In recent months, India’s luxury real estate market has witnessed a notable transformation. The trend now is clear: ₹10 crore apartments are losing their appeal among the country’s elite, while ₹50 crore land parcels are becoming the preferred choice for high-net-worth individuals (HNWIs). This quiet shift signals a major change in investment patterns and lifestyle preferences among India’s wealthiest, as explained by leading real estate advisors.

Traditionally, ₹10 crore apartments have been the gold standard for luxury living in India’s metropolitan cities. These premium flats offer state-of-the-art amenities, strategic locations, and the prestige associated with owning a high-value property. However, in recent times, many affluent buyers are turning away from these high-end apartments in favor of purchasing large plots of land valued at ₹50 crore or more.

According to a prominent real estate advisor who prefers to stay anonymous, this shift is driven by multiple factors, including a desire for greater privacy, more customization opportunities, and long-term wealth creation through land ownership.

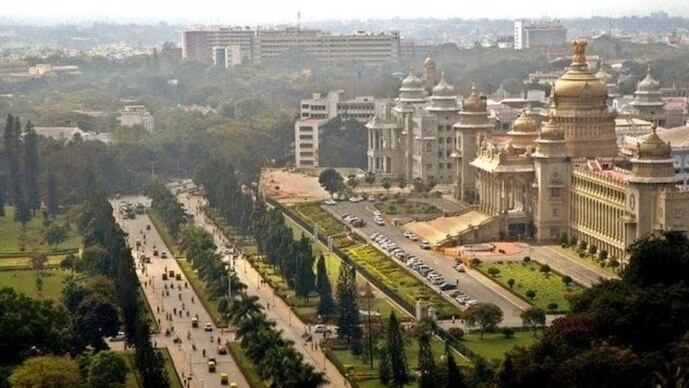

The demand for ₹10 crore apartments has stagnated in some of the top cities like Mumbai, Bengaluru, and Delhi-NCR. The reasons behind this decline are multifaceted:

On the other hand, land parcels worth ₹50 crore or more have seen a surge in demand. This trend is particularly noticeable in emerging luxury hotspots around metropolitan areas and exclusive destinations such as Goa, Pune, and parts of South India.

Here are the key reasons why land is becoming the investment of choice:

“The shift from ₹10 crore apartments to ₹50 crore land is subtle but impactful,” says the advisor. “We are seeing HNWIs looking beyond immediate convenience. They want to own something unique, something they can shape and truly call their own. Land offers that freedom. It is a return to tangible, lasting value rather than just premium living spaces.”

He adds, “This trend also reflects a mindset change. After years of urban density, the elite prefer open spaces and exclusivity. They’re investing in privacy and customization over the status symbol of a luxury flat.”

Real estate data from major cities confirms this emerging pattern. In Mumbai, the sales volume for apartments priced around ₹10 crore has plateaued or declined slightly, whereas luxury land sales in adjoining areas have increased by approximately 20% year-on-year.

Similarly, in Bengaluru, land transactions worth ₹50 crore and above in suburbs and outskirts are rising as buyers seek larger plots to build sprawling homes. In Delhi-NCR, exclusive gated land communities are gaining popularity, reflecting this new demand pattern.

Developers who traditionally focused on luxury apartments are now adapting by acquiring large land parcels to create bespoke housing projects or luxury estates. This shift in strategy is also driving up land prices in selected premium locations.

For investors, this change offers both opportunities and challenges. While land investment tends to be safer in terms of appreciation, it requires more patience and careful planning compared to liquid apartment markets.

The quiet move by India’s elite from ₹10 crore apartments to ₹50 crore land has wider implications. It could lead to:

The real estate landscape among India’s elite is quietly evolving. The move away from ₹10 crore apartments towards ₹50 crore land is more than just a change in asset preference; it reflects deeper lifestyle shifts, wealth preservation strategies, and a search for exclusivity. This trend underscores how India’s luxury market is adapting to new realities and expectations.

For buyers and investors, understanding this shift can be crucial in making informed decisions in the high-end property space.

Also Read – Overseas luxury real estate: Here’s why it is catching the eyes of HNIs