Now Reading: Palm Jebel Ali: 7 Massive Developments Set to Dominate 2025

-

01

Palm Jebel Ali: 7 Massive Developments Set to Dominate 2025

Palm Jebel Ali: 7 Massive Developments Set to Dominate 2025

Table of Contents

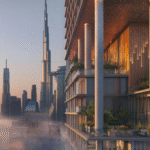

Palm Jebel Ali, a 13.4 sq.km. artificial archipelago by Nakheel, is a transformative waterfront project in Dubai, 50% larger than Palm Jumeirah. Relaunched in May 2023 by Sheikh Mohammed bin Rashid Al Maktoum, it spans seven islands with 16 fronds and 91km of beachfront, aiming to house 35,000 families, per nakheel.com.

With AED 5.81 billion ($1.58 billion) in contracts awarded in 2024 and a 60% sales rate for initial phases, it offers 7-9% rental yields and 12-20% capital gains, per aysdevelopers.ae. Located near Jebel Ali Free Zone (5 minutes), Dubai Marina (20 minutes), and Al Maktoum International Airport (25 minutes), it’s connected by a new 6km road to Sheikh Zayed Road, per dubaiholding.com.

Below are seven massive developments set to dominate 2025, their features, investment potential, and compliance steps with the Dubai Land Department (DLD) and Federal Tax Authority (FTA).

1. Beach Collection Villas

Overview: Nakheel’s flagship offering on six fronds, featuring 723 ultra-luxury 5- to 7-bedroom villas from AED 14.4 million ($3.92 million). Handover by Q4 2026, per thenationalnews.com.

Features: Beachfront villas (7,316-7,798 sq.ft.) with private pools, rooftop terraces, and panoramic Gulf views. Near planned retail hubs and a 5km sandy beach, per resortx.com. Includes smart home systems and eco-friendly designs.

Investment Potential: Yields of 7-9% (e.g., AED 1.3 million/year for a AED 14.4 million villa) and 15-20% capital gains by 2027, driven by exclusivity and tourism, per dxbinteract.com.

Compliance: Register SPAs via DLD’s Ejari system. Verify escrow accounts. Obtain valuation certificate for Golden Visa (AED 2 million+). Retain records for FTA audits, per taxvisor.ae.

2. Coral Collection Villas

Overview: Nakheel’s second phase on four fronds, offering 336 luxury 5- to 7-bedroom villas from AED 15 million ($4.08 million). Handover in Q4 2026, per globeecho.com.

Features: Waterfront villas with private beaches, lush landscaping, and access to waterparks and boardwalks. Near Jebel Ali Beach’s mangrove section (1.6km), per newswire.ca. Emphasizes indoor-outdoor living.

Investment Potential: Yields of 6.5-8.5% (e.g., AED 1.275 million/year for a AED 15 million villa) and 12-18% capital gains by 2027, fueled by family-friendly amenities, per aysdevelopers.ae.

Compliance: Register SPAs via Ejari. Verify freehold status. Retain records for FTA audits, per adres.ae.

3. Select Group Waterfront Residences

Overview: A luxury residential and hospitality project by Select Group and ESIC on two fronds, offering apartments and villas from AED 3 million ($816,900). Launching Q2 2025, handover by Q1 2028, per khaleejtimes.com.

Features: Upscale 1- to 4-bedroom apartments and villas with marina access, private beaches, and resort-style amenities like spas and infinity pools. Near planned retail zones, per dubaieye1038.com.

Investment Potential: Yields of 7-8.5% (e.g., AED 255,000/year for a AED 3 million apartment) and 12-15% capital gains by 2029, driven by third-party developer prestige, per dxbproperties.ae.

Compliance: Register SPAs via Ejari. Verify escrow accounts. Retain records for FTA audits, per gtlaw.com.

4. Jebel Ali Beach Development

Overview: A 6.6km beachfront project by Nakheel and Dubai Municipality, featuring a 5km sandy beach and 1.6km mangrove beach. Completion in Q3 2025, per newswire.ca.

Features: Public beaches with water sports, cycling paths, and eco-friendly facilities like solar-powered kiosks. Near planned hotels and dining, enhancing lifestyle appeal, per luxliving.ae.

Investment Potential: Indirectly boosts nearby property yields to 7-9% and capital gains by 10-15% by 2026, due to increased tourism and footfall, per westgatedubai.com.

Compliance: Register adjacent property SPAs via Ejari. Retain records for FTA audits, per dubailand.gov.ae.

5. Gateway Tower Complex

Overview: A mixed-use development by Nakheel at the crescent’s apex, offering apartments, offices, and retail from AED 2.5 million ($680,800). Launching Q3 2025, handover by Q4 2027, per thepalm-jebelali.com.

Features: High-rise towers with 360° views, rooftop dining, and smart city technologies. Near six marinas and leisure zones, per arabmls.org. Integrates business and residential spaces.

