Real Estate shares fall sharply this week, signaling a fresh wave of concern among investors and analysts. The recent dip has caused panic selling in several markets, with real estate companies witnessing a significant drop in stock value. Investors are now questioning what triggered this downward spiral and whether this signals a long-term trend or a short-term correction.

This article explains the top reasons behind the fall in real estate shares, how it affects both global and Indian markets, and what investors should prepare for next.

When real estate shares fall, it means the stock prices of companies involved in real estate – such as property developers, construction firms, and real estate investment trusts (REITs) – are declining. This fall can affect individual investors, mutual funds, institutional investors, and even the economy if it becomes a trend.

Typically, such a drop is linked to macroeconomic factors like interest rate hikes, inflation, reduced demand for housing or commercial spaces, or changes in government policies. In 2025, a mix of these elements is creating instability across the real estate sector.

One of the key reasons real estate shares fall is the increase in interest rates by central banks globally. Higher interest rates make borrowing more expensive. This reduces the number of buyers and investors entering the real estate market, which directly impacts property sales and company revenues.

With fewer transactions happening, real estate companies report lower earnings, which then causes a drop in their stock prices.

Market sentiment plays a crucial role in stock performance. In 2025, growing concerns over an economic slowdown and inflation have created a fear-driven environment. Many investors are pulling money out of real estate stocks and switching to safer assets like bonds or gold.

This change in investment behavior is one of the major triggers for why real estate shares fall suddenly and sharply.

In key markets like Dubai, Mumbai, and New York, there is a growing inventory of unsold apartments and commercial units. This oversupply is leading to falling property prices, tighter cash flows for developers, and rising maintenance costs.

These issues reduce company profitability, making their stocks less attractive to investors. As a result, real estate shares fall even further as confidence drops.

Countries that once attracted foreign real estate investments – such as the UAE, UK, and Australia – are seeing reduced interest due to geopolitical uncertainty, stricter visa norms, and a stronger U.S. dollar. Foreign investors now find it riskier and costlier to invest in overseas property markets.

As cross-border investments slow down, so do revenues for major developers, leading to a decline in their share prices.

Policy changes, such as new land acquisition laws, stricter taxation rules, or environmental regulations, often impact how real estate companies operate. In countries like India, sudden changes in stamp duty or GST regulations have disrupted investor confidence.

Whenever governments make unpredictable or heavy-handed changes, investors react negatively. This uncertainty contributes to the current environment where real estate shares fall regularly.

REITs were once seen as a safe way to gain real estate exposure without actually buying property. But in the past few months, even REITs have reported falling yields and stagnant returns.

Poor performance of REITs signals deeper problems in the sector and triggers a wider sell-off in all real estate-linked stocks.

Inflation has not only increased the cost of living but also the cost of building. Cement, steel, and labor costs have skyrocketed. Delays due to worker shortages or permit issues are also driving project costs higher.

As operational expenses rise, profit margins shrink. Investors, worried about declining margins, begin offloading their holdings, which causes real estate shares to fall even more.

India has been a booming market for real estate over the past decade, especially in metro cities. However, the current global uncertainty is slowly spilling into Indian stock exchanges.

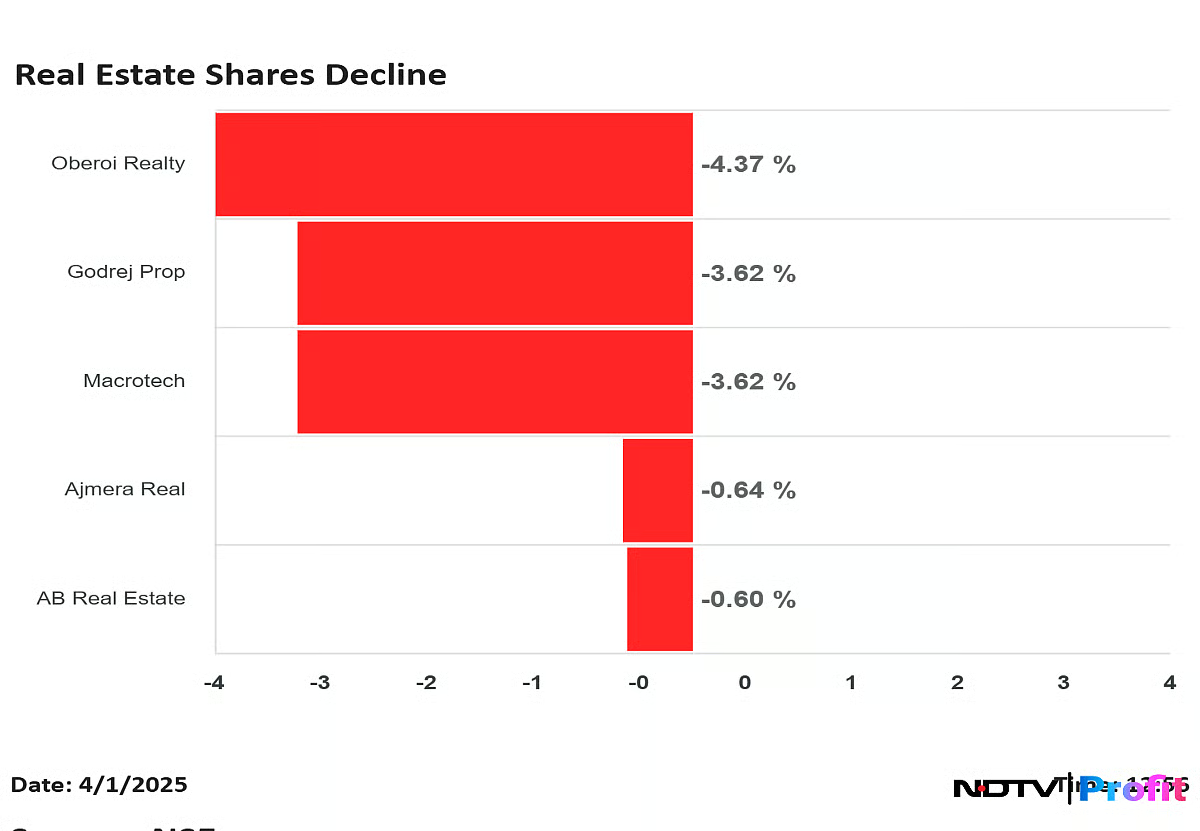

Prominent developers like DLF, Godrej Properties, and Sobha have seen their share prices dip between 8% and 14% over the last two weeks. Meanwhile, investors are closely monitoring RBI’s upcoming decision on interest rates, which could further influence real estate activity in the country.

If you’re an investor in the real estate sector, here’s what you can consider:

The current situation where real estate shares fall may seem alarming, but it is not unprecedented. Markets operate in cycles, and real estate has always been a volatile sector, impacted by multiple external factors.

While some of the concerns such as rising interest rates and global inflation may take months to settle, other issues like oversupply and regulatory instability can be addressed more quickly through smart governance.

Investors must keep a close eye on developments and seek expert financial advice if unsure. For now, caution and diversification remain the best strategies to weather this real estate storm.