Now Reading: escrow account property UAE: A Pillar of Security for Investors

-

01

escrow account property UAE: A Pillar of Security for Investors

escrow account property UAE: A Pillar of Security for Investors

The rapid growth and sophistication of the United Arab Emirates’ real estate market have been bolstered by a robust regulatory framework, with escrow accounts playing a particularly crucial role in safeguarding investments. Especially pertinent to the off-plan property sector, where properties are purchased before completion, escrow accounts provide an essential layer of security and transparency for both buyers and developers across the Emirates.

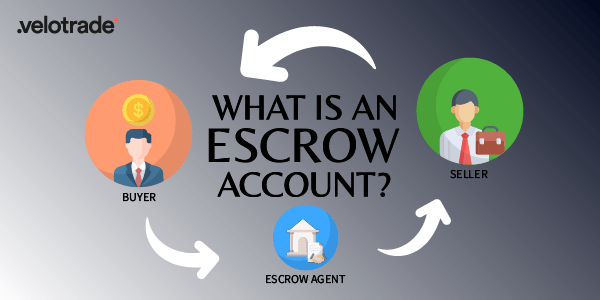

At its core, an escrow account is a specialized bank account where funds related to a property transaction are held securely by a neutral third party, known as an escrow agent. This agent, typically a licensed bank or financial institution, acts as an intermediary, ensuring that money is only disbursed once specific, pre-agreed conditions of the sale or development are met. This system is a fundamental protective measure against potential fraud, project delays, or developer insolvency, fostering trust and confidence in the UAE’s dynamic property landscape.

Table of Contents

The Mandate and Mechanisms of Escrow Accounts

The use of escrow accounts for off-plan property sales is not merely a best practice; it is a legal requirement in major real estate markets like Dubai and Abu Dhabi.

In Dubai, the Real Estate Regulatory Agency (RERA), a division of the Dubai Land Department (DLD), is the primary authority overseeing escrow accounts. Law No. 8 of 2007 (Concerning Escrow Accounts for Real Estate Development in the Emirate of Dubai) and subsequent amendments, such as Law No. 13 of 2017, firmly mandate that developers selling off-plan properties must open and operate designated escrow accounts.

Similarly, in Abu Dhabi, the Abu Dhabi Real Estate Centre (ADREC), under the Department of Municipalities and Transport (DMT), is responsible for regulating and enforcing escrow account requirements.

The operation of an escrow account follows a structured process:

- Developer’s Obligation: Before any off-plan units can be advertised or sold, the developer must obtain RERA (or ADREC) approval and open a dedicated escrow account for that specific project with an approved bank in the UAE. Each project requires its own separate escrow account to ensure funds are not commingled.

- Buyer Payments: All payments made by purchasers for off-plan units, including down payments and subsequent installments, must be deposited directly into this project-specific escrow account. Buyers are often provided with a unique reference number to ensure their payments are correctly attributed.

- Controlled Disbursements: This is where the core protection lies. The developer cannot freely access the funds in the escrow account. Funds are released by the escrow agent only when specific construction milestones are achieved and independently verified. These milestones are typically outlined in the escrow agreement and certified by an independent technical auditor or engineer appointed by the regulatory authority.

- Permitted Uses of Funds: The funds in the escrow account are strictly earmarked for the project’s development. This includes costs related to construction, land payments, consultancy fees, and approved sales and marketing expenses. This prevents developers from diverting funds to other projects or for personal use, a common risk in unregulated off-plan markets.

- Retention for Defects: A crucial protective measure, particularly in Dubai (as per Article 14 of Law No. 8 of 2007), is the retention of a percentage (typically 5%) of the total project value in the escrow account for a period (usually one year) after the completion certificate is issued and units are registered in the purchasers’ names. This “warranty fund” ensures that any defects or issues that arise post-handover can be addressed by the developer, with funds available for rectification if necessary.

Benefits of Escrow Accounts for Stakeholders

The escrow account system offers significant advantages for all parties involved in a real estate transaction:

For Buyers/Investors:

- Fund Protection: The primary benefit is the security of their investment. Funds are held by a neutral third party and are not directly accessible by the developer until specific conditions are met, drastically reducing the risk of financial loss due to project abandonment or developer bankruptcy.

- Reduced Fraud Risk: The stringent regulatory oversight and the involvement of an independent escrow agent minimize the chances of fraudulent activities or misuse of funds.

- Ensured Project Progress: Funds are released incrementally based on verified construction milestones, providing a strong incentive for developers to complete the project on schedule and to the agreed specifications.

- Transparency: The escrow agreement clearly outlines the terms of fund release, providing buyers with transparency on how their money is being utilized throughout the development process.

- Dispute Resolution: In the unfortunate event of a dispute or project issues, the existence of an escrow account provides a clear mechanism for recovery or resolution, as funds are secured.

For Developers:

- Increased Investor Confidence: The mandatory use of escrow accounts significantly boosts investor confidence in the UAE’s real estate market, making it more attractive for both local and international buyers. This facilitates easier fundraising for new projects.

- Clear Financial Management: The structured release of funds based on milestones helps developers manage project finances more effectively and ensures a steady cash flow tied directly to construction progress.

- Compliance and Reputation: Adhering to escrow regulations enhances a developer’s reputation for reliability and compliance, which is crucial in a competitive market.

For the Overall Market:

- Market Stability and Trust: Escrow accounts contribute significantly to the overall stability and transparency of the UAE’s real estate sector. By reducing risks and enhancing trust, they encourage sustained investment and prevent market volatility caused by unreliable projects.

- Regulatory Oversight: The system allows regulatory bodies like RERA and ADREC to maintain close oversight of off-plan projects, ensuring developers operate within legal frameworks and meet their commitments.

- Fairness and Accountability: Escrow accounts promote fairness and accountability by establishing clear conditions for fund release and consequences for non-compliance.

Challenges and Due Diligence

While highly effective, it’s crucial for buyers to exercise due diligence even with the presence of escrow accounts. This includes:

- Verifying Developer and Project Registration: Always confirm that the developer and the specific project are duly registered with the relevant land department (DLD/RERA in Dubai, ADREC in Abu Dhabi) and have an active escrow account.

- Understanding Payment Plans: Buyers should carefully review the payment plan linked to the escrow account and understand the conditions for each installment release.

- Seeking Professional Advice: Engaging a reputable real estate agent or legal counsel specializing in UAE property law can provide additional guidance and ensure all contractual obligations are clear.

In conclusion, the escrow account system is a cornerstone of the UAE’s commitment to creating a secure, transparent, and attractive real estate investment environment. By providing a robust financial safeguard, particularly for off-plan properties, it instills confidence, minimizes risks, and plays a vital role in the continued growth and maturity of the Emirates’ property sector.

WATCH MORE: https://www.khanacademy.org/economics-finance-domain/core-finance/housing/home-buying-process/v/escrow

READ MORE: https://estatemagazine.ae/fortifying-foundation-an-overview-of-real-estate/