The United Arab Emirates UAE real estate market Invest has demonstrated remarkable resilience in 2025, even as global economic slowdowns cast uncertainty over many markets worldwide. Dubai, in particular, continues to be a focal point for investors, residents, and developers alike.

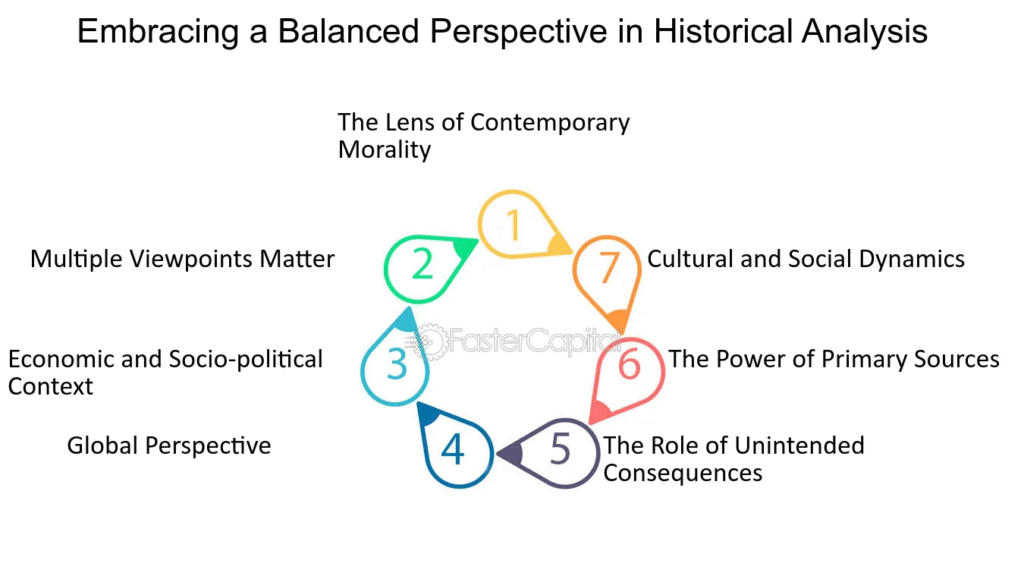

Despite global economic headwinds, the UAE’s diversified economy has provided a buffer against external shocks. The non-oil sector now constitutes 75% of the nation’s GDP, encompassing industries such as technology, finance, tourism, and renewable energy. This diversification has been instrumental in maintaining economic stability and investor confidence.

The UAE’s strategic initiatives, such as the “We the UAE 2031” vision, aim to double the nation’s GDP and further reduce dependence on oil revenues. These forward-thinking policies have positioned the country as a beacon of economic stability in the region.

Dubai’s real estate sector has experienced significant growth, with property prices soaring by up to 70% since 2019. The city recorded a record 51,000 home sales in Q2 2025, highlighting its appeal to both investors and residents.

However, experts caution that this rapid growth may lead to a market correction. Fitch Ratings projects a potential 10–15% decline in property prices through late 2025 and into 2026, primarily due to an anticipated surge in housing supply. Approximately 210,000 new units are expected to be delivered over the next two years, doubling the previous three years’ supply.

Despite these projections, Dubai’s real estate market remains attractive to high-net-worth individuals and international investors, owing to its tax advantages, world-class infrastructure, and strategic location.

