Now Reading: Sumitomo Realty Faces Big Threats From Elliott Push

-

01

Sumitomo Realty Faces Big Threats From Elliott Push

Sumitomo Realty Faces Big Threats From Elliott Push

Table of Contents

Sumitomo Realty Faces Elliott Management Pressure to Stakeholder Value as one of Japan’s biggest developers becomes the latest target in a global wave of activist investing. The move has sparked conversations around transparency, restructuring, and better shareholder returns in Japan’s traditional corporate world.

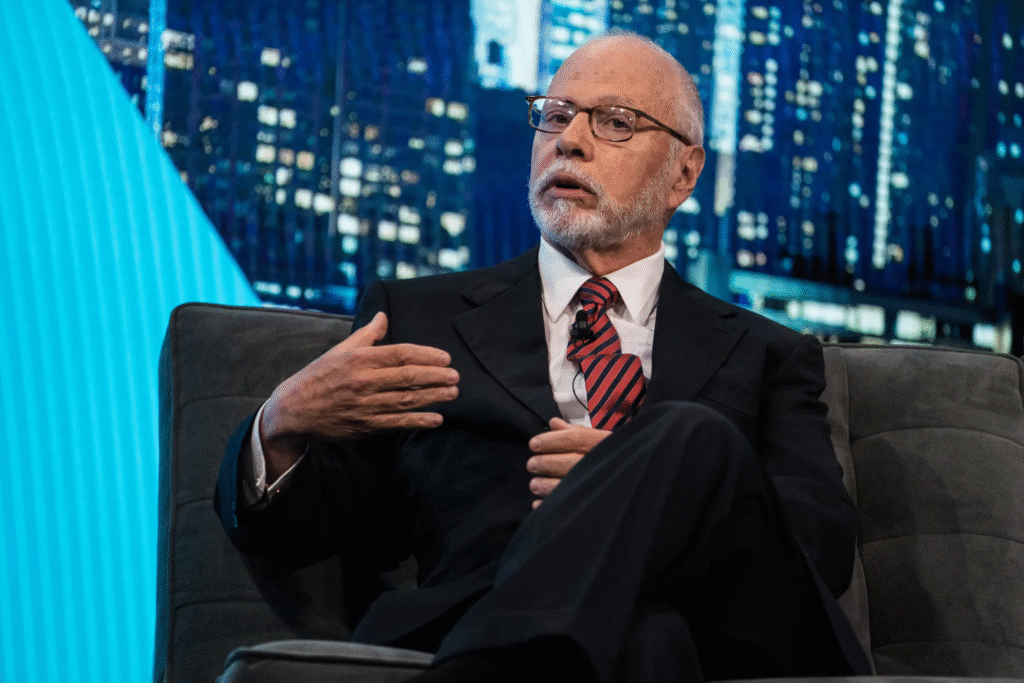

U.S.-based hedge fund Elliott Management, known for its aggressive campaigns, has taken aim at Sumitomo Realty & Development Co., urging the real estate giant to unlock greater value for shareholders. The development follows a trend of activist investors pressuring Japanese companies to increase efficiency, transparency, and profitability in line with global standards.

Elliott’s Entry: Why Sumitomo Is Under the Microscope

Sumitomo Realty, a pillar of Japan’s property sector, has long maintained a conservative management style. But Elliott Management believes this model is outdated and significantly undercuts the company’s market potential. While Sumitomo holds valuable assets, including a vast portfolio of commercial properties in Tokyo, its share price has underperformed relative to its peers.

Elliott has reportedly taken a significant stake in the company and is pushing for stronger corporate governance, more shareholder engagement, and clear steps to boost stock performance.

According to sources familiar with the matter, Elliott’s proposal includes:

- Reevaluation of Asset Holdings – urging the company to sell or spin off non-core assets.

- Improved Capital Allocation – calling for higher dividend payouts and share buybacks.

- Transparency and Board Reform – demanding independent directors and better stakeholder communication.

