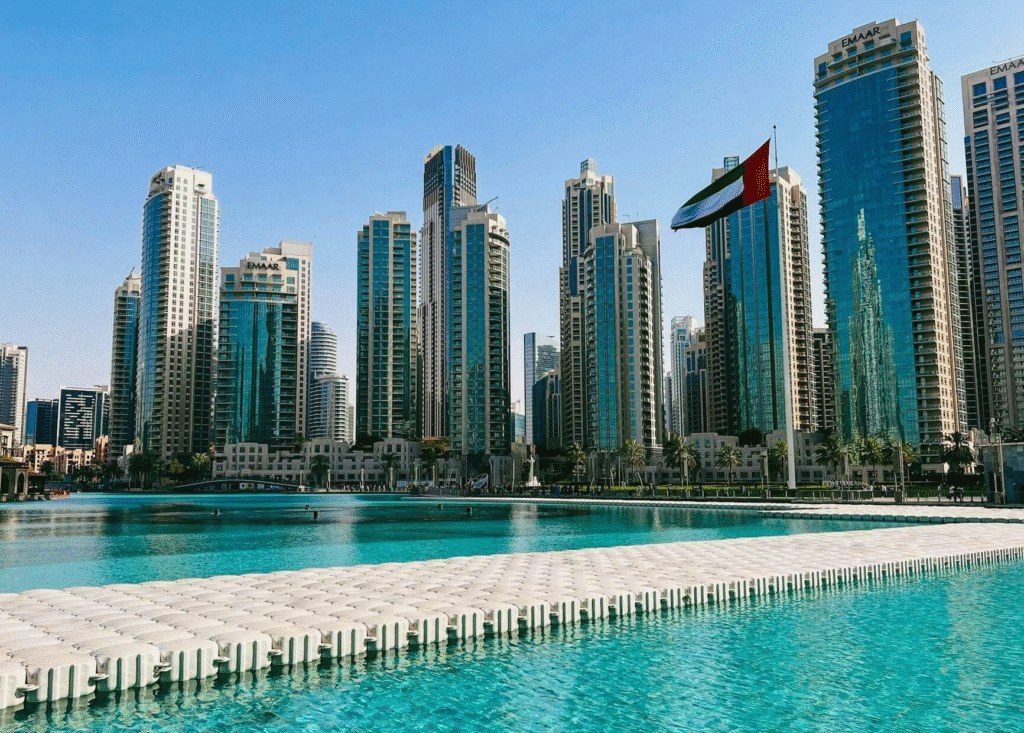

Dubai real estate has become a top global destination for real estate investment. With its tax-free income, strong economy, safe living environment, and world-class infrastructure, it’s no wonder investors from across the globe are eyeing this vibrant city. But while buying property in Dubai seems like a dream, succeeding in this competitive market requires smart strategies.

In this article, we break down the most effective real estate strategies in Dubai for 2025 and beyond. Whether you’re an investor, first-time buyer, or seller, these approaches will help you make the right decisions in one of the world’s most dynamic property markets.

1. Off-Plan Property Investment – A Hot Trend

One of the most popular strategies in Dubai right now is investing in off-plan properties. These are units sold before they are completed and often at lower prices than ready properties.

Why it works:

- Lower entry prices and flexible payment plans

- High appreciation potential when the project is completed

- Easy to resell (assign) during the construction phase

In 2025, developers are offering competitive prices, long-term post-handover payment plans, and guaranteed rental returns. Many savvy investors are booking early with top developers in areas like Dubai South, JVC, and Business Bay.

2. Focus on High-Yield Rental Areas

If your goal is to generate regular income, rental yield strategy is essential. Rental yields in Dubai remain among the highest globally ranging from 6% to 10% in some areas.

Top performing rental yield areas in 2025:

- Jumeirah Village Circle (JVC)

- Dubai Silicon Oasis

- Dubai Marina

- International City

Investors are combining location research with property management services to ensure stable rental income. With Expo City attracting more corporate workers and remote employees choosing Dubai, long-term rentals are in high demand.

3. Diversify Across Freehold and Leasehold Zones

Many buyers stick only to the popular freehold areas (like Downtown, Palm Jumeirah, or Marina), but smart investors are now diversifying into upcoming leasehold zones and suburban freehold areas.

For example, areas like Mirdif Hills or Al Qusais are gaining traction for their affordability and government-backed development plans. These properties may offer lower initial returns but promise long-term capital growth as infrastructure improves.

4. Lifestyle-Driven Property Investment

Today, people are not just investing in bricks and mortar they are buying into lifestyle trends. Developers in Dubai have caught on and are now designing entire communities with wellness centers, co-working spaces, retail, and green zones.

Popular lifestyle investment strategies include:

- Buying branded residences (e.g., Armani, Ritz-Carlton, Bugatti Residences)

- Choosing eco-friendly buildings with smart technology

- Investing in walkable communities like Dubai Hills Estate or Bluewaters

Such properties are not only attractive to residents but also fetch a higher resale value.

5. Flipping Properties with Short-Term Gains

For experienced investors, property flipping remains a powerful strategy. This involves buying a property, improving it (or waiting for market appreciation), and then selling it for a profit.

To succeed with this strategy in 2025:

- Choose under-construction or newly launched projects in growing zones

- Leverage market momentum watch quarterly price trends closely

- Time the sale before handover or shortly after when demand peaks

Due to strong tourism and expat inflow, Dubai’s secondary market is more active than ever, making flipping a viable short-term strategy.

6. Using Mortgage to Maximize ROI

With loan-to-value ratios for expats reaching up to 80% and interest rates remaining competitive, using a mortgage to invest in property can increase your returns. This strategy allows investors to:

- Secure high-value property with lower upfront capital

- Use rental income to pay EMIs

- Benefit from capital appreciation over time

Mortgage-backed investing is becoming more popular, especially among overseas buyers who want to build a Dubai real estate portfolio slowly but steadily.

7. Legal & Exit Strategy Planning

Many investors fail not because of a bad purchase but due to poor exit planning. The 2025 smart investor understands:

- How to assign or resell off-plan properties before handover

- Which developers allow flexible exit clauses

- What legal protections exist for foreign investors under RERA

It’s essential to align with certified real estate agents and legal advisors to avoid risk and maximize returns.

Final Thoughts: Strategy Is the Key to Dubai Real Estate Success

Dubai property market is filled with opportunities, but success doesn’t happen by chance. It comes from using the right real estate strategies at the right time. From off-plan purchases and rental yield targeting to mortgage-backed investing and lifestyle trends, the options are diverse.

With supportive government policies, increasing foreign interest, and new developments across the city, the future of Dubai real estate in 2025 is promising if approached with a clear strategy.

Pro Tips for Real Estate Investors in Dubai:

- Work with RERA-approved agents and brokers

- Stay updated with Dubai Land Department announcements

- Track key development areas and infrastructure plans

- Always check the developer’s reputation and past record

Conclusion

If you’re planning to buy, sell, or invest in Dubai’s property market, now is the time to act smart. These real estate strategies not only protect your investment but also give you an edge in a rapidly changing market.

Read More:- Shobha Realty Launches Its Most Luxurious Project Yet—Full Details Inside 2025