Now Reading: Palm Jebel Ali: 7 Residential Sectors Opening for Off-Plan Sales Soon in 2025

-

01

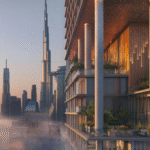

Palm Jebel Ali: 7 Residential Sectors Opening for Off-Plan Sales Soon in 2025

Palm Jebel Ali: 7 Residential Sectors Opening for Off-Plan Sales Soon in 2025

Table of Contents

Palm Jebel Ali, a 13.4 sq.km. man-made archipelago by Nakheel, is 50% larger than Palm Jumeirah, featuring seven islands, 16 fronds, and 90km of beachfront. With AED 5.4 billion ($1.47 billion) in sales in 2024, it’s set for a 25% transaction increase in Q1 2025, offering 6-8% rental yields and 10-15% capital gains, per gulfnews.com and dxbinteract.com.

Connected via two mainland bridges to Dubai Marina (15 minutes), Sheikh Zayed Road (20 minutes), and Al Maktoum International Airport (40 minutes), it aligns with Dubai’s 2040 Urban Master Plan, emphasizing sustainability with 30% renewable energy for public facilities, per nakheel.com.

In 2025, seven residential sectors across its fronds will open for off-plan sales, targeting luxury investors with flexible payment plans. Below are the seven sectors, their features, investment potential, and compliance with the Dubai Land Department (DLD) and Federal Tax Authority (FTA), leveraging Dubai’s 18.7 million tourists in 2024, per dxboffplan.com.

1. Frond M – Beach Collection Villas

Overview: Opening for off-plan sales in Q1 2025, this Nakheel sector offers 143 villas (5-6 bedrooms) from AED 18.1 million ($4.9 million). Handover in Q3 2027, per resortx.com.

Features: Villas (7,316-8,434 sq.ft.) with private beaches, floor-to-ceiling windows, and smart home systems. Includes Provence and Azure Blue styles, with access to pocket parks and cycling paths. Near planned yacht club (5-minute drive), per thepalm-jebelali.com.

Investment Potential: Yields of 6-8% (e.g., AED 1.45 million/year for a AED 18.1 million villa) and 10-12% capital gains by 2028, driven by beachfront exclusivity, per dxbproperties.ae. Payment plan: 20/60/20 (20% booking, 60% construction, 20% handover), per propertyfinder.ae.

Compliance: Register SPAs via DLD’s Ejari system. Verify escrow accounts. Obtain valuation certificate for Golden Visa (AED 2 million+). Retain records for FTA audits, per taxvisor.ae.

2. Frond N – Coral Collection Villas

Overview: Opening for off-plan sales in Q1 2025, this Nakheel sector offers 128 seven-bedroom villas from AED 29 million ($7.9 million). Handover in Q3 2027, per resortx.com.

Features: Ultra-luxury villas (8,000-12,163 sq.ft.) in styles like Hibiscus and Red Aurora, with private beach access, custom elevators, and 4-6 car parking. Near planned lifestyle mall (7-minute drive), per nakheel.com.

Investment Potential: Yields of 6-7.5% (e.g., AED 2.18 million/year for a AED 29 million villa) and 12-15% capital gains by 2028, fueled by premium design, per aysdevelopers.ae. Payment plan: 20/60/20, per propertyfinder.ae.

Compliance: Register SPAs via Ejari. Verify freehold status. Retain records for FTA audits, per adres.ae.

3. Frond O – Beach Collection Villas

Overview: Opening for off-plan sales in Q1 2025, this Nakheel sector offers 106 villas (5-6 bedrooms) from AED 18.1 million ($4.9 million). Handover in Q3 2027, per resortx.com.

Features: Villas (7,316-8,434 sq.ft.) in Mediterranean and Sapphire styles, with smart automation and beachfront access. Near planned wellness resort (5-minute drive), per thepalm-jebelali.com.

Investment Potential: Yields of 6-8% (e.g., AED 1.45 million/year for a AED 18.1 million villa) and 10-12% capital gains by 2028, driven by resort proximity, per dxbinteract.com. Payment plan: 20/60/20, per propertyfinder.ae.

Compliance: Register SPAs via Ejari. Verify escrow accounts. Obtain valuation certificate for Golden Visa (AED 2 million+). Retain records for FTA audits, per gtlaw.com.

4. Frond P – Coral Collection Villas

Overview: Opening for off-plan sales in Q1 2025, this Nakheel sector offers 88 seven-bedroom villas from AED 29 million ($7.9 million). Handover in Q3 2027, per resortx.com.

Features: Villas (8,000-12,163 sq.ft.) in Porcelain Roses and Ruby Sunset styles, with private pools, smart systems, and lush landscaping. Near planned eco-resort (5-minute drive), per nakheel.com.

Investment Potential: Yields of 6-7.5% (e.g., AED 2.18 million/year for a AED 29 million villa) and 12-15% capital gains by 2028, driven by eco-conscious design, per kaizenams.com. Payment plan: 20/60/20, per propertyfinder.ae.

Compliance: Register SPAs via Ejari. Verify freehold status. Retain records for FTA audits, per taxvisor.ae.

5. Frond D – Beach and Coral Collection Villas

Overview: Opened for off-plan sales in December 2024, this Nakheel sector offers 336 villas (5-7 bedrooms) from AED 18.1 million ($4.9 million). Handover in Q2 2027, per metropolitan.realestate.