Sumitomo’s Silent Response Raises Eyebrows

Despite growing investor attention, Sumitomo Realty has remained quiet, a common response among traditional Japanese firms. While the company has not officially responded to Elliott’s suggestions, analysts expect a cautious approach rather than any aggressive pushback or immediate compliance.

Sumitomo is known for holding valuable assets long-term, some dating back decades. While this strategy offers stability, Elliott argues it hides immense value that should be reflected in current shareholder returns.

Many institutional investors in Japan and abroad are closely watching how Sumitomo responds, as it could set a precedent for other legacy firms.

Japan’s Corporate Shift: Why Activism Is Rising

The Elliott-Sumitomo battle reflects a broader shift in Japan’s corporate culture. Traditionally, Japanese firms emphasized long-term stability, employee loyalty, and corporate harmony over market pressures. But with growing global scrutiny, the need for better governance and investor return has taken center stage.

Prime Minister Fumio Kishida’s administration has also signaled support for increasing shareholder value, encouraging reforms in corporate governance and capital markets.

Sumitomo Realty, valued at over $20 billion, now finds itself at a turning point—to either modernize under pressure or risk long-term stagnation.

Market Reacts: Shares Spike Amid Investor Optimism

Following the reports of Elliott’s involvement, Sumitomo Realty’s share price surged by over 6%, indicating market support for potential changes. Traders view Elliott’s push as a sign of untapped value that could finally be realized.

“Sumitomo has long been seen as a sleeping giant in Tokyo real estate,” said one Tokyo-based investor. “If Elliott can wake it up, even a little, the returns could be huge.”

Investor sentiment appears to favor transformation—especially when it comes with better dividends, clearer strategy, and international governance norms.

Not the First Time: Elliott’s Record in Japan

This isn’t Elliott’s first attempt to unlock value in Japanese corporations. The firm has previously targeted major companies such as SoftBank Group and Toshiba, often stirring controversy but occasionally succeeding in pushing partial reforms.

In Japan, activist investors still face resistance, especially from traditional companies with long-standing internal cultures and powerful founding families. However, Elliott’s persistence and financial leverage make it a formidable force even in the relatively cautious Japanese market.

Sumitomo Realty, with its deep roots and complex structure, will be a challenging case—but not impossible.

What’s at Stake for Sumitomo Realty?

There is much more than stock price at stake for Sumitomo. Its reputation, legacy, and relationship with institutional investors could face lasting impact depending on how this unfolds.

If Elliott’s suggestions lead to increased transparency, asset sales, or stronger shareholder alignment, Sumitomo Realty may unlock billions in market value.

However, if management resists and investor confidence declines, Sumitomo risks being seen as lagging in a fast-evolving market—especially as competitors adopt modern practices.

Some analysts warn that ignoring Elliott’s pressure could create long-term reputational risk, not only for Sumitomo but also for other legacy firms in Japan’s real estate sector.

The Road Ahead: Possible Scenarios

The next few months will be crucial. Here are the most likely outcomes:

- Partial Compliance: Sumitomo agrees to minor reforms such as appointing new directors or boosting dividend payouts.

- Full Restructuring: The firm sells underperforming assets, restructures its board, and rolls out a new capital allocation strategy.

- Resistance: Sumitomo maintains status quo, leading Elliott to escalate pressure with more aggressive tactics or proxy battles.

No matter the outcome, the global investment community is watching. The case could serve as a benchmark for foreign investor influence in Japan’s real estate and broader corporate landscape.

Conclusion

Sumitomo Realty faces Elliott Management pressure to stakeholder value, and the effects are rippling across Japan’s corporate world. The clash between traditional Japanese business values and modern global investment expectations is now unfolding in real-time. Whether Sumitomo bends or holds firm, the implications will likely shape the future of Japanese corporate governance.

As Sumitomo Realty stands at a crossroad, its next steps will determine whether it leads Japan’s real estate sector into a new era of transparency and growth—or remains anchored in the past.

Also Read – Dubai’s Fastest Tokenised Property Funded in Just 2 Minutes