Now Reading: Small Investment Today Can Save You Thousands Later 2025

-

01

Small Investment Today Can Save You Thousands Later 2025

Small Investment Today Can Save You Thousands Later 2025

Table of Contents

In a world where rising expenses affect nearly every part of life, from groceries to fuel, people are constantly Investment on the lookout for ways to save money. But what if spending just a little more today could lead to much bigger savings in the future? According to recent expert insights and market trends, this approach may be more financially sound than ever before.

The idea is simple: paying slightly more upfront can sometimes prevent bigger costs later. While this strategy may seem counterintuitive in the short term, its long-term benefits are increasingly being backed by evidence across industries from home maintenance and technology to health and personal finance.

The Smart Spending Strategy

Many consumers are cautious about Investment increasing their current spending, especially with economic uncertainty still looming in several regions. But experts suggest that certain smart investments, though initially costlier, can significantly reduce expenses over time.

For instance, consider energy-efficient appliances. A refrigerator with a slightly higher price tag due to its energy-saving features can lower your monthly electricity bill for years. The difference might be small at first glance, but it adds up. Similarly, investing in a reliable water purifier system or high-quality air conditioner may seem expensive upfront, but it reduces repair costs and energy use in the long term.

“A slightly higher investment at the beginning Investment usually pays off,” says Ravi Mehta, a consumer economist based in Delhi. “People often overlook long-term cost benefits while chasing short-term savings.”

Real-Life Examples Show the Impact

Take the example of Rajeev and Neha Sharma, a middle-class couple from Pune. Two years ago, they had the option of buying a budget washing machine or one with a higher energy rating for ₹3,000 more. They chose the energy-efficient model. “Our electricity bill dropped by around ₹250 per month. In one year, the extra amount we spent was already recovered,” says Rajeev. “Now it’s just saving us money every month.”

Another example can be seen in vehicle maintenance. Investment Opting for synthetic engine oil might seem unnecessary to some drivers because it costs more than regular oil. However, it improves engine life and reduces the number of oil changes needed. In the long run, this means fewer workshop visits and a longer-lasting vehicle.

Small Price, Big Health Benefits

The same logic applies to health. People who spend slightly Investment more on regular health checkups or nutritious food may be able to avoid expensive medical treatments later. Preventive healthcare is a growing trend, with more people opting for wellness packages that help catch problems early.

Nutritionist Ananya Patel explains, Buying organic or fortified foods may cost more now, but they boost immunity and reduce risks of chronic illnesses. When you calculate the savings on hospital visits, the choice is clear.

Even in the personal care segment, using high-quality skincare or Investment dental products may prevent future visits to dermatologists or dentists again proving that a minor cost today could save a larger expense tomorrow.

Businesses Are Catching On Too

It’s not just individual consumers. Businesses are increasingly applying the same philosophy to reduce their operational costs. Companies that invest in employee training, Investment quality control systems, and preventive maintenance for their equipment are seeing measurable long-term gains.

Ritu Joshi, an operations manager at a textile company in Ahmedabad, shares, “We upgraded our machines with slightly more expensive ones last year. In return, we’ve seen fewer breakdowns, less wastage, and better product quality. It’s saving us a lot more than we expected.”

Not Always the Right Choice

While the idea holds true in many situations, it’s not a universal rule. Sometimes, spending more doesn’t always guarantee better outcomes. The key is in understanding where that extra expense brings real value.

Consumer rights expert Ramesh Verma warns, “Be careful not to fall for marketing gimmicks. Higher cost should come with verifiable long-term benefits. Read reviews, check warranties, and look for energy or safety certifications.”

He adds that spending slightly more should be a calculated decision, not an emotional one. Use budgeting tools and consult experts if unsure.

Government Incentives Make It Easier

Governments in many countries, including India, are promoting energy-efficient appliances, solar panels, and electric vehicles through subsidies and tax benefits. These incentives reduce the initial cost gap, making long-term savings even more appealing.

Under India’s UJALA scheme, for example, LED bulbs and energy-saving fans are being made available at affordable rates to reduce electricity use. This initiative has already helped lakhs of households lower their power bills.

Final Thoughts

While it may not seem attractive to pay a little more right now, this approach often works out in your favor over time. Whether it’s choosing better-quality products, investing in health, or maintaining assets proactively, the long-term savings can be well worth it.

So the next time you’re faced with a buying decision, ask yourself: “Will this slightly higher price reduce other costs in the long run?” If the answer is yes, you might just be making a smarter financial choice than you think.

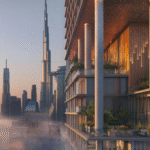

Read More:- Shobha Realty Launches Its Most Luxurious Project Yet—Full Details Inside 2025