Now Reading: The World Islands: 5 Hospitality-Focused Villas Targeting Luxury Investors in 2025

-

01

The World Islands: 5 Hospitality-Focused Villas Targeting Luxury Investors in 2025

The World Islands: 5 Hospitality-Focused Villas Targeting Luxury Investors in 2025

Table of Contents

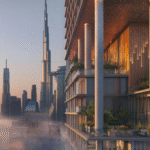

The World Islands, a 300-island artificial archipelago by Nakheel, spans 6x9km in the Persian Gulf, 4km off Dubai’s coast, shaped like a world map with 232km of shoreline. After delays post-2008, it recorded AED 1.8 billion ($490 million) in transactions in 2024, with a 25% year-on-year sales increase in Q1 2025, per gulfbusiness.com.

Offering 6-10% rental yields and 15-25% capital gains, it targets ultra-high-net-worth individuals (UHNWIs) with hospitality-focused villas designed for short-term rentals and luxury tourism, per aysdevelopers.ae. Connected via private boats to Jumeirah (10 minutes), Dubai Marina (15 minutes), and Dubai International Airport (30 minutes), it lacks mainland utilities, relying on diesel generators and independent systems, per en.wikipedia.org.

Below are five hospitality-focused villa projects in The World Islands for 2025, tailored for luxury investors, with features, investment potential, and compliance steps with the Dubai Land Department (DLD) and Federal Tax Authority (FTA). These projects leverage Dubai’s 18.7 million tourists in 2024 and growing hospitality demand, per dxboffplan.com.

1. Amali Island Villas

Overview: A Damac Properties project by Ali and Amira Sajwani on a 1.2 million sq.ft. island in the UAE cluster, offering 24 ultra-luxury villas from AED 50 million ($13.6 million). Handover in Q4 2025, per bloomberg.com.

Features: Beachfront villas (20,000-30,000 sq.ft.) with private beaches, berths for 100m yachts, and a 10,000 sq.ft. clubhouse featuring a gourmet restaurant, swim-up bar, horizon pool, spa, and gym. Includes smart home systems and concierge services tailored for short-term luxury rentals. Near Burj Al Arab (10-minute boat ride), per timeoutdubai.com.

Investment Potential: Yields of 6-8% (e.g., AED 4 million/year for a AED 50 million villa) and 20-25% capital gains by 2026, driven by exclusivity and high tourist demand for private island stays, per dxbinteract.com. Ideal for UHNWIs targeting Airbnb-style rentals.

Compliance: Register SPAs via DLD’s Ejari system. Verify escrow accounts. Obtain valuation certificate for Golden Visa (AED 2 million+). Retain records for FTA audits, per taxvisor.ae.

2. Heart of Europe – Sweden Island Palaces

Overview: A Kleindienst Group project in the Europe cluster, offering 10 five-story luxury villas from AED 40 million ($10.9 million). Handover in Q2 2025, per squareyards.ae.

Features: Swedish-inspired palaces with private beaches, rooftop pools, and access to a spa, ice cave, and lagoon. Designed for hospitality with guest suites and event spaces. Near Monaco Hotel (5-minute boat ride) and Heart of Europe amenities like climate-controlled streets, per thoe.com.

Investment Potential: Yields of 6.5-8.5% (e.g., AED 3.4 million/year for a AED 40 million villa) and 15-20% capital gains by 2026, fueled by branded luxury and short-term rental demand, per dxbproperties.ae. Appeals to European and Asian tourists.

Compliance: Register SPAs via Ejari. Verify freehold status. Retain records for FTA audits, per adres.ae.

3. Zaya Zuha Villas

Overview: A Zaya project in the World Islands, offering 30 exclusive villas from AED 15 million ($4.08 million). Handover in Q3 2025, per squareyards.ae.

Features: Boutique villas (3,000-5,000 sq.ft.) on a 2.5 million sq.ft. island with 2.5km of beachfront, private pools, and lush greenery. Includes a wellness-focused resort with a spa, yoga decks, and fine dining, ideal for luxury getaways. Near Jumeirah (12-minute boat ride), per traveltodubai.ae.

Investment Potential: Yields of 7-9% (e.g., AED 1.35 million/year for a AED 15 million villa) and 15-18% capital gains by 2026, driven by privacy and resort-style amenities, per aysdevelopers.ae. Strong appeal for wellness-focused tourists.

Compliance: Register SPAs via Ejari. Verify escrow accounts. Obtain valuation certificate for Golden Visa (AED 2 million+). Retain records for FTA audits, per gtlaw.com.