Investment Potential: Yields of 6.5-8% (e.g., AED 200,000/year for a AED 2.5 million apartment) and 12-15% capital gains by 2028, driven by commercial appeal, per dxbinteract.com.

Compliance: Register SPAs and commercial leases via Ejari. Verify freehold status. Retain records for FTA audits, per taxvisor.ae.

6. Palm Jebel Ali Apartments

Overview: Nakheel’s upcoming apartment blocks on four fronds, offering 1- to 3-bedroom units from AED 2 million ($544,600). Launching Q1 2025, handover by Q2 2028, per thepalm-jebelali.com.

Features: Modern apartments with sea views, communal pools, and access to retail and waterparks. Near Jebel Ali Free Zone (5 minutes), per propertywire.com. Designed for affordability and luxury.

Investment Potential: Yields of 7-8.5% (e.g., AED 170,000/year for a AED 2 million apartment) and 10-12% capital gains by 2029, ideal for young professionals, per aysdevelopers.ae.

Compliance: Register SPAs via Ejari. Verify escrow accounts. Retain records for FTA audits, per adres.ae.

7. Luxury Hospitality Resorts

Overview: Nakheel’s planned 80+ hotels and resorts across the crescent, offering branded residences and suites from AED 4 million ($1.09 million). Launching Q4 2025, first completions by Q4 2027, per propertywire.com.

Features: 5-star resorts with private beaches, wellness centers, and fine dining. Near water theme parks and boardwalks, per dxboffplan.com. Targets high-net-worth tourists and residents.

Investment Potential: Yields of 6-7.5% (e.g., AED 300,000/year for a AED 4 million suite) and 12-15% capital gains by 2028, driven by Dubai’s 17.2 million tourists in 2024, per dxbproperties.ae.

Compliance: Register SPAs and leases via Ejari. Verify freehold status for branded residences. Retain records for FTA audits, per gtlaw.com.

Why These Projects Matter

Beach Collection Villas, Coral Collection Villas, Select Group Waterfront Residences, Jebel Ali Beach Development, Gateway Tower Complex, Palm Jebel Ali Apartments, and Luxury Hospitality Resorts position Palm Jebel Ali as a global luxury hub, offering 6-9% yields, surpassing benchmarks like Miami’s 3-4%, per qbd.ae.

With 2,000 villas, 6,000 apartments, and 80 hotels, the project doubles Palm Jumeirah’s scale, adding 110km of coastline, per dxbmmediaoffice.ae. Its sustainability focus—30% renewable energy, solar-powered facilities—aligns with Dubai’s 2040 Urban Master Plan, per easternhousing.ae.

Connectivity via a new 6km road and proximity to JAFZA and Expo City Dubai (10 minutes) drives business and lifestyle appeal, per hausandhaus.com. Posts on X highlight its rapid progress and investor buzz, per @khaleejtimes.

Challenges include past delays (2008-2023) and erosion risks, mitigated by advanced marine works (AED 810 million contract to Jan De Nul) and 95% reclamation completion, per arabianbusiness.com. Golden Visa eligibility (AED 2 million+) applies to most projects, per pangeadubai.com.

Tax Tools for American Investors

U.S.-UAE DTA: Credit UAE taxes via IRS Form 1118, preserving 12-20% returns, per immigrantinvest.com.

Zakat for Muslim Investors: Pay 2.5% Zakat on rental income (e.g., AED 2,500 on AED 100,000). Consult Islamic scholars, per taxvisor.ae.

VAT Recovery: Recover 5% input VAT on commercial expenses (e.g., AED 25,000 on AED 500,000) for VAT-registered investors, per fintedu.com.

Market Outlook and Challenges

Palm Jebel Ali’s 60% sales in 2023-2024 and 7.5% average ROI reflect robust demand, with off-plan properties driving 65% of Dubai’s luxury market, per gulfbusiness.com. Infrastructure like two DEWA substations (AED 270 million) and a 6.6km beach enhances livability, per prnewswire.com.

Risks include oversupply (97,000 new units by 2026) and marine erosion, offset by limited waterfront supply and strong tourism (17.2 million visitors in 2024), per dxboffplan.com. These developments, backed by Nakheel and Select Group, redefine luxury and sustainability, aligning with Dubai’s D33 Economic Agenda, per mediaoffice.ae.

Conclusion

Beach Collection Villas, Coral Collection Villas, Select Group Waterfront Residences, Jebel Ali Beach Development, Gateway Tower Complex, Palm Jebel Ali Apartments, and Luxury Hospitality Resorts are Palm Jebel Ali’s top developments for 2025, offering 6-9% yields and 12-20% capital gains.

With 91km of beachfront, smart city tech, and proximity to key hubs, they attract investors and residents seeking luxury and innovation. Compliance with DLD’s Ejari and FTA ensures secure investments in this iconic waterfront destination. Palm Jebel Ali

read more: Bluewaters Island: 5 Premium Projects Blending Retail and Residential Lifestyle in 2025