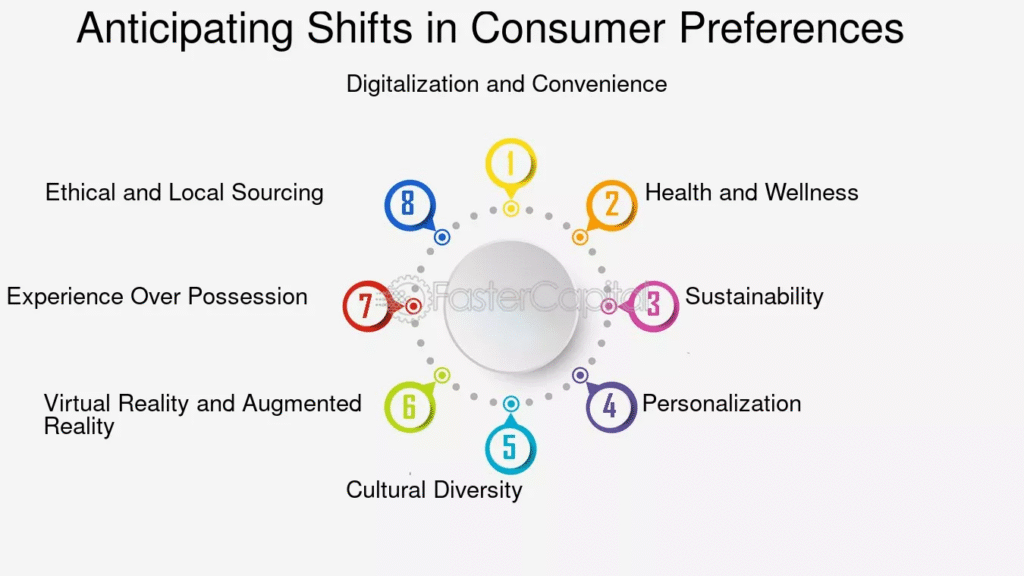

The post-pandemic era has witnessed a shift in buyer preferences. There is a growing demand for larger homes, with two-bedroom apartments in Dubai experiencing a 17% price increase and villas seeing an 8% rise. This trend reflects a desire for more spacious living arrangements, particularly among families and expatriates.

Additionally, the luxury real estate segment continues to thrive, with developments like branded residences gaining popularity. These properties, often associated with renowned hospitality and lifestyle brands, offer exclusive amenities and cater to affluent buyers seeking a premium living experience.

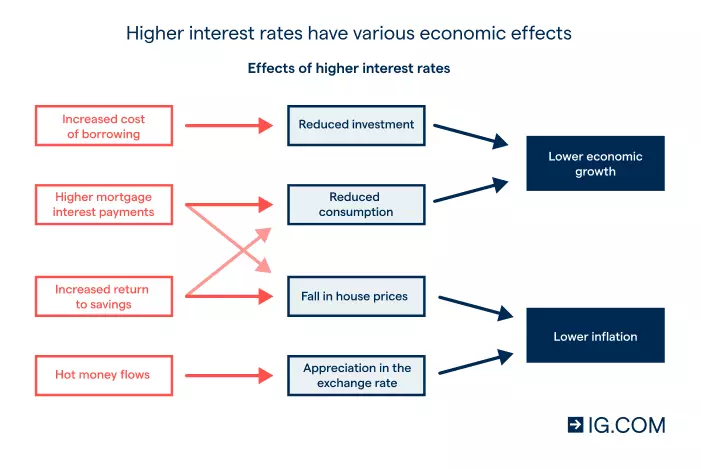

Global interest rate hikes, particularly by the U.S. Federal Reserve, have led to increased borrowing costs in the UAE. As the dirham is pegged to the U.S. dollar, local interest rates have mirrored these increases, potentially dampening demand in mortgage-backed property segments.

Moreover, inflationary pressures have raised construction costs, which may affect developers’ profit margins and could lead to higher property prices. However, the UAE’s proactive economic policies aim to mitigate these challenges and maintain market stability.

The UAE government continues to implement measures to stimulate the real estate market. Initiatives such as the Golden Visa program have attracted a significant number of foreign investors, contributing to the demand for residential properties. Additionally, the consolidation of state-owned developers and the launch of the D33 strategy aim to bolster the sector’s growth and sustainability.

The influx of foreign-owned real estate firms into the UAE market underscores the nation’s status as a global real estate hub. This trend reflects the confidence investors have in the UAE’s economic prospects and real estate potential.

While challenges such as rising interest rates and potential market corrections exist, the UAE’s real estate market is poised for continued growth. The nation’s economic diversification, strategic government initiatives, and sustained demand for residential properties provide a solid foundation for the sector’s resilience.

Investors and potential homeowners are advised to conduct thorough market research, consider long-term trends, and remain adaptable to the evolving economic landscape. With prudent planning and informed decision-making, the UAE real estate market offers promising opportunities in the years to come.

READ MORE:– Inside the World of Business Acquisitions: Secrets of Corporate Growth 2025