4. Floating Seahorse Villas

Overview: A Kleindienst Group project in the Europe cluster, offering 131 floating three-level villas from AED 12 million ($3.27 million). Handover in Q1 2025, per thoe.com.

Features: Unique villas with underwater bedrooms, coral gardens, and acrylic pool bottoms, plus upper decks with private pools and jacuzzis. Designed for high-end short-term rentals, with access to Heart of Europe’s beach clubs and dining, per dubai-property.investments.

Investment Potential: Yields of 7-9% (e.g., AED 1.08 million/year for a AED 12 million villa) and 15-20% capital gains by 2026, driven by innovative design and tourist appeal, per dxbinteract.com. Popular for Instagrammable stays.

Compliance: Register SPAs via Ejari. Verify freehold status. Retain records for FTA audits, per taxvisor.ae.

5. The Jordan Project Villas

Overview: A boutique project by an undisclosed developer in the Asia cluster, offering 65 luxury villas from AED 15 million ($4.08 million). Handover in Q2 2025, per dubai-property.investments.

Features: Waterfront villas with private beaches, a large beach club, and eco-friendly systems like solar panels. Includes leisure amenities like beach volleyball courts and small boat locks. Near Jumeirah Beach (10-minute boat ride), per kleindienst.ae. Designed for hospitality with flexible layouts for guest hosting, per squareyards.ae.

Investment Potential: Yields of 6.5-8% (e.g., AED 1.2 million/year for a AED 15 million villa) and 15-18% capital gains by 2026, driven by leisure amenities and privacy, per aysdevelopers.ae. Appeals to families and groups seeking exclusive rentals.

Compliance: Register SPAs via Ejari. Verify escrow accounts. Obtain valuation certificate for Golden Visa (AED 2 million+). Retain records for FTA audits, per adres.ae.

Why These Projects Matter

Amali Island Villas, Sweden Island Palaces, Zaya Zuha Villas, Floating Seahorse Villas, and The Jordan Project Villas are hospitality-focused, offering 6-9% yields, outperforming global luxury markets (e.g., Monaco’s 2-3%), per aysdevelopers.ae. Tailored for short-term rentals, they capitalize on Dubai’s 18.7 million tourists in 2024 and the islands’ exclusivity, per dxboffplan.com.

Features like private beaches, underwater bedrooms, and resort-style amenities attract UHNWIs and tourists, with 71% of global HNWIs favoring Dubai, per sevenluxuryrealestate.com. The islands’ isolation ensures privacy but poses challenges like delayed utilities (no underwater cables as of May 2025) and erosion risks, mitigated by Nakheel’s AED 13 billion investment and 80% project revival, per riotimesonline.com.

Connectivity via private boats or helicopters (JBR’s La Mer Beach Residences, 10 minutes) supports accessibility, per dubai-property.investments. Posts on X highlight UHNWI interest, per @luxury_playbook. Golden Visa eligibility (AED 2 million+) applies to all projects, per pangeadubai.com.

Tax Tools for American Investors

U.S.-UAE DTA: Credit UAE taxes via IRS Form 1118, preserving 15-25% returns, per immigrantinvest.com.

Zakat for Muslim Investors: Pay 2.5% Zakat on rental income (e.g., AED 2,500 on AED 100,000). Consult Islamic scholars, per taxvisor.ae.

VAT Recovery: Recover 5% input VAT on commercial expenses (e.g., AED 25,000 on AED 500,000) for VAT-registered investors, per fintedu.com.

Market Outlook and Challenges

The World Islands’ 25% transaction growth in Q1 2025 and up to 10% ROI reflect strong hospitality demand, with 63% of 2024 transactions being off-plan, per prelaunch.ae. The Dubai 2040 Urban Master Plan supports sustainability with eco-friendly designs and planned resorts, per excelproperties.ae.

Risks include oversupply (41,000 new units in 2025) and utility delays, offset by scarce ultra-luxury inventory and Dubai’s 9,800 millionaire influx in 2025, per gulfnews.com. These villas, backed by Nakheel, Damac, and Kleindienst, position The World Islands as a premier hospitality investment hub, per signaturehabitat.com.

Conclusion

Amali Island Villas, Sweden Island Palaces, Zaya Zuha Villas, Floating Seahorse Villas, and The Jordan Project Villas are The World Islands’ top hospitality-focused villa projects for 2025, offering 6-9% yields and 15-25% capital gains.

With private beaches, unique designs, and resort-style amenities, they target luxury investors seeking high-end rental income. Compliance with DLD’s Ejari and FTA ensures secure investments in this exclusive archipelago. The World Islands

read more: Dubai Islands: 7 Off-Plan Projects Worth Watching in 2025