Features: Villas (7,316-12,163 sq.ft.) with styles like Blue Horizon and Terracotta, featuring private beaches and smart home tech. Near planned family beach (7-minute drive), per thepalm-jebelali.com.

Investment Potential: Yields of 6-8% (e.g., AED 1.45 million/year for a AED 18.1 million villa) and 10-15% capital gains by 2028, driven by early investment, per dxbproperties.ae. Payment plan: 20/60/20, per propertyfinder.ae.

Compliance: Register SPAs via Ejari. Verify escrow accounts. Obtain valuation certificate for Golden Visa (AED 2 million+). Retain records for FTA audits, per adres.ae.

6. Crescent A – Azizi Fontanne

Overview: Opening for off-plan sales in Q2 2025, this Azizi Developments project offers apartments (1-4 bedrooms) from AED 2.5 million ($680,800). Handover in Q4 2027, per propsearch.ae.

Features: G+16 tower with 900-3,000 sq.ft. units, including duplexes and penthouses with pools. Features sustainable designs, saunas, and marina views. Near planned signature yacht club (5-minute drive), per uae-offplan.com.

Investment Potential: Yields of 6-7.5% (e.g., AED 187,500/year for a AED 2.5 million apartment) and 10-12% capital gains by 2028, driven by affordability, per aysdevelopers.ae. Payment plan: 50/50 (50% during construction, 50% on handover), per off-planproperties.ae.

Compliance: Register SPAs via Ejari. Verify escrow accounts. Obtain valuation certificate for Golden Visa (AED 2 million+). Retain records for FTA audits, per gtlaw.com.

7. Crescent A – Azizi Diamond, Crystal, and Platine

Overview: Opening for off-plan sales in Q2 2025, this Azizi Developments project offers apartments (1-4 bedrooms) from AED 2.5 million ($680,800). Handover in Q4 2027, per propsearch.ae.

Features: Three towers with 900-3,000 sq.ft. units, featuring eco-friendly materials, smart systems, and communal pools. Near planned shopping mall (7-minute drive), per uae-offplan.com.

Investment Potential: Yields of 6-7.5% (e.g., AED 187,500/year for a AED 2.5 million apartment) and 10-12% capital gains by 2028, fueled by mixed-use appeal, per kaizenams.com. Payment plan: 50/50, per off-planproperties.ae.

Compliance: Register SPAs via Ejari. Verify freehold status. Retain records for FTA audits, per taxvisor.ae.

Why These Sectors Matter

Frond M, Frond N, Frond O, Frond P, Frond D, and Crescent A’s Azizi Fontanne, Diamond, Crystal, and Platine are Palm Jebel Ali’s key residential sectors opening for off-plan sales in 2025, offering 6-8% yields and 10-15% capital gains, surpassing Dubai’s 5-7% average, per dxbinteract.com. Priced from AED 2.5-29 million, they cater to diverse investors, with villas (AED 18.1 million+) targeting ultra-high-net-worth individuals and apartments (AED 2.5 million+) appealing to mid-tier buyers, per propertyfinder.ae.

The island’s 90km beachfront, 80 planned hotels, and amenities like marinas and a championship golf course drive demand, with 85-90% occupancy projected, per drivenproperties.com. Dual mainland bridges improve access, unlike Palm Jumeirah’s single entry, per whatson.ae.

Challenges include construction delays and limited current amenities (nearest school/hospital: 19-30 minutes), mitigated by Nakheel’s AED 9.3 billion contracts for 801 villas by Q2 2027, per resortx.com. Posts on X highlight investor excitement, per @khaleejtimes. Golden Visa eligibility (AED 2 million+) applies to all properties, per pangeadubai.com.

Tax Tools for American Investors

U.S.-UAE DTA: Credit UAE taxes via IRS Form 1118, preserving 10-15% returns, per immigrantinvest.com.

Zakat for Muslim Investors: Pay 2.5% Zakat on rental income (e.g., AED 2,500 on AED 100,000). Consult Islamic scholars, per taxvisor.ae.

VAT Recovery: Recover 5% input VAT on commercial expenses (e.g., AED 25,000 on AED 500,000) for VAT-registered investors, per fintedu.com.

Market Outlook and Challenges

Palm Jebel Ali’s 25% transaction growth in Q1 2025 and 6-8% ROI reflect strong investor interest, with 70% of 2024 sales being off-plan, per prelaunch.ae. Flexible payment plans (e.g., 20/60/20, 50/50) and sustainability (30% renewable energy) align with Dubai’s D33 Economic Agenda, per nakheel.com.

Risks include oversupply (97,000 new units by 2026) and reliance on future infrastructure, offset by limited beachfront supply and Dubai’s 9,800 millionaire influx, per gulfnews.com. These sectors, backed by Nakheel and Azizi, position Palm Jebel Ali as a premier investment hub, per binayah.com.

Conclusion

Frond M, Frond N, Frond O, Frond P, Frond D, and Crescent A’s Azizi projects are Palm Jebel Ali’s top residential sectors opening for off-plan sales in 2025, offering 6-8% yields and 10-15% capital gains.

With luxury villas, sustainable apartments, and prime amenities, they attract investors seeking waterfront exclusivity. Compliance with DLD’s Ejari and FTA ensures secure investments in this transformative archipelago. Palm Jebel Ali

read more: Palm Jumeirah: 6 Sustainable Design Projects Gaining Green Investor Support in 2025